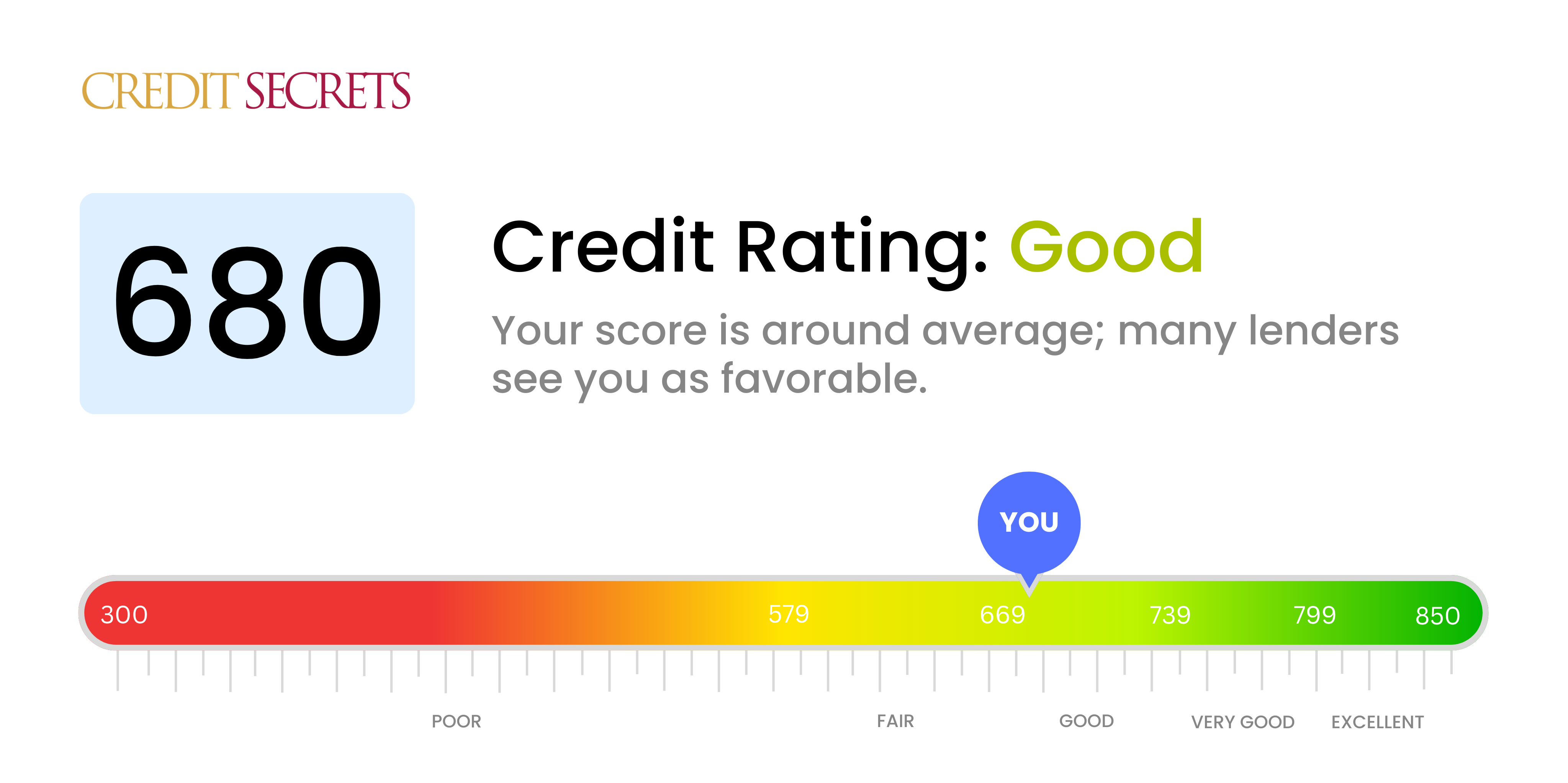

Is 680 a good credit score?

Your credit score of 680 falls into the 'Good' range. With this score, you're likely to be approved for credit at most places, although you might not receive the most favorable interest rates. Nonetheless, this score demonstrates responsible financial behavior, and with continued good practices, you can aspire to raise your score even further.

Can I Get a Mortgage with a 680 Credit Score?

If your credit score is currently 680, there's a fair chance you'll be approved for a mortgage. A score above 670 is generally viewed as good by many lenders, and so, at 680, you're within the threshold of what most consider favorable.

However, while you may get approved, remember that your credit score also influences the interest rates that you will be offered. Higher scores often secure lower interest rates and better terms for their loans. Therefore, with a credit score of 680, you might be offered a modest mortgage rate. While applying for a mortgage, expect lenders to look beyond just your credit score. They'll also consider your debt-to-income ratio, employment history, and other factors to determine your ability to repay the loan. Staying prepared and understanding the entire picture will help you navigate the mortgage approval process efficiently.

Can I Get a Credit Card with a 680 Credit Score?

Boasting a credit score of 680, the likelihood of getting approved for a credit card is fairly high. You're in the "good" credit range. This shows that you've been pretty responsible with your finances, making payments on time and keeping any debts manageable. This is an encouraging position to be in, and it signifies that you've been making sound financial decisions.

Given your good credit score, a range of credit cards could be available to you. Secured credit cards or starter cards might be options, but you might also be eligible for credit cards with rewards programs or lower interest rates. The type of credit card to choose largely depends on your financial needs and goals. For example, if you travel often, a credit card that rewards travel-related purchases might be right for you. However, always remember to review the terms and conditions, including the interest rates and fees, before choosing a credit card. The journey towards strong financial health often involves prudent decision-making and continual credit score monitoring.

Having a credit score of 680 signals a fair credit profile to lenders. It's not an outstanding score, but it doesn't spell disaster either. This score straddles the line between acceptable and high-risk. Consequently, your likelihood of securing a personal loan will largely depend on the financial institution's policies and your other qualifications.

When applying for a personal loan, it's likely that your interest rates will be higher than those offered to people with excellent credit scores. Expect the personal loan application process to involve a detailed review of your financial history and potentially, a request for additional documentation. Lenders must ensure that despite your moderate credit score, you are responsible enough to handle repayment. It's not a guaranteed approval, but with a thorough application and patience, success is possible.

Remember, every lender has different standards and requirements. If one lending option doesn't work out, don't be discouraged. Other opportunities might be just around the corner.

Can I Get a Car Loan with a 680 Credit Score?

Having a credit score of 680 puts you in a better position to be considered for a car loan. Many lenders generally consider a score above 660 to be a fair score, and a 680 falls into this category. Your score signifies moderate reliability to loan issuers, therefore, standing a good chance to get approved. However, the exact terms of the loan, including the interest rate, will heavily rely on other personal financial factors.

Expect a relatively smoother car purchasing process with your credit score. Lenders may still carry out a thorough evaluation of your overall financial health but are more likely to approve your car loan application. Pay close attention to the offered loan terms and the details of the loan agreement. Though you may not get the best interest rates available, people with a score similar to yours commonly get reasonable terms. Keep in mind, maintaining and improving your credit score further will set you up for even more favorable terms in the future.

What Factors Most Impact a 680 Credit Score?

Navigating through a score of 680 can lead you to improve your financial health. By understanding what influences this score, you can take significant steps towards building a strong credit foundation. Remember, your financial path is unique and filled with opportunities for growth and education.

Credit Payment History

Being punctual with your credit payments greatly affects your credit score. Any missed or late payments can potentially be a driving factor for your current score.

How to Check: Go through your credit reports for any history of late or missed payments. Reflect on your payment habits as these can greatly impact your score.

Credit Utilization

Optimal utilization of credit can either make or break your score. If your existing credit is mostly used up, it might be a crucial part of your score.

How to Check: Closely scrutinize your credit card balances. Are they close to their limits? Try to keep balances as low as possible.

Credit History Timeline

A limited credit timeline can be detrimental to your score. New credit can negatively impact your overall credit history.

How to Check: Assess your credit reports for the age of your oldest and newest accounts, and the average age of all your accounts. Having newly opened accounts can negatively affect your credit score.

Diversity of Credit

Maintaining a mix of credit types and managing new credit efficiently plays role in ensuring a good score.

How to Check: Evaluate your credit portfolio. Do you have a healthy mix of credit cards, retail accounts, and mortgage loans? Apply for new credit only when necessary.

Credit Inquiries or Public Records

Multiple credit inquiries or public records like bankruptcies can lead to a drop in your score.

How to Check: Verify your credit report for any credit inquiries or public records. Address any discrepancies on these records if necessary.

How Do I Improve my 680 Credit Score?

With a credit score of 680, you’re in a good position to make powerful changes. Here are some practical measures you could immediately take to continue improving your credit standing:

1. Begin Debt Consolidation

If you have multiple outstanding debts, consolidating them into a single, manageable payment can potentially lower your interest costs and make repayment more straightforward. This could also reflect positively on your credit file.

2. Pay Bills on Time

Ensure all your bills are paid promptly. Late or missed payments can lower your score. By setting up automated payments, you can avoid potential late payments and improve your score over time.

3. Monitor Your Credit Report

Accurate tracking can identify any potential errors that might affect your score. If you find errors, report them immediately to the credit bureau for rectification.

4. Consider a Personal Loan

A small personal loan used responsibly can help improve your credit mix. Borrow only what you can afford to pay back and always make payments on time.

5. Maintain Low Credit Card Balances

Keep your credit card balances low in respect to the card’s limit. Strive to maintain a balance below 30% of your total credit limit, lower if possible. This demonstrates responsible credit use and can boost your credit score.