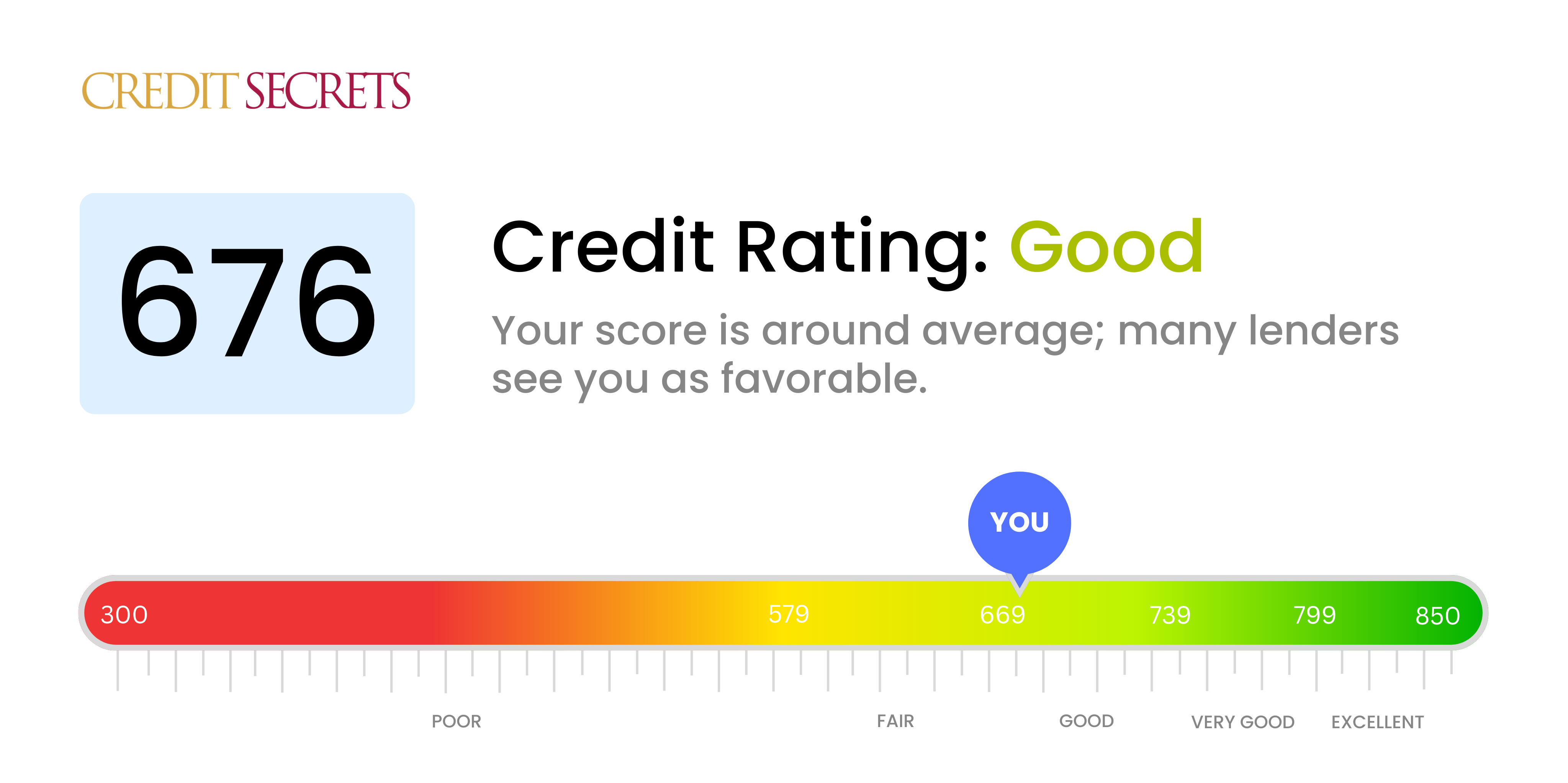

Is 676 a good credit score?

Your credit score of 676 falls into the 'Good' category. This implies that while you're not at any extreme ends of the scale, you're fairly well placed in the eyes of potential lenders and creditors, increasing your chances of getting approved for loans and credit lines with trusted banking institutions.

As you've maintained a fairly solid credit history, it's likely that you'll receive decent interest rates on loans and credit cards, but better options might be out there for those with 'Very Good' or 'Excellent' scores. While it's an encouraging position to be in, there's still room for growth if you continue making your payments on time and reducing your debt where possible, pushing your score into even better categories over time.

Can I Get a Mortgage with a 676 Credit Score?

With a credit score of 676, your chances of mortgage approval show promise. This score indicates a fairly decent financial responsibility, aligning closely with the minimum score that most lenders expect. With the correct preparation, you might very well be on your way towards a successful mortgage application.

In this process, interest rates are inevitably a factor to consider. Due to your credit score not being in the highest echelon, you might face slightly higher interest rates than an applicant with an excellent credit score. Nevertheless, don't let this be an obstacle towards accomplishing your homeownership dream. By demonstrating consistent, on-time payments of existing credit and maintaining a stable income, you can still secure a mortgage that fits your budget. It's all a question of perseverance, financial awareness and managing your credit maintaining habits. It's not a sprint, it’s a marathon.

Can I Get a Credit Card with a 676 Credit Score?

A 676 credit score is somewhat on the threshold. It's not an excellent credit score, but it's not bad either. This score indicates to potential lenders that you're fairly diligent in repaying your debts, but there might have been a few minor hiccups along the way. It's a delicate situation, but not one that means doom and gloom for your credit future.

Being approved for a credit card is definitely within your grasp, but you may not qualify for cards that offer the most attractive perks, such as premium travel cards. Your best bet might be to look into starter credit cards or secured credit cards. These cards often have higher interest rates and may require a security deposit, but they're designed to help people like you build or repair their credit. By using these cards responsibly and always making your payments on time, you can gradually boost your credit score.

With a credit score of 676, there's a bit of uncertainty when it comes to being approved for a personal loan. It's not a low score, but it's not exactly high either. Most traditional lenders may hesitate to lend the full amount you request or may offer you a personal loan at a higher interest rate due to the perceived risk associated with this mid-range score.

When you apply for a personal loan with this credit score, you should prepare for a thorough review of your credit history. Also, in terms of interest rates, remember that they are determined by a number of factors, including the loan amount and term, your income level, as well as your credit score. With your score of 676, you might face somewhat higher interest rates. However, don't be discouraged. The key is to diligently compare offers from different lenders to find the most reasonable terms for you.

Can I Get a Car Loan with a 676 Credit Score?

With a credit score of 676, you're closer to the threshold that lenders typically seek when approving car loans. Generally, scores above 660 are viewed positively by lenders, meaning your score doesn't place you in the subprime category often associated with high-interest rates or denied loans. So, chances are good in securing a car loan with this score, as it indicates you represent a moderate risk to lenders.

While the car purchasing process should be relatively smooth, remember, your specific credit score could still impact the terms of your car loan. As a borrower on the border of what's considered a "good" score, you may encounter slightly higher interest rates compared to those with scores above 700. Yet, with a diligent approach of comparing different loan offers and taking time to understand the terms, it's indeed possible to nail down a loan that accommodates your needs.

What Factors Most Impact a 676 Credit Score?

Understanding a credit score of 676 is important to improve your financial standing. Your score is slightly below the national average, and it allows us to identify areas that can enhance your overall credit status.

Credit Utilization

Credit Utilization plays a significant role in your credit score. High balances relative to your credit limits can negatively impact your score.

How to Check: Review your credit accounts to measure your credit utilization ratio. Aim to maintain your balances low compared to your credit limits.

Payment History

Your payment history greatly affects your credit score. Any delayed or defaulted payments could be responsible for your current credit score.

How to Check: Evaluate your credit report for any late payments or defaults. Being mindful about making payments on time can help improve your score.

Length of Credit History

A relatively short credit history may influence your score. Be careful when opening new accounts as it can shorten your average account age.

How to Check: Check your credit report to ascertain the age of your oldest and newest accounts as well as the average age of all your accounts. Refrain from opening new accounts unnecessarily.

Credit Mix

Strive for a diverse mix of credit accounts - credit cards, student loans, mortgage - with a proven record of good management.

How to Check: Assess your current mix of credit accounts. Ensuring that you have a variety of well-managed credit types can aid in boosting your credit score.

How Do I Improve my 676 Credit Score?

Your credit score of 676 is considered fair to good. However, there are important actions you can take to increase and maintain your score in excellent range. Implement these strategic steps specific to your current situation:

1. Monitor Your Credit Report Regularly

Keep an eye on your credit reports from the three major bureaus. Look for any inaccuracies or fraudulent activities that could be damaging your score, and report any inconsistencies. This will ensure that your credit score accurately reflects your credit habits.

2. Maintain Low Credit Utilization

High credit card balances may lower your credit score. Aim to use less than 30% of your credit limit on each card, ideally below 10%. This demonstrates responsible credit use and helps boost your score.

3. Consider a Credit-Builder Loan

As you’re in the mid-600s, consider taking out a credit-builder loan. This type of loan is specifically designed to improve your credit score. Prompt and full loan payments will contribute positively to your credit history.

4. Add Variety to Your Credit

Diversify your credit portfolio. Having a mix of different types of credit, for example credit cards, retail accounts, installment loans, mortgage, can show lenders you’re capable of managing various types of credit responsibly.

5. Keep Old Accounts Open

If you’ve paid off a credit card or another type of loan, consider keeping the account open. This could actually help your score by lengthening your credit history and increasing your total available credit. Be mindful of any fees involved.