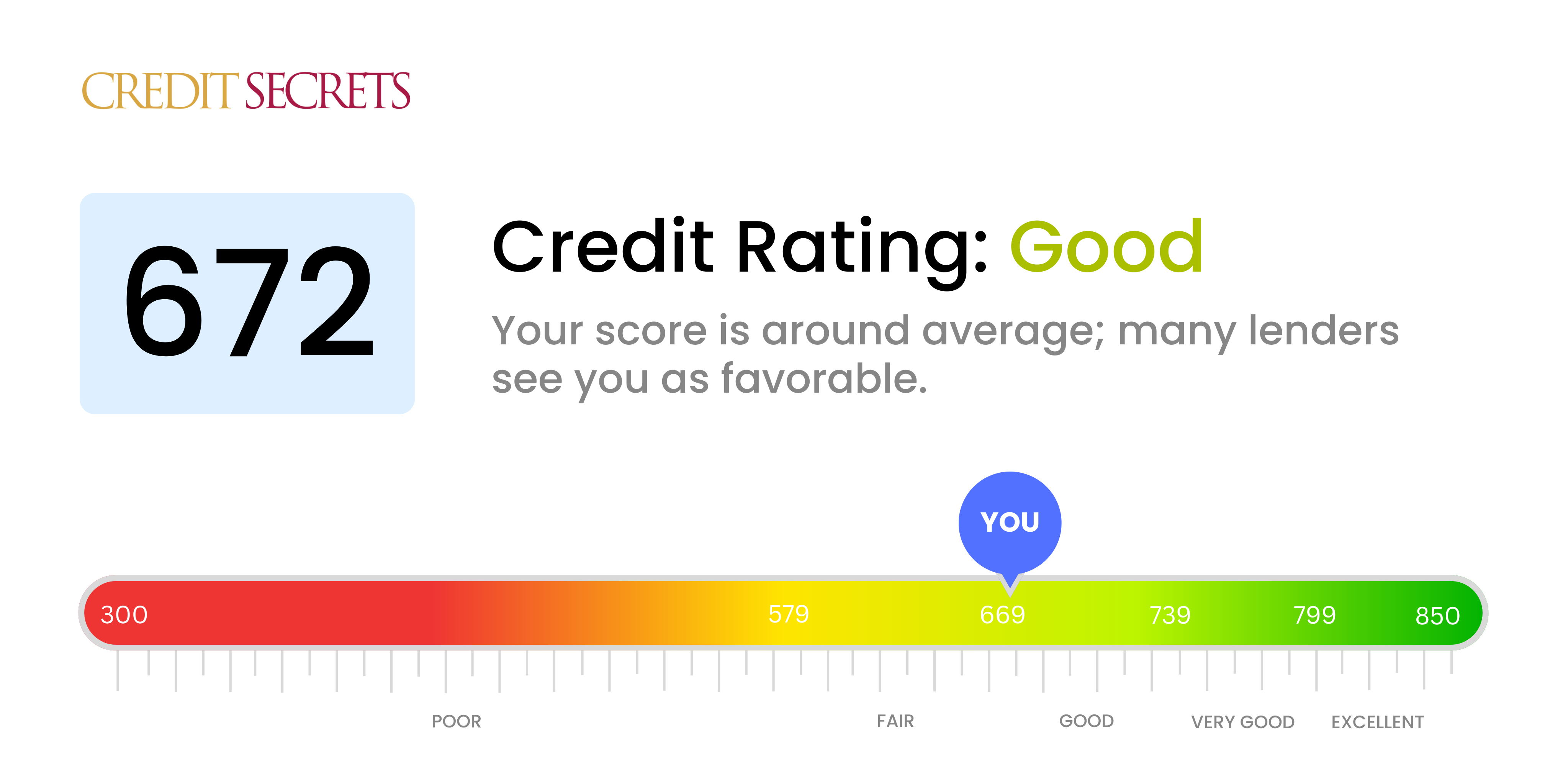

Is 672 a good credit score?

With a credit score of 672, you're categorized as having a good credit rating. Falling within the 670-739 credit range, your score presents you favorably to lenders, meaning this is a positive step towards financial growth.

You can usually expect to be approved for most credits or loans, including credit cards, auto loans, and mortgages. However, the interest rates might not be as favorable as those assigned to 'very good' or 'excellent' credit brackets. Keep up with your positive financial practices, and you can improve this even further.

Can I Get a Mortgage with a 672 Credit Score?

Having a credit score of 672 suggests that you are in the 'Fair' range. It's not excessive, but it's also not too low. You are right on the cusp of having a 'Good' credit rating, which can likely make a significant difference in your mortgage approval chances. Lenders typically prefer applicants with scores in the good to excellent spectrum, hence your chance of securing a mortgage may not be as high.

Getting approved for a mortgage isn't just about whether you can get one or not. It’s also about the terms of the mortgage. With a credit score of 672, if you are approved for a mortgage, you might find the terms to be less favorable than someone with a 'Good' or 'Excellent' credit score. For example, you could potentially face higher interest rates or require a larger down payment. You are so close to a better score and enhancing your score to the ‘Good’ range could open up more opportunities with better terms.

Can I Get a Credit Card with a 672 Credit Score?

If you have a credit score of 672, it's normal to wonder what it means for your chances of getting a credit card. So, is a 672 credit score good? Well, it's not bad. You're in fair territory, and while that doesn't mean you'll be approved for every credit card you want, you do have some positive options. It's about knowing you stand on solid ground even if the ultimate goals haven't been realized yet. There's room for improvement, but you're not starting at the bottom, which is something to be proud of.

As for which cards work best for a credit score of 672, your best bet would probably be low-interest credit cards or balance transfer cards. These types of cards tend to have less stringent approval requirements, and they could also help maintain or improve your credit score. Secured credit cards could also be a good option as they require a deposit that converts into your credit limit. But remember, higher interest rates may be common in the fair credit range, but luckily, as you continue working on it, your options will broaden and rates could get lower. There is always a way forward—just keep building.

If your credit score is at 672, you are on the right track and pretty much in the middle of the credit scale. At this score, it's feasible that you will be approved for a personal loan. However, it is not guaranteed and could largely depend on the type of lender and their individual requirements. Being straightforward, you should know that it's possible you may not receive the lowest interest rates or the most favorable terms.

While applying for a personal loan with a 672 credit score, remember that several factors will be considered by the lender, not just your credit score. They may take into account your income, job stability, and debt-to-income ratio as well. As a potential borrower, you have the responsibility of maintaining and improving your credit score to better your chances for future loans. Although it might be a challenge at times, it's worth the effort for your overall financial wellness.

Can I Get a Car Loan with a 672 Credit Score?

With a credit score of 672, it's rather likely that your application for a car loan will be looked upon favorably by lenders. The standard that lenders commonly search for is above 660, hence your score of 672 puts you in a decent position. This is because your credit score communicates your reliability to lenders. In simple terms, the higher the score, the less risk you present to the lender.

What you can anticipate from the car loan process is largely anchored in your credit score. Having a score above the usual threshold increases your chances of getting favorable terms. Keep in mind, though, that your interest rates are dependent on your score. A score like yours, while above the standard, may not qualify you for the absolute lowest rates. Nonetheless, it's a clear way from here to transforming your car purchase into reality, assuming all other considerations are good. Be sure to fully comprehend all conditions before signing to ensure the best potential outcome.

What Factors Most Impact a 672 Credit Score?

If your credit score is 672, it's vital to understand what factors may be impacting it. While everyone's financial circumstances are different, certain elements are likely at play at this score range. By identifying these factors, you can take significant strides toward improving your credit health.

Credit Utilization Ratio

With a score in the mid-600s, credit utilization could be an essential factor. Using too much of your available credit can negatively affect your score.

How to Check: Regularly monitor your credit card balances. If they're nearing the limit, reducing your balances could help improve your score.

Past Delinquencies

Historical late or missed payments may also be bringing your score down.

How to Check: Analyze your credit report for late or missed payments. Addressing these with consistency makes a huge difference.

Credit History Length

Having a shorter credit history can lower your score significantly.

How to Check: Look at your credit report to gauge the age of your accounts. Rapidly opening new ones might be a detrimental factor.

Credit Mix

A lack of diversity in your credit types could also be affecting your score.

How to Check: Assess your range of credit types, such as credit cards, retail accounts, and loans. If you're only using one type, consider diversification.

Public Records

Public records like bankruptcies or tax liens can severely damage your credit score, even if they are not recent.

How to Check: Scrutinize your credit report for any public records. Make sure to address and resolve any items present there.

How Do I Improve my 672 Credit Score?

A credit score of 672 is categorized as a fair score. Aim to increase it into the good or excellent range with the following tailored strategies:

1. Regularly Monitor Your Credit Report

Regularly review your credit report for any discrepancies or errors. An error on your report can unfairly drag your score down. Most credit bureaus offer one free report per year or more.

2. Payment Consistency

Consistently making payments on time has a significant impact on your credit score. Ensure all bills, loans, and credit card balances are paid promptly. Setting up autopay is a handy way to avoid overlooking your payments.

3. Manage Your Utilization Rate

High credit utilization, or using a large part of your available credit, can impact your score. Try to maintain your balance under 30% of your total credit limit, preferably closer to 10%.

4. Prioritize High Interest Debt

Prioiritze paying off high-interest rate debts first, like credit cards. This not only lowers your total debt but saves you from substantial interest payments over time.

5. Establish Long-term Credit History

A longer credit history generally leads to a higher score. Be patient, your score will rise as you continually make payments on time and maintain low balances.

6. Limit New Credit

Each time you apply for a new credit, a hard inquiry is made, which can lower your score. Avoid unnecessary applications for new credit and only apply when needed.