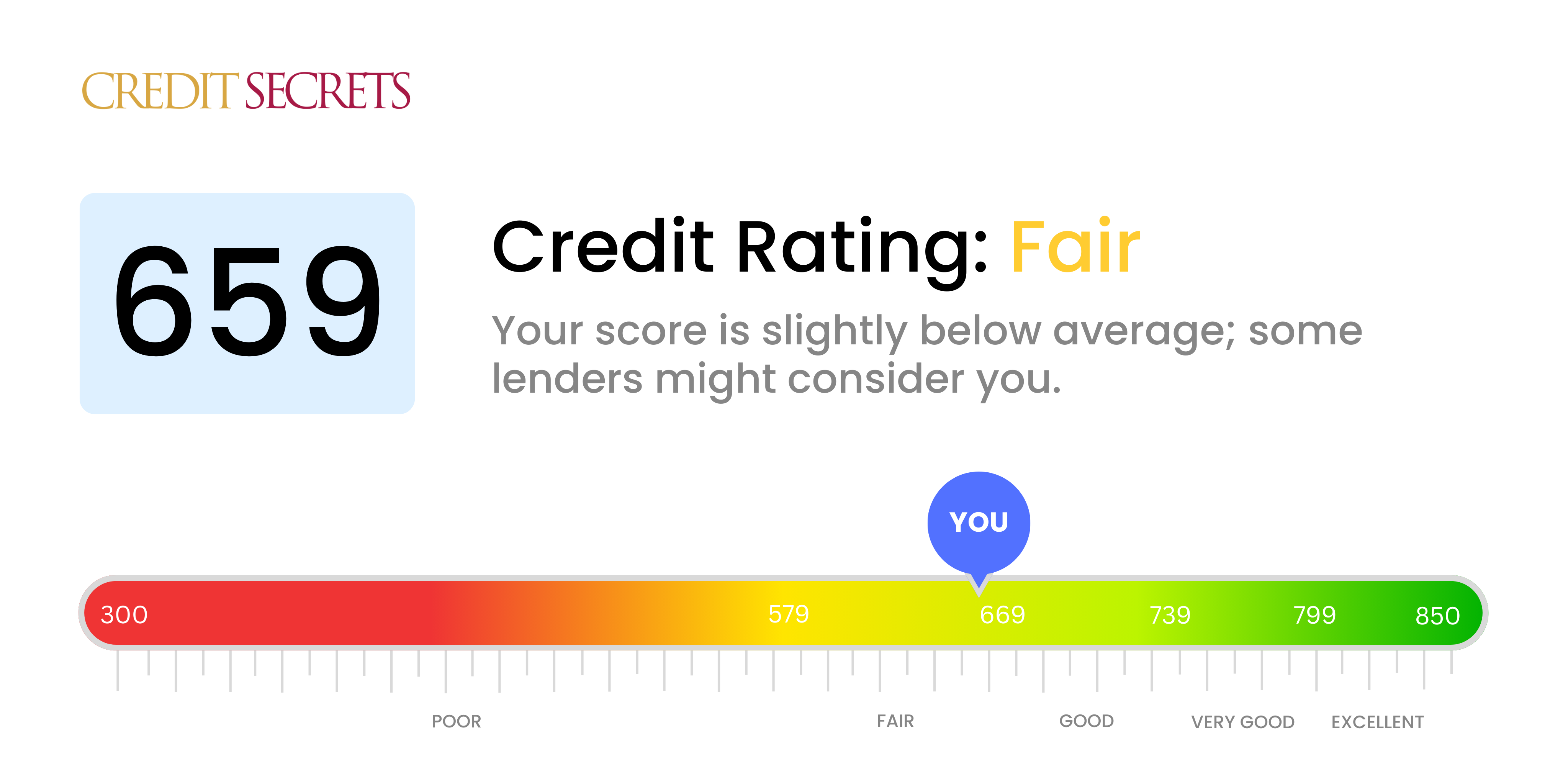

Is 659 a good credit score?

With a credit score of 659, you fall into the 'fair' credit score range. Your score is neither considered good nor poor, but shows potential lenders that you're moving towards a more positive credit standing.

This score might make it somewhat challenging to secure loans at lower interest rates, however, it doesn't completely close off your opportunities. You might receive approval for credit or loans, but the terms and interest rates might not be the most favorable. Remain positive though, as this score could be the motivation you need to take corrective steps towards improving your credit health.

Can I Get a Mortgage with a 659 Credit Score?

With a credit score of 659, getting approved for a mortgage could be a bit challenging. This score is just below the average credit score that lenders typically look for. It may imply that you have had some financial difficulties in the past, such as late payments or overutilized credit. Although it's a tough spot, it doesn't mean there are no options available.

In terms of alternatives, you might consider looking for loan programs tailored for those with lower credit ratings, or attempt to make a larger down payment which could potentially sway lenders. While these alternatives could cost more in interest rates, they might be a viable choice for your current situation. However, the ideal solution would be to improve your credit score further so you can secure a mortgage at a lower interest rate in the future.

Can I Get a Credit Card with a 659 Credit Score?

A credit score of 659 sits on the edge of what is considered "fair." While it is not the highest of credit scores, with a little bit of effort and time, you can potentially increase it to the "good" range. Nonetheless, being approved for a credit card is still a possibility with this score, though the offerings might not be as attractive as they would be for those with higher scores.

Credit cards that could fall into your bracket with a 659 score are typically starter cards or secured credit cards. Starter cards give you the opportunity to build your credit by starting small, while secured ones allow you to use a deposit as a security measure for the lender. This deposit is usually equal to your credit limit. With these types of cards, your interest rates might be slightly higher due to the perceived risk associated with a fair credit score. However, with regular payment and responsible usage, these cards can serve as stepping stones to better credit card opportunities and lower interest rates in the future.

Having a credit score of 659 places you in the "fair" range. This is seen as a borderline average score and you could be seen as a potential risk by lenders. There is a reasonable chance that you would be approved for a personal loan; however, it's equally possible that your application could be declined. Lenders may have mixed views on your credit-worthiness given this score.

If you're approved, you can expect a somewhat rigid loan application process. It's likely that you'll be offered a higher interest rate than someone with an excellent score, since lenders would be taking a bit more risk by extending credit to you. The loan amount you're approved for might also be lower than you'd hoped for. Additionally, the lender may require more comprehensive documentation or impose stricter terms on your loan compared to those with a higher credit score. However, this is not the end of the road, because by meeting your repayment obligations, you can have a chance to raise your credit score for the future.

Can I Get a Car Loan with a 659 Credit Score?

At a score of 659, your chances of getting approved for a car loan can be somewhat challenging but it's not impossible. Often, lenders are looking for credit scores of 660 and above for favorable interest rates. Your score, being just below this threshold, may mean you could be faced with slightly higher interest rates or stricter loan repayment terms. This is due to lenders viewing a score under 660 as a somewhat increased risk.

Despite this, it's important to remember that you still have opportunities in the car loan market. Lenders exist who are willing to work with those who have a credit score similar to yours. While they might charge higher interest rates to account for the perceived risk, it doesn't mean that getting a car loan is off the table. Just be ready to carefully review the terms of any loan agreements to ensure they're manageable for your financial situation.

What Factors Most Impact a 659 Credit Score?

Grasping your credit score of 659 is key to setting a successful financial journey. By pinpointing the factors impacting your score, you can shape a more prosperous financial future. No two financial paths are the same; every step presents a valuable learning experience.

Payment History

Prompt and consistent payments have a notable influence on your credit score. Late payments or defaulted amounts can negatively impact your score.

How to Check: Inspect your credit report for any delayed or missed payments. Review all occasions of late payments, as they could have lowered your score.

Credit Card Balances

Overuse of credit can harm your score. If your credit card balances are high, this could be one reason your score isn't higher.

How to Check: Look through your credit card statements. Are your balances almost at the limit? It's beneficial to maintain balances that are a smaller percentage of your limit.

Length of Credit History

A short credit history might not necessarily be a bad thing, but a longer history could add more weight to your score.

How to Check: Check your credit report to know the age of your longest-standing and newest accounts. Consider if there have been any new accounts added recently.

Types of Credit

Having a wide range of credit types and managing them wisely contributes to a healthier score.

How to Check: Take a look at your range of credit accounts like credit cards, installment loans, and mortgages. Consider how regularly you apply for new credit.

Public Files

Public records such as tax liens or bankruptcies can substantially impact your credit score.

How to Check: Review your credit report for any public records. Pay close attention to all items that need resolution.

How Do I Improve my 659 Credit Score?

With a credit score of 659, you’re on the border of fair and good credit. Improvement is well within reach, and the following strategies can help you boost your score:

1. Reevaluate Your Credit Utilization

Credit utilization, or the ratio of your balance to your credit limit, plays a crucial role in credit scoring. Strive to keep your credit utilization below 30% on each card and across all accounts.

2. Regularly Monitor Your Credit Report

Ensuring the accuracy of your credit report is significant. Regularly review your report for errors or fraud and promptly dispute inaccuracies with credit bureaus to enhance your score.

3. Stay Current on All Bills

Your payment history profoundly impacts your credit score. Maintaining a record of on-time payments on all your bills, not just credit cards or loans, can help improve your credit score.

4. Do Not Apply For New Credit

Each time you apply for new credit, a hard inquiry is noted on your credit report, which can temporarily lower your score. Therefore, refrain from applying for new credit unnecessarily.

5. Build a Length of Credit History

Scores are higher for individuals with a long and strong credit history. Aim to open and maintain an account in good standing for an extended period to increase your score.

By focusing on these practical and achievable improvements, your credit score can continue to climb, moving you into the ‘good’ or even ‘excellent’ category.