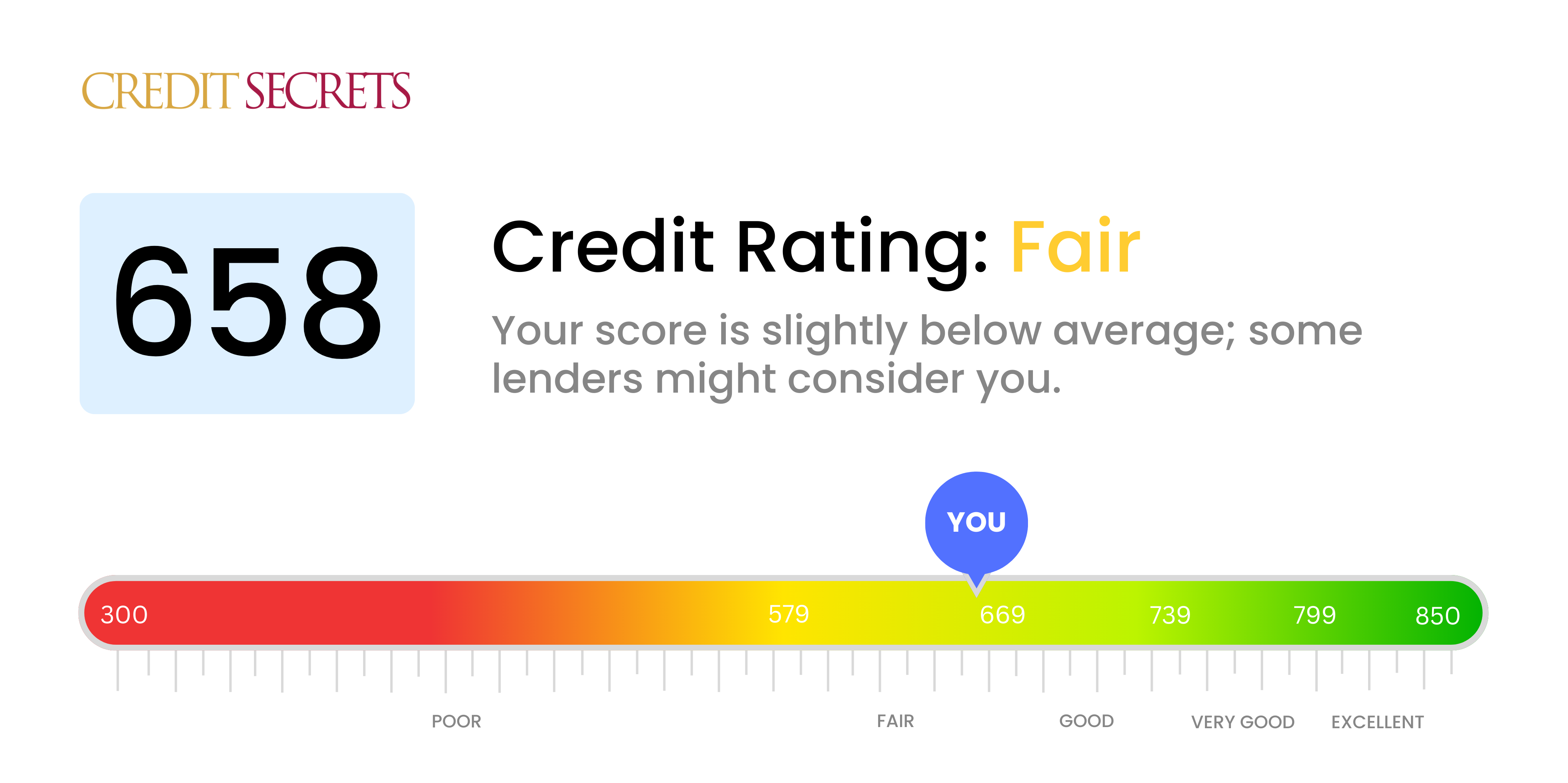

Is 658 a good credit score?

With a score of 658, your credit falls in the 'Fair' category. This isn't the ideal position, but there's room for plenty of improvement and growth, and you're also not in the worst possible situation

Typically, a fair credit score means you might have a harder time getting credit from some lenders, and may face slightly higher interest rates than someone with a good or excellent score. However, it's not a life sentence - credit scores change over time based on your financial behaviors. With diligent focus on improving your credit health, you can move into a higher category and enjoy better financial flexibility.

Can I Get a Mortgage with a 658 Credit Score?

With a credit score of 658, you're in a position where securing a mortgage may be somewhat challenging. This score is viewed by lenders as fair, but not strong. It suggests that you've had some difficulties managing your financial obligations in the past. Therefore, you may face higher interest rates or stricter lending conditions.

However, it's not all firm doors against you - some lenders may still approve individuals with this credit score for mortgages, taking into account other aspects of their financial position, such as income stability and down payment availability. It's key to remember, the better your credit score, the more likely you are to get approved for a mortgage with favorable terms. This is why it's beneficial to monitor and consistently work towards improving your credit score. Building a good credit history by making payments on time and avoiding high credit card balances can improve your chances of mortgage approval in the future.

Can I Get a Credit Card with a 658 Credit Score?

Having a credit score of 658 places you fairly in the mid-average range. This score, while not exceptional, can still have some doors open for credit card approval. However, remember that credit card companies do factor in more than just a credit score when assessing risk. Nevertheless, understanding where you stand helps set realistic expectations for the type of credit card options available to you.

With a credit score of 658, you might not qualify for premium travel cards or cards with a high reward rate, as these often require excellent credit. Instead, look towards credit cards designed for average credit—typically, these offer less lucrative rewards but come with lower fees and interest rates. Secured credit cards might also be an option. These require a deposit that serves as your credit limit. While this sounds limiting, it can actually help guide responsible spending, and over time, can aid in improving your credit score. Remember, the journey to financial stability is a marathon, not a sprint.

Looking at your credit score of 658, getting a personal loan may be somewhat of a challenge. Many traditional lenders view this score as slightly below the threshold for typical loan approval. It's a tough situation, and it's essential to understand what this credit score means for your chances of securing a loan.

Traditional loans might not be easily attainable, but other options exist. You might consider secured loans, requiring collateral, or loans co-signed by someone with stronger credit than yours. Peer-to-peer lending opens another door, often having more relaxed credit score requirements. It's vital to note though that these options tend to have higher interest rates and less generous terms due to the lenders taking on more risk. Keep your future financial goals in mind and make thoughtful choices when considering these routes.

Can I Get a Car Loan with a 658 Credit Score?

Having a credit score of 658 can sometimes be a gray area when it comes to securing a car loan. Most lenders favor scores above 660, which makes your current score slightly below the mark. Despite this, don't lose hope. This is because a credit score of 658 is not in the subprime range, giving you a decent chance of approval.

The process of obtaining a car loan may come with some stipulations. For instance, there might be slightly higher interest rates due to the perceived risk from lenders. This is to protect their investment against the increased risk they bear with a modest credit score. Exploring alternate options like credit unions or online lending platforms is advised, as they may offer more flexible terms. While a score of 658 isn't perfect, it's by no means a dead end. Always be sure to read the fine print before signing any loan agreement, to ensure you're not hit with any unexpected terms or fees.

What Factors Most Impact a 658 Credit Score?

Decoding a credit score of 658 is instrumental in shaping your path towards financial progress. Recognizing and tackling the elements responsible for this score can forge the path for a financially sound future. Remember, each financial journey is distinct, comprising unique lessons and growth prospects.

Credit Utilization

For a credit score of 658, credit utilization might be a significant factor. High utilization can harm your credit score, especially if you're consistently maxing out your credit cards.

How to Check: Scrutinize your credit card statements. Are your balances approaching their limits? Striving to maintain lower balances relative to your limit could be advantageous.

Duration of Credit History

A credit score of 658 might be indicative of a brief credit history, which could potentially impact your score negatively.

How to Check: Analyze your credit report to determine the age of your oldest and newest accounts and the overall average age of your accounts. Contemplate if you've recently opened new credit accounts.

Payment Record

Your payment record plays a fundamental role in your credit score. If you've missed or been late on payments, they could be the culprits behind a 658 score.

How to Check: Look at your credit history for any record of missed or delayed payments. Think about whether any late payments may have affected your score.

Credit Types and Fresh Credit

Maintaining a healthy mix of credit, including credit cards, retail accounts, installment loans, and housing loans, and dealing responsibly with new credit are key to improving your score.

How to Check: Analyze your assortment of credit accounts. Ponder on whether you have been applying for new credit judiciously.

How Do I Improve my 658 Credit Score?

A credit score of 658 is below average, but you have every reason to be optimistic about improvement. Here are the specific strategies crucial for your current financial situation:

1. Updated Bill Payments

Ensure all your bill payments are up-to-date and continue to make full payments by your due date each month. Take advantage of any automated payment options offered by your creditors to avoid any accidental late payments, which can negatively impact your score.

2. Efficient Credit Utilization

Credit utilization accounts for a significant part of your credit score. Work on keeping your credit utilization ratio below 30% – aim to hold it under 10% for long-term benefits. Pay particular attention to the credit cards with high utilization rates.

3. Manage Existing Credit

While a 658 score may make it tough to secure regular credit, you still have control over the credit you currently possess. Regularly and responsibly spend and pay off what you already have, proving your ability to manage credit effectively.

4. Leverage a Trusted Contact

Find a close friend or family member with impressive credit and ask if they could add you as an authorized user. This can help your credit score as their positive credit history could reflect positively on your report. Just make sure they report to the credit bureaus!

5. Explore Various Credit Types

Diversity in your credit accounts can influence your score positively. After you’ve built a consistent payment history, look into different types of credit, such as auto loans or retail credit cards, and handle them responsibly.