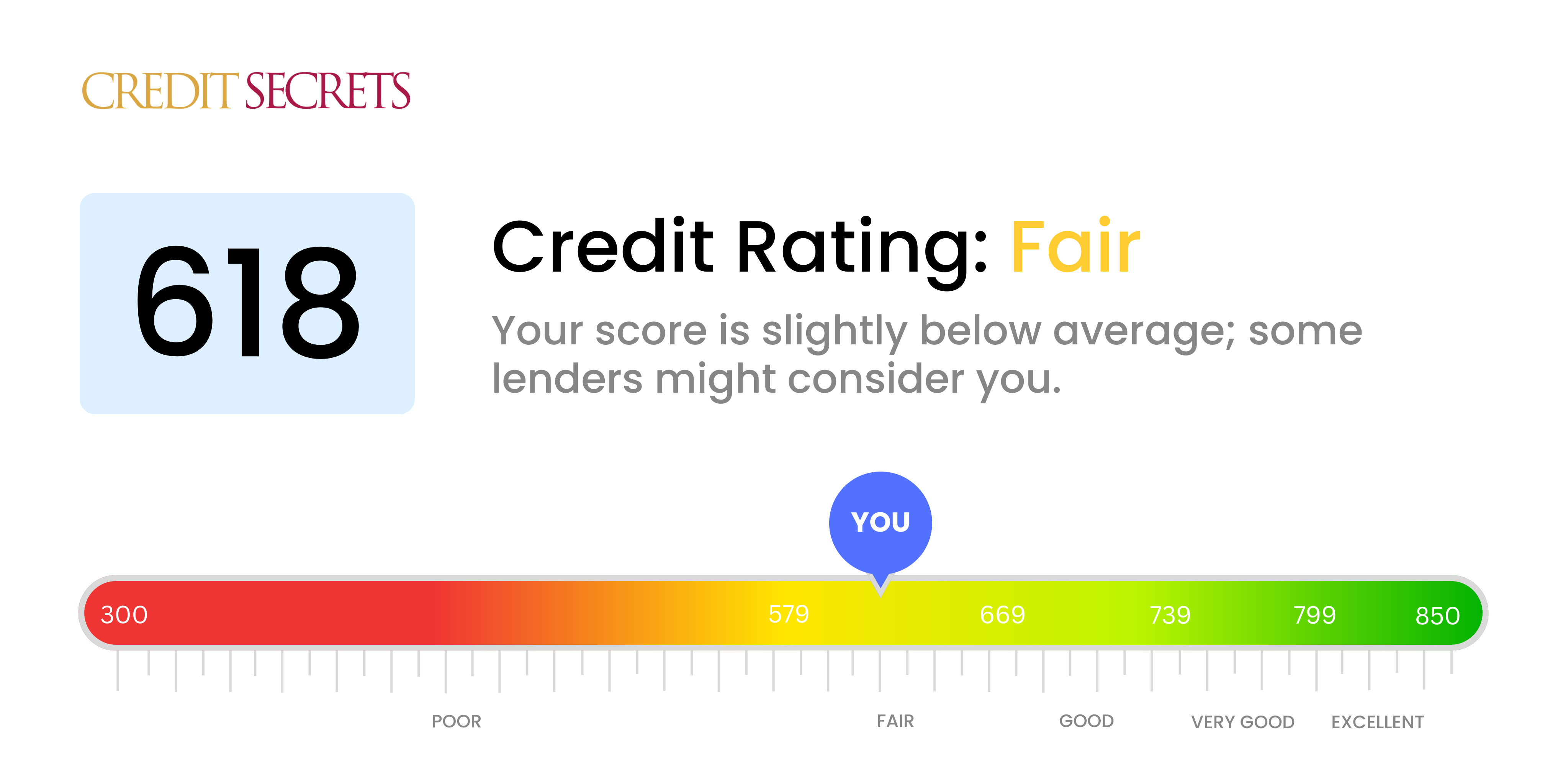

Is 618 a good credit score?

With a credit score of 618, your score falls under the 'Fair' category. It's not the best situation, but it's not a lost cause either and offers room for enhancement.

Typically, those who have a credit score in this range may face situations where they are offered higher interest rates or have difficulty securing loans or credit. But remember, your credit score is not a static number and with diligent effort and good financial practices, it can improve over time. Keep being consistent and committed to your credit health and you can make a positive change.

Can I Get a Mortgage with a 618 Credit Score?

With a credit score of 618, securing approval for a mortgage might be quite challenging. This score falls short of what most lenders typically consider for a mortgage, indicating a track record of some financial difficulty or inconsistent payment. It's important not to be discouraged by this, as many people face similar circumstances.

Your options may include seeking out specialized lenders who cater to individuals with lower credit scores. However, this often comes with higher interest rates, meaning you would pay more over the life of your loan. Another approach could be to explore programs that provide homebuyer assistance, which can include more flexible credit requirements. Though the immediate outlook may be tough, these options can offer a path forward towards homeownership without relying on traditional lenders. Over time, consistently meeting your financial obligations will help to improve your credit score.

Can I Get a Credit Card with a 618 Credit Score?

With a credit score of 618, it's not easy to be approved for a typical credit card. This number tells lenders you might be a higher risk when it comes to repaying credit. While this may feel unsettling, it's crucial to be honest about your current position. Recognizing your credit status is an essential initial stage in your journey to fiscal stability, even if it means confronting some uncomfortable realities.

This score, although difficult, has created alternative financial doors for you. Secured credit cards might be a good choice as they are mostly easier to acquire and can also contribute towards rebuilding credit. These cards need a deposit that serves as your credit limit. Other options might be finding a trusted co-signer or looking into pre-paid debit cards. Keep in mind, while these options do not offer an immediate solution, they are instrumental in helping you work towards financial stability. Yet, be mindful, the interest rates these credit cards could have may be significantly higher due to the perceived risk associated with your current score.

A credit score of 618 implies caution to most traditional lenders when considering personal loan approval. Looking at this score, lenders may feel that there is some risk involved in offering you a loan as it raises questions about your credibility. Let's be honest, it can be a tough pill to swallow when your credit score potentially holds you back from financial opportunities.

However, not all doors are closed. Non-traditional lending routes can be explored. For instance, secured loans against collateral or having a loan co-signed by someone with higher credit can be feasible solutions. Alternatives like peer-to-peer lending platforms are another possibility, but understand these can come with a price. The risk associated with lower credit scores often results in higher interest rates or less favorable terms. Remember, it's all about weighing your options and deciding on what works best for you in your current situation.

Can I Get a Car Loan with a 618 Credit Score?

With a credit score of 618, securing a car loan might be a bit challenging. Most lenders prefer a credit score above 660 for the best conditions. A score of 618 is considered to be in the "fair" range, which could lead to less advantageous loan terms or even outright rejection. The reason for this is that a lower credit score may indicate to lenders a greater possibility of difficulties in paying back the debt.

However, having a credit score of 618 doesn't mean purchasing that dream car is impossible. Certain lenders may work with you even if your score isn't perfect. Be aware, though, that these lenders often charge higher interest rates due to the elevated risk they perceive. So, while getting a car loan may prove to be slightly tougher, it's not out of your reach. Remember to carefully review the terms and conditions, and consider all options before making the commitment. Stay hopeful – there are ways to make it happen!

What Factors Most Impact a 618 Credit Score?

Decoding a score of 618 will help you navigate your path to better financial health. Recognizing the factors contributing to this score will help you in addressing them effectively and enhancing your financial situation. Believe that your financial journey, filled with experiences and learning, is irreplaceable and unique.

Credit Utilization Ratio

Your credit score draws impact from your credit utilization ratio. High utilization ratios, where you're utilizing a large percentage of your available credit, can be detrimental to your score.

How to Check: Look at your credit card statements and see how close you are to your credit limit. Shooting for a lower balance relative to your limit can help improve your score.

Payment Consistency

Your payment records play a significant role in determining your credit score. Regular late payments can damage your credit score.

How to Check: Scrutinize your credit report for late payments. Reflect on any instances where you've delayed a payment, as it could be affecting your score.

Credit History

A brief credit history might negatively impact your score.

How to Check: Evaluate your credit report to determine the age of your accounts. Consider whether you've recently opened new accounts, as this could impact your score.

Public Filings

Public filings such as bankruptcies or tax liens can profoundly affect your credit score.

How to Check: Go through your credit report to identify any public records and act towards addressing any items that might need settlement.

How Do I Improve my 618 Credit Score?

Crafting a brighter financial future with a credit score of 618 will take careful steps, but it’s entirely possible. Right now, your best moves involve focusing on these crucial areas:

1. Organize Late Payments

You might have accounts that have fallen behind; it’s entirely normal. The important thing is to take actions to sort them out now. Identify these accounts, contact the lenders, and negotiate a feasible payment plan to become current. This will help stop any further harm to your credit score.

2. Trim Down Credit Card Debts

Carrying high credit card debt can weigh down your credit score. Strive to keep your balances below 30% of your credit limit or ideally under 10% in the long run. Start by focusing on cards with the highest utilization, and steadily work your way down.

3. Consider a Secured Credit Card

Building credit with your current score might need a different approach. A secured credit card could be a great start. They require a refundable deposit, which then becomes your credit limit. Use it wisely, pay off the balance every month, and watch your credit score climb.

4. Establish Yourself as an Authorized User

A trusted person with good credit history can add to your credit score boost. They can add you as an authorised user on their credit card, and their positive credit behaviour will reflect on your report. Ensure the card owner’s lender reports authorised user activity to credit bureaus.

5. Explore Diverse Credit Options

As you begin to rebuild your credit, aim for a healthy mix of credit types. Once you’ve mastered the secured credit card routine, consider other forms of credit like credit builder loans or department store cards. Always remember to manage these responsibly.