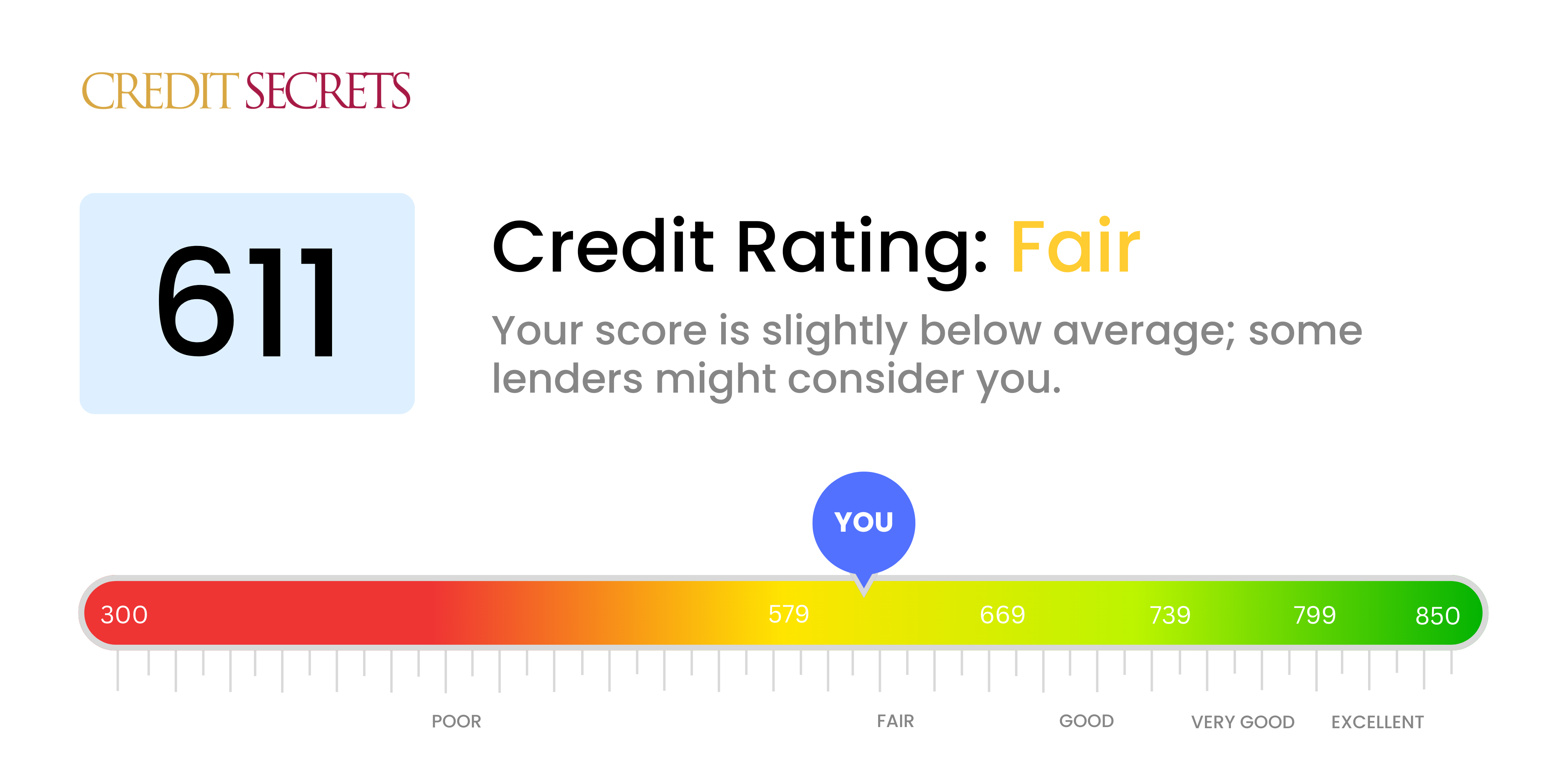

Is 611 a good credit score?

With a credit score of 611, you're in the 'Fair' range. This isn't the best standing, but don't be disheartened, there's room for improvement and a lot you can do to boost your score.

Your score might make it a bit harder to get approved for loans and credit cards compared to someone with a higher score. You could also face higher interest rates for the credit you do qualify for. Nevertheless, it's not all bad news, with consistent effort and credit-positive actions, your score can climb into the 'Good' or even 'Very Good' range.

Can I Get a Mortgage with a 611 Credit Score?

With a credit score of 611, the likelihood of being approved for a mortgage might be a challenging endeavor. This score falls below the threshold that most mortgage lenders typically prefer. This score can be indicative of some past financial difficulties such as late payments or possibly not meeting debt obligations in time.

Know that this is not the end of your journey, there are options available for you. Consider low-credit score mortgages, these are designed for people with similar situations, though be prepared as they generally come with higher interest rates to offset the risk deemed by the lenders. Alternatively, rent-to-own agreements may also serve as a suitable intermediate solution before you apply for a mortgage again. Meanwhile, it will be beneficial to develop a plan to boost your credit score. Without any third party involved, look towards paying off debts promptly and fully. Remember, elevating your credit score is not an overnight task, but with persistent work, you can improve your financial standpoint.

Can I Get a Credit Card with a 611 Credit Score?

Having a credit score of 611 indicates that there's some room for financial improvement and doesn't make it especially easy to be approved for a credit card. Lenders might see this score as somewhat risky, implying past financial struggles. It may feel disheartening, but it's essential to acknowledge this situation with honesty and an open mind. Knowledge of your credit score is key in initiating the path to financial recovery, even though it often uncovers certain uncomfortable realities.

Due to the hurdles associated with such a score, you might want to investigate alternatives to standard credit cards. Options like secured credit cards, which use a deposit as your credit limit, may be easier to acquire. These cards can play a significant role in gradually boosting your credit. Or consider involving a person as a co-signer or resorting to pre-paid debit cards as viable alternatives. These methods won't bring an immediate solution, but they will certainly assist in your journey towards financial improvement. Remember, individuals with credit scores like yours often face considerably higher interest rates due to the increased perceived risk to lenders.

With a credit score of 611, securing a personal loan could prove difficult. Traditional lenders typically prefer borrowers with scores in the higher ranges. A credit score of 611 can indicate you may have had some financial struggles, and lenders usually interpret this as increased lending risk. Despite this, it's essential to recognize what such a credit score could mean for your borrowing prospects.

Don't be disheartened. Alternative options exist, such as secured loans that require collateral, or co-signed loans where a trusted third party with a better credit score can vouch for your capability to repay. You might also consider peer-to-peer lending platforms that may provide more flexible credit requirements. However, do keep in mind that these options often have higher interest rates and less favorable terms due to increased lender risk. Yet, understanding these possibilities can make navigating your financial future a bit clearer.

Can I Get a Car Loan with a 611 Credit Score?

A credit score of 611 might make getting a car loan a bit challenging. Typically, lenders prefer credit scores above 660 for ideal terms. But don't lose heart, this isn't the end of the road. Your score is considered subprime, not necessarily bad, but it could possibly lead to higher interest rates or even loan rejection. Lenders see a credit score as a reflection of financial responsibility. A lower score like 611 suggests a higher risk of not being able to repay the loan in the eyes of lenders.

That said, this doesn't make getting a car loan impossible. Some lenders cater to those with lower credit scores. However, be aware that such loans may carry steeper interest rates. These higher rates are attached due to the increased risk the lenders bear. Through careful examination of the terms, and wise decision-making, getting that car loan isn't out of reach. Hold onto hope, the journey might have a few bumps, but the destination is still within sight.

What Factors Most Impact a 611 Credit Score?

With a credit score of 611, understanding the key factors influencing your score is the first step towards financial well-being. Your financial journey is individual and unique, offering plenty of opportunities for growth and learning.

Payment Consistency

Regular and timely payments significantly affect your credit score. Any inconsistencies or late payments could be contributing to your current score.

How to Check: Analyze your credit report for any inconsistencies or late payments. Consider any circumstances that might have led to delayed payments.

Credit Usage

High usage of your total available credit could negatively impact your score. If your credit card balances frequently max out, this could affect your score.

How to Check: Review your credit card balances. If they're frequently at or near their limits, it's beneficial to keep them lower.

Account History

A comparably shorter credit history could negatively affect your score.

How to Check: Assess your credit report for the age of your oldest and newest accounts and the average age of all your accounts. Reflect on whether you've recently added new accounts.

Types of Credit and New Credit Management

Managing a range of credit types responsibly and limiting new credit applications goes a long way in improving your score.

How to Check: Examine your credit portfolios, including credit cards, retail accounts, loans, and mortgage loans. Reflect on how often you have been applying for new credit.

Public Records

Public records like bankruptcies or tax liens can significantly lower your score.

How to Check: Scrutinize your credit report for any public records. Address any listed items that can be resolved.

How Do I Improve my 611 Credit Score?

With a credit score of 611, you’re on your way to improving your financial situation, but there’s still work to be done. Let’s delve into steps you could take tailored to your current credit position:

1. Dispute Errors on Your Credit Report

An important initial step is to get a copy of your credit report. Errors sometimes occur, and identifying and rectifying them can raise your credit score. You can do this for free annually via the three major credit bureaus.

2. Pay Down Outstanding Balances

Paying down your outstanding debt is vital. Try aiming towards paying down the accounts with the highest interest first, as this can both lower your overall debt and improve your credit score.

3. Secured Credit Card

A secured credit card could be a practical option at your current credit score. They necessitate a cash collateral deposit, the amount of which then serves as your credit limit. Using it wisely, by making minimal purchases, and paying fully each month will help establish a healthy payment history.

4. Get a Credit-Builder Loan

A credit-builder loan is another avenue to consider. These loans are particularly designed to help improve a credit score. They work by holding the borrowed amount in a locked savings account while you make payments. This contributes positively to your payment history.

5. Keep Your Credit Utilization Low

Your credit utilization ratio is the percentage of your total available credit that you’re using. Aiming to keep this below 30% is ideal to improve your credit score.