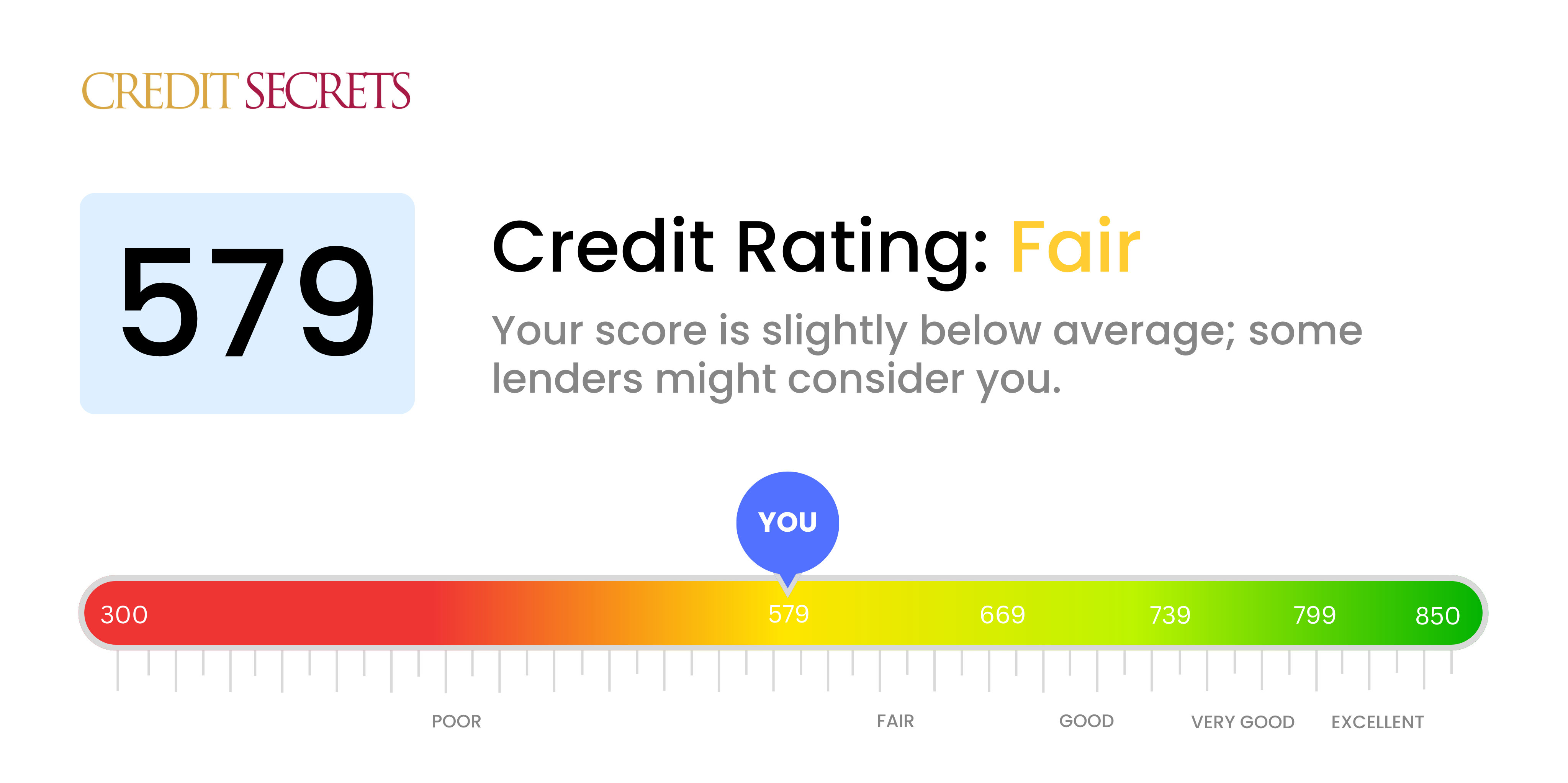

Is 579 a good credit score?

With a credit score of 579, your current situation falls into the "Poor" category. It's certainly not an ideal position to be in, but remember, this isn't a permanent situation and it's entirely possible to boost your score.

You can expect to face certain challenges such as higher interest rates, stricter loan requirements, or difficulty getting approved for credit. Having said that, you do have the power to improve your credit over time. It's about understanding what factors affect your credit score and then implementing strategies to manage them effectively.

Can I Get a Mortgage with a 579 Credit Score?

A credit score of 579 is considered in the 'fair' category, and as a result, it is more challenging to get approved for a mortgage. This score suggests that you have had past payment issues or potentially high credit card balances. Lenders see these factors as a greater risk, which can lead to less favorable lending terms, higher interest rates, or even outright mortgage application denial.

While it may be tough, it doesn't mean it's impossible. Certain lenders, particularly those who offer Federal Housing Administration (FHA) loans, are more lenient and may approve scores as low as 500. However, a higher down payment is usually required. It's prudent to focus on credit score improvement before home shopping. Paying bills on time, maintaining low balances, and being careful about opening new credit accounts are among the measures that can help enhance your score. Be patient, as your efforts can lead to better credit and improved financial potential in the future.

Can I Get a Credit Card with a 579 Credit Score?

With a credit score of 579, approval for a traditional credit card may be difficult. This score might indicate uncertainty for lenders, who might perceive a history of inconsistent financial behavior. It's certainly not an easy place to be, but recognizing and understanding your credit situation is an important first step towards better financial health.

Because of the challenges posed by a score of 579, considering alternatives like secured credit cards could be a wise move. A secured card requires a deposit, and this amount becomes your credit limit. This type of card can be simpler to get, and can help improve your credit score over time. Moreover, having a co-signer or using prepaid debit cards could be other options to explore. Remember, these aren't quick-fix solutions, but steady steps towards financial stability. It's also important to note that any credit options will likely come with higher interest rates due to the increased risk seen by lenders.

With a credit score of 579, it may be difficult to secure a personal loan from traditional lenders. This is because lenders often consider scores under 600 as subprime, meaning there may be a higher risk associated with repayment. It's understandably not the ideal scenario, but it's important to remain both realistic and optimistic.

While obtaining a conventional personal loan might be challenging with your current score, it doesn't mean you're out of options. Alternatives like secured loans, where you provide an asset as collateral, or co-signed loans, where a trustworthy individual with a higher credit score co-signs your loan, could serve as feasible alternatives. You might also explore peer-to-peer lending platforms as they often have more lenient credit requirements. Keep in mind, these options may involve higher interest rates and less favorable terms due to the increased lender risk. Nevertheless, they could serve as stepping stones towards achieving your desired financial goals.

Can I Get a Car Loan with a 579 Credit Score?

With a credit score of 579, you might face difficulties when attempting to secure a car loan. Generally, lending institutions favor scores above 660, viewing them as an indication of good creditworthiness. Therefore, a score of 579, which falls under the subprime category (below 600), might lead lenders to perceive you as a higher risk candidate. This perceived risk might result in increased interest rates or, in some cases, denial of your loan application.

However, your situation isn't hopeless. Some lenders are willing to work with individuals who have lower credit scores, as they recognize that everyone's situation is unique. But bear in mind, loans from such lenders may come with substantially higher interest rates. This is the lender's way of mitigating the risk of lending to individuals with lower credit scores. Your journey towards securing a car loan may be a little rocky, but with careful evaluation of loan terms and a determination to navigate the roadblocks, you still have a chance to achieve your dream of owning a car.

What Factors Most Impact a 579 Credit Score?

Understanding a credit score of 579 is a meaningful step towards reshaping your financial picture. By identifying the reasons behind this score, you can effectively delineate a path towards improving it. Remember, every individual's financial situation is unique and offers opportunities for growth and learning.

Payment Track Record

Payment track record carries significant weight in your credit score. Late payments or missed payments could be the main reason influencing this score.

How to Check: Explore your credit report for any late or missed payments. Reflect on your payment habits to identify if this is an area where improvements can be made.

Credit Card Utilization

Your credit card utilization rate could be negatively impacting your score. If your credit card balances frequently approach their limits, this might be driving your score down.

How to Check: Look at your credit card statements. If your balances are often close to the limit, aim to keep them low to ease your utilization rate.

Credit History Duration

A limited credit history might also be a factor influencing your score to the lower side.

How to Check: Look at your credit report to examining the age of your old and new accounts, along with the average age of all your accounts. Consider if you've opened new accounts recently.

Debt Variety and Recent Credit

Maintaining a diverse debt variety and responsibly managing new credit are important for a better credit score.

How to Check: Analyze your credit profile, consider the types of credit you have. Think about how often you've applied for new credit recently.

Public Records

Public records like bankruptcies or tax liens could be significantly impacting your score.

How to Check: Go through your credit report to identify any public records. Make sure to address any items listed that might need resolution.

How Do I Improve my 579 Credit Score?

With a credit score of 579, you fall within a category generally considered as ‘poor’. However, don’t be discouraged. There are several effective steps tailored to your unique financial condition that could drastically improve your credit score.

1. Resolve Negative Marks

Take a look at your credit report to identify and resolve any negative marks. These could include late payments, account in collections, or public records. The sooner these issues are resolved, the faster your credit score can improve.

2. Maintain Low Revolving Credit Balances

Keeping your revolving credit balances low is central to elevating your score. Strive to keep these balances under 30% of your total credit limit, preferably below 10%. Start with accounts having the highest balance in relation to the limit.

3. Apply for a Secured Credit Card

Acquiring a regular credit card at your present credit score might be challenging. However, a secured credit card, which requires a refundable deposit, could be your way out. Ensure to use this card responsibly, to show consistent payment and foster credit growth.

4. Piggyback on a Strong Credit History

If you have a close friend or family member with a good credit track record, consider getting added as an authorized user on one of their credit cards. This could boost your credit history and subsequently increase your score. Make sure the credit card provider reports authorized user data to credit bureaus.

5. Consider Credit-Building Loans

After enabling a solid compensation pattern with your secured card, consider adding credit-builder loans to your portfolio. These loans are reported to credit agencies, thus enhancing your credit mix and potentially raising your score.