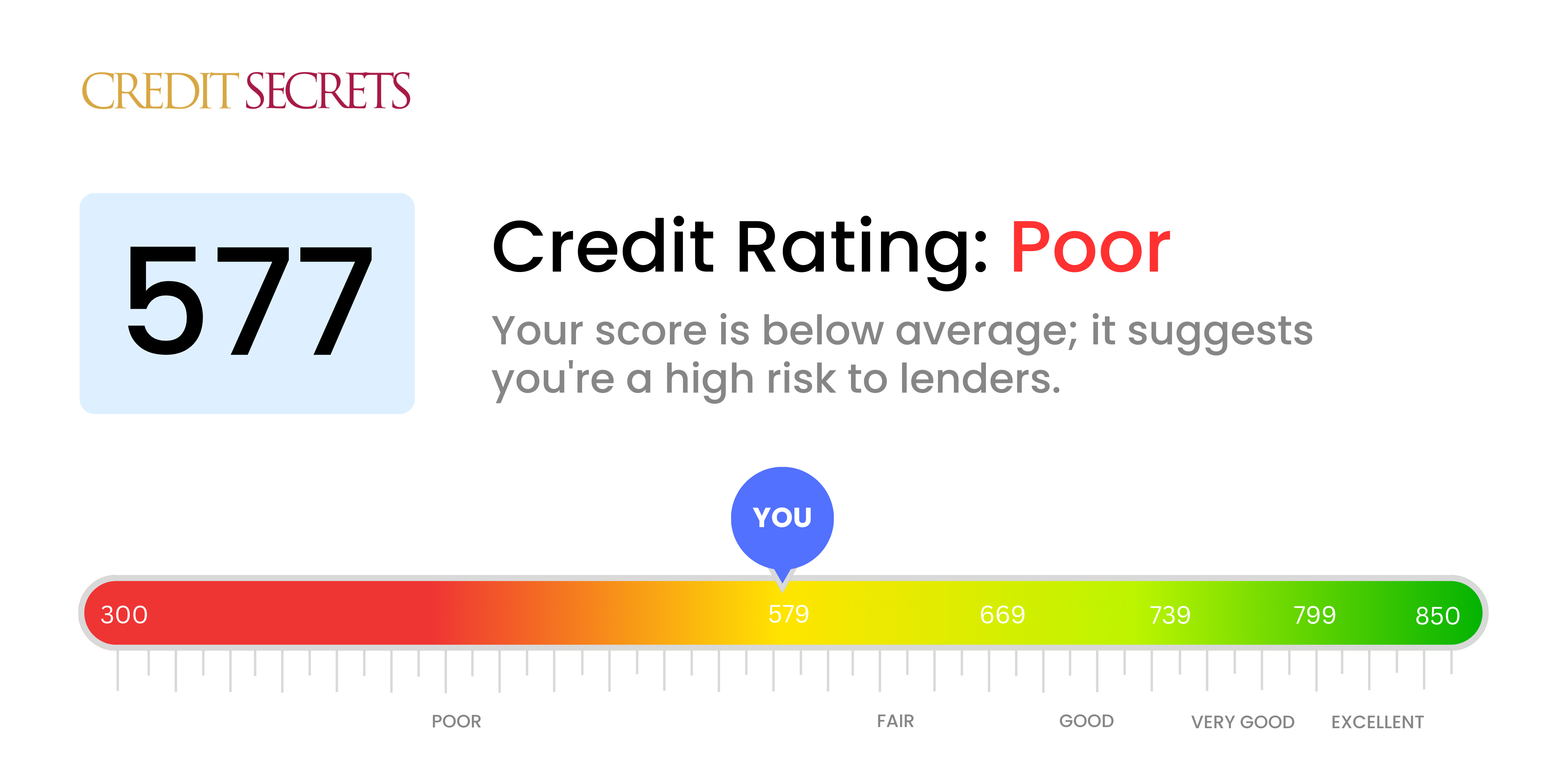

Is 577 a good credit score?

With a credit score of 577, you're currently in the "poor" range. It's essential to understand that this can make it challenging to secure loans or credit cards with reasonable terms. However, don't lose hope, because improvement is indeed possible.

While lenders might see you as a risk with this score, remember that your journey towards better credit is not impossible. It might take time, and require dedicated, consistent efforts, but with the right strategies and responsible financial habits, you can gradually increase your score and enhance your financial outlook.

Can I Get a Mortgage with a 577 Credit Score?

With a credit score of 577, securing a mortgage approval might be a difficult task for you. This score is well below the preferred range of most lenders and indicates that you may have had financial challenges, like missed payments or other credit issues, in your past.

Being in this situation can feel daunting, but remember, every challenge presents the opportunity for change. It's important to be knowledgeable and proactive in managing your debts, specifically those contributing negatively to your credit score rating. Make a commitment to consistently pay your bills on time as this will gradually build a positive credit history. Another option to consider is a government-backed FHA loan which is designed for lower credit scores. However, it's essential to understand that these loan types may come with high-interest rates.

Your credit score doesn't define you - when understood and managed well, it can be a powerful tool to help you achieve your financial and life goals. Start today and create a brighter, more secure financial future.

Can I Get a Credit Card with a 577 Credit Score?

With a credit score of 577, receiving approval for a conventional credit card can pose significant challenges. This score, considered subprime, often signals to lenders a degree of financial instability or past difficulties in handling credit. This reality may feel disheartening, however, it's crucial to face it with courage and pragmatism. Recognizing your credit standing marks the beginning of your path to financial improvement.

Given the barriers tied to a lower score like 577, consider alternative options. Secured credit cards, requiring a deposit that serves as your credit limit, may be more attainable and can assist in reestablishing your credit over time. Exploring options such as acquiring a co-signer or utilizing pre-paid debit cards could also be effective strategies. Keep in mind these alternatives won’t magically transform your credit overnight, but they could be instrumental in your route to financial recovery. It should be noted that any form of credit extended to people in this bracket usually attracts higher interest rates, reflecting the elevated level of risk perceived by lenders.

A credit score of 577 points towards a more difficult path for securing a personal loan. When traditional lenders notice this number, they correlate it with high financial risk. This makes it less probable for them to approve your loan request. It is certainly a tough situation, but one must remember that this score has a direct impact on your borrowing opportunities.

Although mainstream lending options may seem hard to access, there are other methods to consider. You could look towards secured loans where you provide an asset as collateral, or co-signed loans where an individual with a higher credit score guarantees your repayment. Platforms that facilitate peer-to-peer lending can be favorable as their credit requirements might be comparatively lenient. It's crucial to note that these choices tend to carry higher interest rates and might come with terms that are less accommodating. This is because the lender is taking on more risk due to your lower credit score.

Can I Get a Car Loan with a 577 Credit Score?

A credit score of 577 can make securing a car loan a tad complicated. Typically, lenders seek credit scores above 660 to offer advantageous terms. Scores under 600 are frequently branded as subprime, which includes your score of 577. Unfortunately, this results in high interest rates or possibly a denial of your loan application. The reason is straightforward: a lower credit score signals a higher risk to lenders, as it can reflect past difficulties in repaying loans.

Even so, there's no need to abandon your car-buying plans. Certain lenders cater specifically to individuals with lower credit scores. However, please tread carefully, as their loans usually carry substantially higher interest rates. These inflated rates are a tool for lenders to protect their investment, given the increased risk linked with lower credit scores. Although the journey might be challenging, by scrutinizing the terms and considering all angles, a car loan remains a plausible objective.

What Factors Most Impact a 577 Credit Score?

Demystifying a credit score of 577 is crucial to jumpstart your road to financial fitness. By recognizing and addressing the elements affecting this score, you can stride towards a promising financial future. Your financial journey is singular and full of insight and lessons to be drawn from.

Debt to Income Ratio

This ratio can seriously influence your credit score. A high debt to income ratio might be a significant factor.

How to Check: Tally your monthly debt payments and compare it to your gross monthly income. If the ratio is high, it may be dipping your score.

Credit Card Utilization

Maxing out your credit cards can harm your score. If your credit cards are nearly at their limit, this could be impacting your score.

How to Check: Go through your latest credit card statements. If the balances are nearly reaching the credit limit, it may be a potential issue.

Account Delinquency

Account delinquencies can depreciate your score.

How to Check: Check your credit report for any defaulted accounts or late payments. Reflection on late payments could help improve your score.

Financial Hardships

Recent financial hardships like bankruptcies or liens can adversely affect your score.

How to Check: Peruse your credit report for any recent financial hardships. Rectifying any outstanding issues could boost your score.

Applications for New Credit

Frequent new credit applications can negatively influence your score.

How to Check: Scrutinize your report for numerous credit inquiries. Limiting these applications keeps your score healthy.

How Do I Improve my 577 Credit Score?

Having a credit score of 577 positions you within the ‘poor’ credit category, but don’t worry – turning this around is within reach. Focus on these tailor-made strategies for your situation:

1. Revisit Late or Missed Payments

Your priority should be amending any missed or late payments to rectify credit score damage. Begin tackling the most delinquent accounts first. If repayment is tough, communicate with your creditors to explore possible payment plans.

2. Keep Credit Card Balances Low

Manage your credit card usage wisely. Keep the balances lower than 30% of your credit limits, and strive to maintain it even further below at 10%. Pay down cards with the highest utilization rates first.

3. Opt for a Secured Credit Card

Given your score, a regular credit card might be out of reach. A secured card could be an alternative, where a cash deposit becomes your credit limit. Use this card for small purchases, always clearing the balance entirely each month, to exhibit responsible credit usage.

4. Seek out an Authorized User Role

Request a trusted individual with solid credit if you could become an authorized user on their credit card. This can enhance your score as their credit behavior reflects positively on your credit report, provided the card issuer reports authorized user activity to the bureaus.

5. Expand Your Credit Portfolio

Make your credit profile strong with a mix of varied credit types. After establishing sound payment behavior with a secured card, examine other credit types like retail credit cards, or credit builder loans, and manage them prudently.