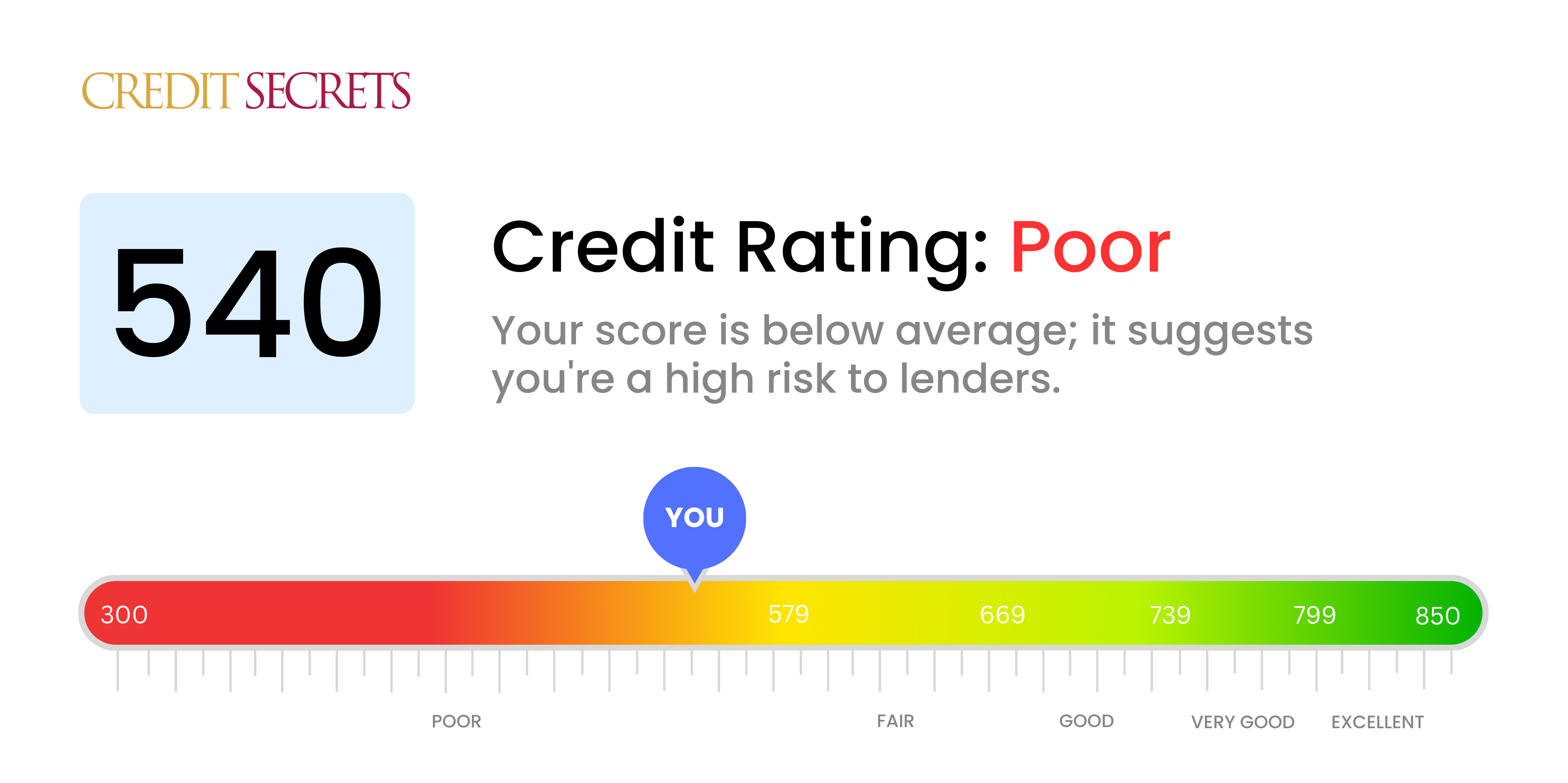

Is 540 a good credit score?

With a credit score of 540, your current credit standing falls into the 'Poor' category. This is not an ideal situation, but recognizing it's time for changes and improvement is a crucial first step.

Life with a 540 credit score might have its challenges; it may be difficult qualifying for new credit, securing competitive interest rates, or even applying for rentals. However, everyone's financial journey is unique, and this doesn't mean good credit is out of your reach. By understanding your current score, you can better plan for the future and take positive, meaningful steps to boost your credit profile.

Can I Get a Mortgage with a 540 Credit Score?

If your credit score is 540, it's unfortunately unlikely you'll be approved for a mortgage. Lenders typically look for scores well above this number, as it suggests a reliable payment history and financial stability. A score of 540 could imply you've had past problems with late payments, maxed-out credit lines, or even a bankruptcy or foreclosure, making you a riskier proposition for lenders.

This isn't an easy situation, but there are options available for you aside from traditional mortgages. Look into offer programs, such as FHA loans or VA loans if you are a veteran, which sometimes approve applicants with lower credit scores. Another option could be to save up for a larger down payment, which lowers the risk to lenders. While these alternatives might come with higher interest rates, they could provide the stepping stone you need to owning a home. Don't lose hope - credit scores aren't fixed figures and with steady, responsible financial habits, it's possible to increase your score over time.

Can I Get a Credit Card with a 540 Credit Score?

If you have a credit score of 540, it's going to be rather tough to get approved for a regular credit card. This score is seen by lenders as high-risk, indicating a history that may be marred with financial struggles or mishaps. It's tough to hear, but it's vital to face your situation honestly and sensibly. Knowing the status of your credit is the essential first move towards your financial recovery, even if it means confronting some uncomfortable realities.

In light of the challenges associated with a score of 540, other alternatives may be exploring options like secured credit cards. These types of cards require a deposit, which then becomes your credit limit. They can be easier to get and can help you gradually rebuild your credit. Also, you might consider finding a co-signer or using prepaid debit cards. Remember that these alternatives aren’t a quick-fix, but can serve as constructive stepping stones towards generating a stable financial base. One thing to keep in mind is that any type of credit that's accessible to someone with such a score will likely carry higher interest rates, mirroring the risk seen by the lenders.

Unfortunately, a credit score of 540 might potentially be a roadblock when applying for a personal loan. Most mainstream lenders usually prefer to extend credit to individuals with scores that lie in the higher bracket, seeing a lower score as an elevated risk. It's tough, but it's crucial to understand and acknowledge what your score indicates for your borrowing chances.

But remember, this doesn't mean that all hope is lost. Alternative solutions such as secured loans, where you pledge an asset as collateral, or co-signed loans with a person having a better credit standing, could be viable choices. Peer-to-peer lending platforms could also be a potential source of funds as their credit necessities can sometimes be more relaxed. However, you should bear in mind that these alternatives likely come with steeper interest rates and possibly more stringent conditions, due to the higher perceived risk for the lender.

Can I Get a Car Loan with a 540 Credit Score?

A credit score of 540 could make it quite hard to secure a car loan. You may experience some challenges as lenders generally prefer credit scores above 660. Falling under 600, your score of 540 is seen by lenders as subprime. What this implies is that, based on past actions, you may encounter difficulties repaying borrowed money, making you a higher-risk borrower in the eyes of lenders.

Despite this, it's important to remember that this doesn't totally close the car purchasing door for you. There are lenders who concentrate on working with low-score borrowers; however, it's worth noting that these types of loans often come with much higher interest rates. These heightened rates are a reflection of the increased risk that the lenders are taking on with low-score borrowers, and act as a safety net for their investment. While the process may be a little tougher, securing a car loan still remains quite possible with careful consideration and thorough examination of loan terms.

What Factors Most Impact a 540 Credit Score?

Unraveling a credit score of 540 requires understanding the essential determinants of this specific score. Addressing these factors is the first step towards achieving a more promising credit future. Remember, every financial pathway is distinct, and every setback fosters learning.

Defaults and Late Payments

Defaults or late payments may play a significant role in influencing your score. They indicate potential difficulty in meeting financial obligations.

How to Examine: Assess your credit reports for any instances of defaults or late payments. Consider periods where meeting payment deadlines was challenging.

Credit Utilization

Your credit score may be affected if you're utilizing a high amount of your available credit. This might suggest financial strain.

How to Examine: Review your credit card statements. High balances relative to your credit limit could potentially lower your score. Endeavor to maintain a low balance.

Credit Age

A brief credit history might have a negative impact on your score.

How to Examine: Evaluate your credit report to establish how old your accounts are. Reflect on whether you recently created new accounts, as this could also affect your age of credit.

Diversity of Credit

A lack of diverse credits and a negative new credit management could have a notable impact on your score.

How to Examine: Look over your mix of credit types, such as credit cards, retail accounts, and different loan types. Reflect on your habits of applying for new credit.

Negative Public Records

Holding negative public records like bankruptcy or tax liens can have a severe effect on your credit score.

How to Examine: Search your credit report for any negative public records. Pay close attention to any that may need immediate resolution.

How Do I Improve my 540 Credit Score?

With a credit score of 540, you’re certainly in need of a boost, but don’t worry! Here’s what you should focus on to aid in improving that score:

1. Prioritize Overdue Payments

Start by tackling any accounts that are overdue. Focusing on the oldest dues first can alleviate the negative impact on your credit score. If it appears overwhelming, don’t hesitate to contact your creditors to create a manageable repayment plan.

2. Control Credit Card Use

Queue in next is addressing your credit card usage. Large balances can harm your credit score quite a lot. Try to maintain your credit card balance below 30% of your limit initially, and, over time, aim for a balance under 10%. Target the cards with the highest utilization first.

3. Consider a Secured Credit Card

An excellent step you can take now is to look into secured credit cards. These require a deposit that establishes your credit limit. Demonstrate your creditworthiness by utilizing this card sensibly, making small purchases, and paying off the full balance each month.

4. Seek Trusted Co-Signer

Connect with a well-credentialed friend or family member and ask if they’d permit you as an authorized user on their credit card. This can inflate your score as their good payment habits reflect on your credit report. Confirm the card issuer reports all user activity to credit bureaus.

5. Introduce Variety in Credit Type

Holding a diverse collection of credit accounts can fortify your credit score. Once you’ve stabilized your payment history with a secured card, research other credit options, like credit builder loans or retail credit cards. As always, exercise responsibility when managing them.