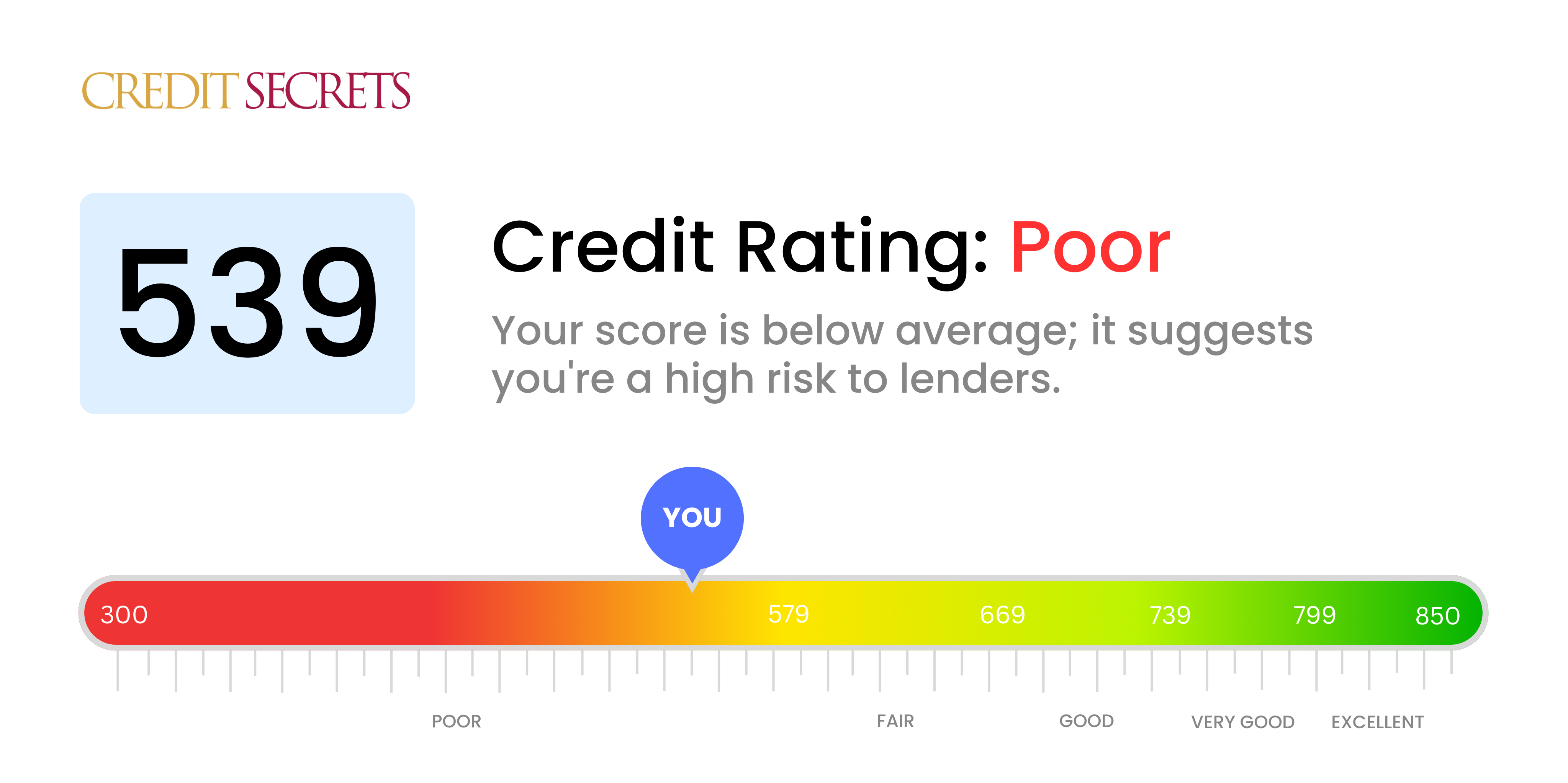

Is 539 a good credit score?

Having a credit score of 539 is considered poor. However, it's important not to lose hope or feel disheartened as this is just a temporary situation that can be improved with the right actions. Creditors might be skeptical about lending to individuals with this score, as it indicates a history of missed or late payments, maxed out credit cards, or possible major events like bankruptcy. This could lead to you facing higher interest rates and stricter loan terms.

However, don't let this discourage you. At this stage, every financial decision you make can impact your credit score, so it's crucial to prioritize the right choices to start building a stronger financial future. Committed practice of good financial habits can gradually raise your score. Monthly, on-time, full payments of your bills, reducing your overall debt, and avoid applying for new credit too frequently can help you get your credit health back on track. And remember, at Credit Secrets, you're not alone in this journey.

Can I Get a Mortgage with a 539 Credit Score?

With a credit score of 539, your chances of securing mortgage approval are unfortunately slim. Lenders typically seek credit scores significantly higher to ensure reliability in repayment. Credit scores within this range might be indicative of a credit history with certain obstacles such as missed or late payments, which lenders perceive as risky.

While this might seem discouraging, it is important to keep in mind that your present circumstance does not define your future financial status. There are alternative paths available like considering a mortgage designed for lower credit scores, might provide the opposite outcome. However, these often come with higher interest rates and more stringent requirements. Another path could involve working actively towards boosting your credit score by managing existing credit responsibly. Remember, your financial journey is unique, and it's entirely possible to reach your goals with informed planning and patience.

Can I Get a Credit Card with a 539 Credit Score?

With a credit score of 539, being approved for a typical credit card could be a hurdle. This score often implies to potential lenders that there is a higher risk involved, usually due to past financial instability or mistakes. Recognizing this isn't easy, but it's a vital first step on your road towards improved financial circumstances.

This doesn't mean there aren't options open to you though. Secured credit cards can provide a feasible solution. A secured card works by having you make a deposit that then acts as your credit limit. While these cards might not be your first choice, they can be pivotal in rebuilding your credit health over time. For those unable to go down this route, finding a trustworthy co-signer or considering prepaid debit cards may be other worthwhile alternatives. Keep in mind that interest rates for credit options available to you are likely to be slightly elevated, reflecting the higher level of risk you represent to lenders. However, remember that these aren't forever measures, but stepping stones on your path to a stronger credit score.

Holding a credit score of 539 typically implies you may encounter substantial hurdles when seeking a personal loan from traditional lenders. Most lenders view a credit score this low as indicative of a high-risk borrower. Consequently, it is probable that, without substantial improvement to your credit score, approval for a conventional loan will be unlikely. This news might be tough to accept, but gaining an understanding of your current position is a crucial step in moving forward.

Nonetheless, there are a few options you could explore. Secured loans, which require collateral, or co-signed loans, which involve someone with a higher credit score backing your loan, are two possibilities. Peer-to-peer lending platforms may provide another avenue as they can sometimes offer options more adaptable to lower credit scores. Be aware, though, these alternatives often carry higher interest rates and less consumer-friendly terms in response to the lender's increased risk. Your path may be challenging, but there are still roads to explore.

Can I Get a Car Loan with a 539 Credit Score?

A credit score of 539 can make getting an approval for a car loan a bit challenging. Typically, lenders prefer credit scores above 660 for optimal terms, and anything below 600 is usually considered subprime. Unfortunately, your score of 539 falls into this less desirable subprime range. This might mean facing higher interest rates, or perhaps even having your loan application denied. The reason being that lenders perceive a lower credit score as a higher risk, suggesting you may have had difficulties repaying borrowed money in the past.

Despite this, having a lower credit score does not mean you need to abandon your dreams of owning a car entirely. There are lenders out there who can help, even if your credit score is lower. However, be mindful that borrowing under these circumstances often comes with higher interest rates. Higher rates compensate the lender for the additional risk they are accepting by lending to someone with a lower credit score. So, while the path to getting your car loan may have some hurdles, with careful thought and understanding of the terms, the journey is definitely not an impossible one.

What Factors Most Impact a 539 Credit Score?

A credit score of 539 signifies a focus area for financial improvement. Grasping the key factors that shape this score is crucial for revitalizing your financial wellness. Everyone's financial journey is different, hence understanding your unique circumstances can lead to a healthier credit standing.

Status of Accounts

Your credit score may be affected by derogatory marks on your accounts such as collections, charge-offs, or bankruptcies.

How to Check: Scan your credit report for derogatory marks on your accounts. Any recent ones could be significantly impacting your score.

Credit Usage

Overuse of your available credit can detrimentally affect your credit score. High utilization of credit cards or loans could be one reason behind your score.

How to Check: Study your credit card and loan statements. Strive for credit card balances to be well below your limits, and work on decreasing loan balances.

Credit History Duration

A lesser credit history period could lower your credit score.

How to Check: Go through your credit report to identify the age of your oldest and most recent accounts, and the average age of your total accounts. If new accounts were opened recently, they might have influenced your score adversely.

Frequency of Credit Applications

Applying for new credit frequently over a short duration can negatively affect your score.

How to Check: Evaluate the frequency of your recent credit applications. Are you often applying for new credit? If yes, it could be adversely affecting your score.

Financial Legal Actions

Public records of judgments, tax liens or other financial legal actions can severely affect your score.

How to Check: Investigate your credit report for any legal financial actions. Any pending ones need to be addressed to improve your score.

How Do I Improve my 539 Credit Score?

With a credit score of 539, you may face hurdles in securing favorable credit terms. However, don’t lose hope. There are specific, achievable actions you can take to enhance your creditworthiness:

1. Catch Up on Delinquent Accounts

Negative information, such as overdue balances, has substantial effects on your credit score. To actively improve your score, focus first on clearing any delinquent accounts. Communicate with your lenders about potential options to manage these debts more effectively.

2. Lower Credit Utilization

Credit usage, specifically the ratio of your credit card balance to your credit limit, significantly influences your credit score. Make it a goal to keep each balance under 30% of your respective credit limit, ideally striving for less than 10%. Start by tackling the highest utilized cards.

3. Opt for a Secured Credit Card

Procuring an unsecured credit card may pose difficulty at this point. Hence, consider a secured credit card that requires a refundable deposit, reflecting your credit limit. Using this card prudently—for small payments—and clearing the balance monthly can engender a positive credit history.

4. Request to Become an Authorized User

Inquire if a trusted person with good credit would agree to add you as an authorized user on their credit card. This can reflect their good payment behavior in your report. However, ensure that the credit card issuer submits authorized user data to the bureaus.

5. Expand Your Credit Portfolio

Once you’ve established positive patterns with your secured card, consider introducing other credit types, like a credit builder loan or store credit card, to enhance your credit diversity. Responsible management of these accounts can further improve your credit score.