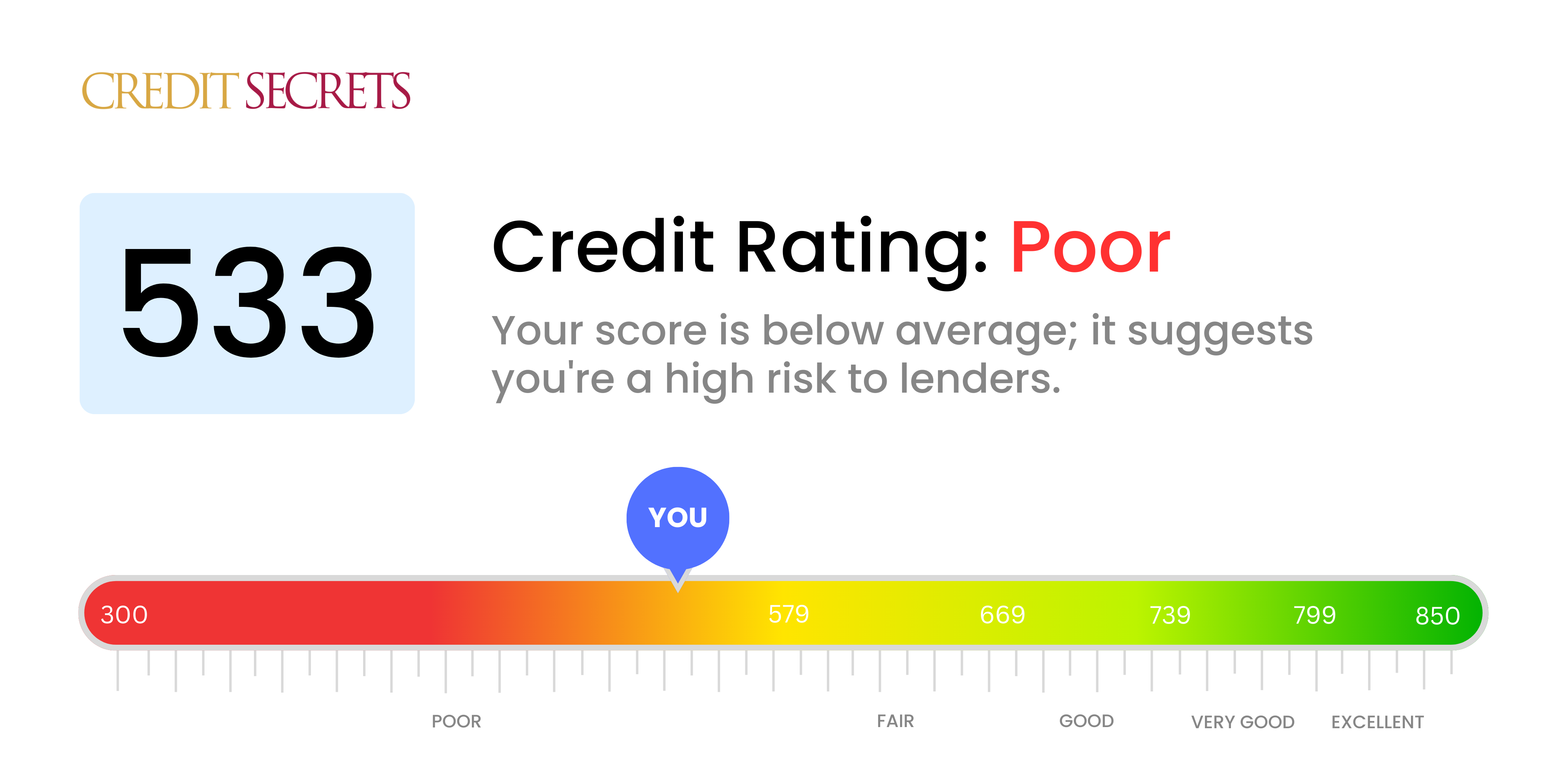

Is 533 a good credit score?

With a credit score of 533, your credit health falls into the 'poor' category. This means you might face challenges when seeking loans or credit, end up with high interest rates, or even get turned down outright. But don't be disheartened, this isn't a life sentence. With the right strategy and commitment, it's possible to increase your score and enhance your financial opportunities.

What you can expect right now may seem tough, but it's a stepping stone towards better financial health. It's likely that certain doors may seem closed to you because most lenders consider scores like yours a risk. But remember, your situation doesn't have to be permanent. There are practical ways and helpful Credit Secrets strategies that our program can provide to help you raise your credit score.

Can I Get a Mortgage with a 533 Credit Score?

With a credit score of 533, acquiring a mortgage may prove challenging. This score is significantly below the ideal range that investors are typically looking for. A score within this bracket reflects potential issues in your financial history, like late payments on bills or possibly even defaulted loans.

Despite this, it's important not to lose heart. There are alternatives available. For example, exploring government-backed loans such as FHA loans, which cater for low credit scores, might be a suitable option. But bear in mind, these options may come with higher interest rates and insurance requirements. Remember, the journey to enhance your credit score is a steady process. By settling outstanding debts and ensuring timely payment of bills, you can improve your credit health. The picture may seem bleak now, but with diligence and commitment, a path to financial stability can be created.

Can I Get a Credit Card with a 533 Credit Score?

Navigating the financial world with a credit score of 533 can feel overwhelming. It's essential to face the reality that this score is in the 'poor' range, and as a result, approval for a traditional credit card can be a significant challenge. Lenders often see this score as a risk marker, indicating possible financial difficulties in the past. Recognizing and accepting your credit situation might not be easy, but it's indeed a vital part of moving towards financial stability.

This might seem like a roadblock, but there are still options. Secured credit cards, for example, could offer a viable route. These cards require a deposit that serves as your credit limit and they are generally more accessible to people with lower credit scores. Additionally, thinking about a co-signer or examining prepaid debit cards could also be alternatives worth considering. Don't forget, these routes won't provide a quick solution, but they can serve as constructive tools on the path to better credit health. It's also crucial to remember interest rates tend to be higher for those with lower scores, reflecting elevated risks for the lenders.

With a credit score of 533, the chances of being approved for a traditional personal loan are slim. Lenders will typically view a score this low as high risk, making it less likely for you to secure a loan under regular circumstances. Your credit score may feel like a roadblock, but understand this is simply the financial landscape you're currently navigating.

In light of this, exploring potential alternatives might become a necessity. Options like secured loans, where an asset is pledged as collateral, or co-signed loans, where somebody with higher credit backs your application, may be avenues to consider. Peer-to-peer lending is another option that may have more relaxed credit score requirements. Remember, these alternatives often come with higher interest rates and unfavorable terms; a reflection of the risk the lender is taking. However, these strategies could be the stepping stones towards your financial goals. Don't lose hope; difficult situations often lead to innovative solutions.

Can I Get a Car Loan with a 533 Credit Score?

When it comes to applying for a car loan, having a credit score of 533 might present some obstacles. Generally, lenders favor credit scores above 660. Anything below 600 is usually considered subprime, meaning there's a higher risk involved for the lender. Given that your score of 533 is below this threshold, you might face higher interest rates or possibly a loan denial.

However, a glimmer of hope remains. Some lending institutions may be open to working with folks who have lower credit scores such as yours. Keep in mind though, these loans can carry a hefty interest rate, reflecting the lender's effort to balance the risk. It's crucial to be mindful of this while exploring your options. So, even though the journey to your new car may have a few bumps in the road, don't lose heart. With careful planning and understanding of the loan terms, owning a car is still achievable.

What Factors Most Impact a 533 Credit Score?

Decoding a score of 533 can be the first step towards improving your financial health. Recognizing the factors that possibly contributed to your current score is essential.

Late or Missed Payments

Poor payment history can greatly impact your credit score. Missed or late payments may be a significant factor causing your score.

How to Check: Carefully examine your credit report for any instances of late or missed payments. Acknowledge if there have been cases where payments were delayed, as this would have harmed your score.

High Credit Card Balances

High balances on your credit cards can hurt your score. If your credit utilization ratio is high it could be lowering your score.

How to Check: Review your credit card statements. If your balances are high relative to your limits, this could be affecting your score negatively.

Short Credit History

The length of your credit history can also affect your score. If your credit history is relatively young or if you recently opened new credit accounts, this could result in a lower score.

How to Check: Look at your credit report to check the age of your oldest and most recent credit accounts. Ensure you're not opening new credit accounts too frequently.

Credit Diversity and New Credit Applications

A diverse mix of credit types and limited applications for new credit can contribute towards a healthy credit score.

How to Check: Examine your credit report to see the variety of credit accounts you have. Also, if you have recently been frequently applying for new credit, this could negatively affect your score.

Public Record Entries

Entries in public records such as bankruptcies or tax liens can substantially lower your score.

How to Check: Check your credit report for any public record entries. Immediate action on these items can help to improve your score.

How Do I Improve my 533 Credit Score?

Carrying a credit score of 533 signals some past credit troubles, but with diligent action, you can certainly improve. Here are a few strategic steps tailored to your current credit status:

1. Tackle Delinquent Accounts

Your first order of business should be to address any delinquent accounts. These significantly drag down your credit score. Start with the longest overdue ones. If tackling them seems daunting, contact your creditors to discuss possible repayment plans.

2. Keep Credit Utilization Low

High credit card balances hurt your credit score. Strive to use less than 30% of your available credit, thoroughly aiming for less than 10%. Concentrate on paying off cards with the highest utilization first.

3. Opt for a Secured Credit Card

Your current score may prevent you from obtaining a conventional credit card. In this case, a secured credit card could be of help. It requires a collateral deposit, which acts as your credit limit. Use it wisely to form a healthy payment record.

4. Seek to be an Authorized User

Try to find a person with excellent credit habits who might consider adding you as an authorized user on their credit card. This can inflame your credit score by associating their stable payment habits with your credit report. But remember, the credit card company must report authorized user activities to credit bureaus.

5. Mix and Manage Credit Types

Incorporating a variety of credit types can help augment your credit score. Once you have shown disciplined use of a secured card, delve into other credit types, like retail cards or credit builder loans, while ensuring to handle them responsibly.