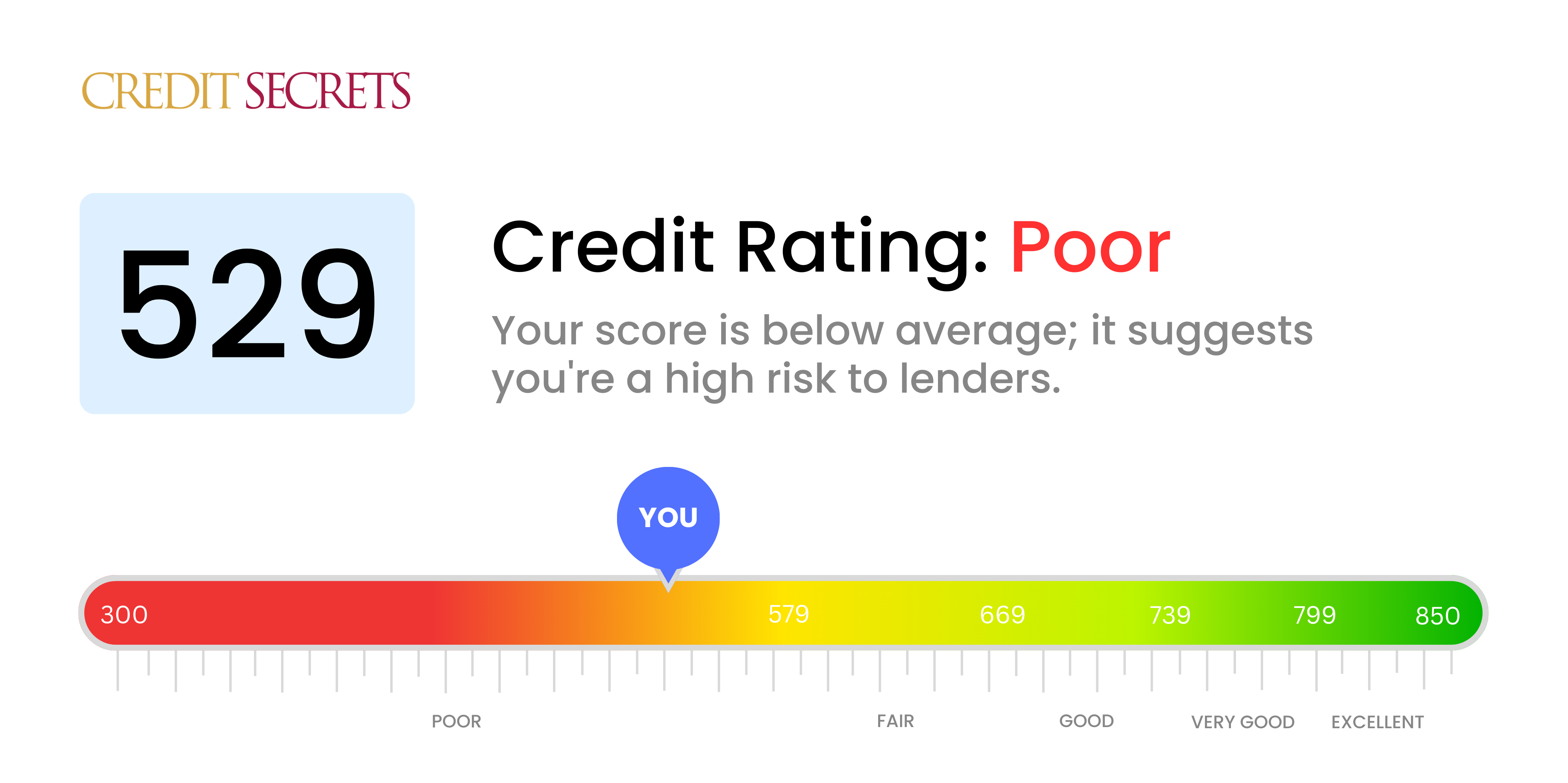

Is 529 a good credit score?

A credit score of 529, unfortunately, falls into the 'poor' category. This might present difficulties when trying to secure loans or credit, as lenders may view you as a high-risk borrower, which could result in higher interest rates or even declined applications. However, it's essential to remember credit scores can be improved over time by making consistent, timely payments and managing your debts wisely.

While a lower score may pose challenges, it's not permanent and there are things you can do to build it back up. By staying committed to wise financial habits, you can work towards better score outcomes. It's a journey, and the first step is understanding where you stand and where you can go.

Can I Get a Mortgage with a 529 Credit Score?

If your credit score is 529, it's unfortunately below the typical minimum threshold for mortgage approval. Most lending institutions look for a score of at least 620, indicating a reasonable level of creditworthiness. With a credit score of 529, it suggests you've possibly faced financial troubles in the past, such as late payments, or carrying high levels of debt.

However, don't despair. There are alternatives to mainstream mortgages that may be worth considering. Some institutions offer Federal Housing Administration (FHA) loans or other types of government-insured mortgages which have lower credit score requirements. Bear in mind, though, that with a lower score, you may face higher interest rates. It's also important to note that a better credit score can offer more favorable mortgage terms. So, any steps you can take to improve your score—even by a few points—could make a significant difference.

Can I Get a Credit Card with a 529 Credit Score?

With a credit score of 529, getting approved for a standard credit card might be a challenge. This kind of score can suggest to potential lenders that there may have been credit difficulties or mismanagement in the past. Although the situation seems daunting, acknowledging the current credit standing is a key part of starting the journey towards financial wellness. It's always better to confront the hard facts rather than shying away from them.

However, the scenario is not so grim. Secured credit cards could be a great alternative, given that such cards typically demand a deposit that equates to your credit limit. They are frequently easier to get approved for and can help to increase a person's credit score over time. Other potential alternatives include considering a co-signer or examining prepaid debit cards. It's crucial to recognize that these options don’t provide an immediate fix. Yet, they can serve as crucial steps towards financial recovery. It's also worth noting that interest rates tend to be considerably higher for credit options available to those with lower scores due to the increased risk perceived by lenders.

Having a credit score of 529 puts you at a significant disadvantage when applying for a personal loan. Most traditional lenders may find it difficult to approve your application because this score indicates considerable risk. It's a harsh reality, but understanding the meaning of this credit score is paramount to navigate your current financial situation.

However, this does not entirely close the doors on loan opportunities. Instead, you may explore alternatives such as secured loans where you back up the loan with collateral or co-signed loans where a high credit scorer guarantees your loan. Online peer-to-peer lending platforms might also consider you, as they are sometimes less rigid with credit requirements. Do bear in mind though, these alternatives frequently come with higher interest rates and less accommodating terms due to the lending risk involved.

Can I Get a Car Loan with a 529 Credit Score?

Securing a car loan with a credit score of 529 might prove to be a difficult task. Most lenders prefer to extend loans to those with credit scores above 660. A score below 600, such as yours, falls into what is recognized as a subprime category. This could potentially lead to higher interest rates or even an outright refusal of your loan application. Your credit score is a key indicator of risk to lenders, and a low score can suggest potential challenges in timely repayments.

Nevertheless, this credit score does not entirely exclude you from the car buying process. There are lenders who cater to folks with lesser credit scores. But exercise caution, the terms of these loans usually include considerably higher interest rates. These higher rates are due to the elevated risk these lenders incur. Even though the financial landscape may feel rough at this moment, with careful thought and a thorough review of your loan terms, securing a car loan remains a possibility.

What Factors Most Impact a 529 Credit Score?

Decoding a score of 529 is an essential step in enhancing your financial health. Unraveling the most likely factors affecting your score will provide a roadmap for your journey toward financial stability. Remember, every financial journey is distinct, offering opportunities for growth and financial empowerment.

Negative Information

Adverse events like overdue payments, collection accounts and charge-offs can significantly impact your score and could be the reason for your current rating.

How to Check: Scrutinize your credit report for any negative items. Reflect on any past financial difficulties that might have led to these marks on your credit history.

Credit Usage

Maintaining high balances relative to your credit limits negatively affects your score. If your credit utilization is high, this could be influencing your score.

How to Check: Inspect your credit card statements. Are your balances closer to the maximum limit? Strive to maintain a lower credit balance.

Credit History Length

A short credit history can contribute to a lower score.

How to Check: Look at your credit report to check the lifespan of your oldest and latest accounts, along with the average age of all accounts. Consider if any recently opened accounts might be impacting your score.

Types of Credit and New Credit Inquiries

Holding a variety of credit accounts and responsibly handling new credit impacts your score. If you've recently applied for multiple new credits, this could be affecting your score.

How to Check: Review your mix of the types of credit you have, such as credit cards, store accounts or loans. Reflect if you've been applying for new credit often.

Public Records

Public records such as bankruptcies or liens can significantly affect your credit score.

How to Check: Review your credit report for any public record listings that need resolving.

How Do I Improve my 529 Credit Score?

A credit score of 529 falls into the poor category, but you have room for significant improvement. We’ve laid down some manageable and impactful steps to revive your credit health:

1. Prioritize Delinquent Accounts

Start by clearing any accounts that are past due. Paying off these accounts is crucial as they weigh heavily on your score. Consider contacting your lenders to discuss a possible payment plan.

2. Slash Credit Card Debt

Excessive credit card debt can pull down your score, especially if you’re nearing your limit. Aim to lower your credit card balances to less than 30% of your total limit. Concentrate on the cards with the highest utilization.

3. Get a Secured Credit Card

Applying for and using a secured credit card responsibly, where you deposit a sum forming its credit limit, can aid in enhancing your score. Regularly make small purchases and pay off the balance fully each month to cultivate a healthy payment pattern.

4. Seek Authorized User Status

Request a close friend or family member with a high credit score to include you as an authorized user on their account. This can help elevate your score by extending their favourable payment history to your report. Ensure the card company reports such activities to the bureaus.

5. Expand Your Credit Portfolio

Once you’ve built a sound payment record with your secured card, consider venturing into other credit types like retail credit cards and credit builder loans. Properly managing these can support credit score advancement.