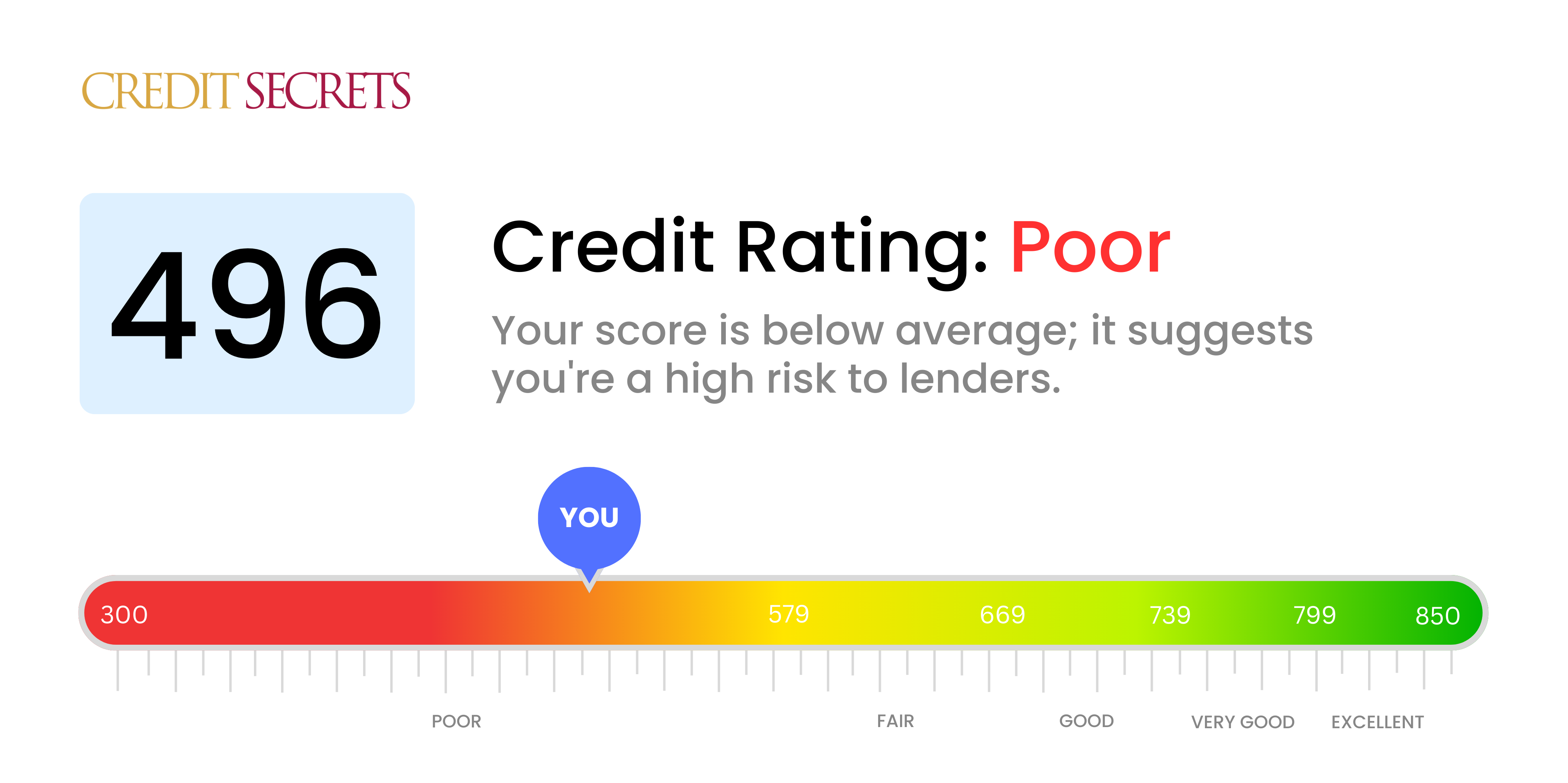

Is 496 a good credit score?

With a credit score of 496, you're currently in the 'Poor' credit range. Although this isn't an easy spot to be in, it's crucial to remember that improving your credit score is quite achievable.

A score of 496 might mean potential lenders and creditors may consider you a risk, making loans and credit cards difficult to get and possibly leading to higher interest rates. However, recognizing that your score needs improvement is the first step towards creating a solid financial future. With time, discipline, and smart credit strategies, you can progressively raise your score.

Can I Get a Mortgage with a 496 Credit Score?

Holding a credit score of 496 signifies that you're likely to experience difficulty when seeking approval for a mortgage. This score is notably lower than the minimum credit score most lenders are comfortable with, reflecting matters such as past payment issues or unsettled debts. There may be a perception that you pose a high risk of defaulting on payments.

However, this doesn't necessarily mean your situation is hopeless. An option you may want to consider is looking for alternative forms of financing, like personal loans, which may have less stringent credit requirements. Additionally, seeking out programs designed to help those with lower credit scores could also be beneficial. Remember, it's always in your favor to start the journey of improving your creditworthiness. By taking responsible actions such as timely bill payments and reducing your debt load, you can gradually elevate your score. Keep going and you will find yourself in a more financially secure situation in the future.

Can I Get a Credit Card with a 496 Credit Score?

With a credit score of 496, it's understandably tricky to get approved for a conventional credit card. This score signals to lenders potential fiscal risk due to past financial mishaps or difficulties. It sure is a tough spot to be in, but remember, acknowledging and understanding your credit status is a significant part of financial recovery. Confronting these challenges realistically is a positive step, even if it reveals some hard financial truths.

Considering the challenges that a score of 496 presents, you might want to explore other options. Secured credit cards, which use a deposit as your credit limit, may be within reach. These cards can serve as stepping stones to better credit health. Checking out options such as enlisting a co-signer or using pre-paid debit cards could also provide a solution. Keep in mind, these options don’t offer a quick fix, but they are practical tools for regaining financial stability. Importantly, available credit options for such scores usually involve higher interest rates, reflecting the elevated risk perceived by lenders.

With a credit score of 496, being approved for a personal loan from a traditional lender is unlikely. Your score is considerably below the typical threshold lenders consider as a safe risk. It's a tough spot to be in, but acknowledging this reality is an essential step towards defining your financial possibilities.

Bear in mind that while standard personal loans may be hard to come by, other alternatives could be considered. You might explore avenues such as secured loans that require collateral, peer-to-peer lending platforms or co-signed loans with a friend or family member backing your ability to repay the loan. However, it's crucial to be aware that these options may carry higher interest rates and less favorable terms, as a direct result of the risk posed to the lender by your lower credit score.

Can I Get a Car Loan with a 496 Credit Score?

A credit score of 496 creates a challenging road to getting approval for a car loan. Many lenders are looking for a minimum score around 660 to provide more favorable loan terms. Your score falls into what's considered a subprime range (below 600), resulting in potential higher interest rates or even denial of a loan because a low credit score suggests a higher financial risk to lenders.

Yet, it's not all bad news. It's a tougher path, but not impassable. Some lenders specialize in working with lower credit scores. They offer options, even though these options usually come hand in hand with higher interest rates. The more elevated rates reflect the perceived risk these particular lenders are willing to assume. Navigating through this demands patience and understanding of terms but it's possible to secure a car loan. It's just a matter of finding the right lender willing to work with your current credit score.

What Factors Most Impact a 496 Credit Score?

Your credit score of 496 isn't merely a number – it's a key element of your financial blueprint. Recognizing the factors that influence this can empower you to shape a promising financial future.

Payment History

Keeping up with your payments is pivotal to your credit score. Late payments or even defaults could have led to your current score.

How to Check: Scrutinize your credit report for any late or missing payments, which can lead to score reductions. A history of consistent, timely payments can positively influence your score.

Credit Utilization Ratio

Having high balances compared to your credit limits can lead to a lower score. This might have influenced your score of 496.

How to Check: Take a look at your credit card balances. Keeping your balances well below your limits is a positive strategy for your credit utilization ratio.

Length of Credit History

A limited credit history may affect your score adversely.

How to Check: Look into your credit report to evaluate the age and history of your accounts. Remember: stability counts in credit history.

Variety of Credit

Maintaining a diverse mix of credit like credit cards, auto loans, or mortgage loans can enhance your score.

How to Check: Look over the diversity of your credit accounts. Balancing variety with manageable limits is key.

Public Records

Public records that include bankruptcies or tax liens can impact your score significantly.

How to Check: Check your credit report for any public records and ensure any listed items have been or are properly resolved.

How Do I Improve my 496 Credit Score?

A credit score of 496 is deemed unfavorable, but it’s important to realize that it’s within your power to improve it. At this credit score level, here are some concrete and significant steps you can adopt to help raise your score:

1. Settle Delinquent Accounts

Dealing with overdue accounts is critical at this stage. Prioritize paying-off the accounts that are overdue the longest, as these have the heaviest impact on your score. If you’re unable to pay right away, contact your creditors to explore setting up a feasible payment plan.

2. Pay down credit card debts

When you’re carrying high credit card balances, it negatively affects your credit score. Start chipping away at these balances and aim to reduce them to less than 30% of your limit. If possible, the ideal goal is to keep them below 10%. Deal with the cards enjoying the highest utilization rates first.

3. Try a Secured Credit Card

Considering your current credit score, obtaining a regular credit card may present a challenge. Applying for a secured credit card might be your best bet – this requires a cash collateral deposit that becomes your credit line. Make sure you use it responsibly for small purchases and pay off the full balance monthly in order to build a solid payment history.

4. Enlist as an Authorized User

Explore possibility of asking a friend or relative with good credit to include you as an authorized user on their card. This move can potentially raise your credit score as their strong payment history would reflect on your credit report. Make sure that the card company reports authorized user activities to credit bureaus.

5. Bolster Your Credit Mix

Having a varied mix of credit can help improve your score. Once you’ve displayed a good track record with your secured card, consider other credit types like retail credit cards or credit builder loans. Manage these wisely to boost your score.