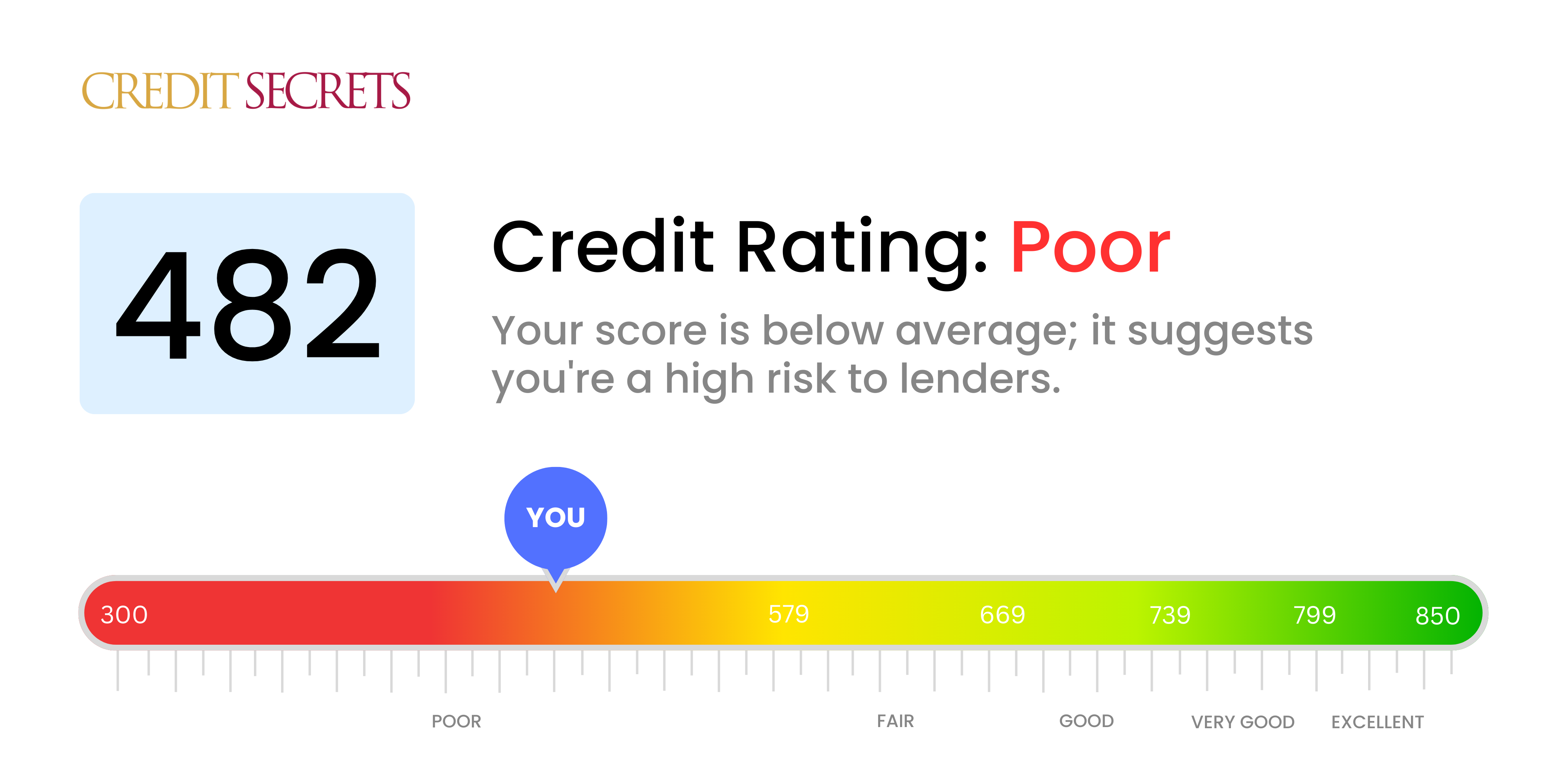

Is 482 a good credit score?

With a score of 482, your credit rating falls into the 'Poor' category. While this isn't optimal, it's important to remember it's just a snapshot of your financial health at a certain point in time, and there are steps you can take to improve it.

A score in this range may result in being turned down for credit, or if you are approved, your interest rates could be higher than someone with a better credit score. Keep in mind, this isn't a lifelong sentence. You have the power to improve your credit score over time, and we're here to help guide you along that journey.

Can I Get a Mortgage with a 482 Credit Score?

With a credit score of 482, it's unlikely that you will be approved for a mortgage. This score is significantly lower than most lenders require, suggesting a history of financial issues, such as late payments or defaults. This might seem like a mountain you can't climb, but it's not insurmountable.

A credit score in this range might require a different approach. One possibility is to seek out programs designed for individuals with low credit scores. These options may have more flexible requirements, but are likely to carry higher interest rates. Alternatively, consider exploring other forms of home financing, like rent-to-own agreements or seller financing. Any of these avenues could provide you with an opportunity to gradually rebuild your credit health over time, ultimately putting you in a stronger financial position in the future.

Can I Get a Credit Card with a 482 Credit Score?

Dealing with a credit score of 482 can be tough. It means that obtaining a conventional credit card might be a difficult task since lenders usually perceive such a score as high-risk. This situation demonstrates a pattern of financial struggles or mismanagement, which understandably might feel discouraging. But acknowledging and understanding the current financial standing is critical for future financial improvement.

Don't be disheartened though. There are other options to consider, such as a secured credit card. This type of card requires a deposit that is equivalent to your credit limit and can be a more accessible credit line for you. Alternatively, considering a co-signer or exploring the use of pre-paid debit cards can be potential solutions. These choices won't instantly rectify the situation but can be invaluable tools in the quest towards financial stability. Take note though; individuals with such scores often have to contend with considerably higher interest rates due to the greater risk perceived by lenders.

With a credit score of 482, unfortunately, your chances of being approved for a personal loan are quite slim. Traditional lenders typically look for credit scores well above this number, seeing a score of 482 as a serious risk. It's essential to be honest about what such a score may mean for your borrowing capabilities.

Given that conventional personal loans might be out of reach, you could explore other alternatives such as secured loans which require collateral, or co-signed loans with the help of someone who has a higher credit score. Another potential route could be peer-to-peer lending platforms, which can be more flexible with credit requirements. Be mindful, though, that these options can come with higher interest rates and less favorable loan conditions due to the increased risk seen by the lenders.

Can I Get a Car Loan with a 482 Credit Score?

With a credit score of 482, it's going to be tough to get approved for a car loan at favorable terms. In most cases, lenders are on the lookout for scores above 660, mainly because such scores represent less risk on their part. A score below 600 typically falls into the subprime category, which often results in higher interest rates or loan rejection. Your credit score of 482 falls into this range, and it's an indication of a higher lending risk.

Nevertheless, all hope isn't lost. Some financial institutions make an effort to work specifically with individuals who have lower credit scores, extending to them car loan offers. However, be prepared for higher interest rates in such situations because the lending risk gets balanced with the increased rates. The journey might not be smooth, but with thoughtful decision-making and a keen understanding of the loan terms, it's not impossible to secure a car loan.

What Factors Most Impact a 482 Credit Score?

Understanding a credit score of 482 can empower you to make informed decisions for your financial future. Let's identify the potential causes so you can set a richer financial course.

Poor Payment History

Your payment history has a major influence on your credit score. Late or missed payments could be significant contributors.

How to Check: Scan your credit report for any payment arrears or defaults. If you've missed payments in the past, these errors could have negatively impacted your score.

High Credit Usage

Using too much of your available credit can decrease your score. If your credit balances are reaching their limits, this might be a core issue.

How to Check: Review your credit card statements. Are you consistently reaching or surpassing your limit? Remember, it's beneficial to keep a low balance relative to your limit.

Limited Credit History

A brief credit history can unfavorably impact your score.

How to Check: Survey your credit report to evaluate the average age of your accounts and your oldest and newest accounts. Think about any newly opened accounts.

Lack of Credit Diversity

Maintaining a diverse mix of credit accounts and responsibly handling new credit is crucial for a healthy score.

How to Check: Assess your variety of credit accounts like credit cards, loans, and mortgages. Consider whether you've been conservative in applying for new credit.

Negative Public Records

Public records like tax liens or bankruptcies can considerably harm your credit score.

How to Check: Consult your credit report for any public records. Resolve any outstanding issues that might be harmful to your score.

How Do I Improve my 482 Credit Score?

With a score of 482, your credit sits within the ‘poor’ category. Despite the challenges, taking strategic measures can help improve your situation. Below are five actionable steps tailored specifically for your current condition:

1. Settle Unpaid Debts

Unresolved debts are the heaviest weights on your credit score. Tackle the oldest or the highest interest debts first, as they have a more damaging impact on your score. Don’t hesitate to communicate with your creditors to agree on a manageable payment plan.

2. Manage Your Credit Utilization

Keeping your credit card balance below 30% of your available credit limit can positively influence your credit score. Aim for eventually keeping it under 10%. Prioritize paying off the cards with the highest balances first.

3. Apply for a Secured Credit Card

Your existing credit score may make it tough to qualify for a regular credit card. A secured credit card, backed by an upfront cash deposit, could be an effective solution. Use it sensibly making modest transactions and paying off the balance monthly to establish a healthy payment history.

4. Consider Being an Authorized User

Request a trusted person with good credit to add you as an authorized user to their credit card. This move can help boost your score by including their well-maintained payment history into your credit report. Verify that the card issuer shares authorized user information with credit bureaus.

5. Broaden Your Credit Portfolio

A diversified credit portfolio can improve your score. After proving responsible management with a secured card, consider other types of credit—such as a credit builder loan or retail credit card—and handle them responsibly.