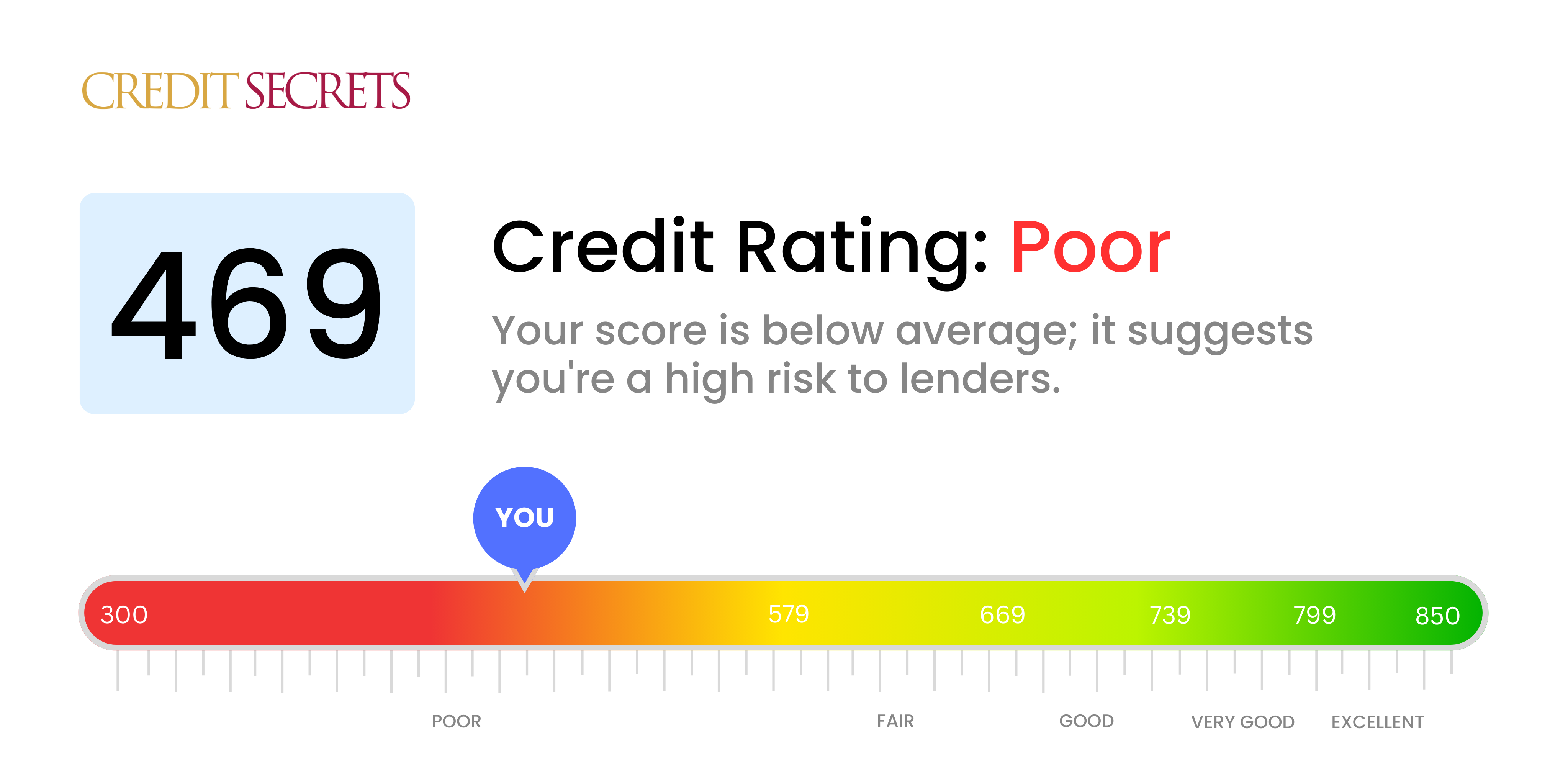

Is 469 a good credit score?

Your score of 469 is considered to fall within the 'poor' credit score range. Unfortunately, this isn't viewed as a satisfying score by lenders, which may make it challenging for you to qualify for credit cards or loans with favourable terms. But remember, it's not an impossible task to improve your credit score; with diligence, you can make the significant strides towards better financial health.

At this credit score, you may encounter higher interest rates, less optional credit, or perhaps your credit applications may be denied. However, the journey towards improving your score starts with understanding your credit background, paying your bills on time, and steadily reducing your debt. Patience and consistency are your allies here; poor scores don't remain fixed forever and every step towards healthier financial habits is an advance towards a better credit score.

Can I Get a Mortgage with a 469 Credit Score?

Unfortunately, a credit score of 469 is significantly lower than what most lenders look for when considering mortgage applications. It suggests that you have experienced some financial hardships, like late payments or defaults on loans, which results in such a low rating. It can be disheartening to hear, but it's important to know that you're not alone and there are paths to improving your financial situation.

Turning around a credit score takes time and patience, but is entirely possible. Begin by addressing those issues that most negatively affect your score, such as unpaid debts. Make a plan to pay your bills in a timely manner to demonstrate responsibility. While it may not be an immediate remedy, over time your credit score can improve. In the meantime, exploring alternatives like finding a co-signer or saving a larger down payment may be worth considering. Remember, your present credit score isn't a final judgement, it's just a snapshot and it can be improved.

Can I Get a Credit Card with a 469 Credit Score?

Having a credit score of 469, you're likely to find it quite challenging to be approved for a standard credit card. Many lenders see this score as high risk, signaling past financial struggles or missteps. It can feel disheartening, but accepting your credit standing is key to moving towards financial health, even though it comes with some tough realities.

In light of the hurdles that come with a lower score, you may find it worthwhile to consider alternatives like secured credit cards. This type of card involves a deposit that sets your credit limit and can be easier to qualify for, offering a chance to rebuild your credit score over time. Other options could involve getting a co-signer or exploring pre-paid debit cards. Though these might not be instant solutions, they can play a crucial role in your path toward financial stability. Do bear in mind that any credit available to individuals with such scores might come with higher interest rates, due to the higher risk the lenders perceive.

Having a credit score of 469 poses significant challenges when trying to secure a personal loan from most traditional lenders. This score is considerably below the standard range deemed acceptable, suggesting a high-risk level to potential lenders. Regrettably, with this credit score, it's improbable that a personal loan would be approved under regular conditions. Nonetheless, it is crucial to acknowledge this reality to better understand your borrowing possibilities.

Don't lose hope though. Alternatives, such as secured loans, are an option. Here, you offer an asset as collateral to secure the loan. Co-signed loans are another possibility, where someone with a better credit score vouches for you. Peer-to-peer lending, too, can be a helpful alternative since they often have more flexible credit requirements. However, be aware that these options generally come with higher interest rates and less advantageous terms due to the increased risk posed to the lender.

Can I Get a Car Loan with a 469 Credit Score?

Regrettably, with a credit score of 469, securing approval for a car loan may be difficult. Most lenders tend to prefer credit scores above 660 for prime loan rates, and regard scores under 600 as subprime. As your score of 469 falls into this subprime category, securing a loan may present challenges including higher interest rates or even outright loan denial. This is because a lower credit score signifies high-risk to the lenders, acting as an indicator of potential challenges you may face in repaying the loan.

But don't lose heart; a lower score doesn't entirely eliminate your chances of purchasing a car. There are certain lenders who specifically help individuals with lower credit scores. However, caution is advised as these loans usually carry considerably higher interest rates. This is because these lenders perceive they're taking on an increased risk and need to protect their investment. Nevertheless, despite slight bumps along the way, with a thorough understanding of the loan terms, you might still be able to secure a car loan.

What Factors Most Impact a 469 Credit Score?

Gaining a clear understanding of a credit score of 469 is essential to navigate your path toward financial stability. Determining the factors driving this score can help lay the foundation for effective credit repair strategies.

Payment History

Missed or late payments possess a considerable weight on your credit score. They could well be a principal factor behind your current score.

What You Can Do: Peruse your credit report for any past-due or defaulted payments. Recollect any occasions of late payments; these could have left a mark on your score.

Debt-to-Credit Ratio

Keeping a high balance on your credit accounts can put a dent on your score. If your credit cards are nearly maxed out, this could be playing a part in your current credit situation.

What You Can Do: Scrutinize your credit card bills. Are your balances nearing your limits? Working towards lower balances in relation to your credit limit can help.

Credit History Duration

A relatively short credit history may not work in your favor. Younger credit accounts can pull your score down.

What You Can Do: Look at your credit report to understand the average duration of your credit accounts. If you have recently started new accounts, it could be impacting your score.

Credit Variety and New Credit

A diversified credit portfolio and prudent handling of new credit are fundamental to a healthy score.

What You Can Do: Assess your assortment of credit products like credit cards, retail accounts, mortgages, etc. Excessive new credit applications could be burdening your score.

Public Records

Public records like bankruptcies or pending legal actions can significantly lower your score.

What You Can Do: Check your credit report for any public records or legal actions that might need your attention.

How Do I Improve my 469 Credit Score?

A credit score of 469 is certainly low but it’s not unchangeable. You can start taking targeted steps now to increase your score. Here are the best strategies tailored for this score level:

1. Resolve Defaulted Accounts

When you have a credit score of 469, there’s a possibility you have defaulted accounts. Address these first. Reach out to your creditors, discuss your situation, and see if they offer any hardship programs. If you can, start making payments to bring these accounts back to good standing.

2. Prioritize your Credit Card Debt

Another key factor affecting your score is credit card debt. Paying this down to below 30% of your overall credit limit can boost your score. Push yourself and aim for 10% or less. Tackle cards with the highest rates first, then move to the next.

3. Apply for a Secured Credit Card

In your present situation, a secured credit card could be a significant step. This helps you establish a reliable credit and payment history, so use it wisely. Make only necessary purchases and pay off the balance monthly.

4. Consider Authorized User Status

Find a responsible friend or family with good credit who’s willing to add you as an authorized user. It helps to strengthen your credit history because you benefit from their positive credit habits. But remember, they need to confirm that their card issuer reports authorized user data to credit bureaus.

5. Credit Diversity Matters

After maintaining a positive payment pattern with your secured credit card, it’s time to diversify your credit. Broaden your credit portfolio by responsibly managing different types of credit; a credit builder loan or retail credit card could be a good start.