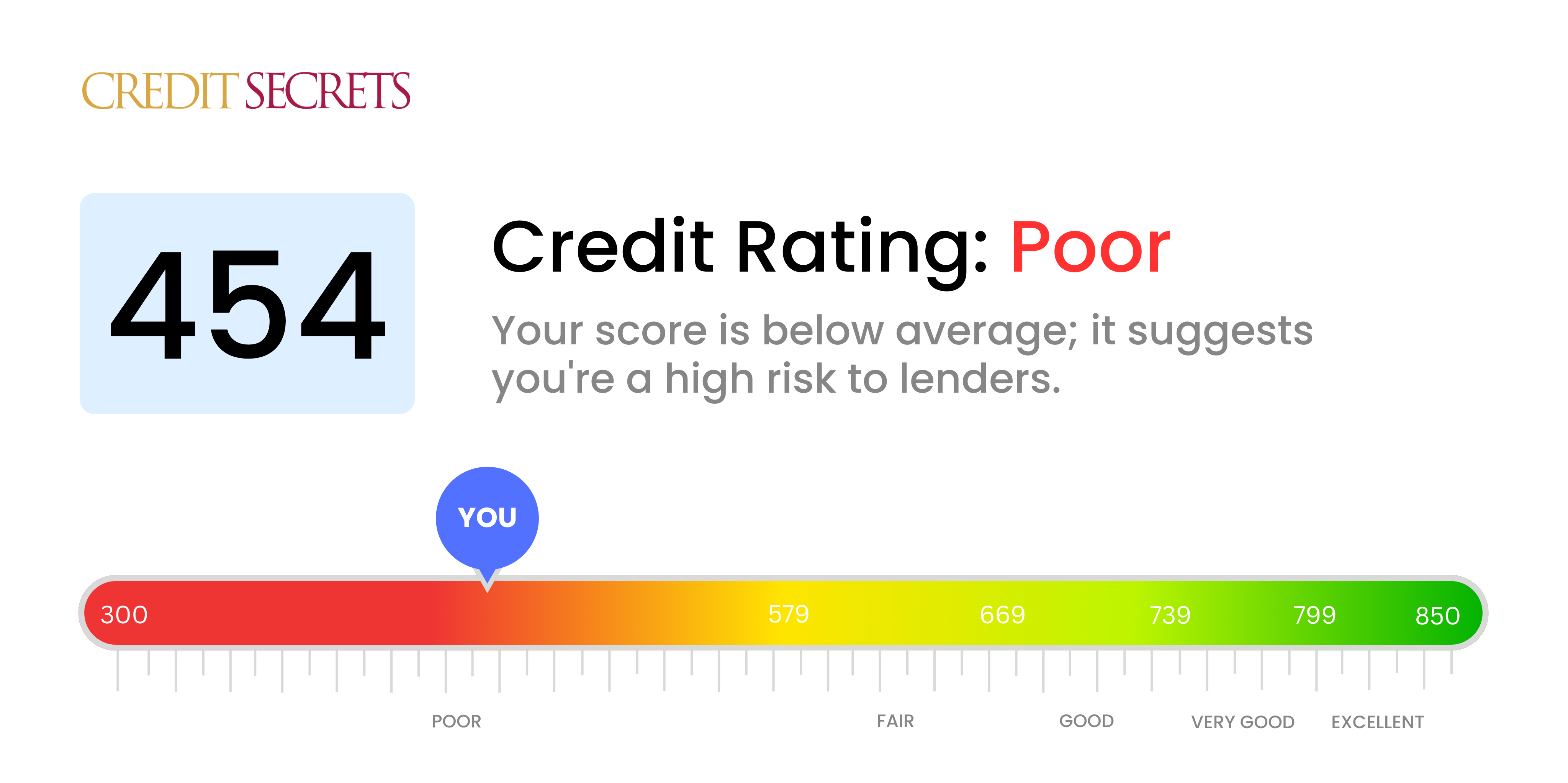

Is 454 a good credit score?

Regrettably, a credit score of 454 is in the “poor” range. This doesn't mean you're out of options, rather, it implies there's a lot of room for improvement and the likelihood of obtaining new credit lines or loans may be harder than it would be for someone with a better score. You could face higher interest rates or more scrutinized lending terms, but keep in mind, it's possible to improve and rebuild your credit over time. Always bear a positive outlook and make a start today towards repairing your credit health while forging a brighter financial future.

Can I Get a Mortgage with a 454 Credit Score?

Stocked with a credit score of 454, you're positioned in a tight spot when it comes to securing a mortgage. Scores within this tier are usually viewed with skepticism by lenders because they possibly indicate past financial struggles or mismanagement. This score is significantly lower than the minimum requirement by most lenders which is generally around the 580 to 600 mark.

Although this news might feel discouraging, remember there are alternatives available to you. Certain government-backed loans such as Federal Housing Administration (FHA) loans, for example, allow for lower scores, although they come with their own set of conditions and generally higher interest rates. Another route you might consider, is seeking a co-signer with a better score, which could improve your odds of approval.

Most importantly, this score doesn't have to be permanent. Consistent payments, keeping your credit usage low, and avoiding new debt can contribute to a brighter financial future. Take it one step at a time and remember, every journey towards better credit begins with the first step.

Can I Get a Credit Card with a 454 Credit Score?

With a credit score of 454, getting approval for a regular credit card could be quite a tough hill to climb. A score in this range often signals to lenders that you've had some hiccups with past financial responsibilities. This isn't an easy pill to swallow, but being honest and realistic about your credit situation is critical. Knowledge of your current financial standing arms you with what you need to take steps towards healthier financial habits.

Your low score doesn't mean that all doors are closed to you. There are alternate ways to handle your finances. For instance, secured credit cards might be a viable option. Here, you provide a deposit which serves as your credit limit. These cards tend to be easier to get and can gradually help rebuild your credit. You might also consider getting a co-signer or opting for prepaid debit cards. Please bear in mind that whichever option you choose, interest rates will probably be higher due to the increased risk seen by the lenders. Keep a positive outlook, as these are stepping stones on your path towards better financial health.

With a credit score of 454, obtaining a personal loan may be a challenging endeavor. This score falls well below the range typically favored by traditional lending institutions. For lenders, this score represents high risk, decreasing the odds that you'd be readily approved for conventional personal loans. This is a difficult circumstance, but acknowledging the implications of this credit score on your borrowing possibilities is crucial.

If conventional lending avenues aren't currently viable, there are alternative options to explore. Secured loans, which involve offering collateral, are one possibility. Another is co-signed loans, where another person with strong credit vouches for your reliability. Peer-to-peer lending platforms can be another resource, as these often have less stringent credit score requirements. Keep in mind, these alternatives usually involve higher interest rates and might have less favorable terms, due to increased risk to lenders. It's vital to fully comprehend these potential complications before proceeding with these alternatives.

Can I Get a Car Loan with a 454 Credit Score?

Carrying a credit score of 454, it's understandable if you're concerned about being approved for a car loan. It's a tough talk, but a score at this level is likely going to present some challenges. Credit rating agencies, as well as most lenders, seek a score over 660 for favorability. They regard a score below 600 as subprime, marking high risk. Hence, your score of 454 sadly lands in this high-risk category. This can result in more pricey interest rates or, in some cases, absolute denial of the loan. This is fundamentally due to that your score signals a high risk to the lenders.

Don't let a low score discourage you entirely. Opportunities do exist for car loans to people with less-than-perfect credit. Be aware that these opportunities often come with loftier interest rates; a system put in place by lenders to protect their investment against high-risk situations. Navigating through this might be challenging, but with thoughtful planning and careful evaluation of loan terms, obtaining a car loan becomes achievable.

What Factors Most Impact a 454 Credit Score?

Recognizing and understanding a credit score of 454 is the first step towards achieving financial health. It's time to dig into factors affecting your score, remember no one's financial journey is the same, hence every bump is an opportunity to learn and grow.

Timeliness of Payments

A major component of your credit score is your payment history. Late payments or defaults on your credit accounts could significantly influence your score.

Check Your Score: Check your payment history on your credit report. Late payments could significantly decrease your score.

Credit Balance

Credit utilization, or the ratio of your credit card balances to their limits, can have an adverse impact on your score. If your credit balances are high, your score could be lower.

Check Your Score: Look through your credit card statements. Are there balances near their limit? Reducing these can help improve your score.

Length of Your Credit History

A shorter credit history can reduce your credit score. Remember, old is gold when it comes to credit history.

Check Your Score: Your credit report also contains the length of your credit history. Review the age of your accounts, and note any recent new ones.

Type and Amount of Credit

Holding a variety of credit types such as loans or retail accounts, and your approach to opening new credit can also affect your score.

Check Your Score: Review the types of credit accounts you have. Also, cautiously approaching new credit can be beneficial for your score.

Public Records

Public records including bankruptcies or tax liens can severely impact your credit score.

Check Your Score: Your credit report also lists any public records. Ensure you deal with any items that may require correction or negotiation.

How Do I Improve my 454 Credit Score?

A credit score of 454 is unfavourable; however, don’t lose hope—your credit standing can be turned around with the right action plan. Here are some tailored approaches to overcome this financial hurdle:

1. Tackle Delinquent Accounts

If you have any accounts in delinquency, rectifying them is the most immediate step to take. Overdue accounts can weigh heavily on your credit score, hence, give priority to the ones most past due. Communicate with your creditors for a feasible repayment plan, if necessary.

2. Minimize Credit Card Debt

Your credit utilization, or the proportion of your available credit that you’re using, greatly impacts your score. Strive to reduce your card balances to less than 30% of your limit, eventually aiming to keep them under 10%. Pay down the cards with the highest utilization first.

3. Consider a Secured Credit Card

Obtaining a traditional credit card might be tough with your current score. A secured credit card, which requires a cash deposit that doubles as your credit limit for that card, could be an option. Use this account sensibly—make minor purchases and settle the balance in full each month, building a solid payment history.

4. Request to be an Authorized User

You could request to be added as an authorized user on a trusted person’s credit card. This can aid in augmenting your credit score as their reliable payment history will reflect on your own report. Be sure the card issuer reports authorized user activities to the credit bureaus.

5. Broaden Your Credit Variety

Having a variety of credit accounts can be beneficial. Once a decent payment history with a secured card is established, explore other forms of credit such as retail credit cards or credit builder loans, and handle them responsibly.