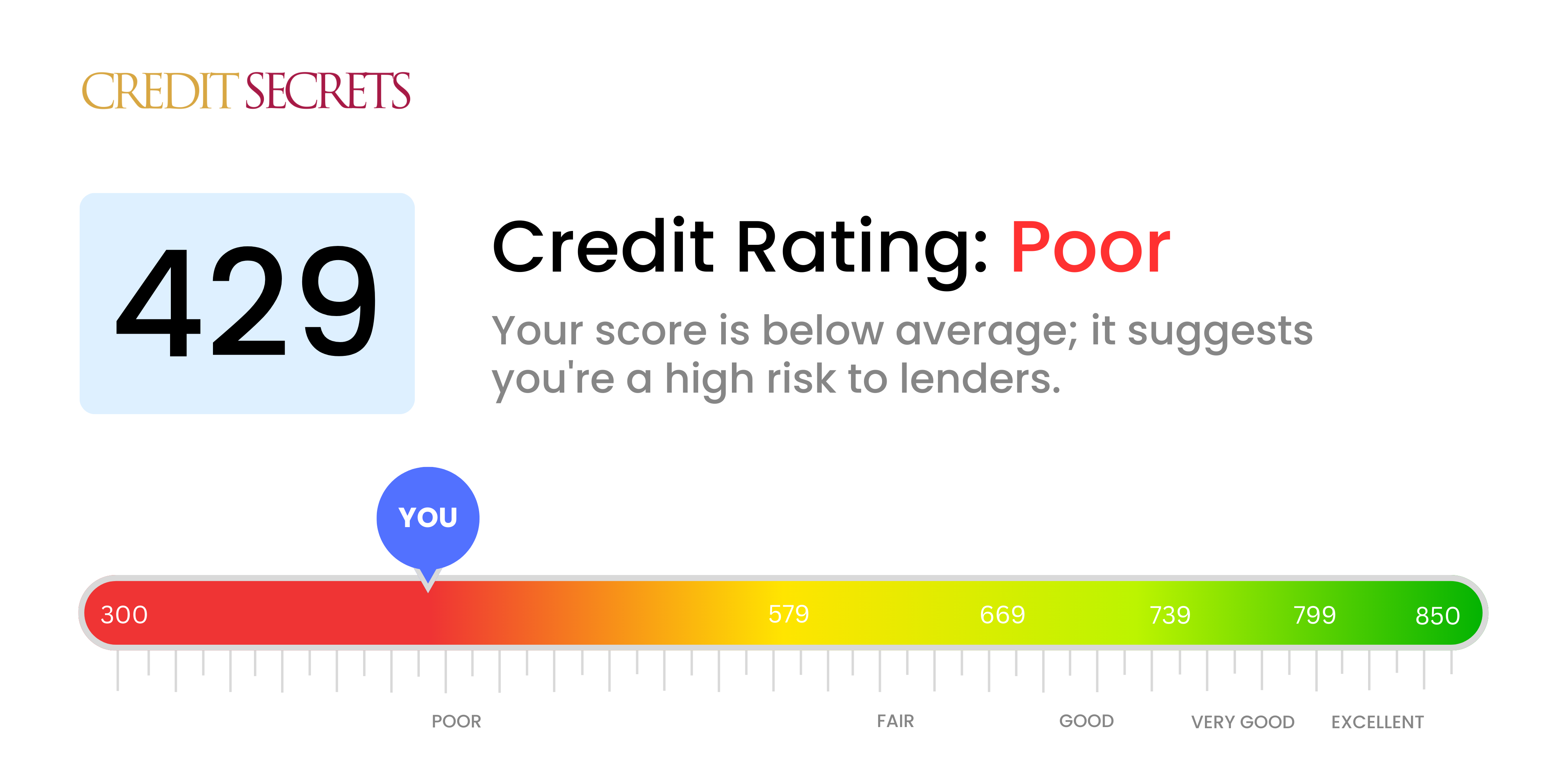

Is 429 a good credit score?

With a credit score of 429, your rating falls within the "poor" category. This is not an ideal position to be in, but remember that you're not stuck here; there are steps you can take to improve your credit score. When you have a score of 429, it can be notably difficult to access certain financial benefits like good interest rates, affordable insurance premiums or approved credit applications. Your current situation may be challenging, but with dedication, it isn't impossible to improve. Look at this as a launching pad for taking control of your financial health.

Can I Get a Mortgage with a 429 Credit Score?

With a credit score of 429, it might be quite difficult for you to be approved for a mortgage since most lenders usually look for a higher score as an indication of credit worthiness. This score suggests there have been significant credit challenges in the past, such as late payments or defaults, which may cause lenders to view you as a risk.

Don't be disheartened. It is possible to gradually move towards a financially healthier path from here. It's important to tackle any outstanding debts or delinquencies that may be lowering your score. Creating a consistent pattern of on-time payments can also be greatly beneficial. And while improving your credit score might take some time and patience, every step taken in the right direction carries you towards a better financial future where getting approved for a mortgage could become reality. Instead of a conventional mortgage, you might want to consider alternatives like FHA loans, which are more forgiving when it comes to credit scores.

Can I Get a Credit Card with a 429 Credit Score?

With a credit score of 429, it might be hard to get approval for a standard credit card. This score is often seen as high-risk to lenders, showing a past of financial struggles or mishandling of finances. Even though this might be discouraging, it's crucial to be realistic and understand the situation. Realizing your credit status is a significant initial move towards financial improvement.

Due to the troubles linked to such a low score, other options such as secured credit cards could be a good alternative. These cards need a refundable deposit which becomes your credit limit and are often more accessible for individuals with lower scores. They can also be beneficial in rebuilding credit over time. Other options can include finding a co-signer or considering pre-paid debit cards. Keep in mind, these choices won't provide a quick fix, but they can be effective tools on your path towards better financial stability. Do note, any credit available to individuals with a low credit score like 429 would likely come with higher interest rates, as this mirrors the higher risk lenders perceive.

With a credit score of 429, it's unlikely that you'll qualify for a traditional personal loan. Lenders often deem a credit score this low as too risky which makes approval for a personal loan quite challenging. It's important to understand the reality of your situation and what this score means for your loan options.

However, there are alternative routes you might consider. Secured loans, where you offer up collateral, or co-signed loans, where someone else with a stronger credit history acts as your backup, could be potential avenues for you. You could also look into peer-to-peer lending platforms as they might have more lenient credit requirements. But be aware, these options frequently come with higher interest rates and less friendly terms due to the increased risk for the lender. Your path may be steep, but remember, every problem has a solution.

Can I Get a Car Loan with a 429 Credit Score?

Having a credit score of 429, it can be tough to get approved for a car loan. Lenders often prefer scores that sit above 660. Your score falls well under 600, which is typically seen as subprime. This means you could face high interest rates or even a rejection for a loan. A low credit score indicates to the lender that there's a risk in lending to you because your history may point to potential struggles in paying back the borrowed amount.

Despite this, getting a car loan isn't entirely impossible with your score. There are lenders out there who cater specifically to those with lower credit scores. However, tread cautiously. Loans from these lenders generally come with steep interest rates. This elevated rate is a result of the risk the lender takes on by loaning to someone with a low credit score and is their way to protect their investment. Still, with a clear understanding of the terms and thoughtful decision-making, obtaining a car loan is achievable.

What Factors Most Impact a 429 Credit Score?

A credit score of 429 points indicates a need for considerable financial improvement, but fret not - deciphering the factors affecting your score can be your first step towards a healthy financial trajectory. Everyone's credit journey is different, but with commitment and diligence, improvements are within reach.

Outstanding Debt

Considerable unpaid balances are a possible huge contributor in creating this credit score.

How to Check: Take a careful look at your credit report. Watch out for any persistent unpaid balances that you may need to handle.

Past Due Accounts

Owing past due amounts on your credit cards or other loans can severely impact your credit score.

How to Check: Check your credit report and account statements for any past due balances. Address these as soon as possible to minimize further impact.

Charge-offs

Accounts charged-off by creditors due to non-payment can be a significant factor in bringing down your score.

How to Check: Your credit report will list charge-offs. Plan ways to settle these debts, ideally in full, to begin rebuilding your credit worthiness.

Collections

Having accounts in collections can substantially affect your score negatively.

How to Check: Peruse your credit report for any accounts listed as being in collections. Address these promptly to start improving your score.

Bankruptcy

Having bankruptcy on your record has a significant effect on your score.

How to Check: Your credit report will indicate whether there has been a bankruptcy filing. It stays on the report for 7-10 years, but its impact lessens with time.

How Do I Improve my 429 Credit Score?

With a credit score of 429, there are tailored steps you can take to improve your situation. Remember, it might seem daunting but with a focused approach, it’s possible to elevate your score. Here’s what you can do:

1. Prioritize Overdue Accounts

Your first step should be managing any overdue accounts. These have the greatest negative impact on your credit score. Start by paying off the most overdue accounts first. If you need additional time, don’t hesitate to contact your creditors to negotiate a suitable payment plan.

2. Focus on High Balance Credit Cards

Balance management is critical – high balances in comparison to your credit limits hurt your credit score. Strive to bring credit card balances below 30% of your credit limit. Even better, aim for less than 10% in the long run. It a good to start paying down those cards with the highest utilization rates.

3. Consider a Secured Credit Card

At your current score, a regular credit card might be out of reach. As an alternative, think about applying for a secured credit card. It functions with a cash collateral deposit that sets the credit line. By using it wisely and paying off the balance monthly, it can help establish a healthier credit history.

4. Explore Authorized User Status

You can ask someone who has good credit, like a friend or family member, to add you as an authorized user on their credit card. This can positively impact your credit score by associating their consistent payment history with your credit report. It’s important to ensure that the issuer reports activity to credit bureaus.

5. Broaden Your Credit Types

Having assorted credit accounts can positively affect your credit score. Once your payment history is stable with a secured card, think about venturing into other credit such as credit builder loans or retail credit cards. As with everything, handle responsibly.