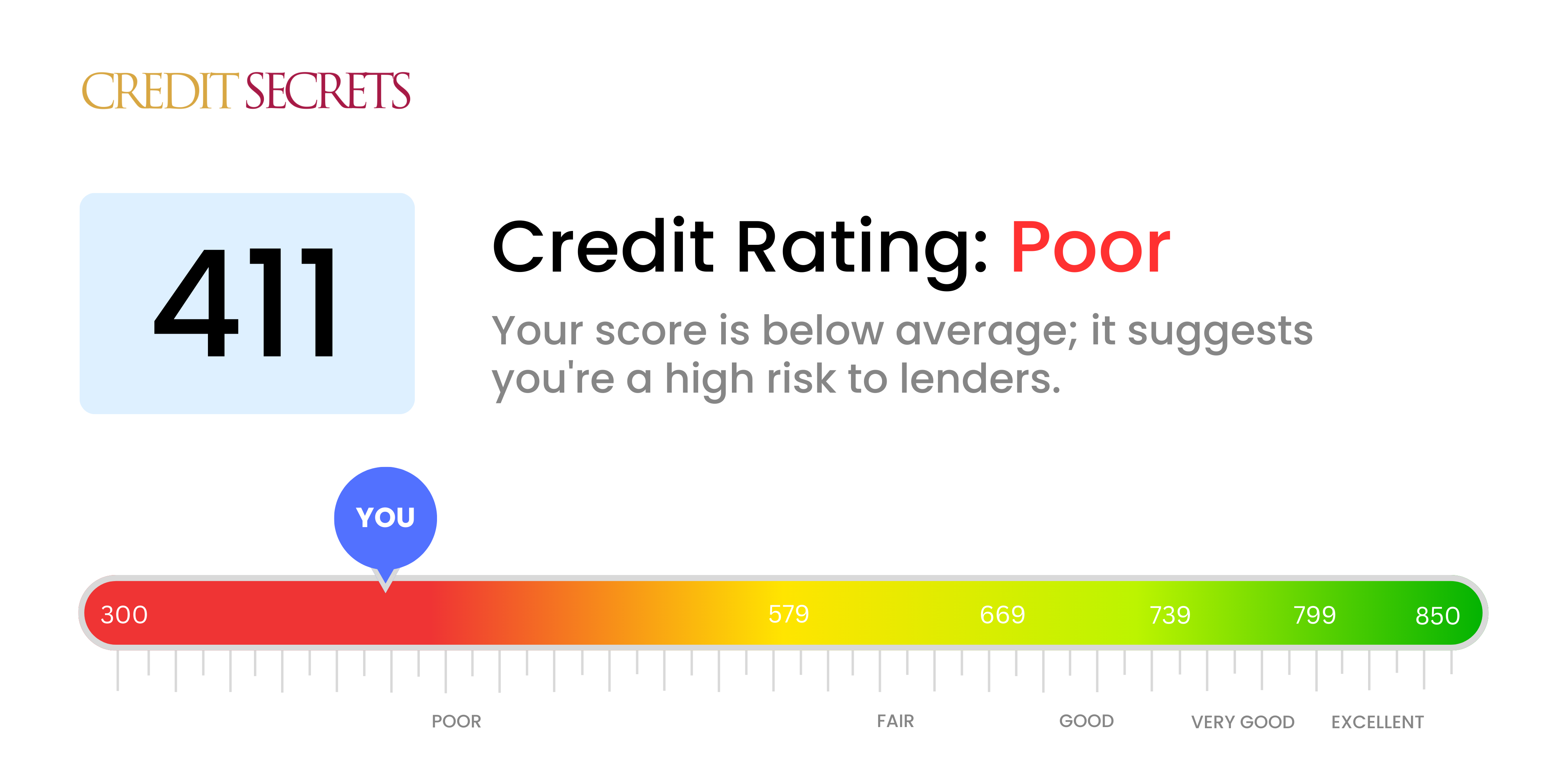

Is 411 a good credit score?

A credit score of 411 is categorized as a poor score. While this isn't an ideal situation, there's always room for improvement.

Unfortunately, with a score of 411, it might be significantly challenging to obtain new credit or loans and the interest rates offered are likely to be quite high, due to perceived risk from potential lenders. That said, it's important to remember that it's entirely possible to improve this score by consistently making on-time payments, reducing outstanding debt, and carefully managing your credit.

Can I Get a Mortgage with a 411 Credit Score?

A credit score of 411 unfortunately falls well below the score range considered 'good' for most lenders, making it very difficult to be approved for a mortgage. It's a harsh reality but it's important to understand that such a score may suggest a history of missed payments, defaults, or other financial mishaps.

Instead of dwelling on the potential negatives, acknowledge this as an opportunity to make positive changes going forward. Start by addressing any existing debts or issues that have contributed to your low score. From there, work diligently toward making regular, on-time payments to slowly build your credibility. Adopting responsible credit habits can eventually increase your score over time. You may also want to explore alternatives such as FHA loans or government-backed programs that may have lower credit score requirements. Remember, improving your credit score isn't an overnight feat - it's a gradual process that requires consistency and dedication.

Can I Get a Credit Card with a 411 Credit Score?

A credit score of 411 is considered very low, making it pretty tough for you to be approved for a traditional credit card. This score is viewed by lenders as high-risk, indicating a past of financial hardships or potential mishandling of funds. It's not the easiest news to digest, but acknowledging this reality is actually a positive step towards financial recovery. Addressing these truths, no matter how tough, is an important part of managing your finances.

With a score as low as this, you might want to consider alternatives. Secured credit cards, which are backed by a deposit you make, are quite an effective avenue. The deposit then becomes your credit limit, giving you more control over your spending. Other options might include looking for a reliable co-signer, or using prepaid debit cards. While none of these options provides an instant fix, they're solid starting points on your journey towards better credit. Do keep in mind, however, that any credit you manage to obtain will likely carry higher interest rates due to the elevated risk factor perceived by lenders.

Can I Get a Personal Loan with a 411 Credit Score?

With a credit score of 453, obtaining a traditional personal loan could be a significant challenge. A score in this range is considered a high-risk by most lenders; hence, approval chances are usually low. It may not be the news you hoped for, but it's vital to acknowledge this fact in your financial journey.

However, this doesn't necessarily mean you're completely out of options. You might explore alternatives such as secured loans, generously provided by you putting up collateral. Cosigned loans are also a possibility, where someone with a stronger credit score backs your loan. Another viable choice could be peer-to-peer lending, known for more forgiving credit prerequisites. But it's essential to understand these alternatives may involve higher interest rates and less desirable terms due to the extra risk lenders undertake. Your journey towards financial stability is still very much possible, and exploring these options is a great starting point.

Can I Get a Car Loan with a 411 Credit Score?

If your credit score is 411, it may be tough to secure approval for a car loan. Lenders often prefer scores above 660 for agreeable loan conditions. Unfortunately, a score as low as 411 can be perceived as risky to lenders, signifying potential trouble in repayment of borrowed funds. This might lead to unfavorable circumstances, such as high-interest rates or outright loan rejection.

Even so, there's no need to abandon hope for a car loan entirely. There are lenders who cater to individuals with lower scores like yours. However, proceed with caution as their loans might carry considerably higher interest rates. They charge higher rates to balance out the added risk they're undertaking by loaning to individuals with less than ideal scores. Though the journey may seem challenging, understanding and considering the terms meticulously can help you to secure a car loan.

What Factors Most Impact a 411 Credit Score?

Understanding your score of 411 is the first step towards improved financial health. Let's examine the factors that could have contributed to this score and discuss ways you can make improvements.

Payment History

One of the most significant factors impacting your score is your payment history. Late payments and defaults greatly affect your score.

How to Check: Scrutinize your credit report for any instances of late or missed payments. Consider if a pattern of delayed payments has led to your current score.

Credit Utilization

Your credit utilization, or how much of your available credit you're using, also plays a big role. High credit utilization can bring down your score.

How to Check: Analyse your credit statements. If your balances are near or exceeding their limits, this could be a crucial factor in your score.

Length of Credit History

A short credit history can negatively influence your score. Your score could be low if you don't have a long history of managing credit.

How to Check: Evaluate your credit report to see the age of your oldest account as well as the average age of all accounts.

Credit Inquiries

Frequent hard inquiries indicating numerous credit applications can negatively impact your score.

How to Check: Check your credit report for a high number of hard inquiries. Consider if you've been applying for new credit frequently.

Public Records

Public records such as bankruptcies, civil judgments or tax liens can significantly dent your score.

How to Check: Review your credit report for any such public records that may need addressing.

How Do I Improve my 411 Credit Score?

A credit score of 411 is exceptionally low, but don’t despair. It’s time to tackle it and start rebuilding, specifically tailoring these accessible, impactful steps to your situation:

1. Clear Outstanding Debts

Overdue accounts drastically affect your credit score. Clear any outstanding debts, prioritizing the ones that are most behind. Engage with your creditors and negotiate a feasible payment plan. This should be your first step towards credit recovery.

2. Decrease Credit Utilization

Your credit utilization ratio – the amount you owe versus your credit limit – carries weight. Try to maintain your balances below 30% of your credit limit. Pay down the cards with the highest usage rates first as part of this strategy.

3. Contemplate a Secured Credit Card

With a score of 411, getting a traditional credit card could be tough. A secured credit card could be an option instead. They require a cash deposit that acts as your credit line. Use it for minor purchases and ensure to clear your balance each month, helping you foster a good payment track record.

4. Consider Being an Authorized User

If you’ve a well-trusted person with a healthy credit score, you could request to be added as an authorized user on their card. This strategy can potentially improve your score, as you would benefit from their positive payment history. Remember to verify that the card issuer reports authorized user activities to the credit bureaus.

5. Build Diverse Accounts

Ensure you have a variety of credit types; it’s advantageous for your credit score. Once you’ve built up a good payment history via your secured card, consider other credit types, like a retail credit card or a credit-building loan. But remember, handle them wisely.