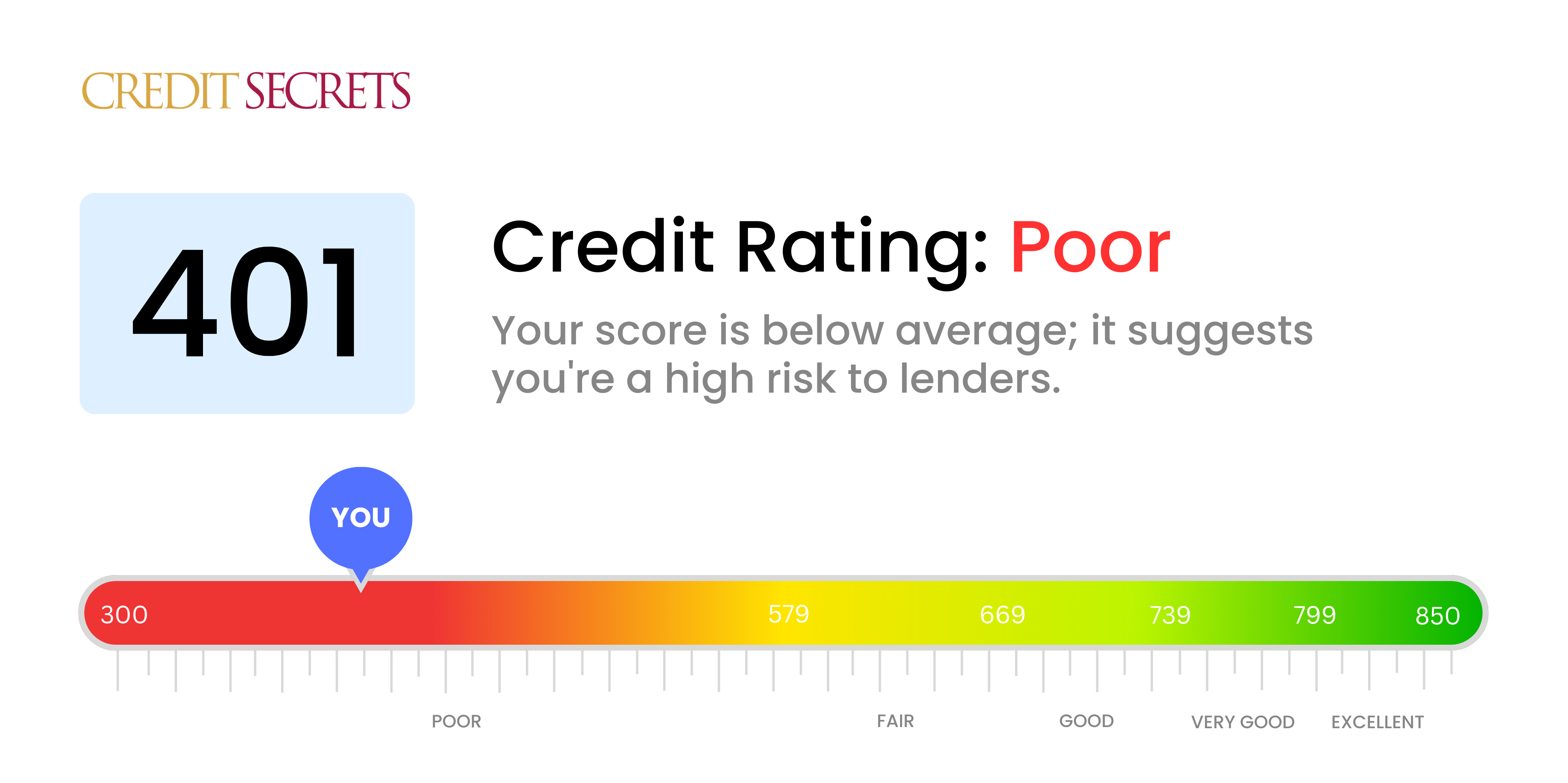

Is 401 a good credit score?

With a credit score of 401, your financial standing is considered 'poor,' which makes it harder for you to secure loans or access various financial services. It's a tough place to be, but remember that it's never too late to start rebuilding your credit.

Typically, this score might lead to lenders viewing you as a high-risk borrower, possibly resulting in loan applications being denied or approved with higher interest rates. However, by learning to manage your credit wisely and taking appropriate steps, such as paying your bills on time, reducing your debt, and keeping your credit utilization low, you can start to improve this score over time.

Can I Get a Mortgage with a 401 Credit Score?

Carrying a credit score of 401, it is rather unlikely that you will be approved for a mortgage. The average for most mortgage lenders typically sits around 600 or higher, indicating a severe discrepancy in your likelihood of approval. A low credit score, specifically within the 300-500 range, often signals significant financial issues, such as habitual late payments or bankruptcies.

Even though your current situation may seem daunting, there's still hope. To enhance your chances of getting a mortgage later, it would be wise to initiate steps towards improving your credit score. Start handling any unsolved credit situations, like unpaid bills or collections, and create a practice of making timely payments. Slowly but surely, these actions can help you build a sturdy credit foundation. It's important to remember that raising a credit score takes time, but the rewards reaped can open doors to financial opportunities including, but not limited to, more favorable interest rates on loans and credit cards.

Can I Get a Credit Card with a 401 Credit Score?

Having a credit score of 401 signifies serious financial challenges. This score is considered extremely low and is usually associated with a risky credit history. Lenders are less likely to approve any kind of credit card application with this score. You might be feeling disappointed or discouraged. But understanding your credit score is an essential step towards effective financial management, even if it involves facing hard facts.

Despite the complexities of a 401 credit score, there are still alternatives worth considering. Secured credit cards, designed with a deposit as your available credit limit, can be beneficial. These may be easier to qualify for and assist in credit repair over time. Contemplating a trusted co-signer or taking a look at pre-paid debit cards could also serve as suitable options. Though these solutions won't rectify the immediate situation, they're instrumental in progressing towards financial health. It's key to note that, due to the high-risk nature of a low score, interest rates on any available credit are typically much higher, mirroring the increased risk to lenders.

Can I Get a Personal Loan with a 401 Credit Score?

With a credit score of 401, obtaining a traditional personal loan is unlikely. Lenders view a score in this range as a high risk, which often results in loan rejection. This situation might seem tough, but it’s crucial to understand the implications this score has on your lending prospects.

While conventional loans may be out of reach, you could potentially explore other avenues. Options such as secured loans, where you provide collateral, or co-signed loans, where another individual with a better credit score acts as your guarantor, might be worth considering. Additionally, peer-to-peer lending platforms may provide more flexibility with their credit score requirements. However, be aware that these options generally carry higher interest rates and less favorable terms due to the increased risk perceived by lenders.

Can I Get a Car Loan with a 401 Credit Score?

If you have a credit score of 401, gaining approval for a car loan might prove tough. For most lenders, a comfortable credit score is above 660. A score below 600 is generally considered below par. In the world of credit, your score of 401 lands in this below par zone. This could lead to less favorable loan terms like high-interest rates or even outright loan rejection. This is due to the fact that lenders view a low credit score as an indicator of higher risk, implying a potential struggle in meeting up with loan repayments.

Nonetheless, a low credit score does not totally eliminate your chances of getting a car loan. Some lenders are known to work specifically with people who have lower credit scores. Bear in mind, however, that loans from these platforms may have substantially high-interest rates, an avenue for lenders to cushion the risk of loss on their investment. While securing a loan with a low credit score may not be a smooth ride, by carefully analyzing and understanding the loan terms, the opportunity to get a car loan continues to remain a feasible option.

What Factors Most Impact a 401 Credit Score?

Navigating the path to financial betterment starts with understanding your credit score. If your score is 401, it's essential to pinpoint the relevant factors that have led to this figure. Be encouraged - there's always room for improvement and growth.

Payment Consistency

Your payment consistency heavily impacts your credit score. Missed or belated payments might largely be the reason for your current score.

How to Check: Scour through your credit report and note any indications of late or missed payments. These lapses could be hurting your score.

Credit Use

Excess use of credit could play a large role in deflating your score. If your credit limits are frequently met or surpassed, this may be one of the causes.

How to Check: Study your credit statements. If your balances are high relative to your overall credit limit, reductions could be beneficial.

Credit Timeline

Having an inadequate credit history length could negatively affect your score.

How to Check: Review your credit report to gauge the duration of your credit history. Consider if you've recently set up new accounts.

Variety of Credit and New Accounts

Having diverse credit types and responsibly handling new loans are vital to maintain a decent score.

How to Check: Scan your blend of credit accounts such as credit cards, store accounts, or loans. Think about if you've been taking up new credit responsibly.

Legal Judgments

Legal judgments like insolvencies or tax liens can vastly harm your score.

How to Check: Check your credit report for any court-related judgments. Address any problems that need resolution.

How Do I Improve my 401 Credit Score?

With a credit score of 401, you’ve got room for improvement. Here are five crucial steps to help boost your score:

1. Rectify Payment History

An essential step for a credit score of 401 would be to confront any delinquent accounts listed in your credit report. Late or missed payments will hinder your score noticeably. Plan out a feasible budget to consistently meet your payment due dates.

2. Analyze Credit Report

Study your credit report thoroughly for any possible inaccuracies that could be negatively affecting your score. If any errors are found, proper dispute procedures should be initiated with the individual credit bureaus.

3. Limit Credit Enquiries

At this score range, several denied credit applications can further lower your score. As such, exercise discretion and apply for credit only when necessary.

4. Opt for a Secured Credit Card

In your current situation, a secured credit card might be the best option. With careful management, this measure helps build a reliable credit history by setting a credit limit equivalent to your deposit on the card.

5. Request Credit Limit Increase

When you’re comfortable with your secured card, request a credit limit increase. Be sure not to use this as an opportunity to engage in reckless spending, but instead, to lower your credit utilization rate.