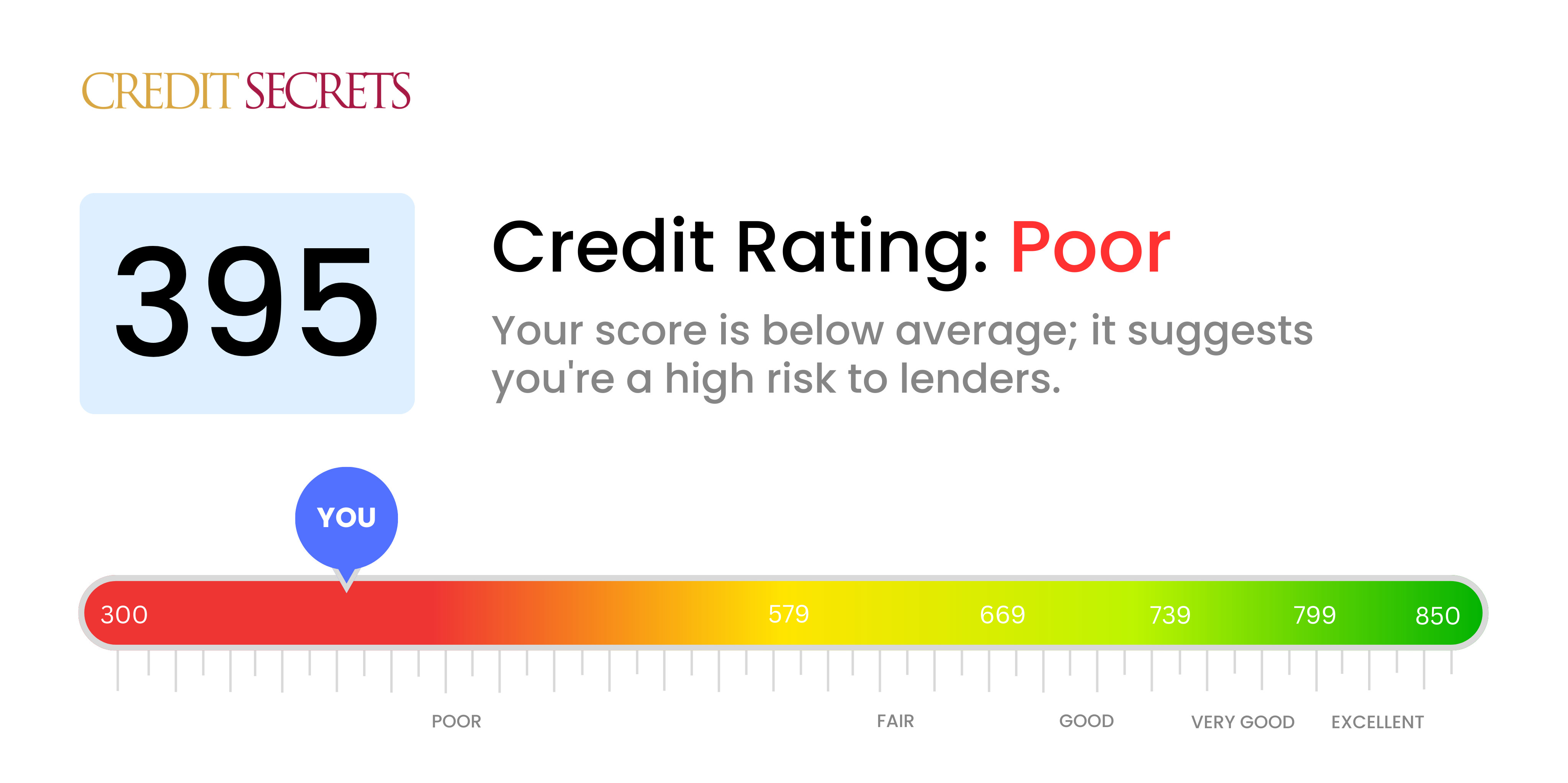

Is 395 a good credit score?

With a credit score of 395, you're currently falling in the 'poor' range. This score may make it challenging to get approved for new credit, loans, or low interest rates. However, there are steps you can take to improve it, and the potential for progress is always present.

You might face higher interest rates, security deposits, or need a co-signer when applying for credit-based services. Potential lenders might view this score as a credit risk. Be persistent, properly manage your credit, and over time, you can certainly raise your score. Keeping a positive outlook is key on your journey to financial stability.

Can I Get a Mortgage with a 395 Credit Score?

With a credit score of 395, it's rather doubtful that you'll be approved for a mortgage. This score is significantly under what most lenders typically demand. A credit score in this range usually signifies a record of considerable financial hardships, including late payments, defaults, or both.

Realizing you're not in an ideal situation is the first step towards improvement. Addressing any current debts or delinquencies that are negatively affecting your credit score should be a top priority. Start working towards demonstrating a pattern of timely payments and responsible credit use. However, remember that this won't happen overnight. Improving credit score is a gradual process which requires consistent efforts from your side.

It's worth noting that your current score will likely result in higher interest rates even if you somehow get approved for a mortgage. Therefore, it's in your best interest to work on improving your financial standing and credit score before seeking a mortgage.

Can I Get a Credit Card with a 395 Credit Score?

Unfortunately, a credit score of 395 is considered low, making it difficult to secure approval for a standard credit card. This score suggests significant financial challenges in the past and lenders often interpret these numbers as a high risk indicator. This reality can feel harsh, but facing it with clarity and honesty is a crucial first step toward improving your financial future.

For a credit score like this, considering alternatives such as secured credit cards could be a wise move. Secured cards necessitate a deposit that effectively serves as your credit limit. They are typically more accessible to those with lower credit scores and can aid in reestablishing credit over time. In addition to secured cards, considering a pre-paid debit card or having a co-signer for your card could be viable options. These options won't immediately resolve the situation, but they can provide an avenue for steady financial progress. Be aware that a lower credit score like this can often mean higher interest rates with lenders, due to the increased risk they perceive.

Can I Get a Personal Loan with a 395 Credit Score?

Having a credit score of 395 brings about some significant challenges, especially when it comes to securing a personal loan. Unfortunately, most conventional lenders tend to see this score as too risky to approve a loan. Your credit score sends a message about your financial habits and trustworthiness, and at 395, it's just not conveying the reliability lenders need.

However, the doors are not entirely closed. Alternative lending options are worth considering. Secured loans, which involve providing assets as collateral, or co-signed loans backed by someone else's credit score, may be viable options. Peer-to-peer lending platforms could also provide some relief, as they may have lesser stringent credit conditions. Keep in mind, though, these alternatives typically come with higher interest rates and harsher terms because they are taking a greater risk with your credit score. Remember, while these are not the perfect solutions, they serve as stepping stones to improve your financial situation and eventually, your credit score.

Can I Get a Car Loan with a 395 Credit Score?

Having a credit score of 395 significantly limits your chances of being approved for a car loan. Most lenders seek scores well above 600 for agreeing to favorable loan terms, and in many cases, scores falling below 600 are deemed as subprime. Your score of 395 falls squarely into this subprime category, and this could lead to an uphill battle when seeking car financing. High-interest rates or even hold-ups in securing the loan could occur due to the higher risk your score portrays to lenders. This score suggests a potential inability to consistently pay off borrowed funds.

This doesn't mean that a car loan is completely off the table, though. Some lenders do work specifically with lower credit scores, but it's important to stay alert. There could be much higher interest rates attached to loans from these lenders — they need to offset the risk they're taking. If you're careful in fully understanding the terms of your loan, it's still possible to secure financing for a car. However, it's crucial to be cautious and take the time to weigh all your options before making any decisions.

What Factors Most Impact a 395 Credit Score?

Grasping the meaning of a 395 credit score is the first step towards enhancing your financial health. Let's break down the factors that might have led to this score and carve a path towards improvement.

Neglecting Bills

Weighing heavily on your credit score is the inability to pay bills in a timely manner. Late, skipped, or defaulted payments can seriously lower your score.

How to Evaluate: Investigate your credit report for delayed or missed payments. It's possible that these are pulling your score down.

Limited Credit Limit

Maxing out your credit cards can take a toll on your score. This condition known as high credit utilization can often lead to a lower score.

How to Confirm: Look into your credit card statements. If you spot balances nearing the limits regularly, it's time to change this habit.

Little Credit History

A relatively new credit profile with limited history can negatively influence your score.

How to Assess: Analyze your credit report for the age of your oldest and newest accounts. If you have limited or no history, this can bring down your score.

Undiversified Credit Accounts

A blend of different credit types is beneficial for your score. A lack of diversified credit or an overload of new credit can be harmful.

How to Probe: Look at your credit report and note down the different types of credit accounts you have. Too little variety or too many new applications can spell trouble.

Public Records

Public records such as bankruptcies and tax liens can considerably lower your score.

How to Check: Skim through your credit report for any such records and plan on resolving these factors, as they could generate a substantial difference in your score.

How Do I Improve my 395 Credit Score?

With a credit score of 395, you’re facing some challenges right now, but don’t lose hope with the right steps, you can enhance your credit score situation. To start:

1. Scrutinize your Credit Report

Study your detailed credit report for any discrepancies that could be unfairly dragging down your score. If errors are found, take immediate action by contacting the relevant credit bureau and filing a dispute.

2. Attend to Delinquent Accounts

Mitigate your score’s negative impact by focusing on delinquent accounts. Records of late payments harm your credit history; hence, prioritize making them up-to-date, then keep them current.

3. Establish a Secured Credit Card

With your present score, a regular credit card may seem out of reach. Hence, apply for a secured credit card. Remember to pay off the entire balance each month, showcasing your financial reliability. This can positively affect your credit profile.

4. Act as an Authorized User

Explore the option of being an authorized user on a credit card belonging to a family member or friend with good credit. Responsible usage can help create a healthy credit history, provided the credit card company reports authorized user activities to the credit bureaus.

5. Variegate your Credit

Strive to diversify your credit options. After proving reliability with a secured card, cautiously add to your credit mix – an installment loan or store credit card could be options. Handle these meticulously to avoid potential pitfalls.