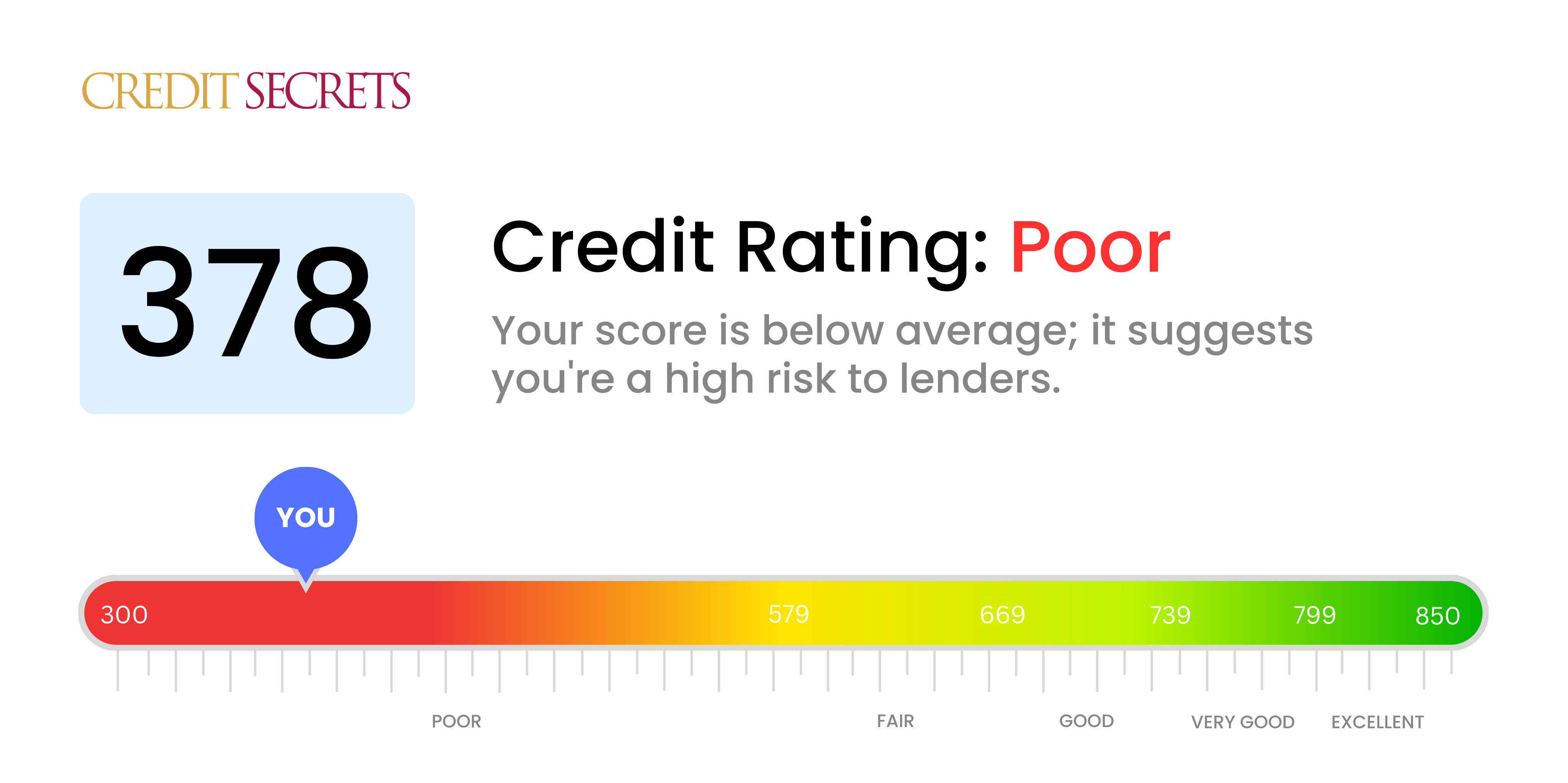

Is 378 a good credit score?

With a credit score of 378, your credit health is unfortunately in the 'Poor' range. This makes it significantly challenging to obtain loans or credit cards at competitive interest rates, if at all. But don't lose hope, there are ways to improve your credit scores and financial health.

A score of 378 indicates credit issues such as frequent late payments, default, collections, or even bankruptcy. These are all red flags to lenders and creditors. But remember, your credit does not define you. It's simply a snapshot of your financial decisions at a certain point in time. With commitment and the right resources from Credit Secrets, you can work towards rebuilding your credit score over time.

Improving a credit score doesn't happen overnight, but every step you take can make a big difference. Being consistent with your credit habits, paying your bills on time and reducing your debt can help in improving this rating. Let's view this as a new financial beginning that lays out a path for healthier financial decisions.

Can I Get a Mortgage with a 378 Credit Score?

If your credit score is currently at 378, obtaining a mortgage approval is unlikely. Mortgage lenders typically look for a minimum credit score of 620, and your rating falls significantly below this benchmark. A credit score in the range of 300-579 is considered 'poor' and it often points to a history of financial difficulties, such as late payments or defaults.

Despite this challenging situation, there are still measures you can take to put yourself on a path towards financial stability. Primarily, focusing your efforts on settling any existing debts, and then establishing a track record of timely payments and responsible borrowing. While improving your credit score is a process that requires patience, every step taken will contribute to better financial health. You may also consider alternatives such as rent-to-own arrangements or exploring assistance from government homeownership programs as a starting point for owning a home. Keep in mind, Mortgage lenders will generally offer a higher interest rate to those with lower credit scores, reflecting the increased lending risk.

Can I Get a Credit Card with a 378 Credit Score?

With a credit score of 378, the chances of being approved for a regular credit card are slim as this is viewed as a high-risk score. Lenders see this score as a sign of previous financial hurdles or struggles. The reality of your credit situation might be difficult to take in, but having knowledge about your credit score is a crucial step towards regaining financial stability. Recognition of your current financial situation, as challenging as it may be, is crucial.

When tackling a low score such as 378, there could be alternate routes to explore. One option could be secured credit cards, where a deposited amount serves as your credit limit. These cards could be more straightforward to acquire and can assist in the gradual rebuilding of your credit. Co-signer consideration or the use of prepaid debit cards could also be possible alternatives. Though these methods may not provide an immediate solution, they are helpful tools on the road to financial stability. However, it's important to note that interest rates associated with these kinds of credit are likely to be higher, indicating the higher perceived risk to lenders.

Can I Get a Personal Loan with a 378 Credit Score?

With a credit score of 378, there's no sugarcoating the fact that securing a traditional personal loan could be quite challenging. Most standard lenders see such scores as a potential risk, making it less likely for them to approve your loan application. Despite this hurdle, realize that your financial path is not at a dead-end. Your credit score is just one aspect of your overall financial picture.

There are some alternatives you could consider. Secured loans, where you provide assets as collateral, might be worth looking into. Another option could be co-signed loans, where someone with a better credit score guarantees your loan. Peer-to-peer lending platforms also cater to those with less-than-perfect credit, but be aware they may have higher interest rates. Remember, these options may carry steeper rates and less favorable terms, a reflection of the higher risk perceived by lenders. Yet, they could potentially offer a lifeline in your current situation.

Can I Get a Car Loan with a 378 Credit Score?

When it comes to obtaining a car loan, a credit score of 378 is going to be quite challenging. Typically, lenders are often comfortable approving loans to those with scores exceeding 660, while a score below 600 is usually viewed as subprime. With a score of 378, this lands you squarely in the subprime territory, which could mean facing high interest rates or even denial of the loan. This is because a low credit score, such as yours, signifies a higher risk to lenders based on past repayment behaviours.

Nonetheless, having a low credit score doesn’t mean that you are entirely stranded from your car-owning aspirations. There are lenders whose expertise is primarily based on dealing with lower credit scores. However, you should approach such loans with a degree of caution, as they often come with notably steep interest rates. These are underpinned by the perceived risk that lenders associate with your credit score, acting as their insurance. While the journey may have its ups and downs, with careful investigation into the loan terms, the possibility of securing a car loan is far from voided.

What Factors Most Impact a 378 Credit Score?

Navigating through a credit score of 378 may seem challenging, but understanding the influential factors can provide a clear path to financial recovery. It is crucial to analyze the aspects that may have resulted in this score and work towards their resolution.

Payment History

Delinquent payments or defaulted loans could be a primary cause of your current score. Payment history profoundly affects credit health.

How to Check: Look through your credit report for any missed or late payments. These factors could be severely hampering your score.

Credit Utilization

If your credit usage ratio is high - which means a majority of your credit is in use - it could cause a significant dip in your score.

How to Check: Analyze your credit card statements. If the balances are nearing the limits, this could be an area of concern. It's advisable to keep the balances low compared to your overall credit limit.

Length of Credit History

A brief credit history might be impacting your score negatively.

How to Check: Browse your credit report to ascertain the lifespan of your oldest and newest accounts along with the average age of all your accounts. Opening new accounts frequency could be affecting your score.

Credit Mix and New Credit Applications

Possessing various types of credit and cautious management of new credit applications is necessary for a better score.

How to Check: Review your mix of credit accounts such as credit cards, retail accounts, installment loans, and mortgage loans. Reconsider if you're applying for new credit too often.

Public Records

Any public records like tax liens or bankruptcies can have a drastic effect on your score.

How to Check: Scrutinize your credit report for any listed public records. Address any outstanding issues immediately.

How Do I Improve my 378 Credit Score?

Having a 378 credit score qualifies as very poor, but don’t stress – credit scores can always improve. Here’s some focused strategies specific for your situation:

1. Verify Your Credit Report

Start by obtaining your credit report and review it for errors. If you find any inaccuracies, dispute them by contacting the credit bureau or the company that reported the incorrect information.

2. Get Up to Speed on Payments

Past due accounts cause substantial damage to credit score. Strive to make current, and maintain, all of your payments. Any collections on your account should be addressed first, as these are most damaging.

3. Apply for a Secured Credit Card

A secured credit card, backed by a cash deposit you provide, is a good option. Use it to make minor purchases, and pay off your balance in full each month to slowly build a history of reliable credit use.

4. Draft a Personal Budget and Stick to It

Design a budget that allows for current repayments and saving. This demonstrates financial responsibility and, if paired with consistent on-time payments, will help to elevate your credit score over time.

5. Aim to Gradually Diversify Your Credit

Once your secured card and budget system are in place and demonstrated as consistently manageable, consider cautiously adding a variety of credit, like a small personal loan or retail credit card, to further improve your credit score. Be sure to stay within your payment capabilities.