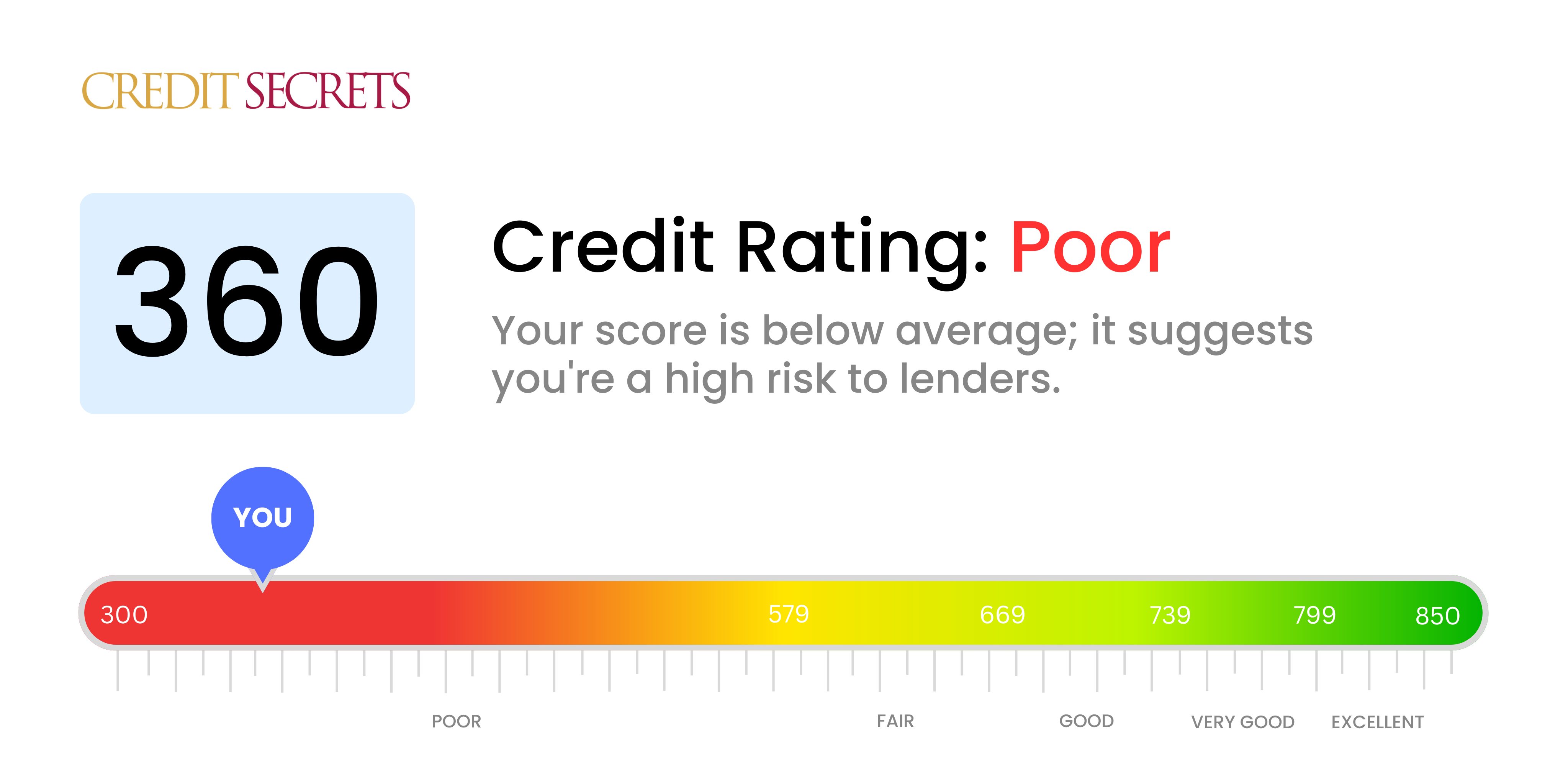

Is 360 a good credit score?

A credit score of 360 falls into the 'poor' category according to traditional assessment scales. This rating signifies that lenders may deem you a risky borrower and it could result in less favorable terms for loans or credit, potentially making it more difficult for you to achieve your financial goals.

However, it's important to remember that everyone starts somewhere, and you have the power to influence your credit score. Through wise financial decisions and consistency, you have the opportunity to build your score over time. There's always room for improvement and remember, at Credit Secrets, we are here to guide you on this journey towards better credit health.

Can I Get a Mortgage with a 360 Credit Score?

With a credit score of 360, the likelihood of being approved for a mortgage is unfortunately very low. This is significantly beneath the minimum score most lenders consider. A score like this often signifies severe financial issues, such as defaulted payments or unresolved debts.

Although this situation may feel overwhelming, know that there are viable alternatives available. It's possible to improve your credit score step by step. Begin by addressing outstanding debts and ensuring future bills are paid on a timely basis. Consistently making payments on time, even small ones, is essential to rebuilding credit. Additionally, keeping credit balances low or paid off whenever possible can also help improve your score. Bear in mind that as tough as it may be now, many people have rebuilt their credit and achieved their financial goals. It's very possible for you, too. Just remember, the road to improving your credit score is a marathon, not a sprint. So, be patient and persistent in your efforts.

Can I Get a Credit Card with a 360 Credit Score?

Having a credit score of 360 admittedly makes getting a traditional credit card quite complicated. Such a score is typically seen as risky by lenders and might be due to past financial difficulties or missteps. It is natural for this to seem disheartening. However, grasping the reality of your credit situation is necessary for financial growth. Accepting this can be tough, but it's a critical part of moving towards a better financial future.

With a score as low as 360, some alternative options could help. Secured credit cards are one such route, these cards are backed by a deposit that you provide which then becomes your credit limit. This can be a more achievable way of getting credit and can also assist in gradually rebuilding your score. Other options to consider could be finding a co-signer or using pre-paid debit cards. Although these alternatives will not magically fix everything, they can be vital sections of the path to financial stability. Do note, however, that the interest rates on any credit that you can access will likely be quite high, due to the lender's perceived level of risk.

Can I Get a Personal Loan with a 360 Credit Score?

With a credit score of 360, getting approval for a personal loan from traditional lenders might prove to be difficult. For lenders, a credit score in this range often indicates high financial risk, making them less likely to approve a loan application under regular terms. It's crucial to understand that a credit score of 360 significantly restricts your borrowing choices but acknowledging this is the first step towards improving your financial situation.

Though it won't be easy, alternative options could still be considered. You might want to explore secured loans, where you put forward collateral such as a car or a home. Another option could be co-signed loans, where someone with a higher credit score agrees to back your loan. Platforms offering peer-to-peer loans may also be worth considering given they tend to have more flexible credit requirements. However, bear in mind that these options usually entail higher interest rates and less generous terms to compensate the lender for taking on greater risk. It's a tough situation but knowing your options can ignite a spark of hope.

Can I Get a Car Loan with a 360 Credit Score?

With a credit score of 360, it's certainly going to be tough to get approved for a car loan. Traditional lenders usually favor credit scores above 660, viewing anything below 600 as high-risk. Your score of 360 is viewed as high-risk, which typically results in higher interest rates or outright loan denial. It signals to lenders that there might have been struggles with paying back borrowed money in the past.

Despite this, having a low credit score doesn't mean it's impossible to secure a car loan. Some lenders cater to those with lower credit scores. Be mindful though, as these sorts of loans often come with much larger interest rates. These higher interest rates allow lenders to protect their investment against the increased risk they're taking. So, even though it will be a challenging journey, with careful planning and understanding of the loan terms, a car loan remains a possibility.

What Factors Most Impact a 360 Credit Score?

A credit score of 360 signifies that there are serious issues that need your immediate attention. Embarking on the journey towards credit improvement starts with understanding and addressing these crucial factors.

Past Defaults

Your credit score is heavily influenced by past defaults on loans or credit cards. This might be a significant contributor to your score.

How to Check: Scrutinize your credit report thoroughly for any signs of defaults. This can provide insight into past issues impacting your current score.

High Debt Levels

Extremely high current debt levels can drastically lower your score. If you have substantial outstanding debt, it could be affecting your score.

How to Check: Look over your current debts in your loan and credit-card statements. Keeping debt levels under control is paramount to improving your score.

Lack of Credit Diversity

Only having one type of credit, such as credit cards only, may negatively impact your score.

How to Check: Check your credit report. If it lacks variety, such as installment loans or mortgages in addition to credit cards, it could be a factor in your low score.

Recent Credit Applications

Making many credit applications in a short span of time may cause your score to drop. If you've recently made several applications, they could be affecting your score.

How to Check: Go over your recent credit inquiries on your credit report. Multiple inquiries may have lowered your score.

Negative Public Records

Public records like bankruptcy and tax liens can severely damage your credit score.

How to Check: Review your credit report. If there are these kinds of public records listed, this will be impacting your score.

How Do I Improve my 360 Credit Score?

With a credit score of 360, strengthening your financial situation may seem a significant challenge, but help is at hand with some focused actions:

1. Catch Up on Past-Due Accounts

Clearing any outstanding debts should be your initial goal. Prioritize the repayment of the longest-overdue accounts first to neutralize their impact on your credit score. If required, get in touch with your lenders to discuss a more feasible payment strategy.

2. Manage Credit Card Debt

Large credit card balances can dramatically lower your credit score. Your aim should be to keep your credit card balance to less than 30% of the total credit limit, working towards a long-term goal of under 10%. Pay off high utilization rate cards first to optimize your credit score.

3. Apply for a Secured Credit Card

Given your current credit score, a conventional credit card may not be attainable. A secured credit card can be a viable alternative. This needs a refundable collateral deposit which defines your available credit. Use it responsibly and ensure the entire balance is paid monthly to establish a disciplined payment history.

4. Request to Become an Authorized User

If you can find a relative or a close friend with a good credit history, request them to add you as an authorized user on their credit card. This offers a boost to your credit score by appending their good payment history to your credit file. Remember to ensure that the card provider shares the details of authorized user activity with the credit bureaus.

5. Diversify Your Credit

Varying the types of credit you manage can enhance your score. Once your payment record with a secured card strengthens, consider additional credit options such as a credit builder loan or department store card. Responsible management of this expanded credit range will further improve your score.