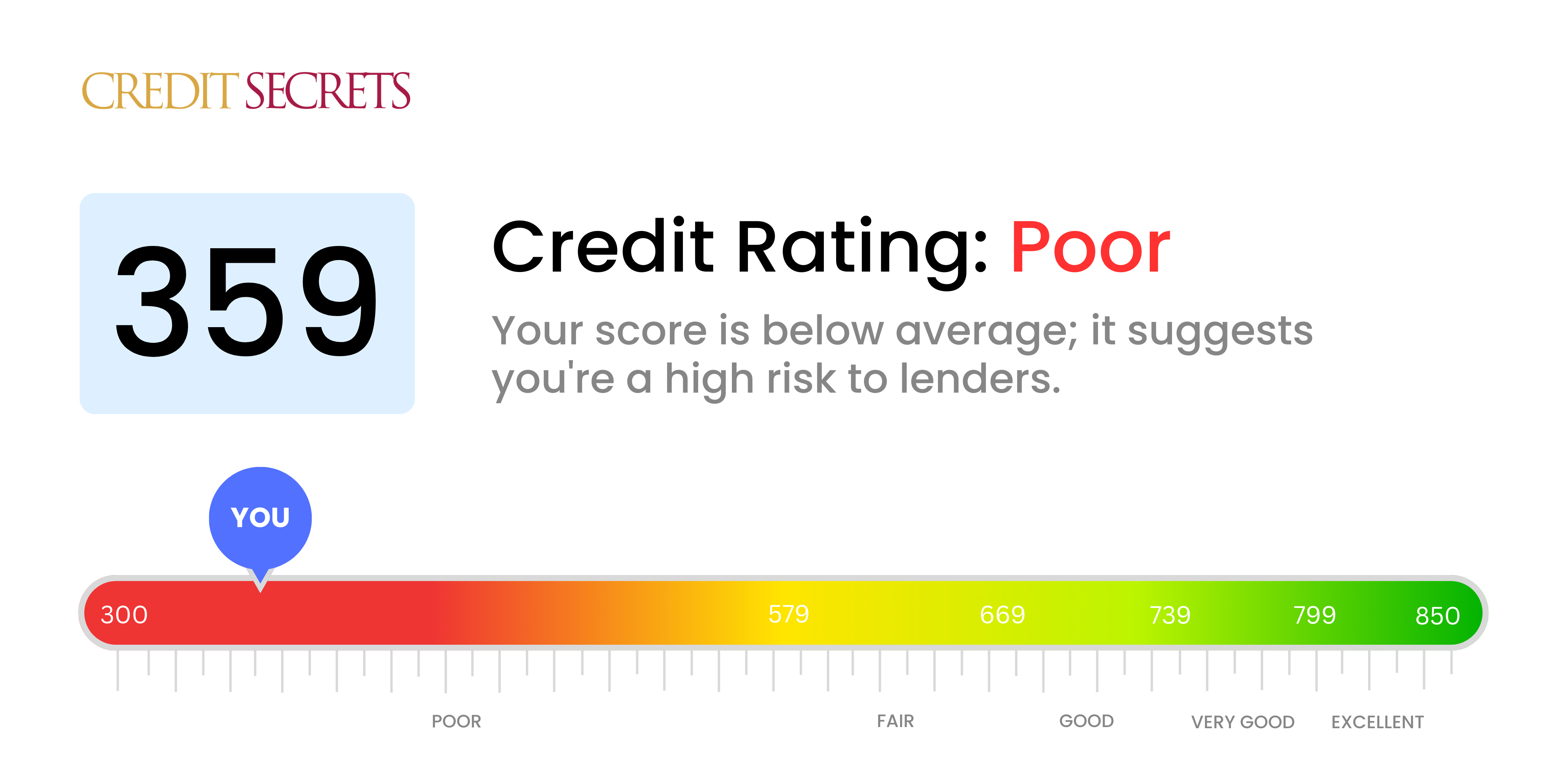

Is 359 a good credit score?

A credit score of 359 is considered a poor score in the credit world. However, you shouldn't lose hope; many people have improved their score from this level and you can do the same.

With a score of 359, you may encounter some challenges. For instance, getting approved for loans, credit cards, or even renting an apartment might be difficult. It's also quite likely you'll face higher interest rates and less favorable terms should you qualify for financing. It's not the ideal situation, but remember, it's not a life sentence—through consistent efforts and good financial habits, improving your score is a very real possibility.

Can I Get a Mortgage with a 359 Credit Score?

If your credit score is currently at 359, it's important to note that obtaining a mortgage approval may be complex. This is considerably below the typical score lenders usually look for. A score in this bracket suggests previous significant financial complications such as late payments or defaults. This might make lenders cautious about granting a mortgage.

Though this is a difficult circumstance, it's important not to lose hope. Start by focusing on clearing any outstanding loans or overdue balances which might be negatively affecting your score. Building a consistent pattern of timely payments and prudent credit use is key to gradually lifting your credit score. This may take time but stay focused and diligent; steps taken today will lay the groundwork for a robust financial tomorrow.

Another possible alternative could be to consider a FHA (Federal Housing Administration) loan that caters to individuals with lower credit scores. Although this kind of loan might come with higher interest rates and require a larger down payment, it could be a temporary path to homeownership while you work on improving your credit score.

Can I Get a Credit Card with a 359 Credit Score?

Having a credit score of 359 can make it quite challenging to get approval for a traditional credit card. Lenders perceive this score as a high-risk indication, often suggesting some financial struggles or poor money management in the past. It's a tough reality to accept but acknowledging your current financial standing is a brave and necessary first step towards achieving financial wellness.

In light of the hurdles presented by such a lower score, it might be wise to consider alternatives. Secured credit cards, which are backed by a cash deposit that serves as your credit limit, could be one viable option. These cards are usually easier to attain and can help rebuild your credit over time. Other potential options may include finding a trustworthy cosigner or exploring the use of prepaid debit cards. Though these choices won't provide an immediate solution, they can become integral assets in your pursuit of better financial stability. Bear in mind, any form of credit that becomes accessible with a score of 359 is likely to carry considerably higher interest rates, reflecting the higher risk perceived by lenders.

Can I Get a Personal Loan with a 359 Credit Score?

With a credit score of 359, obtaining approval for a personal loan through traditional lenders can be a daunting challenge. This score is notably below the average range that lenders typically find acceptable, making you a high-risk candidate. While this news may seem discouraging, it's essential to squarely face the truth about how this credit score impacts your ability to secure a loan.

In lieu of traditional loans, there are still possible routes you could consider. Options such as secured loans, where you provide an asset as collateral, or co-signed loans, where another person with a healthier credit standing co-signs your loan, could be viable alternatives. Peer-to-peer lending platforms may also offer more flexibility regarding credit score requirements. However, it's important to note that these alternatives often carry higher interest rates and more stringent terms due to the increased risk associated with lending to borrowers with low credit scores.

Can I Get a Car Loan with a 359 Credit Score?

With a credit score of 359, securing approval for a car loan can be a tough undertaking. A score under 660 is often seen as below average by most loan providers, and your score of 359 is significantly below this threshold. A lower credit score suggests to lenders that you may have had troubles with financial commitments in the past, thus making you a high-risk client.

That's not to say getting a car loan at this stage is entirely off the table. There are lenders out there who specialize in giving loans to those with lower credit scores, but tread carefully. These types of loans often come with high interest rates as a way the lenders protect themselves from the higher risk. Even though it might be challenging, with a careful study of the loan terms, acquiring a car loan is not altogether impossible. Stay positive and make sure to examine all your options carefully before making a decision.

What Factors Most Impact a 359 Credit Score?

Navigating through a credit score of 359 can seem challenging, but understanding the factors that influence this score is the first step towards recovery. Each individual's financial situation is unique, and gaining knowledge about the different areas affecting your score is an empowering part of your journey to bolstering your financial health.

Neglected Payments

Payment history greatly influences your credit score. Missed or late payments could be the central reason for your current score.

How to Check: Analyze your payment history on your credit report. Missed or delayed payments could be harming your score.

Excessive Credit Utilization

Maintaining high balances on your credit cards could harm your credit score. If you are using most of your available credit, this may be a significant factor.

How to Check: Look at your recent credit card statements. Are you using a majority of your available credit? Endeavor to keep balances low versus your credit limit.

Short Credit History

Length of credit history can also impact your score. A limited credit history may be contributing to your score.

How to Check: Confirm the age of your oldest and newest accounts by reviewing your credit report. Think through if you have recently opened fresh credit accounts that might have influenced your score.

Type and Quantity of Credit

Balancing a diverse mix of credit types and controlling new credit is crucial for a positive score.

How to Check: Assess your variety of credit types including credit cards, installment loans, and mortgage loans. It's important to show responsible management of different credit forms.

Public Records

Public records such as bankruptcies or tax liens can significantly lower your score.

How to Check: Check your credit report for any public records. Identify and address any disconcerting items you may find.

How Do I Improve my 359 Credit Score?

With a credit score of 359, you’re in the poor range. However, don’t be discouraged as rebuilding credit from this point is not impossible. Here are specific, strategic actions that you can take:

1. Settle Delinquent Accounts

Your first step should be to tackle any delinquent accounts you may have. These accounts heavily weigh down your score. Communicate with your lenders and plan a suitable repayment schedule. It’s not just about paying them off, but also about showing consistent, responsible behavior in meeting your debts.

2. Manage Credit Card Debt

Keep your credit card balances low. A high balance relative to your credit limit negatively affects your score. Aim to maintain the balance below 30% of your credit limit, eventually reducing it below 10%. Pay off cards with the highest utilization rates first.

3. Obtain a Secured Credit Card

You might encounter difficulties qualifying for a traditional credit card with your current score. However, a secured credit card, which requires a cash collateral deposit, is a viable alternative. Use it wisely to develop good payment habits and raise your score.

4. Seek to Become an Authorized User

With good credit score holders in your network, seek a favor. Request them to add you as an authorized user on their card. This infuses their good payment conduct into your report. But do remember, the card issuer should report authorized user activities to the credit bureaus.

5. Consider Credit Diversification

Once you’ve improved your score using a secured card, think about diversifying. Having a mix of credit types – such as a credit builder loan or a retail credit card – and maintaining them responsibly contributes to score improvement.