5 Auto Insurance Options That Will Save You Money

Americans love cars. That is why in 2016, more than 7 million cars were sold in the country, representing about 10% of all cars sold globally.

While cars help us with movement, they are also expensive to maintain. Consider the latest streak of hurricanes in Texas, Puerto Rico, Florida, and Louisiana where more than a million cars were damaged. Also, consider the number of times you receive a parking ticket or when you accidentally hit a person.

In all these unavoidable instances, the role of insurance is revealed. In the case of the hurricanes, people who had insured their cars ended up paying nothing because insurance companies handled it. Those who had not insured their cars ended up paying a lot of money for repairs. Furthermore, it is illegal in all states to drive a car without proper insurance.

In this article, I look at some of the best auto insurance companies in the country.

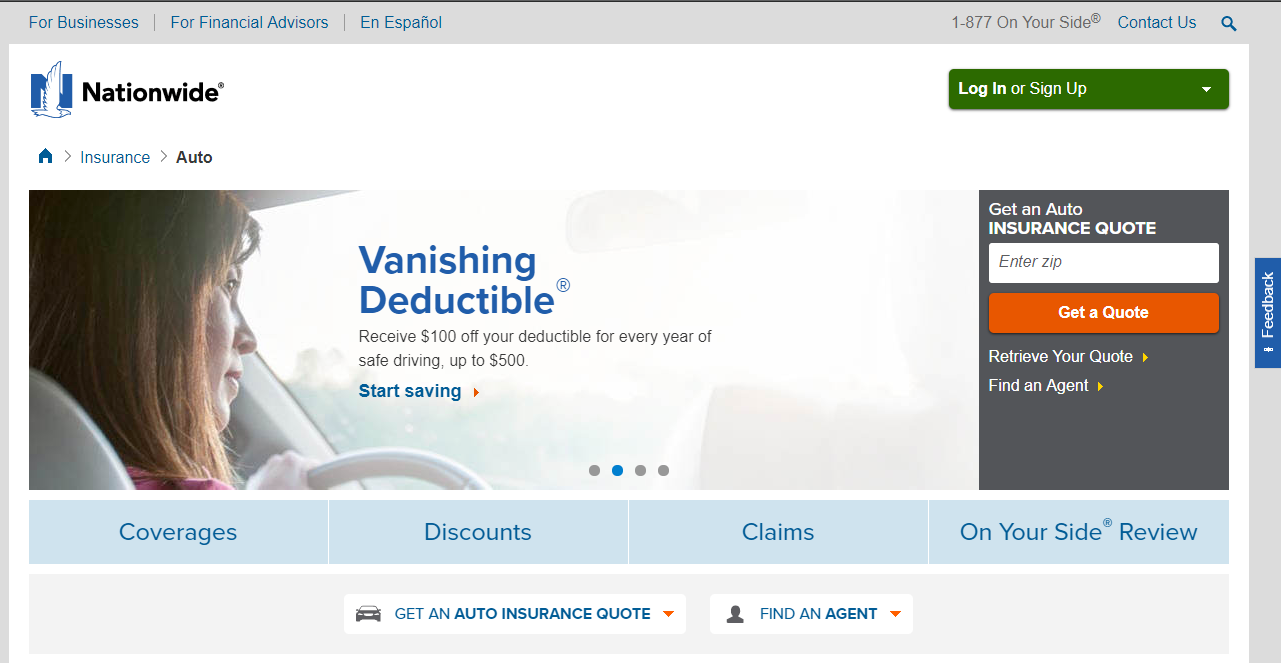

Nationwide

Nationwide is a large insurance company with revenues of more than $43 billion in 2016. The company offers auto and other insurance types like property, life, and specialty insurance.

For auto insurance, the company’s policies are collision coverage, comprehensive car insurance, vanishing deductible, liability coverage, uninsured motorist insurance, underinsured motorist insurance, medical payments coverage, personal injury protection, and accident forgiveness. It also offers options for roadside assistance, towing and labor insurance, and classic car insurance.

The pros of the company are: First, Nationwide is a large and stable insurance company with a good balance sheet. Second, it provides you with several ways of saving money. For example, you can save money by bundling your home, auto and life insurance policies. By bundling, the company gives you a discount of 20% on the multi-policy. You can also save if you have at least 5 years of safe driving. Also, if you are a parent of a student who gets B and above, the company will give you a discount.

Third, nine out of ten customers reviewed by the company would recommend its products to other customers. Fourth, you can apply and get covered online. Finally, Nerdwallet gives Nationwide the 5th spot of the best insurers in the country based on the J.D. Power ratings and customer complaints.

For more details, follow this link.

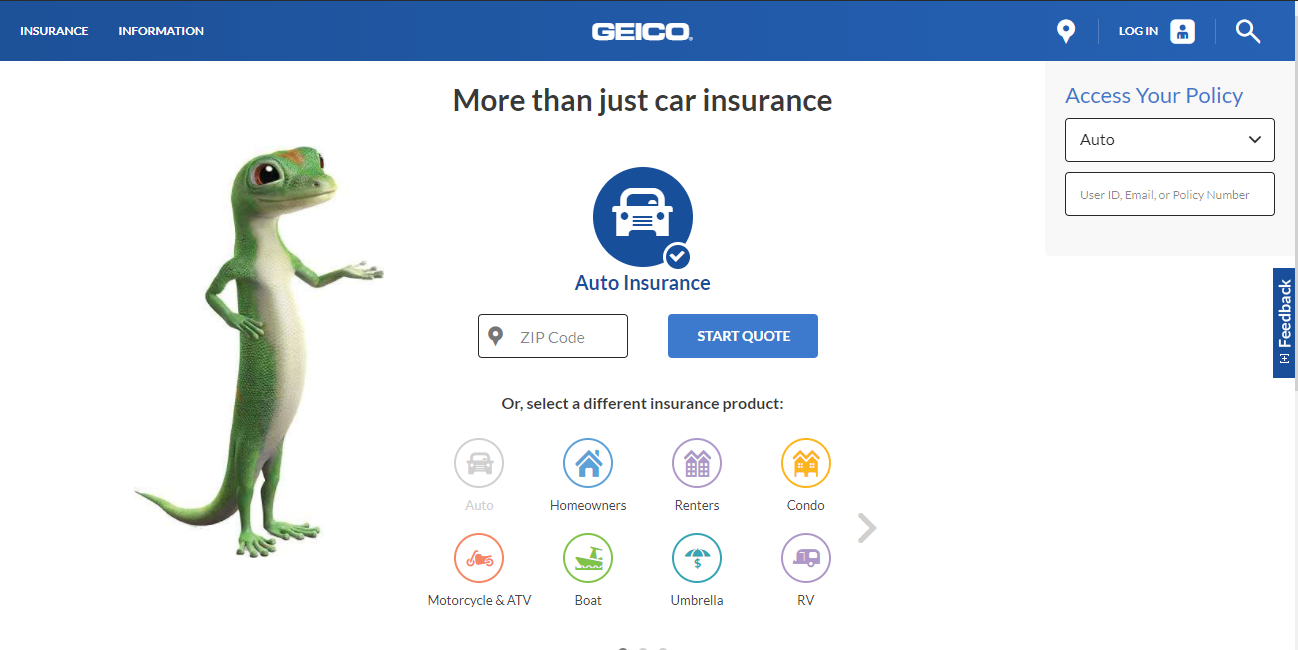

Geico

When Warren Buffet counts his blessings, he mentions Geico twice.

In 1996, Warren Buffet’s company, Berkshire Hathaway completed the purchase of Geico which offers vehicle, property, business, and other types of insurance like travel and life insurance.

One of the reasons why Buffet loves Geico is because of how the company is managed. For example, today, most of its vehicle insurance is done online, eliminating the need for insurance agents. Today, to get a quotation, all you need to do is fill an online form in your browser or in your mobile applications and get a quotation.

I would recommend Geico for its national coverage, the savings, its customer service, and the ease of applying for the policy.

Geico was the 7th in Nerdwallet’s list of the best insurance companies. For a comprehensive Credio review of Geico, follow this link.

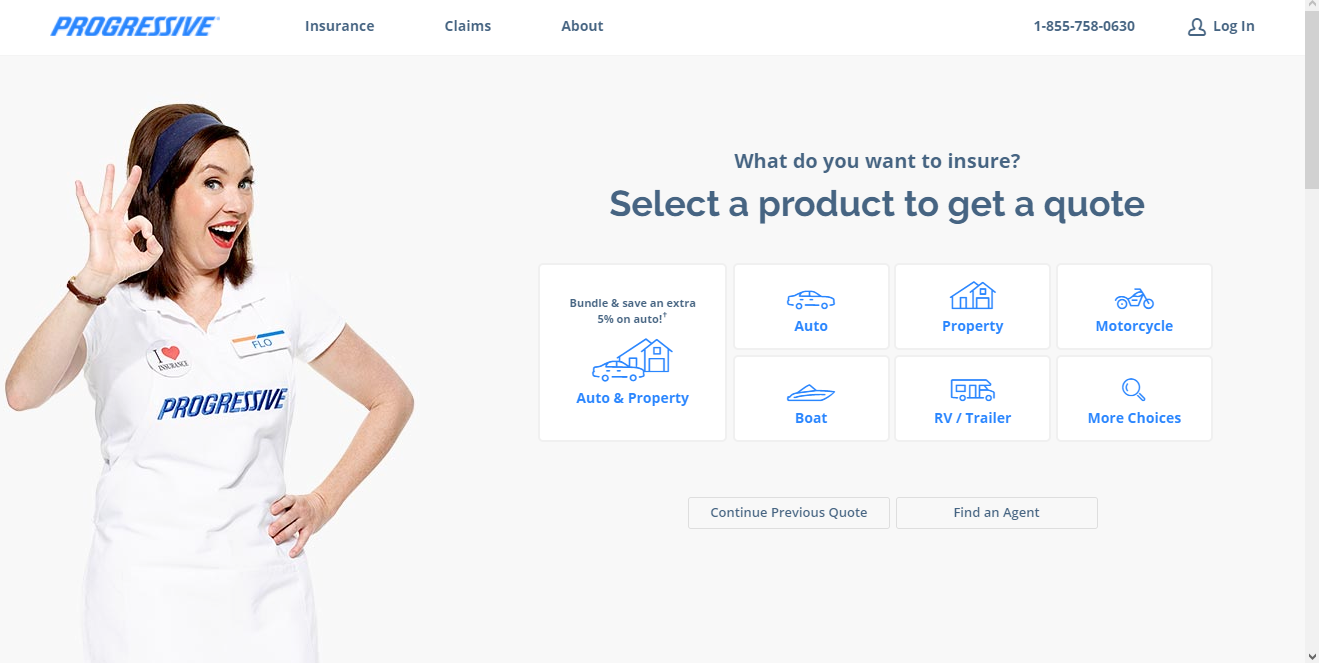

Progressive

Progressive is a general insurance company with more than $30 billion in market capitalization. Credio ranks the company as the third best auto insurance company in the country with a smart rating of 96 and a customer satisfaction rating of 3.9.

I would recommend Progressive for these reasons. First, it is a large financially stable company able to service your claims. Second, it allows people to save up to 10% by bundling insurance policies. Third, you can request a quote within seconds. Fourth, the ability to save money when you buy the policy directly by avoiding agents. In this, you can request a quote using the website or its mobile applications. Finally, the company offers a Name Your Price tool that allows you to select your appropriate price.

The only issue with Progressive is that its customer ratings are a bit lower than that of its competitors and its bundling discount is lower than that of National.

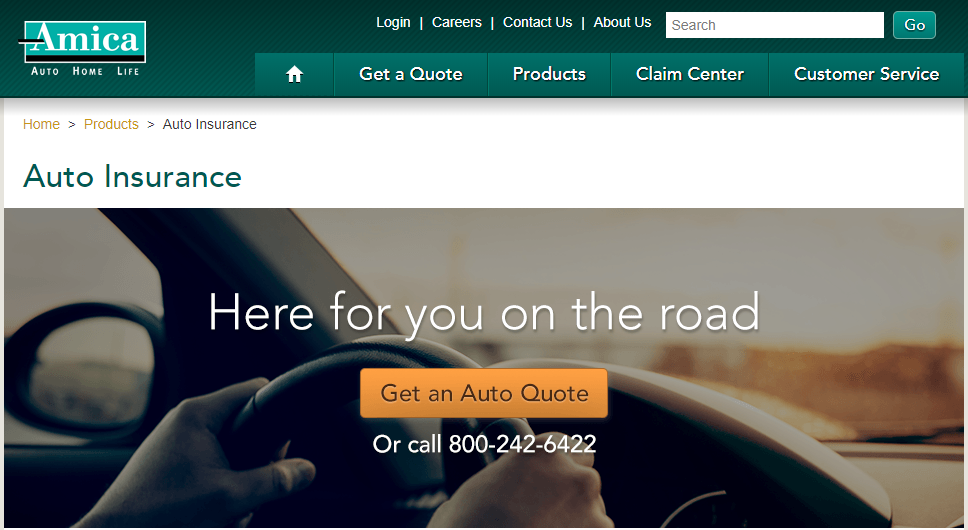

Amica

Amica Auto Insurance is a product of Amica Mutual Insurance Company, the country’s oldest mutual insurer of automobiles in the country.

Credio ranks it as the fourth best auto insurance company with a smart rating of 4.3 and a customer satisfaction rating of 4.3. Nerdwallet gives Amica it’s biggest rating in the auto insurance category.

Amica offers all products offered by the insurance companies above but goes further by offering no deductions for lock replacement, glass repair and when a new vehicle is declared a total loss within the first year of ownership. Also, the company offers you a full reimbursement for lost earnings when you attend a court case at its request.

In addition, the company offers a discount when you bundle your home, auto, and life insurance, when you insure two or more cars, when your car has an alarm, and when you sign up for automatic payments. It also gives you loyalty points which you can redeem for discounts.

Erie Insurance

Erie Insurance is not talked about often, but it is one of the best auto insurance companies in the country with a Credio Smart rating of 4.3 and 4.1 for customer service.

Erie offers different types of auto insurance policies that are similar to those offered by other companies. However, it comes with additional perks that are not offered by other companies like pet insurance and Erie Rate Lock that prevents insurance claims from fluctuating. With Rate Lock, your insurance rates will not change until you make changes to your insurance policy.

Also, Erie offers discounts of between 14% to 30% when you: insure multiple cars, when you make an annual payment plan, bundle policies, when you don’t make a claim, and when you are not using your car for at least 90 consecutive days. Also, if you are an unmarried under 21 driver living with your parent, you can also get a discount.

For more information about Erie, follow this link.

Notable Companies

Other notable auto insurance companies are USAA (if you are a veteran), Allstate, Travelers, American Family, Liberty Mutual, and State Farm among others.

To get a good auto insurance, I recommend that you take time to review each of the insurance companies mentioned above, read their details, and visit their Facebook and Twitter pages to read their user reviews. Consider a company that offers reasonable premiums, excellent claim servicing, and one that has excellent customer service reputation.