16 Best High-Yield Checking Accounts That Will Make You Money as You Sleep

You work hard for your money. At times, you have sleepless nights thinking about work-related issues. Therefore, you want to protect and grow your money.

To achieve this, a checking account in a credible, FDIC-insured bank comes in handy. This is because the account gives you an opportunity to grow your money and access it at any time.

Many banks and credit unions in the United States offer their clients checking accounts with a small interest rate.

As a customer, you want a bank that guarantees: safety for your money, low transaction fees, an attractive interest rate, and ready access to your money.

I spent a substantial amount of time reviewing some of the leading credible institutions that offer high-yielding interest rates. But remember, nationally, (and even internationally), we are in a low-rate environment which means that checking accounts are not yielding as much as they used to before the recession.

Ally Bank

Interest Yield: Between 0.10% and 0.60%

Ally Bank is an online bank that allows customers nationwide to save money and access credit through their mobile phones, tablets, and computers.

By being an online bank, Ally saves money which allows it to offer attractive yields to customers. Other benefits of Ally are:

No monthly maintenance fees.

Easy cash transfer.

24/7 customer care service to a real person.

An easy way to deposit checks.

Free access to AllPoint ATMs

Free Debit Card, overdraft transfer, incoming wires, checks, and standard ACH transfers.

Capital One 360 Checking Account

Interest Yield: Between 0.2% and 1%

This is an online bank offered by Capital One, one of the biggest financial companies in the country. The account features are:

No maintenance fees.

$10 to open an account.

Free Capital One ATM withdrawals (39,000+ ATMs).

Free online and mobile checks deposit.

Free debit card.

More details here.

Radius Bank

Interest Yield: Between 0.01% to 1.25%

Radius Bank offers several checking accounts that yield between 0.01% and 1.25%. You can compare the different packages here.

The top features of these accounts are:

A $10 account opening fee.

No monthly fees.

No minimum account balance.

Free ATM withdrawals worldwide.

Free bill payment fees and eStatements.

Aspiration Summit Account

Interest Yield: Up to 1%

Aspiration Summit Account is offered by Aspiration Financial Services. The account provides clients up to 1% interest yield. Features include:

No monthly account fee.

No monthly fee.

No minimum monthly deposit.

No fees at any ATM in the United States and overseas.

More details about the account are available here.

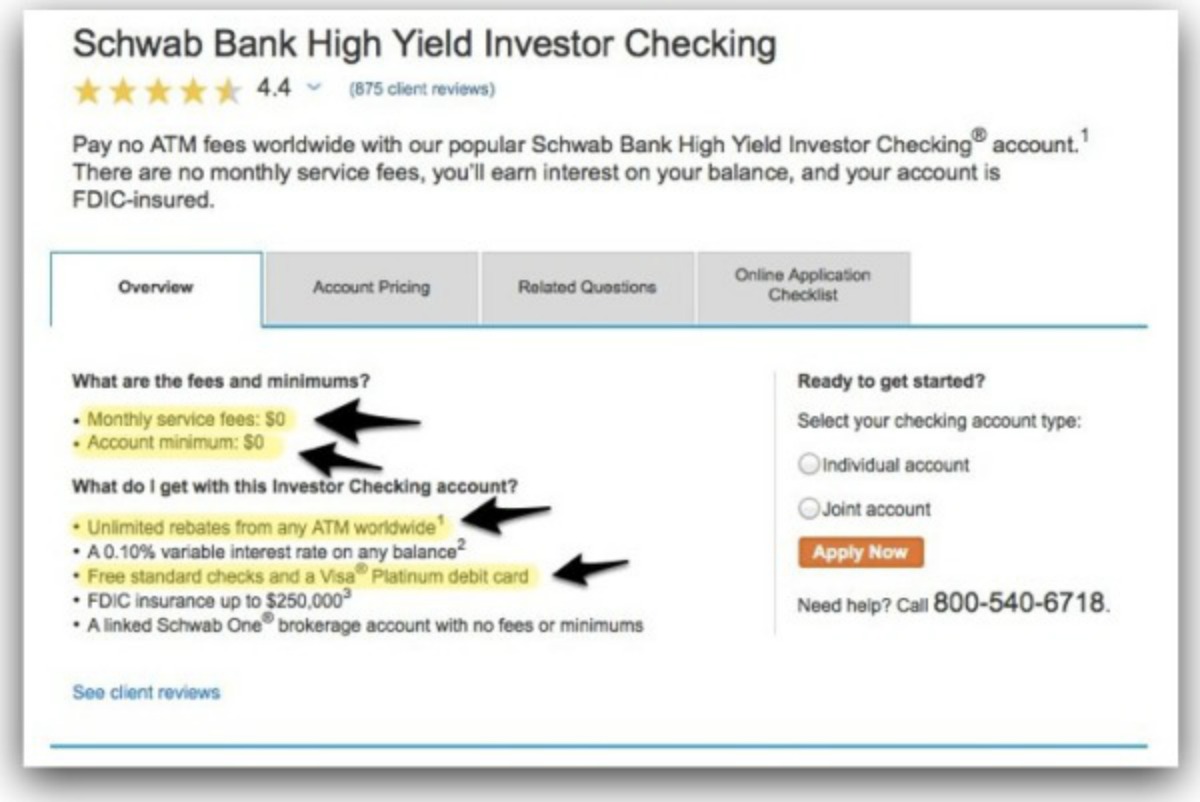

Schwab Bank High Yield Investor Checking Account

Interest Yield: 0.15%

This account is offered by Charles Schwab Bank, a leading financial institution in the country. Its features include:

No monthly fee.

No minimum balance.

Unlimited ATM fee rebates.

No foreign transaction fees.

FDIC insurance of up to $25,000.

Free bill payments.

Free Schwab Bank Visa Platinum debit card

You can find more details about this account here.

Wells Fargo Everyday Checking

Interest Yield: 0.01%

This account is offered by Wells Fargo, the largest bank in the country. The account’s features are:

An initial deposit of $25.

A $10 monthly account maintenance fee. (Other fees can be found here).

Transaction alerts

Text banking

Mobile deposit

Quick Note.

I would not recommend Wells Fargo after its recent scandal and its many avoidable fees.

Popular Direct Plus Savings

Annual Yield: 1.4%

This account is offered by Popular Direct, an FDIC insured financial institutions. The account provides an annual percentage yield of about 1.4%. Its features include:

An interest that compounds daily.

A minimum opening balance of $5,000.

A monthly maintenance fee of $4.

Other fees charged by the account: $5 account dormancy, $5 excessive withdrawal transaction fee, $25 early account closing and a $10 overdraft and return item among others.

You can find more details about the account here.

Syncrony High Yield Account

APY: 1.3%

This account is offered by Syncrony Bank which is an online bank without branches. In 2017, NerdWallet named the account the best high yield savings account. Its features are:

No minimum balance.

No account opening fee.

Use an ATM to withdraw the money.

FDIC insurance of up to $250,000.

24/7 customer care service.

No branches mean better returns.

More details about the account can be found here.

Barclays Bank Online Savings Account

APY: 1.30%

This online account is offered by Barclays bank, a leading FDIC-Insured bank. Its features are:

No monthly maintenance fee.

No minimum balance to open an account.

Multiple savings tools.

Online transfers to other banks.

Withdrawals in thousands of ATMs globally.

More features available here.

PurePoint Savings Account

APY: 1.30%

This account is offered by the new PurePoint Financial, a subsidiary of Mitsubishi UFJ Financial Group (MUFG), the fifth largest bank in the world. Its features are:

A minimum opening deposit of $10,000.

No monthly fees.

Flexible ways of funding your account including bank transfers, mobile deposits, wire transfer, and checks.

An FDIC insured bank.

Online platforms to access your account.

More details can be found here.

American Express Savings Account

APY: 1.25%

This account is offered by American Express, a leading financial institution in the country. Its features include:

A high yield that is above the national average.

No monthly fees and minimum.

Link with up to three current bank accounts.

FDIC insured bank.

More details about the account available here.

Ultimate Account

APY: up to 5%

This account is offered by NorthPointe Bank. It offers up to 5% APY on balances up to $10,000 and a simple interest of 0.10% with a corresponding APY of 5%. Its features include:

Up to $10 monthly refund on all ATM transactions.

15 or more in-person or online debit card purchases.

Free eStatements.

More details about the account can be found here.

EverBank Savings Account

APY: 1.25%

This account is offered by EverBank, an FDIC-Insured bank. Its features are:

A guarantee that your account will earn the top 5 yield based on Bankrate’s Monitor National Index.

$5,000 minimum opening balance.

Mobile check deposits.

No monthly account fee.

Unlimited ATM fee reimbursements.

Mobile payments.

Its fees include $10 cashier’s check, $10 stop payment fee, and $5 replacement of debit card fee.

More details of the account can be found here.

Sallie Mae High-Yield Savings Account

APY: 1%

This account is offered by Sallie Mae Bank. It provides the following features:

No minimum balance and no monthly maintenance fee.

APY is compounded daily and paid monthly.

Free transfers and six free withdrawals per month.

Online account management.

More details can be found here.

SFGI Direct Savings Account

APY: 1.31%

This account is offered by SFGI Direct, a division of Summit Community Bank. Its features are:

No monthly fee.

Deposit a minimum of $1 and earn interest.

Free online account management.

24/7 customer service with real people.

More details can be found here.

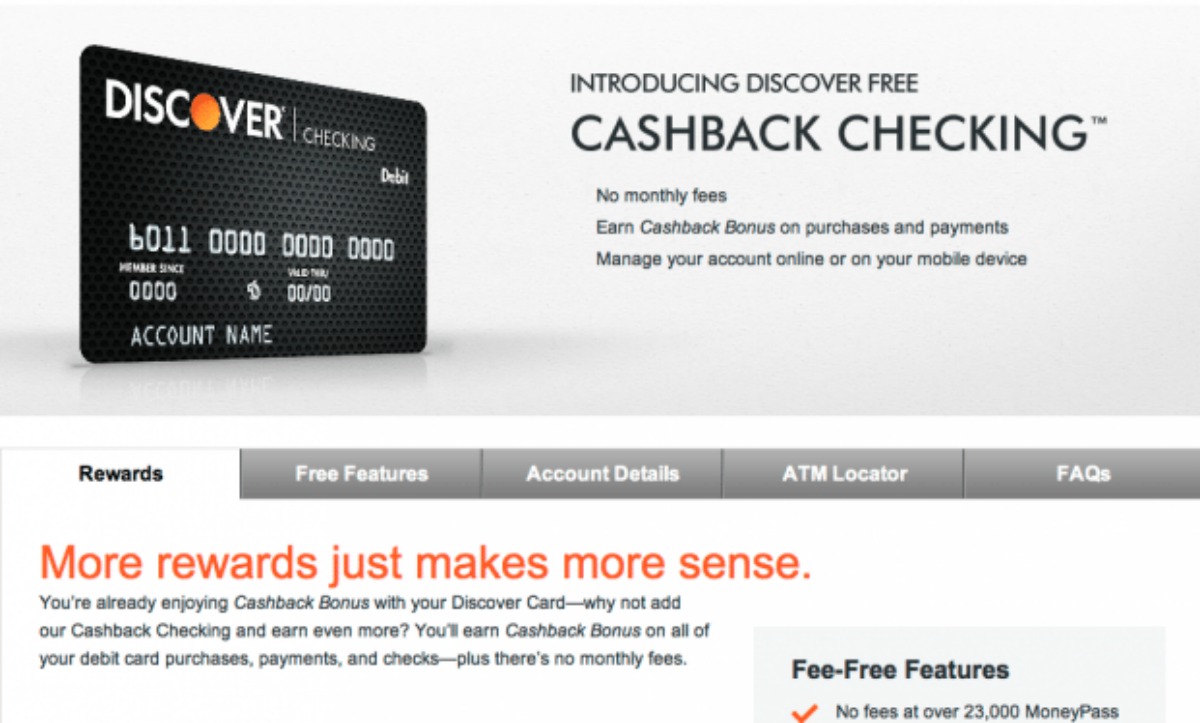

Discover CashBack Checking

APY: 1.1%

This account is offered by Discover, a leading financial institution in the country. Its features include:

1% cash back on up to $3,000 in debit card purchases.

No monthly fees.

Withdraw money in more than 60,000 ATMs with no fees.

Free bill payment

No fee to replace debit card.

No fee for a bank check, delivery of replacement debit card, outbound ACH transfers, incoming wire, and a paper copy of a check.

More details of the account can be found here.

What to Look Out For

As seen, there are many banks that offer high yielding interest rates. Before you select a bank, I recommend that you spend a few hours doing your background research. Find out what the bank’s customers have to say. Read reviews from trusted blogs and most importantly, read the fine prints of the terms and conditions to see whether the bank has hidden fees. Also, when a bank offers very high yields, do your research because, when the deal is so sweet, there might be something hidden.