What Is a Starting Credit Score? A Comprehensive Guide

When you step into managing your finances, the most confusing thing you encounter is your credit score. This three-digit number has the power to make or break your financial future.

But you might wonder.

That’s weird. What is a starting credit score? I’ve never used credit before, so why is there a three-digit number?

It’s because your credit score never starts from zero. There are many other financial metrics that can overwhelm you, especially if you’re a beginner in the finance world. It can lead to mistakes, which can destroy your financial future.

But don’t worry.

In this article, we’ll provide everything you need to know about a starting credit score, what credit score you start with, and much more.

So keep reading to learn more on how to secure your finances.

The Basics of a Starting Credit Score

Your starting credit score is not zero; it’s usually 300. 300 is the lowest possible FICO score. In most cases, your initial credit score will not be excessively high or low.

However, there are many misconceptions about credit scores starting at zero.

You might hear that having no credit history is worse than having a low credit score. Is that true?

No.

Having no credit history is equivalent to a clean slate. You’re not at a disadvantage compared to someone with a low score. Both situations allow you to build credit positively.

Another misconception is zero credit means bad credit.

If you’re starting with zero credit, that doesn’t mean you’ve poor financial habits. It means you haven’t borrowed or used credit extensively yet. There’s a clear difference between these.

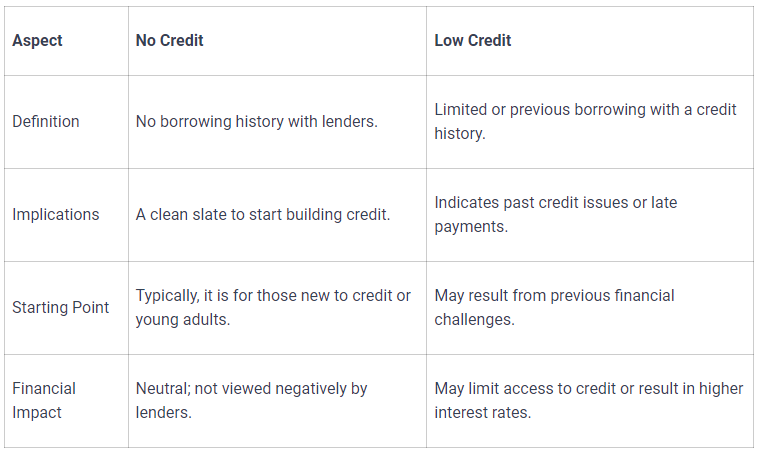

Let’s understand the terms “no credit” and “low credit” in detail.

How Credit Scores Are Calculated?

Before building a new credit score, you should familiarize yourself with the criteria of credit scores and how they are calculated. The FICO credit score is based on five primary factors.

- Payment History (35%): A history of on-time payments of bills carries the most weight. You can start by making a minimum payment and increasing the frequency later. Late payments can lower your score.

- Credit Utilization (30%): It refers to the amount of available revolving credit you use. If your credit card limit is $500, and you have a balance of $100, your credit utilization is 20%. You should aim to keep this percentage lower, which will positively impact your credit score.

- Length of Credit History (15%): The longer you’ve had credit accounts, the better. In this factor, your account age is considered.

- Types of Credit in Use (10%): Different credit accounts positively impact your credit score. Lenders view having a mix of credit, like credit cards and installment loans, as a positive thing.

- New Credit (10%): It refers to how often you apply for new credit. You should wait at least three to six months between credit card applications. Beginners should be cautious about multiple new credit accounts in a short span.

Building Your Credit Score from the Ground Up

Every financial decision matters. You have to make early credit decisions because they can shape your credit history. But for that, you should clearly understand the credit report because your financial future is based on it.

Be sure to check out our comprehensive guide on “How to Read and Understand Your Credit Report.”

Strategies for Building Credit

Let’s uncover some of the crucial strategies that help build credit, and we will tell you more and answer the question of what is a starting credit score.

1. Secured Credit Cards

For secured credit cards, you need to make small deposits as collateral. Your credit limit is determined according to this deposit. So you don’t have to add a large sum of money at once.

Let’s suppose you want to start building credit with a secured credit card. What would be the path for that?

You can deposit $300, which will now be your credit limit. You can use this card for small and manageable expenses.

But some people forget to pay bills on time.

Now, this is where your credit score starts going downhill. You should never let that happen.

Remember to show responsible card usage and healthy payment habits.

2. Credit-Builder Loans

What are credit-builder loans?

Basically, they are designed to assist individuals who are struggling with building credit. You might wonder what is the process for this?

Here’s what happens: the regular payments in your savings account will help you build a positive credit history. When your loan is completely repaid, you can access the accumulated funds.

But there’s something even more important.

It is choosing reputable lenders.

You should understand all the loan terms and interest rates, which will make repayments smoother. Let’s understand it better with an example.

Suppose you’re looking to establish credit. So, you opt for a credit-builder loan offered by a reputable company. You agree to a loan amount of $1,000 and decide to make monthly payments.

After your loan is paid, you’ll have a positive credit history. But there’s more.

You’ll also have access to $1,000 saved during the loan period. But ensure the loan provider company is not a scam or involved in shady activities.

3. Becoming an Authorized User

Many people use this strategy to boost their credit score. This tactic is becoming an authorized user on a family member’s credit card. When selecting the account, you should ensure they have a good payment history and a low credit utilization ratio.

But is that necessary?

Yes.

Because only then will you be able to reap the benefits of this strategy.

Individuals can leverage the positive credit behavior of primary card holders. It will indirectly have a positive impact on your credit score.

Suppose you’re building a starting credit score, but your credit score is not high. You can become an authorized user on your parent’s card. But who should you choose?

- Person A: Has a high credit score, low credit utilization ratio, and history of on-time payments.

- Person B: Average credit score, low credit utilization ratio, and poor payment history.

Then, you should become an authorized user on person A’s card. It will improve your credit score as well.

If you want to take control of your finances, then don’t forget to read How to Build Credit History.

Our experts have also created a comprehensive guide to assist you in the journey. So grab your Credit Secrets book now.

Timeline to Your First Credit Score

Now, you don’t have to research what credit score you start with and what a starting credit score is. So, let’s move to the next step.

It is understanding the timeline of your first credit score. It plays a crucial role in understanding credit reports and improving credit scores.

You’ll establish credit in the first 1 to 6 months of opening a starting credit account. Make small purchases and pay on time. It’ll initiate the creation of your credit history.

The next 6 to 12 months involve building a credit history. You should continue responsible credit use. Pay bills on time. It’s the stage of your credit history development.

Now that you’ve set the foundation of credit, you should gradually improve. In the next 12 to 24 months, you should determine options for diversifying your credit mix. It includes exploring different types of credit, such as installment loans.

You’ve stayed consistent for a year with on-time payments. So, in the next 24 months and beyond, your credit history will mature and start growing. With time, your credit score will show significant progress.

But remember, for starting credit score success:

Key = Consistency + Patience + Positive Financial Behavior

Your credit activities play a crucial role in establishing a reliable credit profile.

Remember, there is no specific score as a default credit score. Basically, the term default is associated with failure to repay debt according to agreement.

Strategies for a Strong Credit Foundation

You can’t implement a lot of strategies and expect your credit score to grow in just one day. Instead, you should prioritize building a strong credit foundation. Here are some effective strategies for this purpose.

Initial Credit-Building Strategies

Responsible credit use is one of the best things for your credit score. Don’t wait till the last day if you’ve got any bills due. Pay bills ahead of time and familiarize yourself with different credit terms.

Maintain a low credit utilization ratio. But how can you do that?

By keeping credit card balances low. Never allow for double-digit utilization to report.

Here are some strategies for this.

- Set a precise budget.

- Monitor your spending.

- Avoid closing accounts.

Early Credit Monitoring

You’re following all the initial credit-building strategies. You’re confident your credit score will grow.

But instead, it’s declining. What’s the reason behind it?

There can be many reasons behind it, but to identify that, you should start monitoring your credit.

In this, you regularly check credit reports and check scores. The score helps you understand the insights regarding your credit. You can check your credit report from the Annual Credit Report for free.

Identify inaccuracies early for correction. Here are some tips for setting up credit monitoring and alerts.

- Select a well-reviewed credit monitoring service.

- Enable alerts for key changes (new accounts, inquiries).

- Verify unexpected alerts directly with the service to avoid scams.

Common Myths and Misconceptions

There are many myths and misconceptions regarding credit scores. Let’s look at some of these so you can make responsible financial decisions.

- Myth: You must be in debt for a good credit score.

Reality: Responsible credit use, not debt accumulation, builds a positive credit history.

- Myth: Checking your credit score lowers it.

Reality: Checking your score has no impact; only lender inquiries matter.

- Myth: Credit score is only based on income.

Reality: Income isn’t directly tied to credit score. Instead, responsible management matters more.

Long-Term Credit Health Maintenance

Maintaining and improving credit health isn’t an overnight thing. Instead, it’s a long-term strategic approach that requires more than basic knowledge. Here are some significant aspects that’ll help you in this regard.

Advanced Credit Management Techniques

Having a diverse mix of credit accounts is extremely helpful in improving credit scores. It mainly involves a combination of:

- Revolving credit (credit cards)

- Installment credit (mortgages, auto loans, personal loans)

It shows responsible credit behavior. Moreover, different types of debt should be managed accordingly.

Mortgage payment is crucial for credit health. Consistent and on-time payment of mortgages leads to financial stability.

But that’s not all.

Loans such as auto loans and personal loans should also be managed effectively. You can implement strategies like:

- Make a structured repayment plan.

- Avoid overextension.

- Stay updated about interest rates and terms.

Credit in Financial Planning

Credit influences financial planning and its different aspects. You can get loans at favorable interest rates if you have good credit. You can use it later for investment purposes.

If you’ve good credit right now, don’t avoid long-term planning.

Instead, plan major purchases with an awareness of how they will impact your credit score. Suppose you’re retired, but your credit score is low; renting a home and getting loans will be difficult.

That’s why you should consider retirement planning while financial planning. Here’s what happens.

Financial planning → High credit score → Access to lower interest rates → Favorable loan terms

So, purchasing a home and starting a business with that amount is easy. But how can you ensure your credit score is high?

By proactively managing it. Review your credit report and address discrepancies. It will set the foundation for your bright financial future.

Conclusion

Your starting credit score might not be outstanding or according to your expectations. But remember that your early decisions matter the most. Regularly check your credit report and implement strategies to improve your credit score.

It doesn’t matter what credit score you start with.

What matters is how well you can control your credit health.

Take the first step by being financially literate.

We have created a free library of credit scores and tools to help you in the journey. Access our VIP finance content and manage your finances like a pro to achieve next-level credit score success.

Jenn Cartwright

What's Trending