First-time Home buyer? Here are the Top Recommendations From an Industry Veteran.

How does owning a home make you feel? The thought of waking up every morning in a space you legally own or the idea of not paying rent at the end of every month.

The thought of remodeling and redecorating your house without being answerable to anyone. The idea of living in an appreciating investment that you can always flip when your life comes falling down.

To many, owning a home is the real definition of freedom. To others, like me, owning a home is one of the most important decisions they can ever make.

However, owning a home or investing in real estate is one of the most complicated decisions. How do you select the location? How do you finance the purchase? What type of house will you buy? Are there more options? Which broker should you use? Will your family love it?

These are difficult questions.

Dana Bull is a real estate veteran who runs a real estate consulting company called Dana Bull Realtor which focuses on the millennial home buyer. She has a real estate license from Massachusetts and is a member of the National Association of Realtors (NAR). She has a five-star rating at Zillow and is affiliated to the Harborside Sotheby’s International Realty. She has also been featured in top publications like Huffington Post, Forbes, and USA Today.

Here are her top recommendations to first-time home buyers.

Get Educated

According to Dana, a common mistake many first-time home buyers make is to ignore the several moving parts involved in home buying.

These moving parts involve finding a house, finding an offer, arranging for financing, finding homeowners insurance, to closing the deal.

Understandably, most home buyers don’t have a good understanding of how all this works and the implications of doing it wrong.

Dana advises people first to get educated from expert professionals on how to approach each of these steps.

Quick Tips

Talk to a friend or colleague who has bought a home before.

Also, talk to an expert in an area you want to live.

Do online research about your ideal location and the amenities available.

Make a Real Estate Plan

We make plans for most things. We make holiday plans, meal plans, and even financial plans. However, most people don’t have time to make a real home buying plan.

According to Dana, every person dreaming of owning a home or investing in real estate must always make a plan. This plan should give them a road map of what they want to own.

Having a well-thought and well-written plan will give you a sense of direction. It will also give you morale to work hard to achieve your goals.

How to do this

Write down your plan on a piece of paper or in a synced app like Evernote or OneNote.

Create a budget for your house and start working on it.

Read more about real estate.

Make realistic plans based on your income.

Vet and Hire Experts

If you are like me, you love to hate real estate agents. In fact, research shows that most people hate dealing or interacting with real estate brokers.

However, these professionals are so important in the home buying process. Ideally, you should go to an experienced and licensed real estate expert who will give you the right and unbiased advice.

Alternatively, you should carefully vet and research all the real estate experts in your area. These include brokers, banks, financial advisors, and security experts among others.

Remember, getting the wrong expert who is interested only in your money can make you make the wrong decisions.

Scrutinize Your Finances

Most of us have the dream of living in the best houses in our neighborhood. However, not everyone can afford to live in such homes.

Many first-time home buyers often make the mistake of buying homes without factoring in their finances.

An excellent and sad example of this is Johnny Depp, one of the best-known actors in our time. At the peak of his career, Depp was one of the best-paid actors. Sadly, he bought several lavish homes that cost him hundreds of thousands of dollars every month to manage. In the end, he went from being one of the wealthiest actors to being broke.

According to Dana, people who live in their tiny houses that they can manage are often happier than people who live in lavish homes that they can’t control.

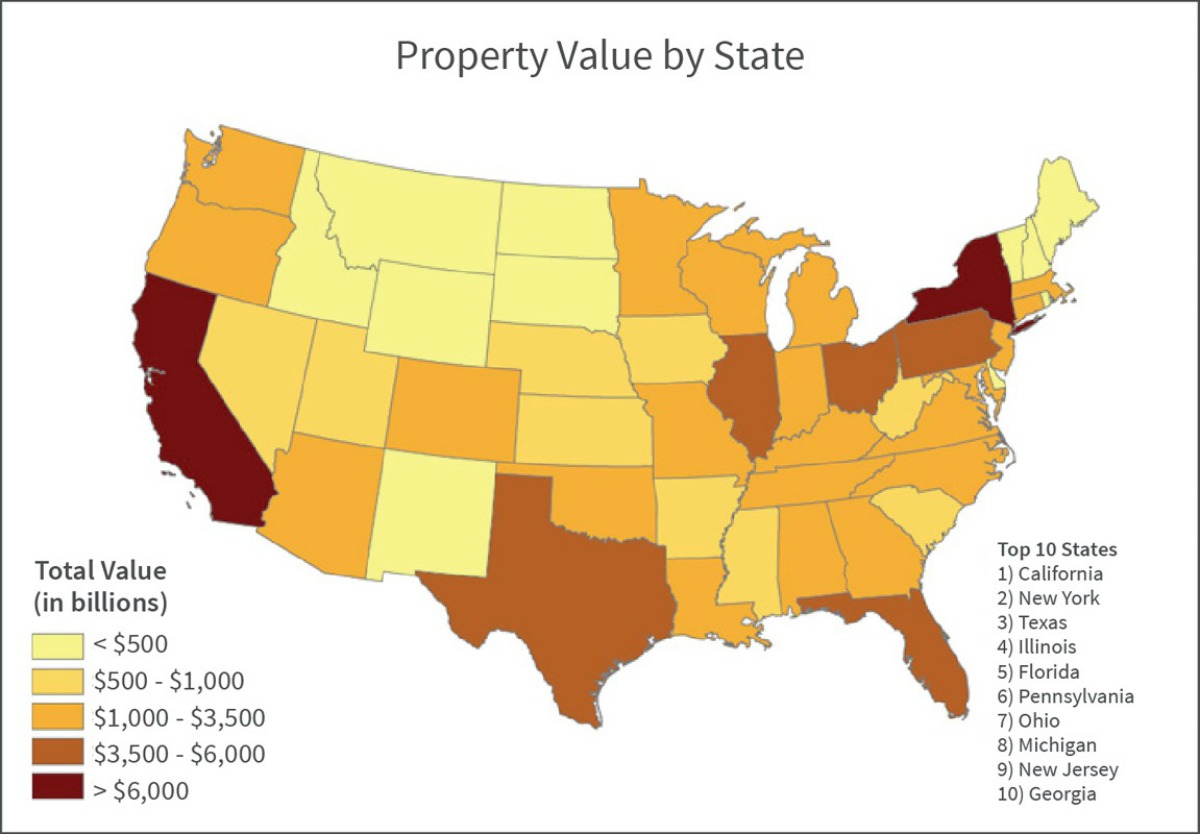

Focus on Value and Location

Location is often the most important thing in home ownership. We all want to live close to where we work and where we take our kids to school.

However, you should be very careful about being distracted by the location of a home, and its value. For example, you will often find similar houses with different prices with the only difference being the accessories.

According to Dana, if you are short of cash, always go for the less-priced house because you can still add the accessories.

Also, you should always do your research on the location of your new home. How is the weather there? Which are the nearest schools or hospitals? Are their better alternatives?

Remember: You are in Control

As a home buyer, you should always remember that you are in the driver’s seat. Often, several things such as a bidding war or competing interests from the agents can distract you.

Remember, in the end; you are in control of the home buying process. You are the one to pay and live in the home.

According to Dana, you have the right to say no when any terms don’t meet your plan.

Other Recommendations

Explore your down payment options. If you don’t have enough money to make your down payment, consider federal mortgage programs like Fannie Mae and Freddie Mac that will accept deposits of as low as 3.5%.

Explore state and local assistance programs.

Compare mortgage rates from different organizations.

Consider your future by buying a house that will accommodate your current and future family comfortably.

Owning a home is exciting, but often, the process is not. Without a doubt, you can expect to meet significant challenges along the way. Following these recommendations and reading more will help ease the pain of owning your home.

What's Trending