What Credit Score Do You Need to Rent an Apartment?

Most individuals believe that renting an apartment requires a higher credit score. But is that true?

Not at all.

Landlords view high credit scores as a seal of trust. However, it’s important to note that credit score requirements for renting an apartment vary greatly based on location and the type of rental property.

In competitive rental markets, landlords have strict rules and regulations. That’s why individuals with low credit scores might fail to secure desirable apartments. However, not all landlords are the same; some are lenient and flexible.

In this blog, we’ll explain in detail what credit score do you need to rent an apartment and much more. So keep reading.

Understanding Credit Score Requirements

A credit score is a numerical representation of an individual’s creditworthiness. It is based on the credit history and financial behavior of a person. Credit bureaus generate it after carefully analyzing information in your credit report. You can check your credit report for free from the Annual Credit Report.

Having a high credit score can make renting an apartment easy.

Do you know how?

Suppose a landlord is renting his house. You’re a potential candidate. Your credit score is around 700. It means you pay bills on time, don’t have a lot of debt, and have healthy financial habits.

So, the landlord will prefer you over candidates with low credit scores because they lack credibility. Here’s the answer to what credit score you need to rent an apartment.

How Credit Scores Vary by Location and Rental Type

If there’s high demand, then the criteria for renting will be extremely strict. In high-end cities like New York, the demand for rental properties is high. So, to narrow down the pool of applicants, credit scores are set high at around 750 or even higher.

Meanwhile, in low-demand cities, the market is balanced. In these areas, a good credit score for an apartment is flexible.

But another factor greatly affects the credit score needed to rent an apartment.

It’s the type of rental.

Luxury apartments usually have stricter criteria in comparison to low-end apartments. Low-end apartments are affordable and have low credit score requirements.

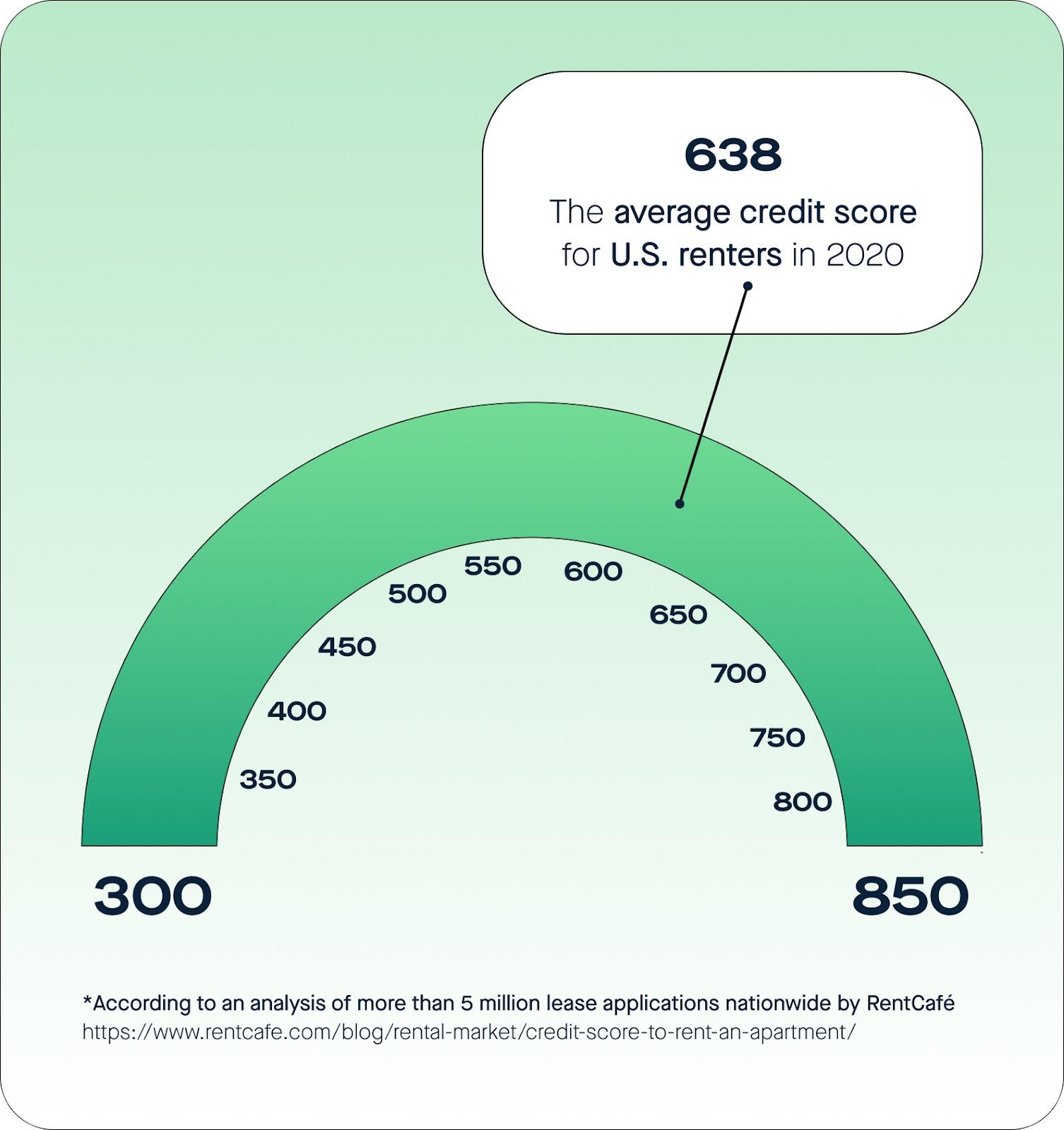

Always consider your credit score while renting an apartment. According to a report, the average credit score of U.S. renters in 2020 was 638. But it varies depending on the rental type and city.

Source: sayrhino

For example, in San Francisco, the credit score was 719. Meanwhile, the credit score for renting an apartment drops to 580 in Arlington, TX. This tells us the difference between credit scores to rent apartments in different areas.

Factors Landlords Consider in Credit Reports

While viewing a potential tenant’s credit report, landlords consider many things. Knowing these is crucial as it tells whether an individual is suitable as a tenant. Let’s examine these factors and how they impact a landlord’s decision.

- Payment History: Reflects timely payments for credit cards and loans. Indicates the likelihood of on-time rent payments.

- Credit Utilization: Measures the percentage of used credit. High balances may suggest financial strain.

- Credit Account Types: A variety of credit types positively impacts creditworthiness. Indicates financial stability and responsible credit use.

- New Credit Inquiries: Multiple recent inquiries may indicate financial stress. Frequent applications may suggest instability.

- Public Records and Collections: Bankruptcies, tax liens, or collections are red flags. Suggests potential financial difficulties.

Strategies for Renting with Different Credit Scores

You might wonder what you should do to rent an apartment if Iyou don’t have a good credit score. Is there any way to resolve this?

There are some strategies you can use, such as finding a co-signer. A co-signer assures the landlord that there is someone else to help make payments, if needed, which increases the chances of approval. You can also offer a large security deposit to mitigate the perceived risks of landlords.

But that’s not enough.

You should strive to improve your credit score. That’s how you can secure even high-end apartments.

Start by budgeting and paying bills on time. Consider having a mix of credit types and adopting healthy financial habits.

Navigating the Rental Market with Your Credit Score

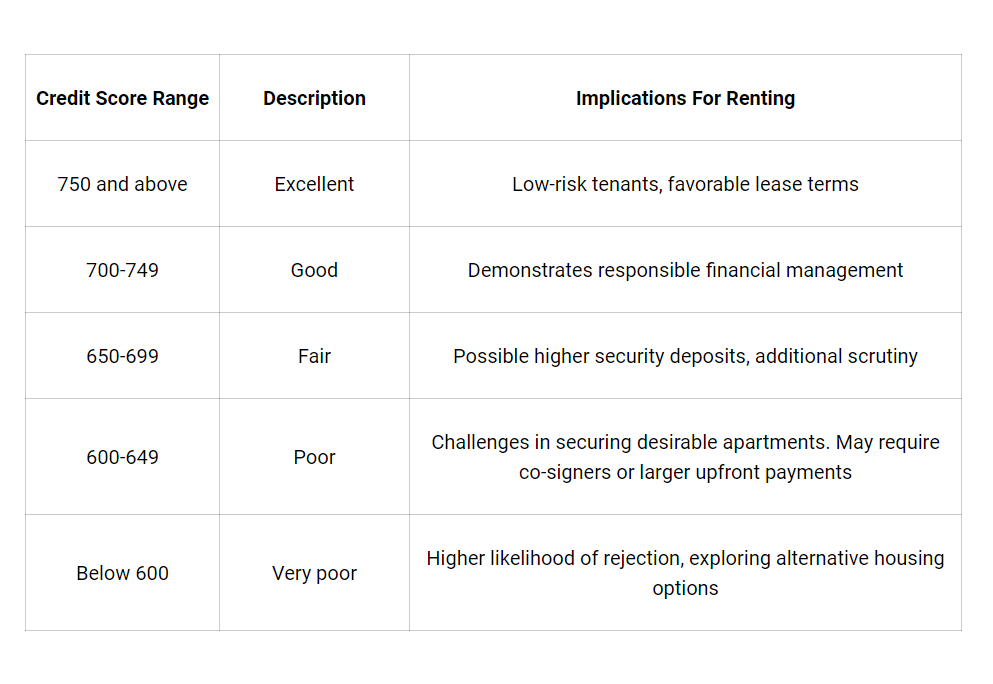

You’ll get many benefits if you have a good credit score for an apartment. But most people are unaware of these and don’t use them. Let’s look at what approach renters should use in the rental market based on their credit scores.

- 750 and above: Leverage strong credit for better lease terms.

- 700-749: Emphasize good credit and negotiate lease conditions.

- 650-699: Explore different rentals and highlight stability.

- 600-649: Seek less competitive markets and be flexible in negotiations.

- Below 600: Look for areas with flexible credit requirements and plan to improve credit.

Meanwhile, those with lower credit scores should avoid competitive rental markets. You should explore private rentals or individual landlords. But most importantly, don’t forget to improve your credit score.

Check our in-depth guides on how you can improve your credit score.

Tips for Improving Your Credit Score for Rental Applications

If your credit score is low, it’s best to use strategies and techniques to increase it. Remember:

High credit score = More chances of securing an apartment as a renter.

You should check your credit report. If there are any inaccuracies, then report them immediately. Reduce your debts and maintain healthy financial habits. That’s how you can boost your credit score to get approval to rent an apartment.

We have created a comprehensive VIP Credit Secrets book. In this, you’ll learn everything needed to skyrocket your credit score. Grab yours now at a discounted price.

Conclusion

Now you know the credit score needed to rent an apartment. If you want to secure a high-end apartment, then you need a high credit score. However, even with a low credit score, you have different options. But you shouldn’t stop there. Instead, take it as a sign to transform your financial health.

If you’re tired of a low credit score and how it’s affecting every part of your life.

Then, it’s time to get to work and check out the Credit Secrets book. We are here to help you with all sorts of assistance to help you boost your scores to qualify to rent an apartment. So contact us today.

Jenn Cartwright

What's Trending