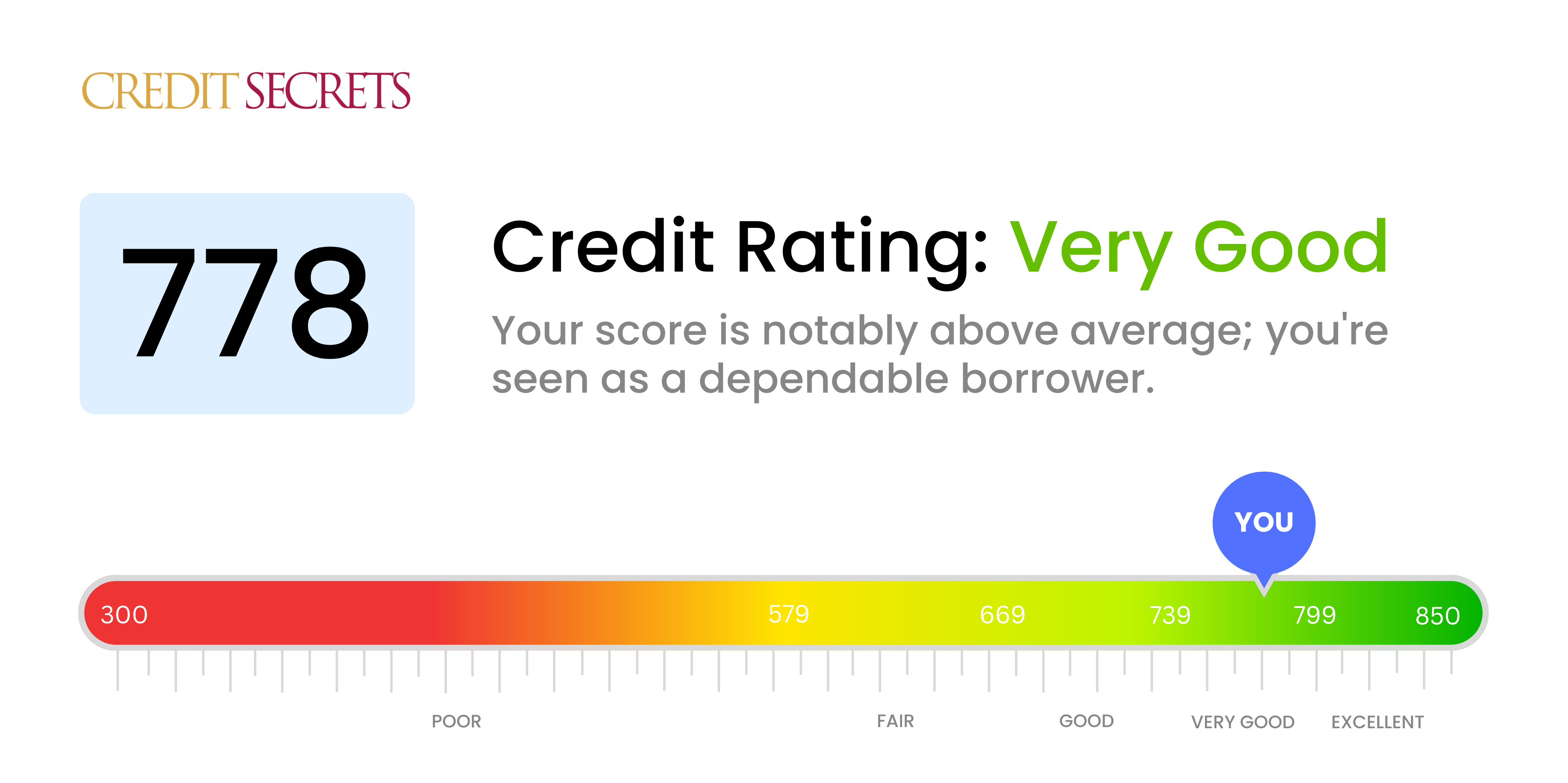

Is 778 a good credit score?

Rest assured, a credit score of 778 is considered well within the 'very good' range. Having a credit score in this range suggests that you've been responsible with your credit and this can lead creditors to see you as a low risk borrower.

This score will likely make you an attractive candidate to lenders, offering you access to favorable interest rates and loan terms. However, it might be beneficial to aim higher and reach the 'excellent' range to ensure the best possible financial opportunities. Remember, every step closer to a perfect score sets you up for greater financial success.

Can I Get a Mortgage with a 778 Credit Score?

A credit score of 778 is indeed impressive and is likely to result in a positive outcome when applying for a mortgage. The score is well above the threshold most mortgage lenders consider good (usually around 620 or higher).

Being in this credit category means you've demonstrated fiscal responsibility by consistently making payments on time and managing your credit wisely. It's a testament to your financial discipline and your potential lenders will definitely take this into account. Owing to your high score, you may expect faster approval processes and favorable interest rates - lenders tend to offer better terms to individuals with high scores as a way to reward and encourage responsible credit use. However, approval also depends on factors like your income and debt ratio, so ensure these are also in good shape as they are also important considerations during the approval process.

Can I Get a Credit Card with a 778 Credit Score?

If you have a credit score of 778, it's pretty likely that you'll be approved for a credit card. A credit score in this range is viewed in an extremely positive light by lenders, as it shows that you've done a good job at managing your credit in the past. It's understood that maintaining a high score like this isn't easy and can require some serious dedication and financial prowess.

With this score, you will qualify for a multitude of credit card options. It may benefit you to explore premium credit cards. These cards typically offer rewards like cash back, travel perks, or exclusive deals, and with your score, they can be within reach. Alternatively, if you're looking to limit potential debt, choosing a card with a low interest rate can be a smart move. Remember, while a high credit score opens up opportunities, the decision should always align with your personal financial situation and goals.

With a credit score of 778, you're right in the 'excellent' bracket. This high score is very favorable, indicating to lenders that you pose a very low lending risk. As such, you can feel somewhat assured in your potential to get approved for a personal loan.

Since your credit score would demonstrate your creditworthiness to lenders, this may lead to beneficial conditions in your loan application process. Higher credit scores like yours often unlock lower interest rates, due to the low risk of potential default. This means the total cost of the loan may be significantly less for you compared to someone with a lower score. It should also result in smoother loan approval processes, with less rigorous checks needed for approval. And while nothing is ever completely guaranteed, with a credit score of 778, you can approach the personal loan application process with confidence.

Can I Get a Car Loan with a 778 Credit Score?

With a credit score of 778, you are well-positioned to be approved for a car loan. Lenders typically consider scores above 660 to be good, and your score of 778 is significantly above this threshold. This high credit score reflects a commendable track record of managing and repaying borrowed money. Lenders will perceive you as a lower risk borrower, which could result in more favorable loan terms.

As you go through the car purchasing process, your strong credit score is likely to afford you lower interest rates compared to those with lower scores. You can expect to have a variety of loan options available to you from various lenders. However, keep in mind that while your credit score is a crucial factor, lenders will also consider your income and other debts. Nonetheless, with a high credit score like 778, you're in an excellent position to negotiate favorable terms for your car loan.

What Factors Most Impact a 778 Credit Score?

Decoding the implications of a 778 credit score can play a pivotal role in modifying your financial tactics. Recognizing and targeting the elements shaping this score can help steer you towards a stronger financial standing. Every fiscal journey is individual and rife with learning curves.

Credit Utilization

With a credit score of 778, it might imply you've efficiently managed your credit utilization. Potential areas of scrutiny could include credit card balances that occasionally spike, even if you pay them off in full every month.

How to Check: Scrutinize your credit card statements. Were there instances when your balances shot up, even briefly? Consider spreading larger purchases over several cards or making mid-cycle payments.

Length of Credit History

Your credit history may be relatively long, which has helped to achieve your current score. However, new credit accounts might decrease the overall age of your accounts.

How to Check: Review your credit report and note the age of your oldest and newest accounts and the average age of all accounts. Have you recently opened new accounts?

Credit Mix

Possessing a diversified mix of credit influences your score. Ensure that you are handling them responsibly.

How to Check: Reflect on your variety of credit accounts including credit cards, installment loans, and other financial products. Is there anything you can add or handle differently?

Hard Inquiries

A high number of hard inquiries on your credit report might have a minor impact on your score.

How to Check: Look at your credit report for any recent hard inquiries. Be mindful of how many times you allow your credit to be checked.

How Do I Improve my 778 Credit Score?

With a credit score of 778, you’re already in an excellent position. The next step is maintaining it and reaching the exceptional bracket. These are the significant steps you can take:

1. Keep Account Balances Low

With a higher credit score, it’s natural to have access to more credit. While this is a benefit, keeping account balances low would help maintain your credit usage ratio. Aim to keep your balances below 10% of available credit limits.

2. On-Time Payments

Consistency is key in maintaining and improving your credit score. Timely payments are a large factor considered in calculating your credit score. The marker of a responsible borrower is timely repayments, which will impress future creditors.

3. Limit Credit Inquiry

Each time a credit inquiry is made, it can lower your score. Be cautious and only apply for new credit when it’s absolutely necessary and beneficial for your financial health.

4. Long-Term Positive Payment History

Your payment history makes a significant difference in your credit score. Ensure that you continue to build a strong, long-term positive payment history by making payments on time and in full.

5. Don’t Close Unused Cards

Unless a card has an expensive annual fee, you should avoid closing unused credit card accounts. Keeping them open and in good standing can benefit your credit score by increasing your credit availability, thus, lowering your overall credit utilization rate.