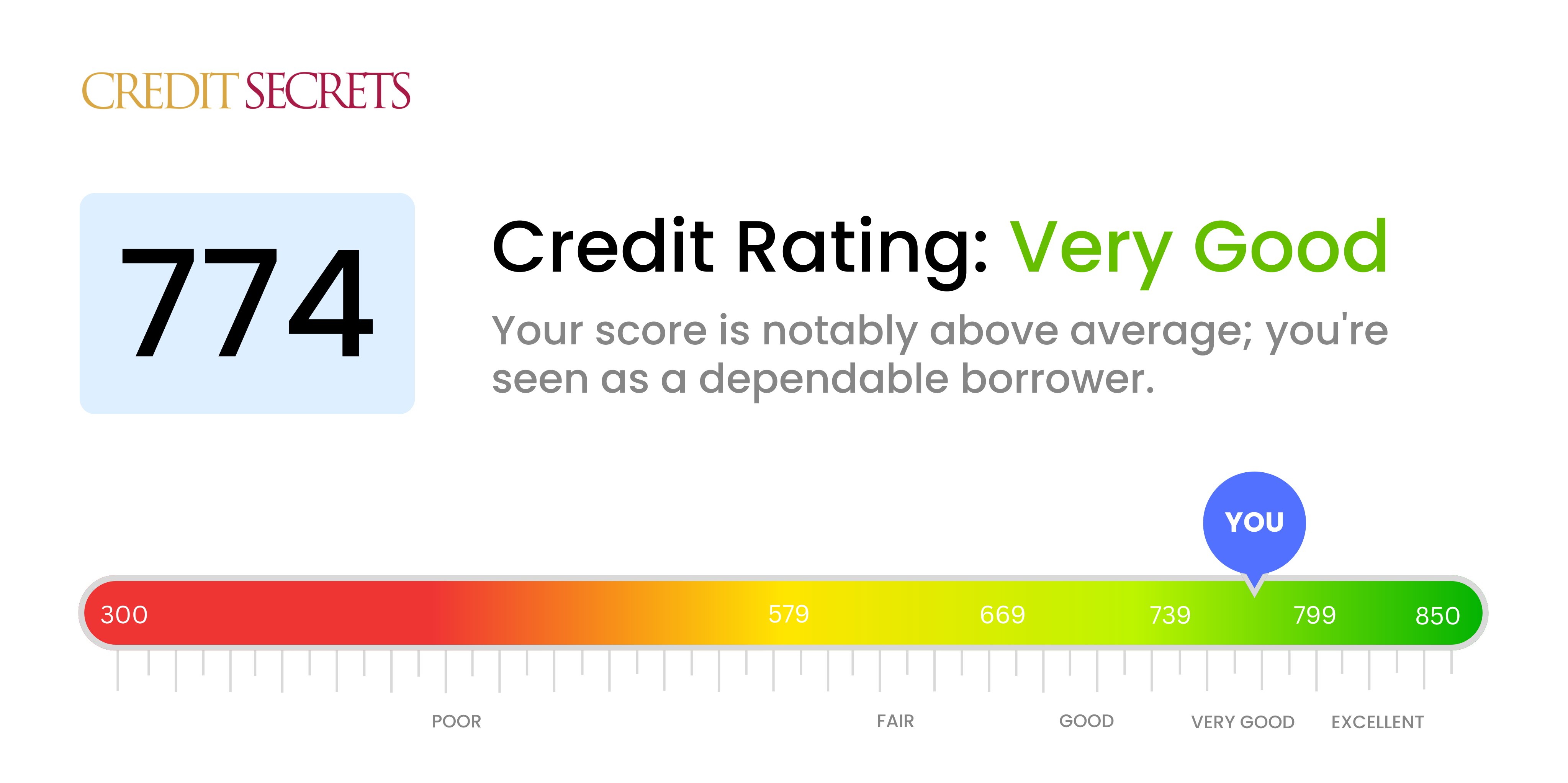

Is 774 a good credit score?

Based on the range provided, your credit score of 774 is considered to be very good. This implies that you have managed your credit responsibly, making you a favourable candidate to many lenders.

What can you anticipate with such a score? Well, a very good credit score like yours greatly increases your likelihood of being approved for credit applications. Lenders usually offer lower interest rates and better terms to those with very good scores, recognizing your proven track record of financial responsibility. Keep in mind, maintaining or even improving your credit score should always be the goal for potential future opportunities.

Can I Get a Mortgage with a 774 Credit Score?

Holding a credit score of 774 places you in an excellent position for mortgage approval. This score indicates a consistent track record of financial responsibility, including timely payment and thoughtful credit use. Mortgage lenders tend to view this score as low-risk, making you a desirable candidate for approval.

During the mortgage approval process, you can anticipate a comprehensive evaluation of your financial standing. This will entail verifying your income, scrutinizing your debt-to-income ratio, and conducting an appraisal of the home you're planning to purchase. As someone with a high credit score, you are also likely to be offered favorable interest rates. This is because lenders often provide lower rates to borrowers who pose a lower financial risk. In the grand scope, your admirable credit score of 774 bodes well for your journey towards home ownership.

Can I Get a Credit Card with a 774 Credit Score?

With a robust credit score of 774, there's a high probability of being approved for a credit card. This score suggests a track record of responsible financial behavior and timely bill payments. Lenders tend to view this score favorably, indicating lower financial risk. Yet, while good news, understand that while a credit score is a pivotal factor, card issuers will also examine other aspects of your financial profile.

With such a higher score, a variety of credit card options might be fitting. Premium travel cards or cash back cards, which typically require excellent credit scores, could be a good match. These cards usually come with high rewards rates, sign-up bonuses, and other strong perks. However, always bear in mind the interest rates, as these can alter the merits of a card’s rewards. Alternatively, if less interested in rewards, a low-interest rate card might be a superior fit, saving money in the long run if carrying a balance month-to-month. Nevertheless, every card comes with its particulars, so it is essential to compare cards and understand their full terms before choosing.

A credit score of 774 is substantial and well within the range that lenders consider good. This high score translates to a lower level of risk for lenders, making it significantly likely that you could be approved for a personal loan. Indeed, having such a credit score signifies that you've handled past credits responsibly and punctually.

As you navigate the personal loan application process, your credit score of 774 can work greatly to your advantage. It not only increases the chances of your application being approved, but also puts you in a better position to negotiate favorable terms. Moreover, lenders may offer you lower interest rates due to your good credit score. This is because the risk associated with lending to you is considered minimal. Nevertheless, every lender has its criteria, so it's smart to compare offers and terms from different lenders.

Can I Get a Car Loan with a 774 Credit Score?

Having a credit score of 774 is very favorable when applying for a car loan. This number places you well above the typical lender's minimum score requirement and into the range of exceptional credit. This high score conveys to potential lenders that you have shown responsibility in handling borrowed money in the past. Thus, they would perceive you as a low-risk borrower.

As a result of your stellar credit score, you can expect a relatively smooth car purchasing process. Interest rates offered to you will generally be lower than those offered to borrowers with lower scores. This translates into less money paid over the life of your car loan. Keep in mind, however, that while your credit score is a major factor, lenders may still consider other factors for approval such as income and employment history. Therefore, ensuring these are also in order will help to solidify your position even more when applying for a car loan.

What Factors Most Impact a 774 Credit Score?

With a credit score of 774, you're already in a strong position. Still, it's essential to understand the determining factors behind your score to maintain or even improve it.

Credit Payment History

Consistency in settling accounts reflects positively on your credit score. Any missed payments or defaults in the past may have had an impact.

How to Check: Look at your credit report and verify it for any late payments or defaults. Any cases of late bills may have affected your score and should be avoided in the future.

Credit Utilization Rate

Even with a high score, keeping your credit utilization low is key. If your credit balance is close to your limit, this might have limited your score from reaching higher numbers.

How to Check: Analyze your credit card statements. If your balances are almost reaching the limit, work towards maintaining fewer balances.

Duration of Credit History

The longer your credit history, the better it reflects on your score. Even a person with good credit behavior can have a lower score if their credit history is too short.

How to Check: Evaluate your credit reports and take note of the age of all your accounts. If you recently opened new credit, it could have an impact on your average credit history length.

Credit Diversity and New Credit

With a score like 774, having various well-maintained credits, from retail accounts to mortgages, is a probable factor. Use new credit responsibly to maintain this positive impact.

How to Check: Observe your variety of credit accounts and see if you recently made new credit applications. Applying for new credit should ideally be occasional and well-planned.

Public Records

Even with a high score, incomplete public records like unsettled bankruptcies or tax liens can affect your score.

How to Check: Check your credit report for any erroneous public records. If found, proceeding to resolve them can help maintain your credit score.

How Do I Improve my 774 Credit Score?

With a credit score of 774, you are already on solid ground when it comes to creditworthiness. However, there are always steps you can take to improve this further. Here are the most critical actions for you at this level:

1. Maintain Timely Payments

Your score reflects a strong history of making payments on time. Your priority should be to keep this up. Each bill that is paid on time confirms your reliability as a borrower and strengthens your score.

2. Regular Credit Check-Ups

Continually monitor your credit report to ensure it’s accurate. Mistakes can occur and damage a strong credit score. If you detect errors, dispute them promptly with the credit bureau.

3. Low Credit Utilization

Keep your credit utilization beneath 30% of your overall limit. Even though you may not carry a balance month-to-month, a high utilization ratio can still impact your score. Stay well below your limits to show responsible credit use.

4. Avoid New Debt

New loans or credit card applications can lead to hard inquiries on your credit report, potentially lowering your score. If you don’t need new credit, avoid applying for it.

5. Diversify Your Credit Portfolio

Having a variety of credit types – such as a credit card, mortgage, and auto loan – demonstrates good credit management across varied types of debt. If your credit portfolio isn’t diverse, consider adding another type of credit, but remember the earlier advice about avoiding unnecessary debt.