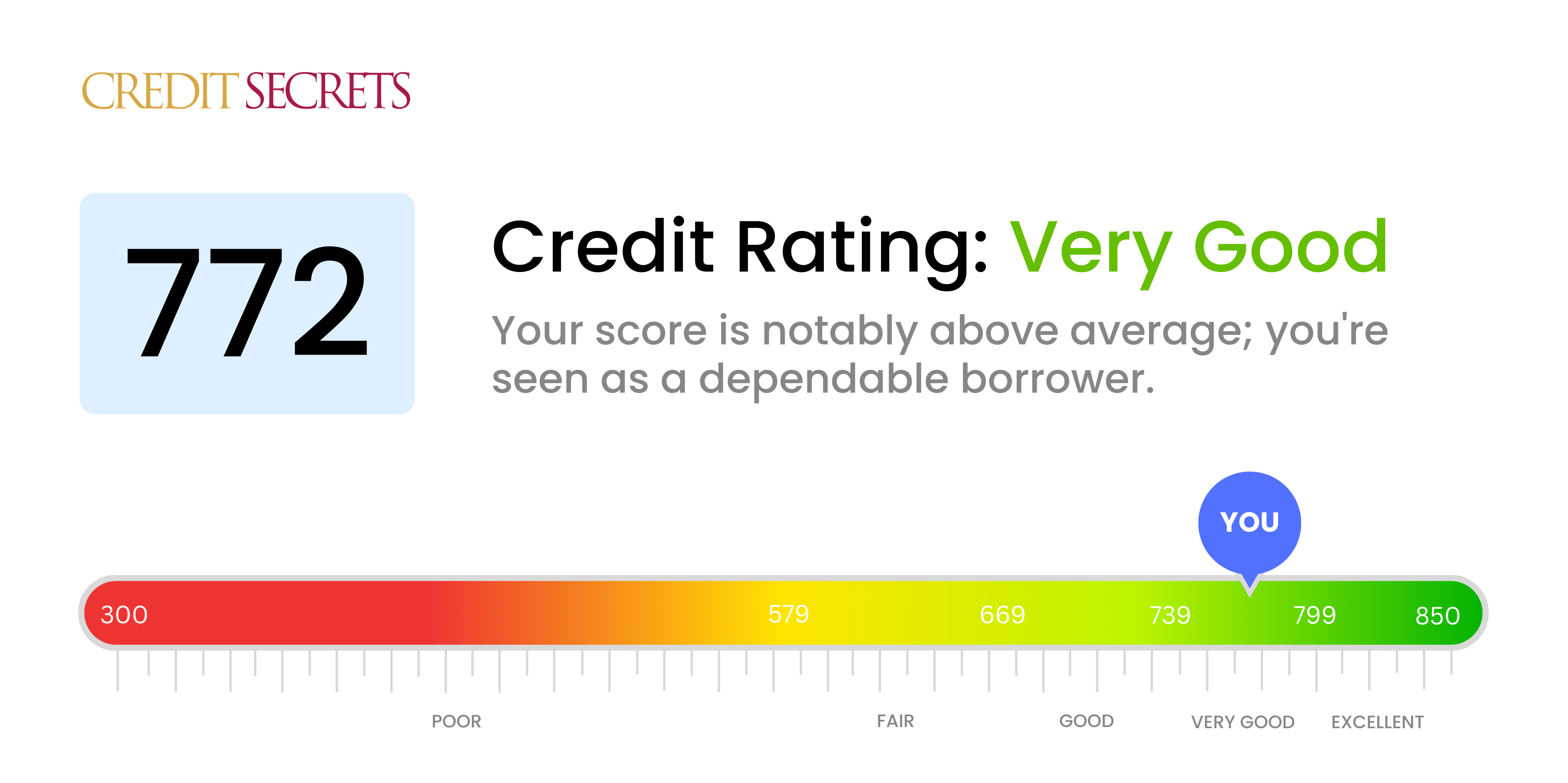

Is 772 a good credit score?

With a credit score of 772, you're in a very good position financially. This is a strong score and indicates to lenders that you're reliable with your money, so you may find it easier to get approved for loans, credit cards and other financial resources, often with favorable interest rates.

Remember, maintaining your credit score at this level is just as important as getting it there. Remember to pay your bills on time, keep your credit usage low, and avoid taking on more debt that isn't necessary. This will help ensure your credit score remains strong over time. Even small increases could push you into the excellent category, so consistent and wise financial habits are key.

Can I Get a Mortgage with a 772 Credit Score?

With a credit score of 772, you are likely to be approved for a mortgage. This score is well above the average and exemplifies a history of responsible financial behavior. Lenders typically see individuals with such scores as low risk, denoting a record of consistent and timely payments as well as judicious credit use.

In the process of mortgage approval, a high credit score like yours can offer substantial benefits. For instance, lenders might offer you more favorable terms, such as lower interest rates and larger loan amounts. It's also probable that you will encounter fewer obstacles during the approval process. However, remember that other factors like your income and debt-to-income ratio will also be taken into account. It's always a good idea to shop around for the best mortgage offer as your excellent score gives you a strong bargaining position.

Can I Get a Credit Card with a 772 Credit Score?

With a credit score of 772, you're on solid ground when it comes to being approved for a credit card. This score in the eyes of lenders speaks to your responsible credit usage and stable financial history. It's absolutely key to recognize the value of maintaining this impressive score, while also leveraging it towards your financial goals.

Credit cards for individuals with your credit score can quite often have high rewards and low-interest rates. You should consider premium travel cards, which can offer benefits like travel insurance or free checked bags. You might also want to look at cash back credit cards, which may offer you a percentage back on everyday purchases. Remember, these cards are a tool to enhance your financial standing but it's important to use them smartly, ensuring you pay off your balances on time. With your score, the world of credit cards is wide open to you.

With a credit score of 772, chances are actually quite good that you would be approved for a personal loan. This score is regarded as excellent by most lending standards, displaying that you've successfully managed your credit with responsibility. It positively reflects on your creditworthiness and encourages lenders to trust you with their money.

However, this doesn't mean that the loan application process will be a breeze. Lenders will still likely check your income, debt, and employment status, in addition to your high credit score. Remember, a top-notch credit score does enable you to negotiate for better terms because lenders see you as being at a less risky position for default. You'd likely be eligible for competitive interest rates and flexible payment terms. Do recall though, that even with a high credit score like 772, it's still important to shop around with different lenders to ensure you're getting the best possible terms for your personal loan.

Can I Get a Car Loan with a 772 Credit Score?

Having a credit score of 772 can be pretty solid when it comes to taking out a car loan. Typically, lenders see anything above 660 as good standing, and a score of 772 is considerably higher than that. As such, you're likely to be viewed favorably by lenders. This means they might trust you more when you say you can pay back the loan, based on your proven credit history.

When it comes to the car buying process, your strong credit score of 772 can serve you well. You may get better interest rates due to your lower risk status, which can translate to lower monthly payments. But remember, it's vital to review all loan terms thoroughly before you make a commitment. Reading the fine print can help you understand the total cost of your car loan and avoid any potential surprises down the line. Your 772 credit score is your ticket to more favorable loan terms, so use it wisely during your car shopping process.

What Factors Most Impact a 772 Credit Score?

Grasping your score of 772 is essential for strategizing your financial objectives. Recognizing key aspects can play a significant part in your ongoing credit improvement. Remember, every person's financial path is different and offers unique opportunities for growth.

Payment Conduct

You've likely been consistent with your payments as it plays a crucial part in your impressive credit score. Any delayed payments or non-payments can harm your score.

What to Do: Go over your credit report for any discrepancies or missed payments. Contemplate on instances, if any, where you delayed payments.

Credit Usage

At your score, your credit usage is probably optimal, maintaining a healthy balance. High credit usage can negatively affect your score.

What to Do: Look over your credit card balances. Keep your balances much lower than the limit, if they are not already.

Credit Tenure

A long credit history often contributes to a high score like yours since it demonstrates financial responsibility.

What to Do: Check your credit report for the age of your oldest, newest, and average age of all accounts. If you've recently opened new accounts, understand its impact.

Credit Diversity and New Credit Applications

A diverse range of credit types and minimal applications for new credit can be advantageous for your high score.

What to Do: Check your different kinds of credit accounts including credit cards, retail accounts, loans etc. Apply for credit only when necessary.

Public Records

Most likely, you have no public records such as bankruptcies, that could adversely impact your credit score.

What to Do: Review your credit report for any public records, prioritize any unresolved issues if they exist.

How Do I Improve my 772 Credit Score?

With a credit score of 772, you’re in an excellent position. However, you can still fine-tune your financial habits to edge closer to that perfect score. Here’s how:

1. Monitor Your Credit Report

Stay vigilant and ensure all the information on your credit report is correct. Inaccuracies or mistakes can hurt your score. You’re entitled to free annual credit reports, so make a habit of checking them.

2. Keep Low Credit Card Balances

You have managed your credit card usage well. Now, continue to keep your utilization rate low. Try not to use more than 30% of your credit limit at any given time, and pay off balances in full each month.

3. Maintain Long-Standing Accounts

Part of your credit score’s strength comes from the longevity of your credit history. Resist closing older, paid off accounts as they contribute positively to your overall credit duration.

4. Diversify Your Credit

Having different types of credits such as mortgage, auto loans, and student loans, can help boost your credit score. If feasible, consider diversifying your credit mix.

5. Limit Credit Inquiries

Only apply for new credit when it’s necessary. Each application results in a hard check on your credit, which can cause temporarily lower your score.

Remember, nurturing your credit is a marathon, not a sprint. Stay steadfast in your responsibilities and your score will remain strong.