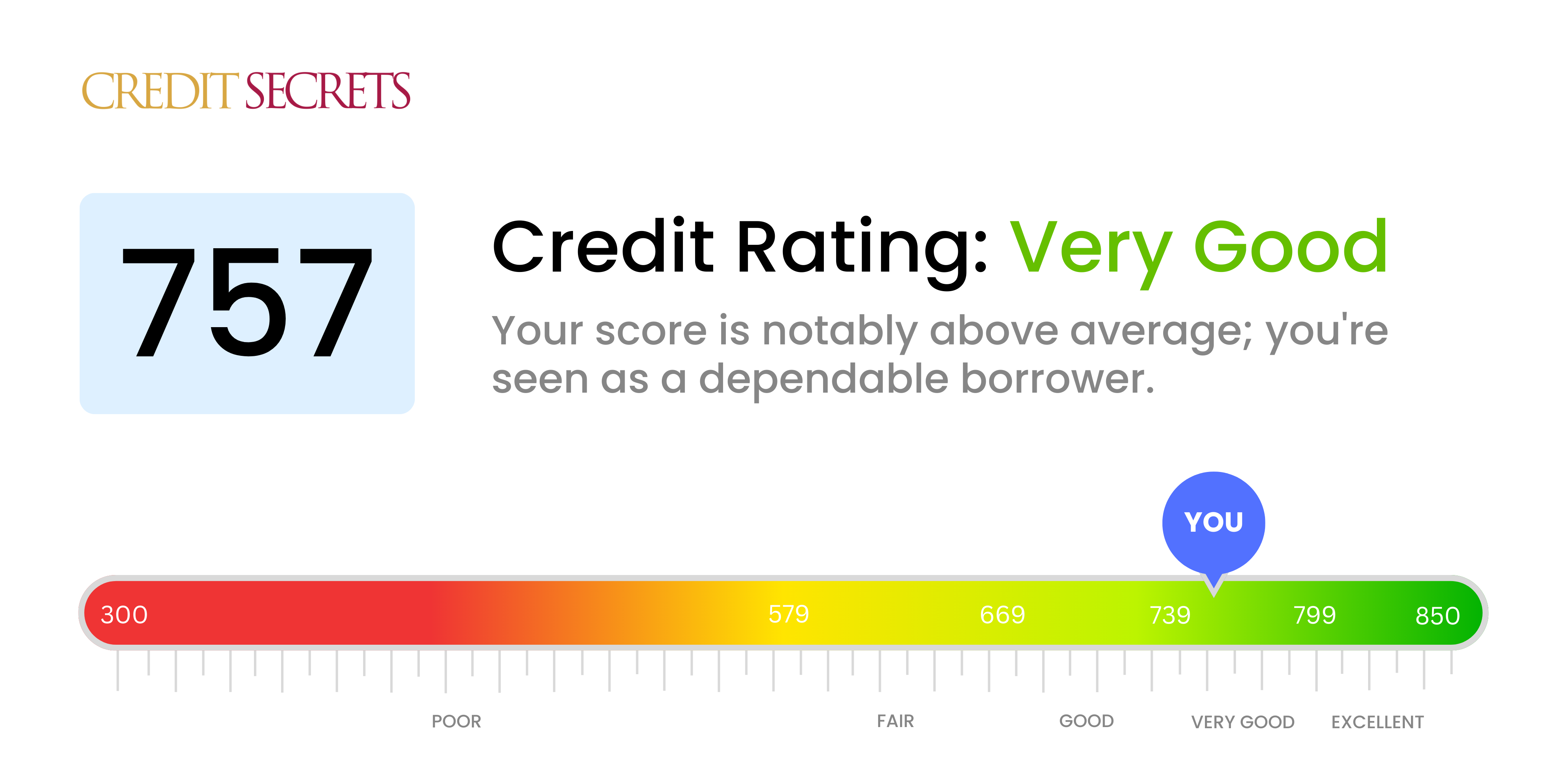

Is 757 a good credit score?

Your credit score of 757 is considered within the 'Very Good' range. With that score, you can expect to be viewed favourably by lenders, potentially qualifying for lower interest rates and favourable terms on loans and credit cards.

Continue to maintain your financial responsibility to keep your credit score at this high level. Remember, each decision you make regarding your financial stability can impact your credit score. So, always pay your bills on time, manage your credit wisely and avoid accumulating too much debt. This will keep your credit health robust and possibly open doors for even better opportunities in the future.

Can I Get a Mortgage with a 757 Credit Score?

With a credit score of 757, you're in a promising position when it comes to mortgage approval. A score in this range is highly regarded by lenders, indicating a history of consistent, timely payments and responsible credit use. This kind of strong credit performance does more than simply increase your likelihood of mortgage approval; it can also help you secure a more favorable interest rate.

As you navigate the mortgage approval process, you can expect lenders to review your credit history in detail. Even with a good score like 757, there still can be elements in your credit report that raise concerns for lenders - such as high levels of existing debt or recent inquiries. However, a solid score such as yours is generally seen as a positive sign of reliability and can make the process more straightforward. Remember, while your credit score is a key factor, lenders also consider your income, employment history, and debt-to-income ratio.

Can I Get a Credit Card with a 757 Credit Score?

With a credit score of 757, you're likely to be approved for a credit card. This score is viewed favorably by lenders, as it reflects a responsible history of credit usage and financial management. It’s certainly encouraging to have such a solid credit rating, and it's something that will pave the way for smoother financial opportunities.

With a score as strong as yours, you could qualify for a wide range of credit cards, including premium travel cards that offer rewarding perks for frequent travelers. These high-end cards often come with benefits such as access to airport lounges, and significant points or miles on purchases. Alternatively, you may also consider cash back credit cards, which reward you with a percentage of the money you spend. Whatever choice you make, expect to enjoy competitive interest rates thanks to your stellar credit score. Remember, having access to these benefits doesn’t mean immediate success, but it certainly gives you a powerful tool for managing your finances wisely.

A credit score of 757 is, indeed, good news as it falls well within the range that lenders consider attractive. This score signals responsible credit habits and a low risk of default, making you likely to be approved for a personal loan. Tough truths aside, it's important to appreciate what such a credit score means for your borrowing prospects.

With a credit score of 757, you can expect the personal loan application process to be relatively smooth and may have some flexibility in choosing your loan terms. Lenders will likely offer competitive interest rates and favourable terms, owing to the lower risk associated with lending to you. Having a good credit score such as this provides you more power in negotiations. However, remember that final approval will also depend on other factors including income stability and debt-to-income ratio.

Can I Get a Car Loan with a 757 Credit Score?

With a credit score of 757, you stand in an advantageous position when it comes to securing a car loan. Such a score is viewed favorably by lenders, as it indicates a strong history of creditworthiness. It's a signal that you are responsible with your financial obligations, which lessens the risk for lenders.

While getting approved for a car loan is quite probable, having a high credit score like 757 doesn't just mean an increased likelihood of approval, but it also comes with the potential for lower interest rates. Typically, lenders use this score to offer competitive interest rates. Because the risk involved in lending money to you is perceived to be low, you can expect to negotiate better terms for your car loan. This advantage can make the car purchasing process smoother and potentially save you money in the long-run. Remain patient and diligent while navigating the process, it will pay off.

What Factors Most Impact a 757 Credit Score?

Grasping the factors behind a 757 credit score is key to building an optimal financial strategy. Each financial story is unique, yet understanding the common elements can provide a path to an improved score and financial outlook.

Credit Utilization

Your credit utilization ratio may be affecting your credit score in a positive or negative way. The closer the credit usage is to your credit limit, the higher the impact on your credit score.

How to Check: Analyze your credit statements. Keep track of credit utilization regardless of your high score. This maintains your good score and even boosts it.

Payment History

Payment history significantly affects credit scores. Keep in mind that consistently making payments on time has a positive impact.

How to Check: Review your credit card statements and loan balances. Look out for any late payments. If you discover any inconsistencies, investigate further.

Length of Credit History

The age of your credit history can also affect your credit score. A long history of good credit can have a positive impact on your score.

How to Check: Verify the age of your oldest account, the age of your newest account, and the average age of all your accounts on your credit report.

Amount of New Credit

A recent addition of new credit could present a risk, hence slightly lowering your score.

How to Check: Cross-check your credit report, see if you have any new credit accounts. It's more beneficial to limit the opening of new accounts too frequently.

Credit Variances

Factoring both secured and unsecured loans into your credit mix can also improve your score.

How to Check: Evaluating the mix of your credit accounts, it's healthier to have various types of credit accounts like retail accounts, credit cards, mortgage loans, and installment loans.

How Do I Improve my 757 Credit Score?

With a credit score of 757, you’re on the right track to optimal financial health. However, there are still steps you can take to further enhance your score. Here’s a tailored guide on how to proceed:

1. Monitor Credit Reports Regularly

Even with a good score, it’s crucial to regularly check your credit reports for any errors or fraudulent activity. Dispute any inaccuracies the moment they’re spotted to avoid unnecessary score drops.

2. Maintain Low Balance-To-Limit Ratio

While it’s important to use credit, keeping your balances low compared to your limits (credit utilization rate) is vital. Aim for a rate under 30%, ideally under 10%, to bolster your score.

3. Keep Old Credit Lines Open

Long-standing credit accounts help establish credit history, which positively influences your score. Even if you no longer use these accounts, keep them open unless they carry high fees.

4. Regular, On-Time Payments

Payment history is a key factor in credit scoring. Continue making your payments on time, for all your accounts, to keep this aspect of your credit score strong.

5. Diversify Credit Types

If most of your credit is revolving (credit cards), consider adding an installment loan (like a car loan or mortgage), provided you can afford it. A healthy mix of credit types can give your score a slight boost.

By following these steps catered for your current score, you’re setting up a robust financial foundation for the future.