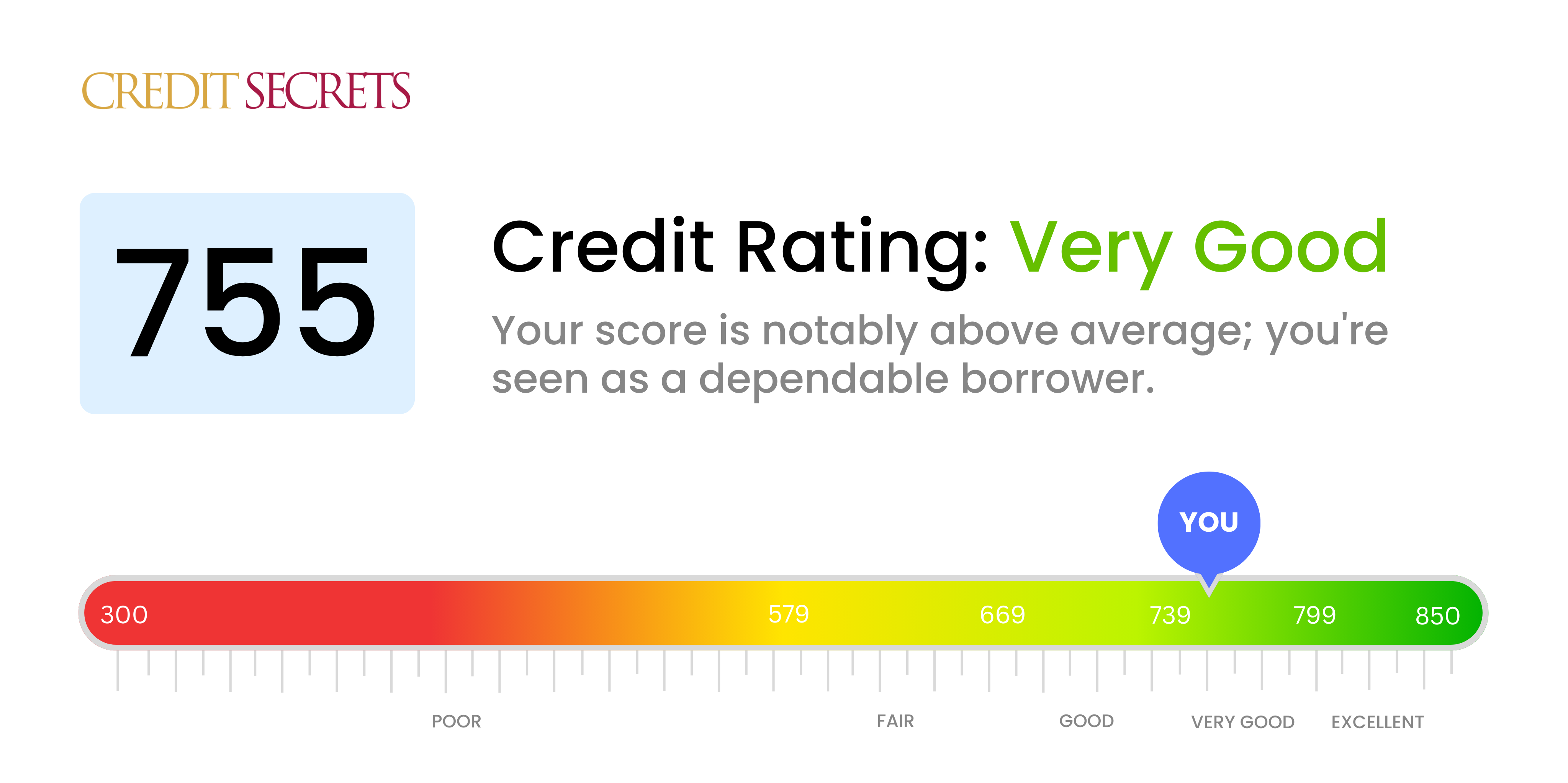

Is 755 a good credit score?

With a credit score of 755, you're deemed to have a very good credit rating. This strong position in the credit rankings isn't just a number, it's a reflection of your creditworthiness and it can open doors for you when it comes to financial opportunities.

While not in the excellent category, a very good credit score like yours may make it easier for you to secure loans, get lower interest rates, or negotiate better terms with lenders. It's a positive sign that you've been managing your credit responsibly. Rest assured, you have a solid financial foundation that you can build upon to reach all your financial goals.

Can I Get a Mortgage with a 755 Credit Score?

With a credit score of 755, you stand a solid chance of being approved for a mortgage. That's because this score suggests a record of reliable financial behavior, which is something lenders value highly. It's positive news, evidencing that your past credit management strategies have been effective.

As your journey continues in the mortgage approval process, you can expect lenders to review your credit history, your income, and your current debts. Since your credit score is in the excellent range, it could positively impact the conditions of your potential mortgage, including the interest rate. Remember, a higher credit score often translates to a lower interest rate, which could save you a substantial amount of money over the life of the loan. Though remember, each lender may have different criteria, so it's a good idea to shop around to ensure you're getting the best terms possible.

Can I Get a Credit Card with a 755 Credit Score?

If you have a credit score of 755, you are highly likely to be approved for a credit card. This score speaks to your successful history of financial responsibility, and lenders typically view this as a positive indication of future creditworthiness. It's an admirable position to be in, and it's a testament to your credit behavior up to this point.

A 755 credit score provides an opportunity to explore different types of credit cards to meet your needs. Based on your score, you may qualify not just for basic credit cards, but for premium cards offering travel rewards, cash back, or other perks. These cards typically require a good to excellent credit score, which you possess. This credit score also means you're apt to secure lower interest rates compared to those with lower scores, lowering your borrowing cost. Remember, the card you choose should align with your financial goals and spending habits to get the most benefit. Continue your habit of good finance management and use your credit responsibly.

Having a credit score of 755 indicates that you've done an excellent job managing your credit, and it places you well within the range that most lenders consider "good". This score suggests that you are responsible with your financial commitments, making you a potentially trustworthy borrower. Therefore, it is very likely that you would be approved for a personal loan.

For an individual with a score of 755 seeking a personal loan, you can often expect smooth sailing during the application process. Lenders will see you as a low-risk candidate, which often results in a quick approval process. More so, having a good credit score means you are likely to get attractive interest rates, as lenders feel confident in your ability to repay. Keep in mind, however, that your income level and other financial factors will also play a role in the loan terms you're offered.

Can I Get a Car Loan with a 755 Credit Score?

You may breathe a sigh of relief because with a credit score of 755, you stand a very good chance of being approved for a car loan. Most lenders consider a score above 700 to be good, and your score of 755 certainly falls well above that bar. This score indicates to lenders that you're a lower-risk borrower who typically repays borrowed money in a timely fashion.

When it comes to the car purchasing process, carrying a high credit score like 755 could greatly benefit you. It's likely that you'll be offered more favorable interest rates, as lenders use credit scores to determine these rates. The better the score, the less of a risk you pose to them financially, which in turn leads to lower costs for you. Keep in mind, though, that while a good score increases your chances for approval and better terms, it doesn't guarantee them - other financial factors come into play as well. Nonetheless, with a score of 755, you're definitely on the right track towards owning your dream car.

What Factors Most Impact a 755 Credit Score?

Unraveling the factors behind a credit score of 755 is key to ensuring continued financial health. Each credit journey is personal and holds numerous chances for improvement and knowledge.

Credit Utilization Ratio

Having a balanced credit utilization ratio is crucial. A high ratio could impact the score negatively. If you're near your credit limit frequently, this might be affecting your score.

How to Check: Regularly monitor your credit card statements. Look at the balances relative to credit limits. It's beneficial to keep this ratio low.

Consistency of Payments

Maintaining consistent and timely payments plays a significant role in credit scores. Issues in this area may detract from an otherwise solid score.

How to Check: Verify your payment history on your credit report. Take note of any late or missing payments, which could be impacting your score.

Credit Diversity

Managing a various types of credit effectively can boost credit scores. Limited diversity could potentially explain why your score isn't higher.

How to Check: Review your mix of credit types, including credit cards, finance company accounts, mortgages, etc. Consider if you might benefit from increasing this diversity.

Age of Credit Accounts

The age of your oldest credit accounts could potentially impact your score. Young accounts may restrict your score's potential.

How to Check: Check your credit report to assess your account history. Review the ages of your oldest and youngest accounts and the total account age.

New Credit Line Applications

Frequent applications for new credit can be a detriment to your score. Balancing this with careful credit management can help maintain your score.

How to Check: Evaluate your recent credit actions. If you've been applying for too many new credits this maybe affecting your score.

How Do I Improve my 755 Credit Score?

With a credit score of 755, you’re already in a good place, reflecting responsible credit habits. However, here are some strategic steps tailored for your situation to enhance your score further:

1. Maintain Consistent, Timely Payments

Avoid any late payments, and continue to stay consistent with paying your bills on time. Every timely payment contributes positively to your credit history, reinforcing your creditworthiness.

2. Keep Credit Utilization Low

Even though your current score affords comfortable credit card limits, it’s important to remain mindful of your credit usage. Keep your credit utilization below 30%, thereby highlighting your caution and skill in managing credit.

3. Exercise Credit Patience

Applying for new credit may lead to hard inquiries, which can temporarily ding your score. Be selective when applying for new credit – only when truly necessary. Your credit score benefits from demonstrating patience and strategic planning.

4. Keep Old Accounts Open

Long-standing credit accounts affirm a lengthy credit history, which can enhance your score. Even if you no longer use a card, consider keeping it open unless it has high annual fees.

5. Monitor Your Credit Regularly

Regularly reviewing your credit reports can help you catch any inaccuracies quickly. Swift detection and correction of errors can prevent unnecessary drops in your credit score.