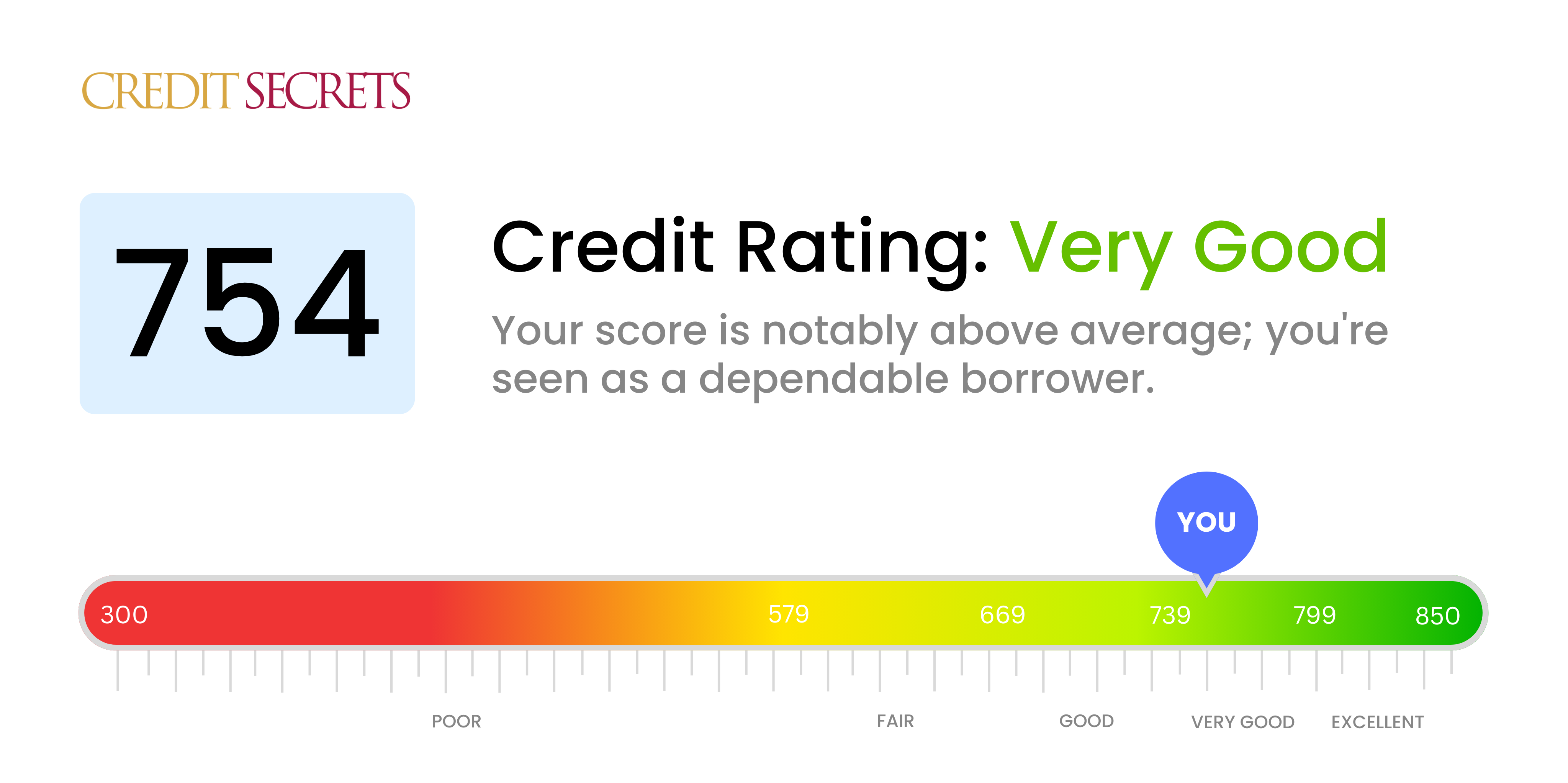

Is 754 a good credit score?

With a credit score of 754, you're sitting comfortably in the "very good" range. This generally means you can expect to receive favorable interest rates and terms when applying for loans or credit cards.

Keep in mind, though, the world of credit isn't just about numbers - it's also about consistent, responsible financial behavior. While your score is solid, continue to pay your bills on time, keep your credit utilization low, and avoid applying for unnecessary credit. These good habits will help to maintain and even improve your score over time.

Can I Get a Mortgage with a 754 Credit Score?

If you have a credit score of 754, you fall within the 'Good' category, which indicates a strong history of responsible credit management. This puts you in a favorable position when it comes to mortgage approval since lenders typically look for scores that are 660 or above.

Obtaining a mortgage with this score is likely, yet the interest rate offered can vary. A higher score might secure a more favorable interest rate. However, other factors such as income stability, debt-to-income ratio, and deposit size will also play a role in the decision-making process. The key is to not consider your credit score as the sole determinant of your mortgage approval process. It's important to have a wholesome financial profile to pitch to your potential lenders.

Can I Get a Credit Card with a 754 Credit Score?

With a credit score of 754, you'll likely find a welcoming reception when applying for a credit card. This score is a testament to your consistent management of your financial responsibilities and is considered an attractive trait by lenders. It shows a level of trustworthiness that they seek in their customers, painting a positive picture of your financial behaviour.

Bearing that in mind, you're likely to have access to various types of credit cards. For instance, premium credit cards could be within your reach. They generally offer more benefits like travel rewards and higher cashback percentages. You might also be eligible for cards with lower interest rates or special promo rates, helping keep your expenses lower. Lastly, remember that while a good score like 754 doesn't guarantee approval, it significantly increases your chances, and it's always advantageous to research and select a card that fits your lifestyle and spending habits.

Regrettably, a credit score of 453 is quite a bit lower than what most traditional lenders consider an acceptable range for approving a personal loan. This score is viewed as high-risk for lenders, meaning chances of approval for a loan under standard conditions are unfortunately slim. It's a tough position to be in, but it's vital to accept and understand what this credit score signifies for your borrowing possibilities.

With traditional personal loans seeming to be unavailable, alternatives such as secured loans or co-signed loans could be considered. Secured loans require collateral, while co-signed loans involve having someone with a higher credit score vouch for you. Peer-to-peer lending platforms could also be an option due to their often more relaxed credit requirements. It's essential to remember, however, that these alternative routes may involve higher interest rates and less attractive terms, due to the increased risk for the lender.

Can I Get a Car Loan with a 754 Credit Score?

A credit score of 754 is generally considered very good, meaning that securing approval for a car loan is highly probable. Potential lenders see this score as a strong indication of reliability. It suggests that you have a positive history of managing credit and making payments on time, which in turn, puts lenders at ease. As a result, you may qualify for loans with favorable terms.

Given your high credit score, you could expect to receive some of the most competitive interest rates on your car loan. Lower interest rates means you could save a significant amount of money on the total cost of your car purchase. Nonetheless, it's essential to shop around and compare loan offers, ensuring that you get the absolute best deal for your situation. While having a good credit score improves chances, it's important that the other facets of your financial picture such as income and job stability also align favorably.

What Factors Most Impact a 754 Credit Score?

Determining why your credit score stands at 754 can provide you with valuable insights for maintaining and even improving your financial health. A deeper dive into the specifics can enrich your understanding.

Credit Utilization Ratio

Keeping your credit utilization low can greatly influence your score. If it's high, this may be pulling your score down.

How to Check: Scrutinize your credit card balances. Are they close to your credit limits? Aim to keep them low in relation to your credit limit.

Financial Consistency

If you're consistent with your payments, that's great! Any inconsistencies could be a culprit in affecting your score.

How to Check: Look at your payment history in your credit report. Any late payments or defaults?

New Credit Lines

Acquiring new credit could temporarily lower your score but it will also add variety to your credit mix.

How to Check: Review your credit history. Have you recently applied for new credit?

Lengthy Credit History

A long-standing credit history can work in your favor and give you bonus points on your score.

How to Check: Examine your credit report for the longevity of your credit accounts.

Public Records

Public records like bankruptcies or liens can impact your score heavily. Watch out for these!

How to Check: Check your credit report for any public records. Any tax liens or bankruptcies listed?

How Do I Improve my 754 Credit Score?

With a credit score of 754, you’re in a decent position, but there’s always room for improvement. Let’s explore the steps you could take to boost your credit score further:

1. Optimize Your Credit Utilization

Your credit score might benefit from reducing the amount of available credit you’re using. Aim for a utilization ratio under 30%, preferably under 10%, sticking to consistent payments to maintain this balance.

2. Be Timely with Payments

Ensure every bill is paid on time, every time. One missed payment can impact your credit score. Consider setting up automatic payments or reminders to help keep track of due dates.

3. Limit Hard Inquiries

Long-term, unnecessary, hard inquiries may affect your score negatively. Only apply for new credit when really necessary.

4. Hold onto Old Credit

Longer credit history can improve your score. Even if an old credit card is no longer in use, consider keeping it open to maintain a longer average account age, provided it doesn’t carry any high fees.

5. Balance Your Portfolio

Having a mixed credit portfolio can impress potential lenders. Your credit score might improve if you balance your credit types, having a mix of revolving credit and installment loans.

Stay consistent with these beneficial habits, and you’ll see your credit health steadily improving over time.