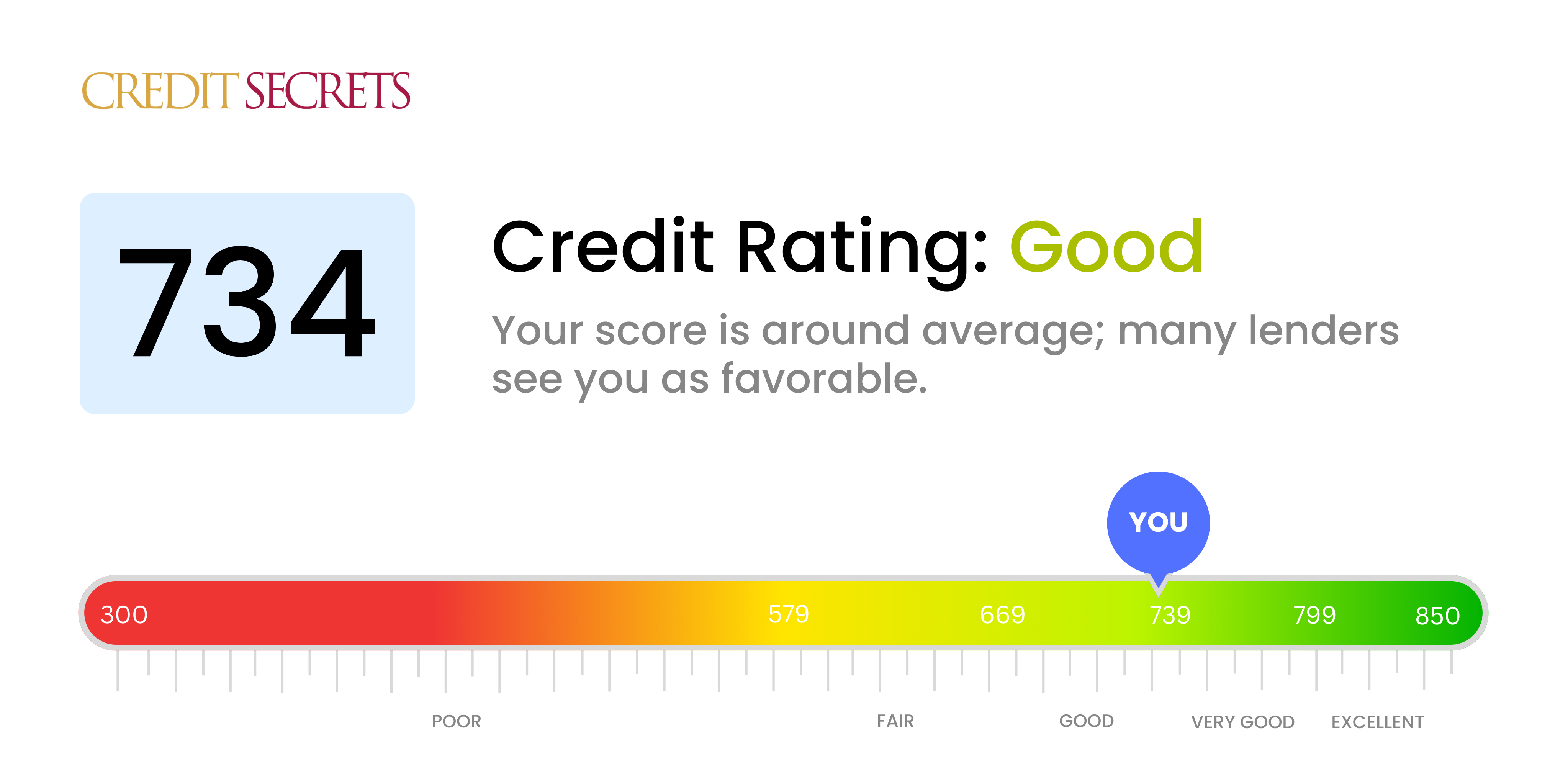

Is 734 a good credit score?

Your credit score of 734 is considered a good score. With this score, you might expect to be given better interest rates and terms compared to those with lower scores, and you're moderately likely to be approved for most types of credit, such as loans or credit cards.

Can I Get a Mortgage with a 734 Credit Score?

A credit score of 734 generally puts you in a good position to be approved for a mortgage. Lenders view this score as an indicator of responsibly managed credit and it potentially means you've maintained a good history of timely payments and balanced credit use. At this level, lenders are likely to perceive you as a low-risk borrower, which enhances your chances of securing a mortgage approval.

As you navigate the mortgage approval process, it's important to understand every facet of it. Bearing in mind your good credit score, you might be able to negotiate better interest rates. This is due to the fact that a high credit score often signals less risk to lenders, who may reward your credit responsibility with more favorable interest rates. However, remember that your credit score doesn't guarantee approval on its own. Other factors such as income, employment stability, and down payment size can also impact your approval chances, so ensure you're prepared in all areas.

Can I Get a Credit Card with a 734 Credit Score?

If your credit score happens to be 734, then yes, you're likely to get approval for a credit card. A credit score of 734 is generally seen as a good score by lenders and can reflect a positive history of managing your finances. It's important to remember that each financial situation is unique and your credit score is a crucial part of being financially stable.

With your credit score, you're likely to have access to a range of credit cards, such as cashback credit cards, reward credit cards, and even premium travel cards. They all come with their perks and advantages. It's always essential to pick one that suits your lifestyle and spending habits. Furthermore, with the 734 score, your interest rates will generally be lower relative to lower scores. This condition means that maintaining and improving that score brings great benefits and opportunities in managing your finances efficiently.

With a credit score of 734, you're in a good position when it comes to getting approval for a personal loan. This score is well within the range that lenders usually deem acceptable, meaning loan application shouldn't represent a significant obstacle. That doesn't mean it will be an entirely smooth path, but it does show lenders that you've made responsible financial choices in the past.

When you start the process of applying for a personal loan, ensure to shop around and review terms and conditions carefully. Your credit score will impact the interest rate you’re offered. Generally, a higher credit score means a lower interest rate. This is because lenders see you as a lower-risk borrower. Remember, understanding all aspects of your loan agreement is crucial before making any commitment. Enjoy the journey, knowing that your past financial responsibility is likely to open doors to financial opportunities.

Can I Get a Car Loan with a 734 Credit Score?

With a credit score of 734, you're certainly doing something right. Generally, credit scores above 700 are considered good, making you a likely candidate for approval on a car loan. Lenders view you as less of a risk, which can be beneficial when it comes to loan terms.

In terms of the car purchasing process, you can expect a smoother journey due to your credit score. You will have more leverage to negotiate the terms of the loan as lenders might be more flexible with you. Interest rates, which can significantly affect your monthly payments and total loan cost, are typically lower for those with higher credit scores. You may find this translates into more favorable loan terms. However, always remember to read the fine print, consider different options, and choose the best loan aligned with your financial needs.

What Factors Most Impact a 734 Credit Score?

Understanding your credit score of 734 can be a vital stepping stone to achieving a better financial position. Here we will focus on the major aspects that might have affected your score.

Credit Utilization

One factor affecting your score could be credit utilization. Even if you are regular with payments, having used a high percentage of your total available credit can affect your score negatively.

How to Check: Look at your credit card balances. Are they close to their limits? Lower utilization could improve your score.

Payment History

Paying your bills consistently and on time is a significant criterion for a good credit score. Even one or two late payments can impact your score.

How to Check: Scrutinize your payment history, looking for late payments or delinquencies.

Account Age

The age of your oldest credit account could play a role in your score. Lenders prefer to see a longer credit history.

How to Check: Evaluate your credit report to check how old your oldest and newest accounts are and how long you’ve been using credit in general.

Credit Mix

The variety of credit types you have—credit cards, installment loans, mortgages—can impact your score.

How to Check: Review your credit report to see the types of credit you have.

Recent Inquiries

If you’ve made several applications for new credit recently, this could be impacting your score negatively.

How to Check: Your credit report will show hard inquiries made within the last two years.

How Do I Improve my 734 Credit Score?

An impressive credit score of 734 indicates your commitment to maintaining good financial habits. But remember, continued vigilance can help elevate your score even further. Here are a few strategies specifically designed for improving your current score:

1. Monitor Your Credit Report

At your score level, it’s important to regularly review your credit report for any errors. Mistakes, while rare, could lead to credit score decline. Contact the three major credit bureaus to dispute any irregularities you may find.

2. Keep Old Credit Accounts Open

Sometimes, we tend to close unused credit lines. However, older accounts reflect your longer repayment history which is beneficial for your credit score. Keep them open unless they’re costing you high annual fees.

3. Opt for Automatic Payments

Even a single late payment can affect your nearly perfect credit record. To avoid forgotten or missed payments, switch to automatic payments. It ensures timely payment and helps maintain your good credit.

4. Limit Hard Inquiries

Each time you apply for a new line of credit, it results in a hard inquiry on your credit report which might lower your credit score. To keep your score intact, limit the frequency of your applications.

5. Maintain Low Credit Utilization

You’re likely doing well in this area, but continue to keep your credit utilization below 30%. This refers to the ratio of your total credit card balances to your total credit limit.