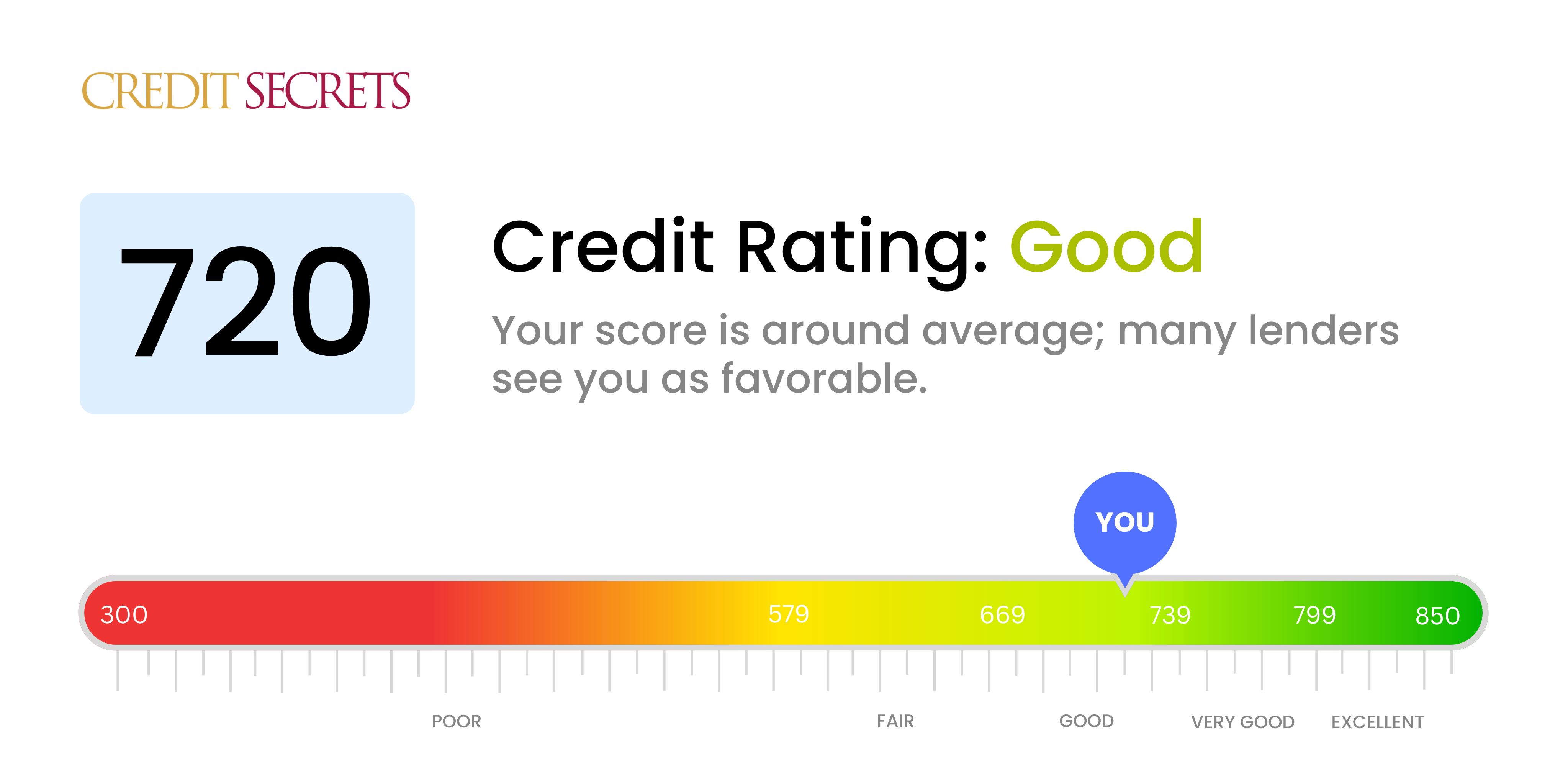

Is 720 a good credit score?

If you're looking at a credit score of 720, you're in the "good" category on the spectrum. While not perfect, this score is certainly respectable and far from poor. You can likely secure loans or credit you need, but may not always be offered the very best interest rates.

Don't get disheartened, your credit score isn't static and can be improved over time. By staying mindful about your financial habits - like paying bills on time and not exceeding your credit limit - you can gradually boost your score. Remember, every responsible step you take towards managing your finances is a move in the right direction for a better credit score.

Can I Get a Mortgage with a 720 Credit Score?

A credit score of 720 traditionally corresponds to a solid financial track record. It's a mark that many lenders consider as good creditworthiness. When it comes to applying for a mortgage, it is more than likely that you would be approved. This doesn't mean that approval is guaranteed, but your prospects are very favorable.

In the mortgage approval process, lenders examine a variety of information beyond just your credit score, such as your income and employment status. But with a credit score of 720, you've already exhibited a history of responsible credit use, which works in your favor. Moreover, having this credit score typically results in more favorable interest rates, which can make your mortgage more affordable in the long run. It's essential to remember that each lender's requirements may vary, so it's always best to maintain a consistent record of good financial behavior.

Can I Get a Credit Card with a 720 Credit Score?

Holding a credit score of 720 is indeed respectable and mirrors a generally responsible handling of financial obligations. This kind of score is likely to result in a positive response to most credit card applications. It portrays a level of financial responsibility that makes lenders considerably confident about approving the credit request, although it's not necessarily considered 'excellent' in the eyes of lenders.

With a 720 score, a broader spectrum of credit cards comes into reach. Opting for cards like starter cards or even premium travel cards could be beneficial. These cards not only provide higher credit limits but also offer impressive rewards like cash backs, travel points, and more. However, it's an important reminder to diligently review these cards' terms and conditions, particularly concerning interest rates, to ensure they are a good fit with personal financial habits and goals.

With a credit score of 720, there's great news for your personal loan aspirations. This score is typically seen as a good credit rating by most lending institutions, implying a lower level of risk. Therefore, the likelihood of you being approved for a personal loan is quite high. It is critical, however, to continuously maintain or enhance this rating to open up even better lending options.

Applying for a personal loan with a credit score of 720 typically reflects positively on loan terms and interest rates. Given your good credit standing, lenders are more likely to present you with competitive interest rates and more favorable loan terms. However, remember that while your credit score is a significant factor, lenders will also consider other financial aspects like your income and debt-to-income ratio. Keep a healthy financial profile for the best outcomes.

Can I Get a Car Loan with a 720 Credit Score?

If you're holding a credit score of 720, you've built a solid financial foundation. This score certainly enhances the likelihood of securing a car loan approval, as anything over 700 is generally seen as 'good' by lenders. This is because your credit history tends to indicate a lower risk, showing that you're usually dependable when it comes to repaying borrowed money.

Having such a credit score means your car purchasing process should be reasonably smooth, as lenders favor borrowers who display consistent financial responsibility. When it comes to the terms of your car loan, a higher credit score can lead to more favorable conditions, such as lower interest rates. This is because you pose less risk to the lender. However, remember to explore all loan terms carefully and fully understand the agreement you're entering before finalizing the car loan, to ensure there are no unwanted surprises down the road.

What Factors Most Impact a 720 Credit Score?

Having a 720 credit score signifies you're managing your credit responsibly on most fronts. However, understanding the elements influencing your score can support your journey towards further financial growth. Let's explore common factors that could be influencing your score.

Credit Utilization

Whilst a score of 720 suggests you're generally managing well, credit utilization might still be an area to watch. A high ratio could lower your score.

How to Check: Scrutinize your credit card balances. Aiming for a balance below 30% of your credit limit can contribute positively to your score.

Length of Credit History

The duration of your credit history might hold back your score from reaching its zenith. A lengthy history with positive payments can advance your score significantly.

How to Check: Analyze your credit report, focusing on the age of your oldest and newest accounts and the overall average length.

Credit Mix

Even with a score of 720, the diversity of your credit types might be a factor holding back your score.

How to Check: Look at your credit accounts. Are you diversifying with a mix of credit cards, retail accounts, installment loans, or mortgages?

Recent Inquiries

Applying for new credit might temporarily cause a dip in your score.

How to Check: Review your report for recent hard inquiries which suggest you're attempting to open multiple new accounts.

How Do I Improve my 720 Credit Score?

Having a credit score of 720 puts you in a good position, but there is always room to aim higher. Here are the most beneficial and achievable steps you can take based on your current credit standing:

1. Maintain Low Credit Card Balances

Manage your revolving credit wisely. Don’t max out your credit cards. It is recommended to keep your balances less than 30% of your credit limit. The lower, the better. Keep your financial discipline and this will contribute positively to your credit score.

2. Keep Old Accounts Open

A factor that influences your credit score is the length of your credit history. Don’t hasten to close old credit card accounts, especially ones with good payment history. It can reduce your credit age and possibly lower your score.

3. Schedule Automatic Payments

At this credit score, you’d like to avoid missing payments or making late payments. Setting up automatic payments for your recurring bills can help maintain a good payment history and thus increase your credit score over time.

4. Diversify Your Credit

While maintaining a stress-free debt level, consider diversifying your types of credit. This shows that you can responsibly manage different types of credit, such as credit cards, mortgage loans, and auto loans.

5. Regularly Review Your Credit Report

Keep an eye out for any inaccuracies on your credit report. If you spot mistakes or outdated information, dispute them promptly as they could be wrongly pulling your score down.