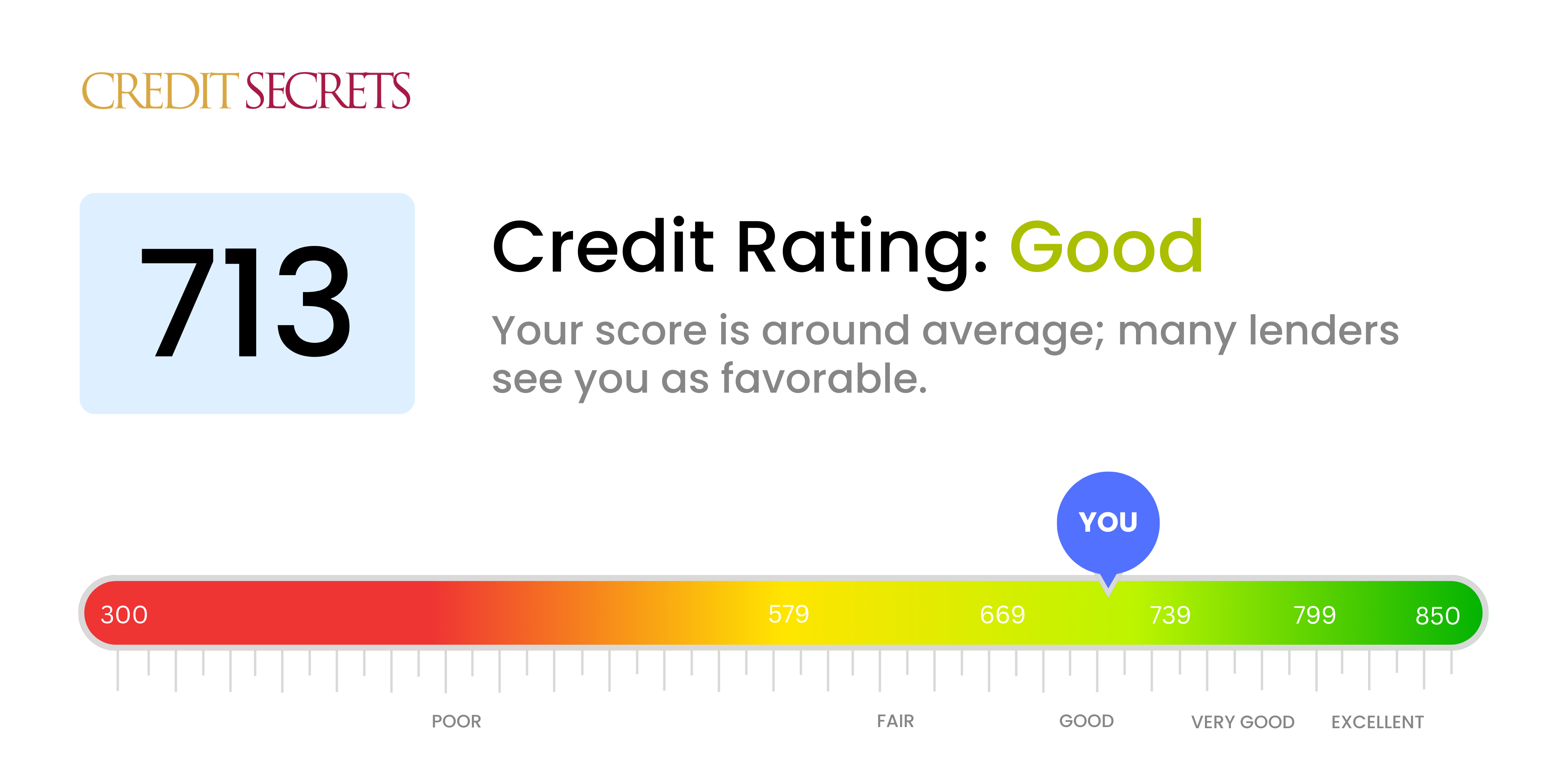

Is 713 a good credit score?

With a credit score of 713, your rating falls within the 'Good' category. You're accomplishing many financial tasks correctly and lenders see you as a dependable borrower who mostly manages loans and credit lines well.

While your score is fairly strong, you're not quite in the realm of 'Very good' or 'Excellent'. This could mean slightly higher interest rates or less flexible loan terms when you borrow. But don't fret, you still have room to grow and opportunities to improve your score. It's within reach to strive for an even better financial future.

Remember, every lender is different, so a 'Good' score may still get you the outcomes you want, depending on factors like your income and the specific loan product. Continue timely payments, maintain low balances relative to your credit limit, and carefully consider new credit lines, and you'll be on your way toward an even stronger credit score.

Can I Get a Mortgage with a 713 Credit Score?

Having a credit score of 713 puts you in a decent position for loan approval, including a mortgage. This score indicates you’ve been primarily responsible with your credit and could pave the way to a potential approval. However, you may not receive the best interest rates. Interest rates are typically reserved for those who have “excellent” credit scores, usually above 740.

Given your current score, you are likely to be considered for a mortgage with standard terms. During the mortgage approval process, you can anticipate that lenders will scrutinize your financial history. Lenders may require documentation of your income, debts, and assets. What's also important is your debt-to-income ratio, along with your down payment, employment history, and the condition of the property. The process may sound lengthy, but being prepared can help make it smoother. Your journey to owning a home is in sight with your current credit score.

Can I Get a Credit Card with a 713 Credit Score?

Holding a credit score of 713 is a commendable achievement, one that places you in a fortunate position for credit card approval. It is critical to acknowledge this progress, while still maintaining a serious and thoughtful approach to your personal finances. Even though every lender has different criteria, a score like yours typically signals trustworthiness to potential lenders.

With a credit score of 713, you can explore diverse types of credit cards to suit your financial needs. You might want to consider cards that offer cash back or reward points on everyday purchases. Travel credit cards could also be a good fit if you're an avid traveler. These options could not only cater to your lifestyle but also lead to more savings and benefits. While exploring these credit cards, stay vigilant about the interest rates. Even with a solid credit score, some cards might have higher interest rates than others. Balance the interest rates with the rewards and benefits while making a decision.

A credit score of 713 is generally considered good and indicates a sound credit history. With such a score, you're seen as a relatively low-risk borrower to traditional lenders, and you stand a good chance of getting approved for a personal loan. It's worth noting, however, that while a score of 713 can open up a range of lending opportunities, it doesn't guarantee approval. Every lender has their criteria and consideration factors.

As you proceed with the application, ensure you understand the terms, especially interest rates. Often, your credit score can influence the interest rate given to you; higher scores typically translate to lower rates. Although a 713 credit score is good, it may not earn you the very best interest rates on the market. Strive to understand all details of the loan agreement before making your decision. It's your financial future on the line, so it's essential to choose wisely and responsibly.

Can I Get a Car Loan with a 713 Credit Score?

With a credit score of 713, your chances of being approved for a car loan are indeed favorable. Lenders generally see scores above 660 as trustworthy, and your score of 713 falls comfortably within this range. This score demonstrates to lenders that you have a history of responsibly managing your credit and repaying your debts, which decreases their risk.

During the car buying process, your solid credit score can play a favorable role. It can help you negotiate better terms, possibly including a lower interest rate. Remember, even though your credit score is considered good, it's still important to shop around to make sure you get the best loan terms possible. There could be discrepancies in rates and terms between different lenders, so it pays to be thorough. However, with a credit score of 713, you're well-positioned to land a fair car loan deal.

What Factors Most Impact a 713 Credit Score?

Navigating finances with a credit score of 713 demands understanding specific factors that have principally influenced your score. Embracing the nuances of these contributors can become a springboard for better financial health.

Payment Consistency

Regular, on-time payments greatly shape your credit score. Recent late or missed payments on your record may be impacting your score.

How to Verify: Scour your credit report for any late or missed payments. Think about the events that led to these financial decisions, keeping in mind their effect on your score.

Credit Utilization

Maintaining a low credit utilization ratio is key. If you consistently reach or exceed your credit limits, this could be affecting your score.

How to Verify: Analyze your recent credit card statements. Ask yourself if your balances usually approach or hit their upper limit. Striving to keep balances at a fraction of the limit can help improve your score.

Age of Credit Account

The duration of your credit history plays a role in your score. Newly opened accounts might be influencing your score negatively.

How to Verify: Peruse your credit report to determine the longevity of both your oldest and newest accounts, and the overall average age.

Diversity of Credit and Fresh Credit

Diversified credit and responsibly managing new credit are critical elements of a strong credit score.

How to Verify: Identify the types of credit you hold currently, including credit cards, retail accounts, or installment or mortgage loans. Reconsider if you have been applying for new credit too often.

Public Records

Any public records like unpaid taxes or bankruptcies can substantially decrease your score.

How to Verify: Peruse your credit report for any public records. Address any issues found for potential score improvement.

How Do I Improve my 713 Credit Score?

With a credit score of 713, you’re on the cusp of a Very Good credit rating. Here’s how to elevate your score to the next level:

1. Maintain Your Payment History

A consistent, on-time payment history is crucial for credit score improvement. Ensure all of your bills are paid promptly. Consider setting up automatic payments to avoid missed due dates.

2. Scrutinize for Credit Report Errors

Errors on your credit report can hold your score back. Review your report regularly for inaccurate information and dispute any errors you uncover with the credit bureaus.

3. Limit Hard Inquiries

Each time a potential lender checks your credit, it can ding your score. Limit these hard inquiries by curbing new credit applications unless necessary.

4. Keep Unused Credit Cards Open

Closing old or unused credit cards can negatively impact your credit score by reducing your available credit. Instead, keep these accounts open and use them sparingly to maintain a low credit utilization.

5. Monitor Your Credit Utilization

Keep your total credit card balances below 30% of your total credit limits to maintain a healthy credit utilization rate. This rate contributes notably to your credit score calculation.

By being mindful of these strategies, you can take accessible and effective steps, tailored to your current score scenario, to further enhance your credit rating.