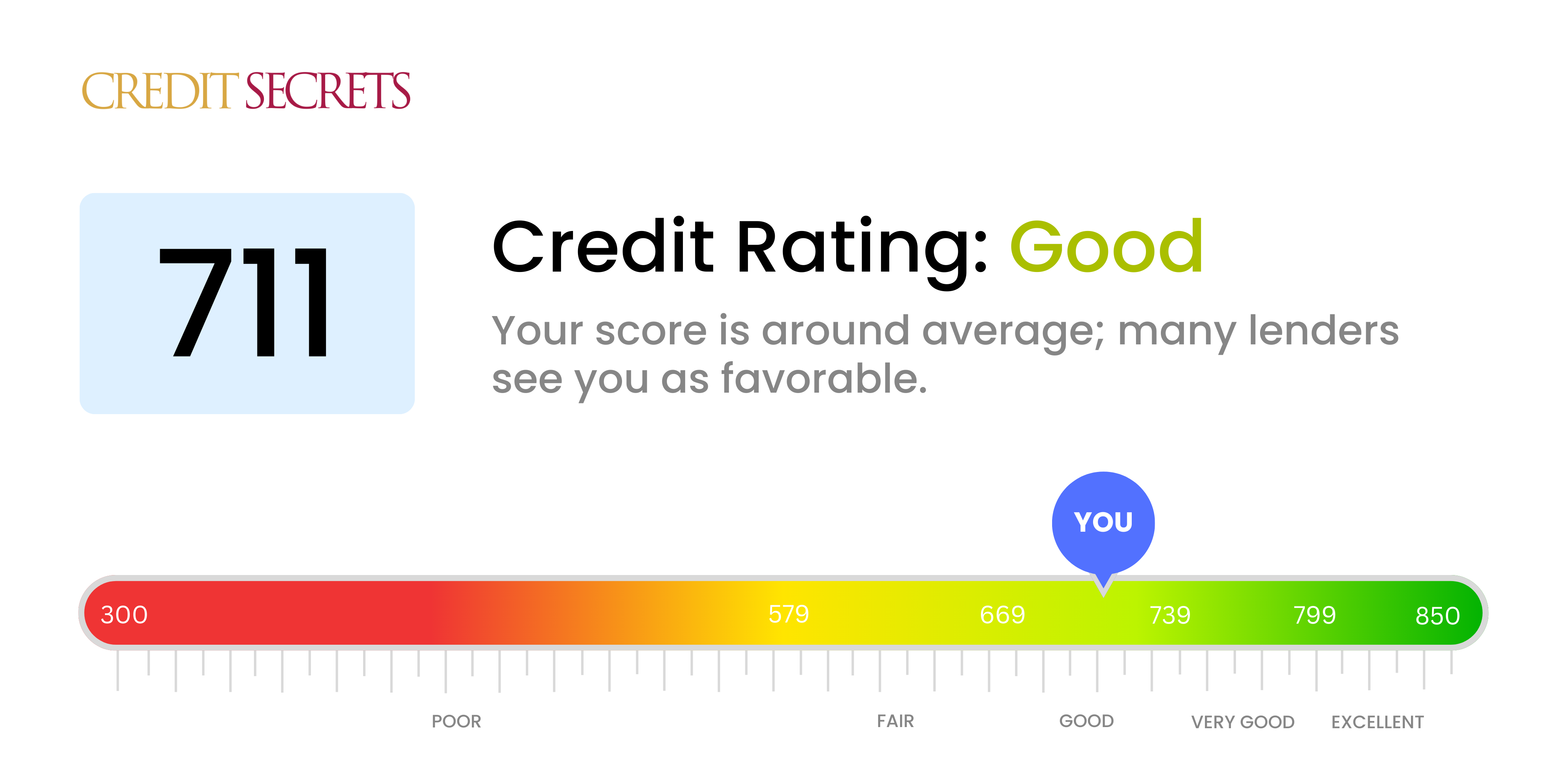

Is 711 a good credit score?

Your credit score of 711 is classified as a good credit score. With this score, you can generally expect to meet criteria for various kinds of credit, including loans and credit cards, although you may not receive the best interest rates or terms. While you're in good standing, there's always room for improvement to ensure even better financial opportunities in the future.

Being consistent with payments, keeping your credit utilization low and carefully managing any new credit account, will help you to continue to strengthen your credit score. Keep on top of your credit report to spot any inconsistencies or errors. Improving your credit score can take time, but every step towards better credit health is a step in the right direction.

Can I Get a Mortgage with a 711 Credit Score?

A credit score of 711 is generally considered to be a good score and can position you well for a mortgage approval. This score indicates to lenders that you've displayed a decent level of responsibility and diligence in repaying your debts. This should enable you to approach the mortgage process with confidence.

The mortgage approval process typically consists of several stages: application, underwriting, conditional approval, and final approval. Interest rates are largely determined by your credit score and the higher your score, the better your chances of getting a lower interest rate and thus, more affordable repayments. However, do bear in mind that other factors, such as your income and employment history, are also significant in this process. While a score of 711 is a good start, maintaining timely payments and having a solid financial foundation can help ensure a smooth mortgage approval process.

Can I Get a Credit Card with a 711 Credit Score?

If your credit score is 711, odds of securing approval for a credit card are generally favorable. With a score in this range, lenders tend to see you as a lower risk, which means you have handled your past credit responsibly. However, while this is promising news, it’s essential to keep up the good credit habits that helped you achieve this score.

Because your score is considered good, you typically qualify for a wide range of card types. Secured cards and starter cards may offer lower interest rates and can be a sensible choice. However, with a credit score of 711, premium travel cards with vast reward systems might be within reach too. Each card offers unique benefits, so align your choice with your lifestyle and financial goals. Regardless of the card, keep a close eye on interest rates, as they can vary widely among card types. Always make payments on time and avoid exceeding your credit limit to maintain or even enhance your current credit score.

Your credit score of 711 puts you in a reasonably good position for obtaining a personal loan. While not exceptionally high, it is quite decent and portrays you as a moderate risk borrower to lenders. Nevertheless, credit score isn't the only factor evaluated in personal loan applications; your current income, debt-to-income ratio, and other related factors also play crucial roles.

With your score, you can expect to be approved by some lenders, albeit likely at a somewhat higher interest rate than individuals with higher scores. This is because lenders often associate higher risks with higher interest rates, considering it their form of 'insurance' should you default. Be prepared to thoroughly review the terms of any loan offers you receive; it's essential to understand all your obligations and to ensure you can meet them adequately. Being cautious now will undoubtedly serve your financial health well in the long run.

Can I Get a Car Loan with a 711 Credit Score?

With a credit score of 711, securing approval for a car loan should be a reasonably achievable goal. This score generally falls into what lenders consider to be a good credit range. It's above the threshold that most lenders associate with a higher risk of missed or late payments and default. Yet, just because this score isn't ‘excellent’ doesn't mean there won't be opportunities for favorable loan terms.

As the car loan process begins, you might find the terms being offered to you are already quite competitive. Interest rates could be lower, and there might be more flexibility with the length of the loan. However, remember it's not just about your credit score. Lenders consider multiple factors, like income, employment stability, and debt-to-income ratio, alongside your score. So, keep in mind that while a score of 711 should open doors, it doesn't automatically guarantee the best possible terms. It's still crucial to shop around and negotiate the best fit for your financial situation.

What Factors Most Impact a 711 Credit Score?

Understanding the significance of a credit score of 711 is key as you work towards financial stability. Identifying the elements that affect this score can guide your path to a better financial condition. Keep in mind, each financial journey is unique and filled with opportunities for growth and knowledge.

Credit Card Balances

Your credit score can be impacted by the level of outstanding credit card balances. If your balances are high, this could be a factor in your current score.

How to Check: Inspect your credit card statements. Are your balances high? Striving to maintain a low balance relative to your limit can be advantageous.

Length of Credit History

The duration of your credit history can also have an influence on your score. A shorter history could negatively affect your score.

How to Check: Analyze your credit report to determine the age of your most and least mature accounts and the average age of all your accounts. Reflect on any recent new accounts.

Types of Credit and New Credit Application

Controlling a variety of credit types successfully and managing new credit efficiently are important factors in maintaining a good credit score.

How to Check: Consider your mix of credit accounts, such as credit cards, installment loans, retail accounts, and mortgage loans. Also, consider whether you have applied for new credit prudently.

Public Records

Public records on your credit report such as tax liens or bankruptcies can have a significant influence on your score.

How to Check: Review your credit report for any public records. If present, tackle the items that require resolution.

How Do I Improve my 711 Credit Score?

With a credit score of 711, you’re on your way to obtaining excellent financial health. Targeted actions can still boost your score to an even more favorable position. Here are some key steps to consider:

1. Keep Timely Bill Payments

One of the top influencing factors for your credit score is on-time payments. Ensure all bills are paid promptly, including utilities and rent. Late payments can detrimentally impact your credit score.

2. Monitor Credit Card Utilization

Maintain low credit card balances. A rule of thumb is to utilize below 30% of your credit limit. If you have a $1,000 limit, for instance, your balance should remain under $300.

3. Avoid Frequent Credit Checks

Frequent credit checks can momentarily decrease your credit score. When possible, opt for soft inquiries over hard inquiries, as these do not affect your score.

4. Check Your Credit Reports for Inaccuracies

Errors on your credit reports can harm your score. Regularly check your reports to identify and dispute any false information.

5. Maintain Healthy Credit Habits

At your score level, consistent healthy credit habits over time will naturally boost your score. This includes keeping a good balance of credit types and maintaining a long credit history with timely payments.