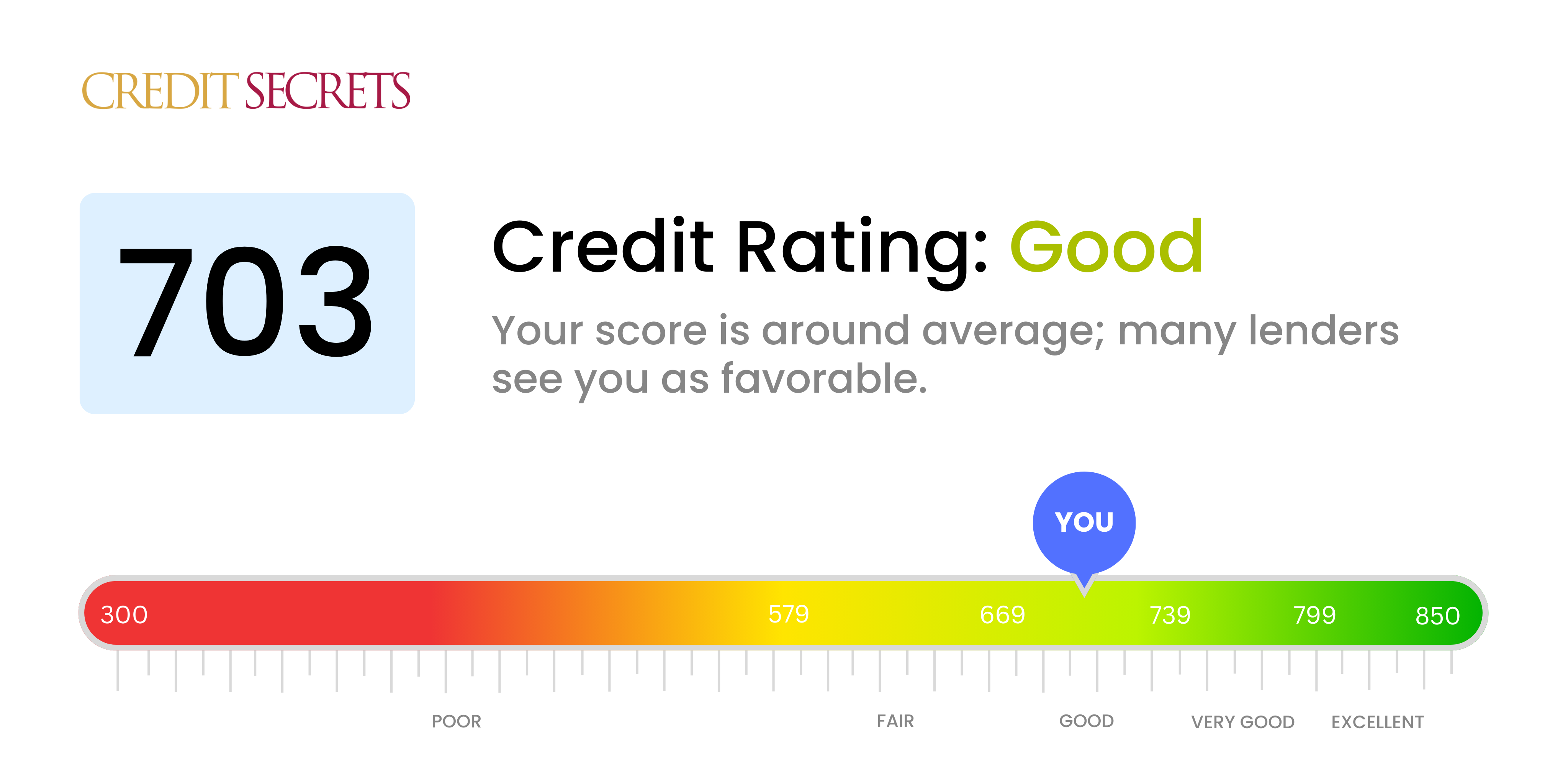

Is 703 a good credit score?

Your score of 703 is classified as good on the credit score scale. This means you're generally viewed as a responsible borrower with a lower risk of defaulting on credit payments. You could be eligible for new loans or credit cards, and lenders might offer you better terms and lower interest rates compared to someone with a lower credit score. However, maintaining your current score or improving it can unlock even better opportunities.

Most importantly, high credit scores unlock financial freedom and flexibility. With your current score, you're well on your way. Don't get complacent, though - focus on eliminating any remaining debts, and ensure you make all of your payments on time to keep moving up the credit ladder. As you take these steps, your financial future will look even brighter. Don't stress if progress feels slow - improving your credit is a marathon, not a sprint. Keep going!

Can I Get a Mortgage with a 703 Credit Score?

With a credit score of 703, you are well within the range most lenders require for approval of a mortgage. Although you would expect a high approval rate, different lenders may have varied criteria, which could affect the decision. Therefore, a score of 703 is considered to be in the 'good' range and it shows that you've been responsible with your credit, avoiding significant issues such as defaults or bankruptcy.

In terms of the mortgage approval process, you should prepare for a detailed financial review from potential lenders. They'll look at your income, debts, employment history as well as your credit score. This is a standard process to ensure that you can handle the financial responsibilities associated with owning a home. Having a good score like 703 might also grant you the benefit of lower interest rates, which will save you significant amounts of money over the term of your mortgage. Remember though, it's not just about numbers; maintaining a healthy financial behavior is also key.

Can I Get a Credit Card with a 703 Credit Score?

A credit score of 703 is one which demonstrates a history of generally responsible money management and repayment habits. Most lenders would be likely to consider this score favourably when considering credit card applications. However, while this can be reassuring news, it's important to be fully aware of the unique financial situation rather than solely relying on the credit score.

Based on this credit score, a variety of credit card options could be available. This could include rewards cards which offer cashback or travel points for every purchase. As this credit score is considered good, you can also find credit cards with lower interest rates, which would be better for long term use. It might also be possible to qualify for cards with a 0% introductory APR offer, allowing purchases to be made over time without the accruement of interest. Despite these potential benefits, each option should be considered with careful thought, ensuring that the choice made aligns best with unique financial goals and behaviour. Remember, planning and understanding are key to maintaining and improving this healthy credit score.

Your credit score of 703 is right around the average for American adults and is generally seen as a good score. This places you in the range where you would likely be approved for a personal loan, assuming all other requirements are met. However, every lender has their own criteria and while some may approve your application, others may not. The good news is that you're not far from the 'very good' range, where approval rates and terms become even more favorable.

As you begin the loan application process, you should expect lenders to highly consider your credit score when setting the terms of your loan. This could determine the interest rate offered, loan amount, and repayment period. Although your score of 703 does indicate that you are a fairly reliable borrower, you may not receive the best possible interest rates on offer; those are typically reserved for borrowers with scores in the 'very good' to 'exceptional' credit range. However, the terms you receive are likely to be reasonably favorable, compared to those for individuals with lower credit scores.

Can I Get a Car Loan with a 703 Credit Score?

Holding a credit score of 703, you stand on favorable ground when it comes to getting approved for a car loan. Lenders generally consider scores above 660 to be good, and yours is effortlessly above that threshold. This means you fall into a category that lenders are typically comfortable with, improving the likelihood of your car loan being approved.

Because of your solid credit score, you can likely expect a smoother car purchasing experience. This score showcases to lenders that you have a proven record of reliably repaying borrowed money, making them more willing to offer you loans with favorable interest rates. However, do keep in mind that the exact terms of your loan will depend on various factors, including the lending institution and the specific loan amount. It's crucial to do thorough research and comparison to ensure you secure the best possible terms on your car loan.

What Factors Most Impact a 703 Credit Score?

Grasping the factors influencing a 703 credit score can steer you on a clear path towards better financial health. Different factors play into this score, and becoming aware of them can lead to improvement.

Payment History

Payment history plays a vital role in your credit score. Even a few missed or late payments can have an impact.

How to Check: Review your credit report carefully for late or missed payments. Ensure you stay on top of all upcoming payments without delay.

Credit Utilization

How much of your available credit are you using? High credit utilization might be dragging your score down.

How to Check: Check your credit card balances. Finding a balance between your credit limit and the amount you owe can help uplift your score.

Length of Credit History

A long credit history generally equates to a better score. A short credit history might be part of the equation for your current score.

How to Check: Check your credit report for the age of your accounts. Take into account the time frame of your oldest and newest accounts and the average age of all accounts.

Credit Mix

A variety of credit types can positively affect your score. If your credit is fairly homogeneous, then diversifying it might be beneficial.

How to Check: Study your credit portfolio. A blend of credit cards, retail accounts, installment loans, and mortgage loans can improve your credit score.

Inquiries

Too many credit inquiries in a short span might have caused your score to drop.

How to Check: Check your credit report for recent inquiries. Respect the balance between applying for new credit and maintaining your current credit lines.

How Do I Improve my 703 Credit Score?

With a credit score of 703, you are on the cusp of achieving a ‘good’ credit rating. By understanding your credit report and making a few smart moves, you can further elevate your score. Here are steps designed specifically for your financial situation:

1. Review Your Credit Report

Ensure that no errors are pulling your score down. These could range from incorrect personal information to errors in your credit history. If there are inaccuracies, dispute them with the credit bureau who provided the report.

2. Manage Your Credit Card Balances

Try to keep your credit card utilization low. It’s optimal to maintain it below 30% of the limit, as it signals to creditors that you can handle your credit responsibly.

3. Maintain Older Credit Accounts

Don’t close your old credit card accounts, even if you don’t use them frequently. A longer credit history can boost your overall score and demonstrates stability to lenders.

4. Limit Hard Inquiries

Multiple hard inquiries in a short period can negatively impact your score. Only apply for new credit when necessary to control the number of hard inquiries on your credit report.

5. Regularly Pay Bills On Time

Consistently paying bills on time is crucial. Set up reminders or automatic payments to help ensure you never miss a due date, as late payments can dramatically damage your credit score.