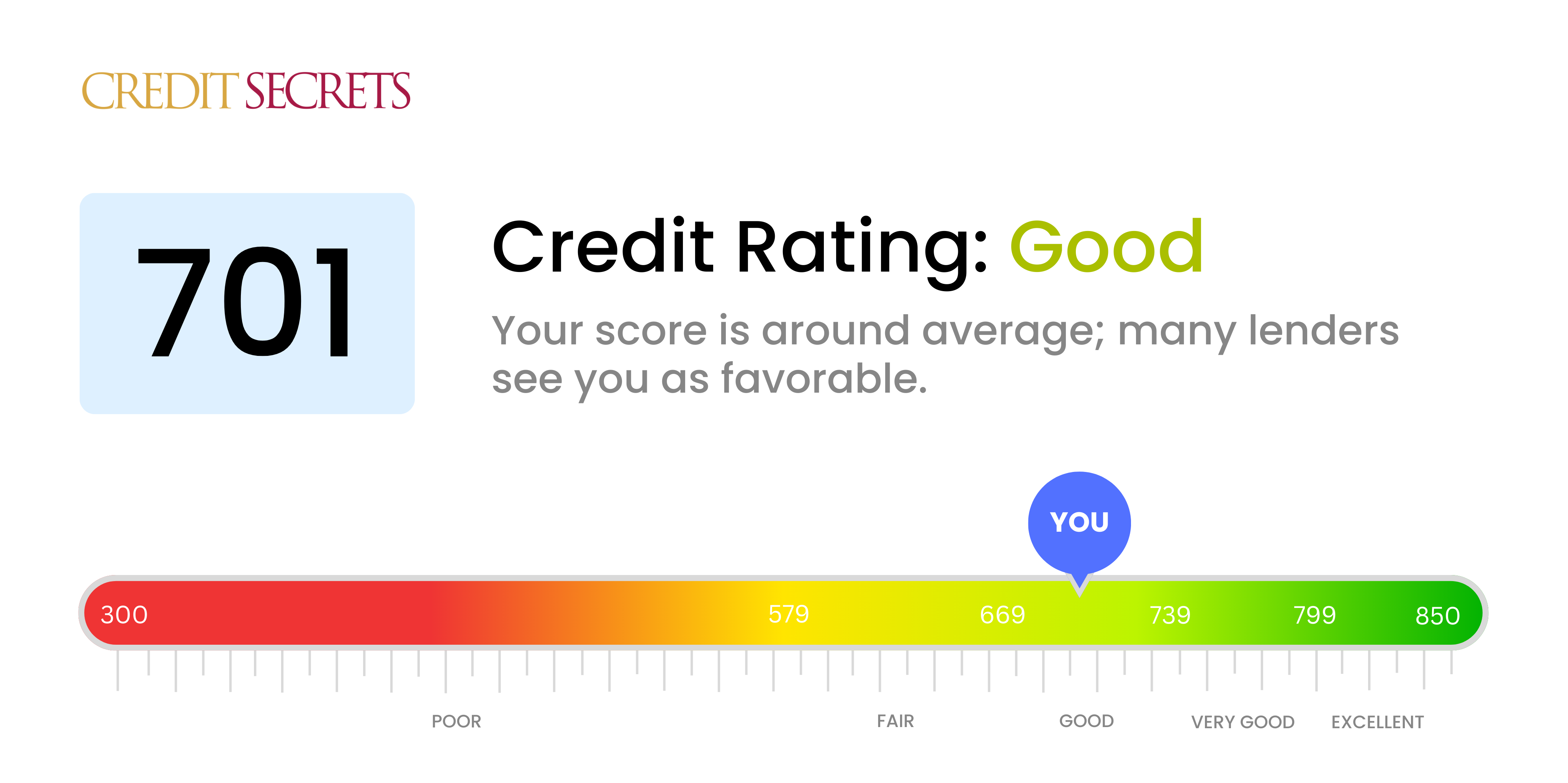

Is 701 a good credit score?

With a credit score of 701, you're in the 'Good' category. This score indicates that you have a generally responsible approach towards handling credit, and lenders are potentially more likely to approve your applications for credit cards and loans. Interest rates offered, however, may not be the best in the market.

Carrying a 'Good' score does open the door to a number of credit opportunities, but further improvement could provide wider access and even better terms. Continue making payments on time, maintain low credit card balances, and avoid taking on unnecessary debt to gradually work towards an even better score.

Can I Get a Mortgage with a 701 Credit Score?

With a credit score of 701, you are in a position that is viewed favorably by most mortgage lenders. This score is above the minimum threshold that many institutions require for approval, indicating that you've generally handled your credit in a responsible way.

In the mortgage approval process, you can expect your credit to be a key factor, but it's not the only one. Lenders will also consider your employment history, current income, and the size of the down payment you can make. While a credit score of 701 doesn't guarantee approval, it does increase your likelihood. Regarding interest rates, your credit score can affect the rate you're offered. Generally, the higher your score, the lower your mortgage rate may be. Still, it's good to remember that lenders will evaluate your overall financial picture when determining your rates.

Can I Get a Credit Card with a 701 Credit Score?

A credit score of 701 is generally a good score, often seen by lenders as an indication of responsible financial behavior. With a score like this, your chances of being approved for a credit card are quite promising. Being responsible with your credit history has pays you dividends when seeking new lines of credit, placing you firmly in a position of financial viability.

Based on this credit score, you're likely to qualify for a range of credit cards. You might consider a rewards credit card or a cash back card, both of which could offer valuable perks and benefits. Additionally, premium travel cards could be within reach, offering rewards like frequent flyer miles. Keep in mind, these cards often come with more stringent eligibility criteria and significantly higher credit limits. Remember to remain diligent when using these cards, as high interest rates on unpaid balances can negate the benefits of points or cash back earned. Approaching credit with caution and understanding can sustain your financial well-being in the long run.

A credit score of 701 is a reasonable figure in the credit world. It reflects your dependable payment history and risk levels that most traditional lenders find favorable for a personal loan. This score does not guarantee approval, but it does increase your chances compared to lower scores. Lenders typically see individuals with such scores as reliable borrowers, which means they're more likely to grant you a personal loan.

Your credit score plays a crucial role in determining the terms of your personal loan. Generally, a score of 701 can give you access to loans with more reasonable interest rates. As you venture into the application process, lenders will scrutinize your credit history to ascertain how regularly you pay off your debts. Your loan terms, including your interest rate, will be determined by this analysis. Remember, while a decent credit score improves your chances, the final decision always rests with the lender.

Can I Get a Car Loan with a 701 Credit Score?

Having a credit score of 701, you're likely to qualify for a car loan. Lenders typically view a credit score above 660 favorably. As your score of 701 surpasses this threshold, it demonstrates to lenders that you've managed your credit responsibly in the past which brings with it a sense of reliability and trustworthiness. This solid credit score can open up avenues of financing with a variety of lenders.

While your 701 credit score tends to indicate that you're a low-risk borrower, it doesn't automatically assure the best loan terms, such as the lowest interest rates. Different lenders have varying policies and parameters. So while they might approve your car loan, they could still offer different interest rates and terms. Nonetheless, having a score of 701, put you in a good position, and should give you the confidence to negotiate with lenders for favorable loan terms. Take your time to shop around and weigh all your options before making a decision.

What Factors Most Impact a 701 Credit Score?

Grasping your credit score of 701 is a crucial step on the path to financial stability. It's vital to note that your financial journey is distinctive, providing a wealth of growth and learning prospects.

Credit Utilization

A critical element of your credit score is your credit utilization rate. If you're using a substantial portion of your available credit, it could negatively affect your score.

How to Check: Analyze your credit card statements. Keeping your balances low compared to your credit limit is advantageous.

Length of Credit History

The length of time you’ve been using credit could be affecting your score. Frequently, a longer credit history leads to a higher score.

How to Check: Assess your credit report to review the age of your oldest and newest accounts and the average age of all your accounts. Reflect on whether you've applied for new credit recently.

Credit No-Nos

Instances of personal bankruptcy, foreclosures, or collection actions can make a significant dent in your score.

How to Check: Scrutinize your credit report closely for any such items.

Recent Credit Activity

Frequent applications for new credit can lead to lowering of your score. This is especially true if you've opened multiple new credit lines in a short span.

How to Check: Have a look at your credit report. If you spot many recent inquiries, consider if you've been seeking new credit frequently.

How Do I Improve my 701 Credit Score?

Having a 701 credit score is a good start and puts you on the path to outstanding credit. Here are a few strategic steps you can take to inch your score even higher:

1. Regularly Review Your Credit Report

Errors in your credit report can harm your score. Make it a habit to review your report occasionally and dispute any inaccuracies immediately.

2. Pay More Than the Minimum Due

Even if your payments are on time, carrying large balances can negatively affect your score. Where possible, aim to pay more than the minimum amount on your credit cards each month.

3. Limit Hard Inquires

Applying for new loans or credit cards can result in hard inquiries, which can slightly ding your score. Be mindful of your applications and only apply for credit when necessary.

4. Diversify Your Credit

Having a mix of credit such as credit cards, home or car loans and student loans can demonstrate that you can handle different types of credit wisely.

5. Maintain Older Credit Accounts

The length of your credit history can also influence your score. Try to keep older credit accounts open and in good standing to boost your overall score.