Is 700 a good credit score?

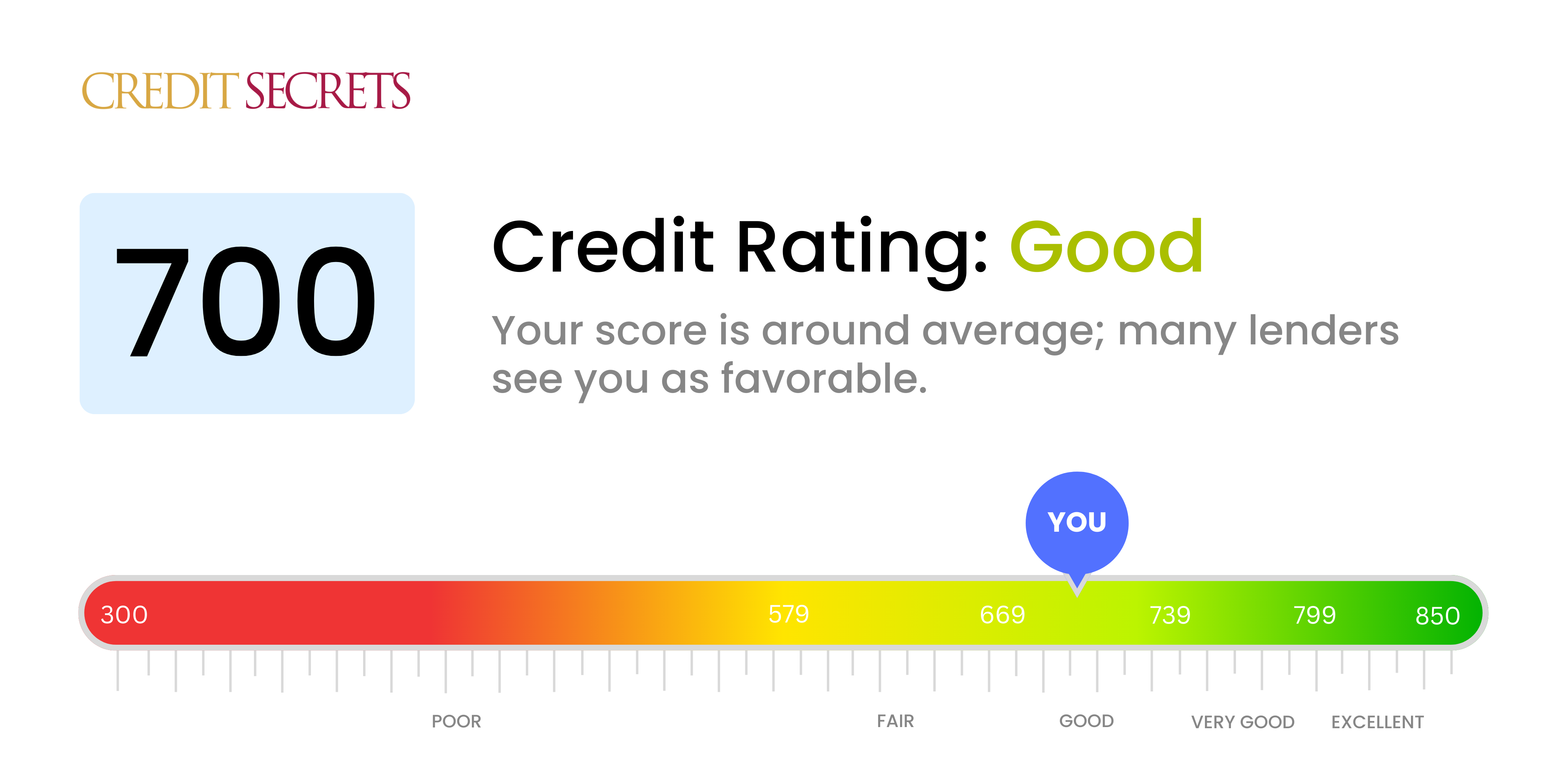

With a credit score of 700, you fall into the 'good' category. This is a solid score that should provide you with a fair degree of financial flexibility.

Because your score is 'good', many lenders will likely view you as a reliable borrower. This could mean you qualify for loans with reasonable interest rates. However, it might be worth taking steps to push your score into the ‘very good’ range (over 740), which could bring even better loan terms and interest rates. Remember, consistently making payments on time and keeping credit card balances low are key steps towards improving this score.

Can I Get a Mortgage with a 700 Credit Score?

For those with a credit score of 700, it certainly looks positive for mortgage approval. Generally, a credit score of around 700 is considered to be a good score and it shows lenders that you are a responsible borrower. It's important to remember that approval isn't guaranteed as there can be additional factors at play, but your score puts you in a good position.

As you navigate the mortgage approval process, you'll likely find that your respectable credit score may help in securing a competitive interest rate. Keep in mind, your credit score impacts the interest rates lenders will offer you – the higher the score, the lower your interest rate could be. This can lead to substantial savings over the life of your loan. It's essential to consistently maintain good credit habits to ensure your score remains at a level that is attractive to lenders.

Can I Get a Credit Card with a 700 Credit Score?

With a credit score of 700, you're in a comfortable position to get approved for a credit card. This is seen as a good credit score by most lenders and typically suggests a history of responsible borrowing behavior. There's no need to worry or feel disheartened. But, it is crucial that you continue to handle your financial obligations with care, maintaining a credit score such as this speaks volumes about your financial habits.

Given your score, a range of credit card options are available to you. This includes secured and starter cards, but might even stretch to premium travel cards depending on other aspects of your financial situation. Be thoughtful in your selection though, making sure to compare interest rates and benefits across card types. Some premium cards, while appearing glamorous, can have higher annual fees or interest rates. However, the right balance between costs and benefits can help you capitalize on your credit score and further your financial health.

With a credit score of 700, you stand on the threshold of what most lenders consider as good credit. It's not without its challenges, but with careful steps, chances are high to secure a personal loan. You're seen as a considerably low risk to credit providers, which can lead to approval under conventional loan terms. Remember that lenders don't just look at your credit score but also consider other factors such as your income and existing debts.

During your personal loan application process, prepare for lenders to examine your credit history closely. Your score provides them with a snapshot of your financial responsibility, but lenders will delve deeper into your credit report. They will likely look at the length of your credit history, any recent credit inquiries, and your standing lines of credit. Remember, with a score of 700, you have established some solid ground but continue to show responsible financial behavior for better loan terms and potentially lower interest rates.

Can I Get a Car Loan with a 700 Credit Score?

With a credit score of 700, your chances of getting approved for a car loan are relatively high. This score tells potential lenders that you've got a good track record of managing and repaying debt. It’s above the average and falls directly into what most lenders consider to be a prime lending score range, making you an attractive prospect for most auto loan lenders.

However, while a credit score of 700 should generally not pose any significant issues in obtaining a car loan, it's always good to remember that lenders don't base approval solely on credit scores. They also consider factors such as income and debt-to-income ratio. So, while this score, would typically allow you access to decent interest rates, the specific details of your personal finance would determine the final deal. Always remember to review and understand all the terms and conditions before signing on the dotted line.

What Factors Most Impact a 700 Credit Score?

Deciphering a score of 700 can help chart your path to financial betterment. Understanding which factors shape this score can provide stepping stones to an improved financial reality. Each financial journey is unique, filled with distinct hurdles and learning possibilities.

Credit Utilization

Your credit utilization rate significantly influences your credit score. If your credit card usage is high, this might be the reason for your 700 score.

How to Check: Peruse your credit card statements. If your balances are typically at or near their limits, aim to keep them lower in comparison.

Payment History

Your payment history, especially any late payments, greatly impacts your credit score. This could be a major reason behind your current score.

How to Check: Inspect your credit report for any late payments or missed installments. Ponder on any late payments in recent times as these could be pulling your score down.

New Credit

Frequent applications for new credit can negatively affect your credit score.

How to Check: Assess if you have been applying for new credit frequently. Doing so can lead to a hard inquiry on your report, affecting your score.

Length of Credit History

A relatively shorter credit history may negatively affect your score.

How to Check: Inspect your credit report for the age of your oldest and newest credit accounts, and the average age of all your accounts. Evaluate if you've opened several new accounts recently, which could shorten your average credit age.

Credit Mix

The diversity of credit types you have also has weightage in your credit score.

How to Check: Take a look at your credit report and see if you have a healthy mix of credit accounts, like credit cards, student loans, a home mortgage, or car loan. Ensure you're managing all responsibly.

How Do I Improve my 700 Credit Score?

A credit score of 700 is considered a good score but it can still be enhanced with focused action. Here are the most pragmatic and effective strategies for individuals with this score:

1. Maintain Low Credit Utilization Ratios

Keeping your credit card balances low compared to your credit limits can benefit your credit score. Aim to utilize less than 20% of your available credit limits. Always remember to pay off balances in full, if possible, to avoid unnecessary interest charges.

2. Steady On-Time Payments

Continue your streak of paying bills punctually. On-time payments showcase your reliability to lenders and positively impacts your credit score. Setting up automatic payments or reminders can be a helpful step towards never missing a payment deadline.

3. Credit Account Ageing

Resist closing old credit card accounts. Keeping these accounts open can increase your credit history length which is favourable for improving your credit score. Use older credit cards occasionally and pay off in a timely manner to keep the accounts active.

4. Responsible New Credit

Applying for new credit can introduce a hard inquiry, which might briefly lower your score. However, if managed responsibly, adding a new form of credit such as an installment loan can demonstrate that you can handle various types of credit, thereby raising your score in the long run.

5. Regular Credit Report Checks

Regularly check your credit reports for errors or fraud that could negatively impact your score. This allows you to stay on top of your credit status and dispute any inaccuracies promptly to maintain your good credit standing.