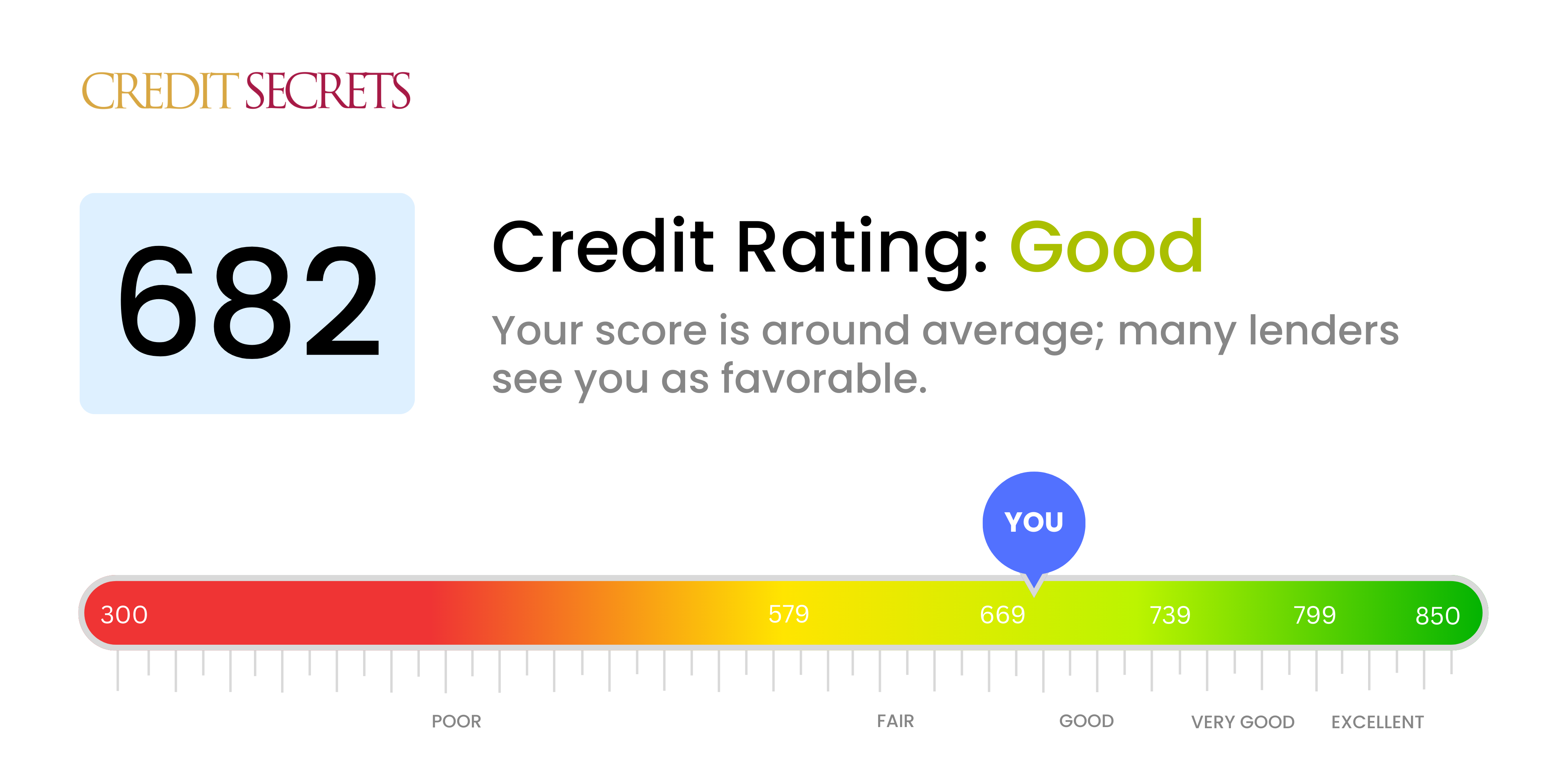

Is 682 a good credit score?

With a credit score of 682, you're within the 'good' range. This means you've demonstrated a responsible approach to managing your finances, but there's still room for improvement.

Typically, individuals with this score can often secure loans and regain credit, although it may not be at the best interest rates. Remember, the journey towards bolstering your financial health is a gradual one - take consistent small steps and you'll surely get there. Staying proactive and informed can make all the difference in enhancing your credit reputation.

Can I Get a Mortgage with a 682 Credit Score?

With a credit score of 682, qualifying for a mortgage is quite feasible. A score in this range indicates that you've managed your credit with some degree of responsibility and creditors perceive you as less of a risk compared to those with lower scores. Keep in mind, however, lenders often consider other factors such as your debt-to-income ratio, employment stability and down payment size in the approval process.

Though mortgage approval is likely at this score, it's essential to understand that higher credit scores often result in better mortgage interest rates. The difference may seem small, but even a fraction of a percentage point can result in significant savings over the life of a loan. So while a score of 682 is a solid foundation, striving for a higher score can potentially put you in a better financial position. It's not just about getting approved, it's also about securing a mortgage with the most favourable terms possible. Stay focused on practicing responsible credit behaviors that will continue to lift your score over time.

Can I Get a Credit Card with a 682 Credit Score?

With a credit score of 682, you have a fair chance at being approved for a credit card. This score suggests that you've demonstrated a reasonable level of financial responsibility and reliability. As such, lenders may be willing to consider you for credit. It's crucial to stay realistic about this - each financial institution has different criteria and expectations, and approval is never guaranteed. But, a 682 score does open some doors for you.

As someone with a credit score in this range, you're likely to be eligible for a variety of credit cards, yet the premium options with extensive rewards might still be out of reach. Look into basic unsecured credit cards or consider cards aimed at those looking to build up their credit. Secured credit cards also remain an option, with your deposit acting as your credit limit. They're easier to obtain and can help you continue to elevate your score. Remember, the APR on these cards can be a bit higher than for those with excellent credit scores, so make sure to pay off balances in full each month if possible. Equip yourself with knowledge and patience, and you'll continue moving forward.

In terms of credit, a score of 682 stands on the edge of fair and good ranges. With a score like this, it is likely that you'll have a fair shot at approval for a personal loan, as it falls within the standard scope most lenders deem acceptable. However, it's crucial to understand that while you may possibly be given the green light, the lending terms may not be as generous as those given to individuals with higher scores. Your less than perfect credit score does make you a bit more of a risk to lenders.

In your loan application process, be prepared for the reality that the interest rate offered might be a bit higher than the best rates on the market. This is because lenders seek to balance the risk associated with lending to individuals with moderate credit scores by implementing slightly higher than average interest rates. Nevertheless, with a credit score of 682, you could have a reasonable chance of securing a personal loan with diligent and careful planning.

Can I Get a Car Loan with a 682 Credit Score?

Having a credit score of 682 puts you in a decent position for applying for a car loan. Most lenders tend to look for a score of 660 or above, so you're just over that line. This means the chances of your car loan application being approved are rather good.

When it comes to car purchasing, this credit score might not get you the lowest interest rates available, but it won't put you in the high-risk category, either. Effective interest rates can vary a great deal based on your credit score, so it's wise to shop around with different lenders to get the best possible deal. Also, remember to be cautious and patient, and read all loan terms thoroughly before making a decision. Getting a car loan is a significant financial decision, and having a score of 682 puts you in a satisfactory spot to navigate this process.

What Factors Most Impact a 682 Credit Score?

With a credit score of 682, understanding the factors impacting your score is a crucial step towards financial health. mitigating them will help you inch closer to a better score.

Payment History

Payment history may play a role in your credit score. If you've missed any payment or delayed it, it's likely impacting your score.

How to Check: Look at your credit report for any default or late payments. Reflect on whether your bills have been paid on time or not.

Credit Utilization

Your credit utilization ratio may be affecting your score. A well-balanced credit usage is the key to a better score.

How to Check: Analyze your credit card statements. How close are you to your credit limit? Try to ensure your balances remain significantly lower than your limits.

Length of Credit History

The age of your credit history might be included in your score, the longer, the better.

How to Check: Review your credit report. Look at your newest and oldest accounts and the average age of your credit history. Consider if you have created new accounts recently.

Public Record and Collections

Any public records or collections on your report will detrimentally affect your score.

How to Check: Scrutinise your credit report for any collections or public records such as tax liens or bankruptcies. Resolve any listed issues promptly.

Hard Inquires

Frequent applications for new credit, another probable reason, can cause hard inquiries which can negatively affect your score.

How to Check: Consult your credit report and be cautious about the number of hard inquiries. You could benefit from avoiding unnecessary credit applications.

How Do I Improve my 682 Credit Score?

A credit score of 682 is fair, yet it’s achievable to improve it with the right strategies. Tailored for your score level, here are the most suitable steps to enhance your credit score:

1. Set Up Payment Reminders

With a score of 682, the consistent habit of timely payments is key. Set up automatic payment reminders to ensure you never miss a due date. This can be accomplished through most banking apps or by setting reminders on your personal devices.

2. Decrease Debt-to-Credit Ratio

Strive to diminish your overall debt, specifically revolving credit such as credit cards. Maintaining your balances below 30% of your total credit limit can enormously affect your credit score in a positive way.

3. Review Your Credit Report

Acquire a copy of your credit report and meticulously review it for inaccuracies. An incorrectly reported late payment can take a toll on your credit score. In case of errors, be sure to initiate the dispute procedure for each credit bureau.

4. Limit New Credit Inquiries

Multiple credit inquiries in a short period can have a negative impact. Only apply for new credit when absolutely necessary and avoid creating several inquiries on your report.

5. Diversify Credit

Having varied types of credit, like installment and revolving credit, can benefit your credit score. Look into options like a credit builder loan or an installment loan once you have a consistent payment history with your current credit lines.