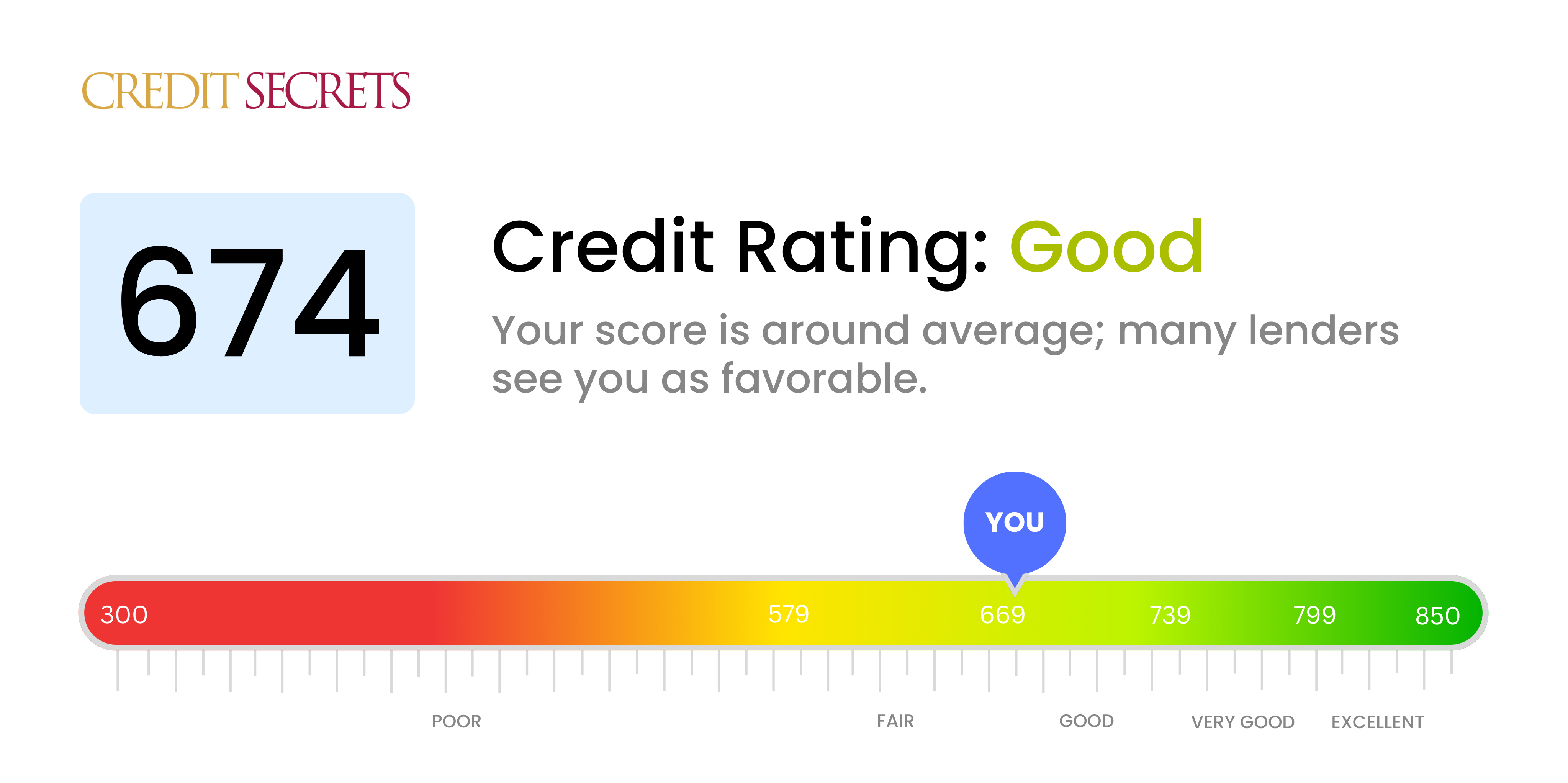

Is 674 a good credit score?

A credit score of 674 falls into the 'Good' category. This means, with disciplined financial habits, you're on track to reaching your financial targets.

With a credit score like yours, you can expect fair approval odds for credit applications, although interest rates offered to you may be slightly higher compared to those with excellent scores. Remember, every lender has a different threshold for their loan approvals. It's important to continue improving your score and staying financially responsible. In the world of credit, there's always room for improvement and, remember, the journey towards excellent credit score is fully achievable.

Can I Get a Mortgage with a 674 Credit Score?

A credit score of 674 lies in the 'Fair' category. This score might enable you to secure a mortgage, albeit with interest rates that could be higher than those offered to borrowers with higher credit scores. A score of 674 is just below the 'Good' credit range, suggesting reasonable financial behavior but with some room for improvement.

However, it's important to remember that credit score is just one factor considered by mortgage lenders, who also take into account your income, employment status and history, and debt-to-income ratio. So, while your score is not necessarily a deal-breaker, improving it could lead to more favorable mortgage terms. It might mean the difference between approval or decline, or thousands of dollars saved in interest over the lifetime of your loan.

It is also a good time to scrutinize your credit report for any errors that might be negatively affecting your score. After all, the journey towards financial empowerment often begins with understanding and taking control of your credit.

Can I Get a Credit Card with a 674 Credit Score?

With a credit score of 674, there's a fair chance of getting approved for a credit card, although it will depend on other factors such as income and debt levels. This score generally falls into the "fair" category. Sometimes, "fair" might be enough, and sometimes it might fall short. It's not an insurmountable obstacle but it's not a surefire guarantee either. Financial institutions consider many factors, and your credit score is certainly a major one.

Considering your credit score, starting with a basic card with fewer frills can be more attainable. Apply for credit cards marketed towards individuals with fair credit. You might not be eligible for premium travel cards or cards with large rewards programs at this time, but don't fret. Basic credit cards often still offer rewards like cash back or points for purchases. Do bear in mind, however, that the interest rates offered with this score might be a bit higher. When used responsibly, securing and responsibly using a credit card can be an effective strategy towards boosting your credit score. The credit card journey is one step towards your overall financial health and wellness.

Having a credit score of 674, while not the highest, can still provide you a reasonable chance of securing a personal loan. Lenders consider this score as "fair", meaning you've demonstrated some degree of responsible credit behavior. It's honest to say that you're in a time of definite potential when it comes to personal financing.

When applying for a personal loan, you should be prepared for a more meticulous review of your credit history. Lenders might examine your past financial habits to assess the level of risk involved. However, this shouldn't discourage you. Being in the fair credit score zone, you can expect typical interest rates ranging from 18% to 26%. These may not be the most attractive rates in the market; however, it becomes a viable option when seeking to meet your personal or financial objectives.

Continue exercising good credit habits, such as making payments on time and maintaining low credit balances, could see your credit score improve over time. This may lead to even better loan opportunities down the road.

Can I Get a Car Loan with a 674 Credit Score?

With a credit score of 674, chances are fairly optimistic that you'll receive approval for a car loan. Lenders generally consider a score above 660 as satisfactory, so your score of 674 puts you just above this threshold. This gives you a decent chance at securing a loan with manageable terms. However, it's important to note, your score still falls in the average range and might not qualify you for the most favorable terms or the lowest interest rates.

The car purchasing process with a credit score in this range will require a bit of diligence. Whichever loan offer comes your way, it's always important to understand all the details before accepting. With a score of 674, you might not get the best interest rates. Be prepared for potential higher rates compared to those with higher credit scores. Lastly, always remember there are multiple lenders in the marketplace. So, even if one lender's terms aren't suitable, another might offer a better deal. Persistence and a thorough understanding of your loan options can lead to a successful car loan procurement.

What Factors Most Impact a 674 Credit Score?

When evaluating a score of 674, your financial trajectory can be significantly influenced by recognizing and maneuvering around the elements contributing to this score. This understanding is a stepping stone to a more favorable financial arena. Each financial voyage is individual and a resource for personal growth and financial wisdom.

Total Amounts Owed

Owing large amounts on credit accounts can seriously affect your score. This could be a vital reason for your current score.

How to Check: Watchfully assess your credit report and existing balances. High balances, particularly on revolving credit like credit cards, could be dragging down your score.

Credit History Length

While your credit history might not be too short, it might not be long enough to provide a diversified picture of you as a borrower, thus hampering your score.

How to check: Scrutinize your credit report to consider the age of your oldest and most recent accounts and the mean age of all your accounts.

Types of Credit in Use

Not having a broad range of managed credit types might be one of the causes for your score’s current state.

How to check: Check your mixture of account types. If you only have one type of credit, like credit cards, a lack of diversity could be holding your score back.

Public Recordings

Public records such as foreclosures, bankruptcies can leave a severe dent in your score.

How to Check: Look into your credit report for any public records. Reconcile any items that demand attention.

How Do I Improve my 674 Credit Score?

With a credit score of 674, you are in the fair credit range. However, there are strategic steps you can take right now to boost your rating:

1. Review Your Credit Report

At this stage, it’s significant to know what is influencing your score. Obtain free copies of your credit report. Thoroughly check for any inaccuracies as they may negatively impact your score.

2. Pay More than Minimum

While making minimum payments on time is good practice, paying more than the bare minimum on credit debts can speed up your progress. It helps to reduce your credit utilization ratio and boost your score.

3. Maintain Low Credit Utilization

Keeping credit utilization, the ratio of your credit balance to credit limit, under 30% can greatly improve your score. Aim to keep it as low as possible on all individual cards and on the total of all cards.

4. Limit New Credit Inquiries

Frequent applications for new credit can lead to hard inquiries, which may lower your score. Apply for new credit sparingly and only if really needed.

5. Be Consistent

Be consistent with your current credit accounts, making your monthly payments on time and keeping balances low. Timely payments contribute to a strong credit history, which plays an important role in your credit score.