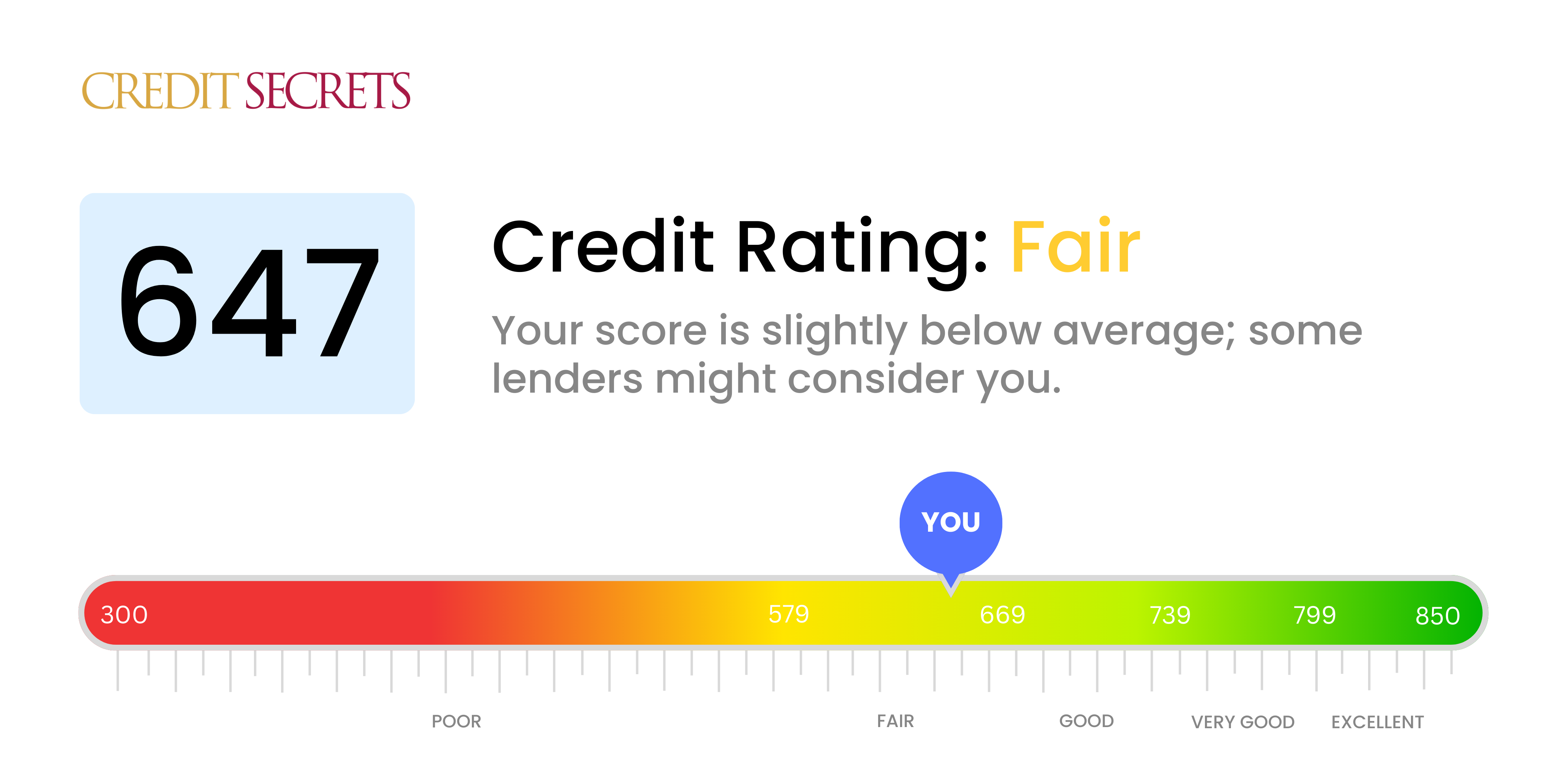

Is 647 a good credit score?

A credit score of 647 lands in the 'Fair' range. While this isn't an unfavorable score, it does indicate room for improvement to better your chances of advantageous loan approvals, lower interest rates, and better financial opportunities.

You are not in a poor credit situation, but you're not quite in the 'Good' category either. Though some lenders might approve loans, you may face higher interest rates and less flexible terms. However, with careful financial habits and responsible credit usage, you have the potential to shift your score into the 'Good' or even 'Very Good' range. Work towards paying bills on time, reducing debt, and being cautious of new credit inquiries.

Can I Get a Mortgage with a 647 Credit Score?

With a credit score of 647, your chances of being approved for a mortgage can be uncertain. While this credit score isn't extremely low, it doesn't fall into the ideal range that most lenders consider as 'good' or 'excellent'. Having a 647 credit score could mean you've had some financial missteps in the past, like late payments or high levels of debt.

However, it's understandable and not implausible. In this scenario, you may find it harder to get favorable interest rates, meaning the cost of borrowing could be higher for you. But it’s not necessarily a barrier to getting a mortgage altogether. Another way could be seeking government-backed mortgages, like FHA loans, which typically have less stringent credit requirements. Again, it wouldn't hurt to focus your efforts on improving your credit score to aim for better terms on your potential mortgage. Laying a solid foundation of timely payments and responsible credit usage will gradually strengthen your credit standing.

Can I Get a Credit Card with a 647 Credit Score?

Having a credit score of 647 can be a challenging situation when it comes to being approved for a credit card. It's likely that lenders may see this score as a sign of some financial struggles in the past. It's understandable if this news makes you feel discouraged, but remember that understanding your current credit position is a crucial step towards achieving financial stability. It's all about taking the situation seriously, and setting realistic expectations.

With a credit score of 647, it may not be easy to qualify for premier credit cards. However, you do have options. Consider starting with secured credit cards, which often require a refundable deposit and can become a pathway to rebuild your credit. Another option might be credit cards designed for average credit. These cards typically offer lower credit limits, higher interest rates, and fewer perks, but they are more accessible for individuals with scores like yours. But be forewarned, due to your credit score, you are likely to face higher interest rates. Though these aren't ideal circumstances, by making wise choices and consistent payments, you can steadily work towards improving your credit score.

Having a credit score of 647 leaves you somewhat in the middle when it comes to securing a personal loan. It's not an exceptional score, but it's not rock bottom either. This puts you in a gray zone where some lenders may approve your application, while others may shy away. This fuzziness can feel frustrating, as the outcomes aren't clear cut.

On the brighter side, there are lenders who specialize in loans for people with fair or average credit. If you apply for a loan with a credit score of 647, you might face higher interest rates than someone with a stronger credit profile. This is because lenders perceive you as somewhat riskier. Your credit score, reflecting your past borrowing behavior, indicates to lenders that you may not always make payments on time or keep up with debt obligations. When you apply for a loan, be prepared for additional scrutiny of your financial situation and be ready to explain any past issues that may have led to this credit score.

Can I Get a Car Loan with a 647 Credit Score?

When it comes to your credit score of 647, getting a car loan might prove to be quite a challenge. It's common for lenders to view a score of at least 660 as the benchmark for favorable loan conditions. Your score falls a bit below this range and this could lead to higher interest rates or not getting approved for a loan. This is because, for lenders, a lower credit score signals a greater potential risk linked to loan repayment.

However, don't be disheartened; there still are options open to you. Some lenders work specifically with people who have lower credit scores. Although the interest rates might be elevated and the terms might not be as favorable as they would be with a higher credit score, don't lose hope. It's important to be cautious and understand the precise terms before jumping into a loan. Consider all possibilities, and weigh the costs and benefits carefully. Though it could be a bit of rough ride, you're still in the game for car loan procurement.

What Factors Most Impact a 647 Credit Score?

A 647 credit score may seem discouraging, but with the right steps, it's possible to improve it. Understanding the factors influencing your score is key to making changes. Let's explore those factors.

Payment History

Your payment history plays a significant role in your credit score. If you have any instances of late or missed payments, these could be contributing to your current score.

How to Check: Scrutinize your credit report for any late or missed payments. If you find any, create a plan to make future payments on time.

Level of Debt

Too much debt can negatively affect your credit score. If your credit card balances are high, this could be causing your score to drop.

How to Check: Look carefully at your credit card statements. If your balances are consistently high, consider ways to pay them down.

Age of Credit

Having a short credit history or new accounts can impact your credit score. Older credit accounts contribute positively towards your score.

How to Check: Review your credit report and take note of the age of your oldest and newest accounts. Having older, active accounts helps boost your credit score.

Variety of Credit

Maintaining diverse types of credit (e.g., mortgages, car loans, credit cards) can also influence your score positively.

How to Check: Evaluate your different types of credit. If you only have one type, it might be worth considering diversifying, though avoid unnecessary debt.

Public Records

Public records such as bankruptcies, collection accounts, or tax liens can have a significant impact on your score.

How to Check: Look through your credit report for any public records. If any exist, addressing these should be a priority.

How Do I Improve my 647 Credit Score?

A credit score of 647 falls into the fair range. But don’t stress, with the right plan, you can work to boost this score yourself. Here are the most relevant actions to take at this score level:

1. Check Your Credit Report

At this score range, there might be errors on your credit report causing your score to be lower. Request for a free credit report from the three major credit bureaus and scrutinize it for inaccuracies. Dispute any errors you find with each credit bureau. This step can make a massive difference in your credit score.

2. Aim for Zero Late Payments

Your payment history has a significant impact on your credit score. Effort to pay your bills on time, every time. If you’re struggling, consider setting up automatic payments or reminders to ensure you never miss a payment date.

3. Manage Credit Utilization Wisely

Try to keep your credit utilization ratio – how much of your available credit you’re using – below 30%. If you are currently above that, having a payment plan to lower your ratio can improve your credit score.

4. Don’t Close Old Card Accounts

If you’re not dealing with regular fees, strive to keep your oldest credit card accounts open. This helps establish a longer credit history, which benefits your credit score.

5. Adopting a Credit-Builder Loan

A credit-builder loan allows you to deposit a small sum into a savings account each month. At the end of the term, the money emerges from the account. The credit bureau sees this as a paid-off loan, which can positively influence your credit score.