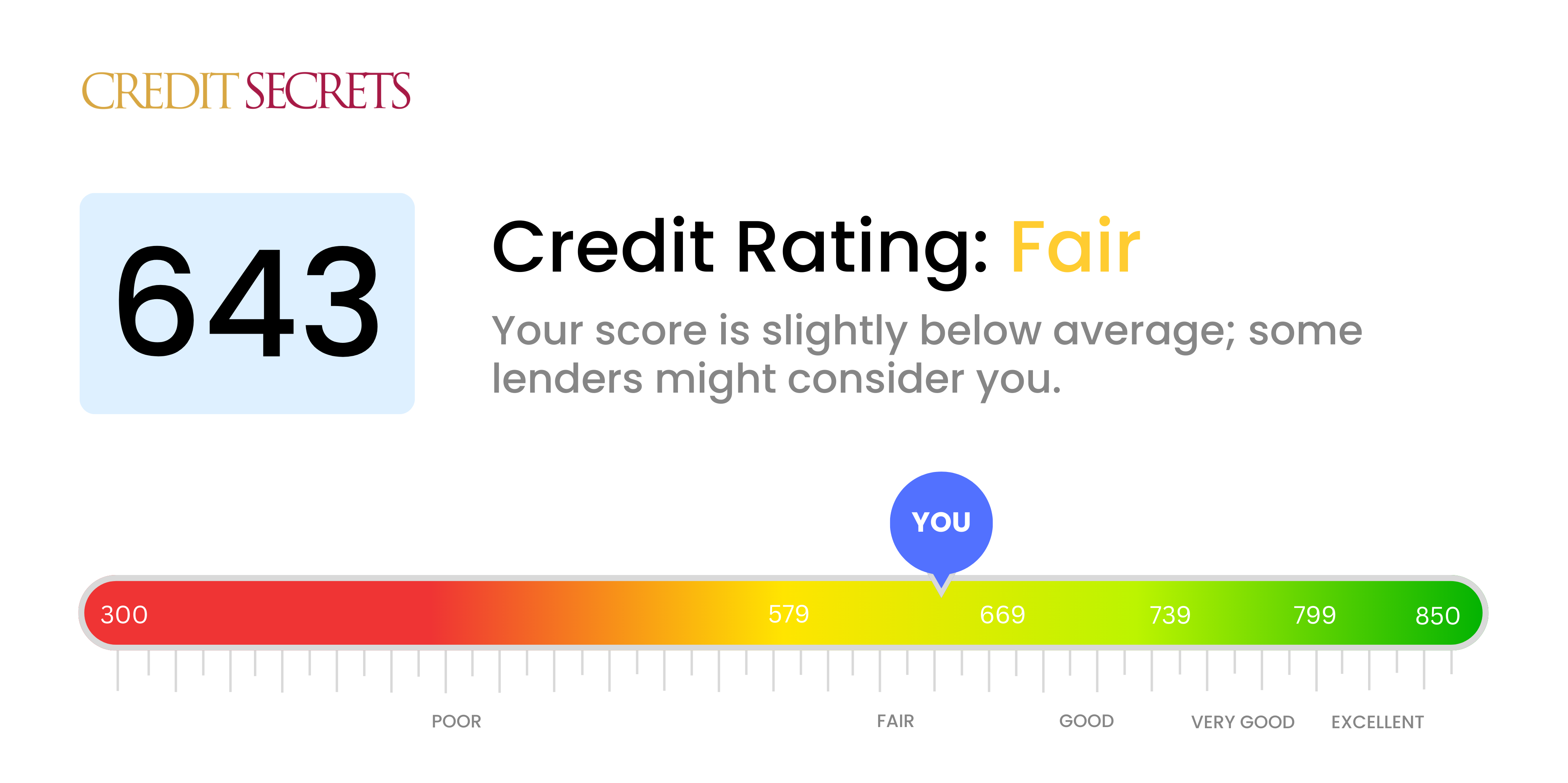

Is 643 a good credit score?

Your credit score of 643 falls into the 'Fair' category. This means, in terms of financial opportunities, you likely may face some challenges securing low-interest loans or premier credit cards, but it's not all bleak as there's potential to improve.

At this level, your creditworthiness is just a little below the average American score. You might face slightly higher interest rates than those with a 'Good' or higher credit score. However, take comfort in knowing many have risen from this point to much higher tiers. It's not impossible for you to improve this score and position yourself for better financial opportunities in the future.

Can I Get a Mortgage with a 643 Credit Score?

Having a credit score of 643 can be a challenging hurdle in your journey to be approved for a mortgage. While it's not bottom-range, it indicates a less-than-favorable credit history, which might dissuade some lenders. This score suggests you've missed payments in the past or have often used up a good chunk of your credit limit.

While the odds may seem against you, don't lose heart entirely. Some lenders might consider factors outside of your credit score, like your income and existing debts. However, due to this credit score, your mortgage might come with higher interest rates or stricter terms. Keep in mind though that improving your financial status is a long-term goal, and getting to a stronger credit score position is definitely not impossible. Consider methods such as paying your bills on time, chipping away at outstanding debts, and maintaining responsible credit use patterns. Persistence and patience are key in this journey.

Can I Get a Credit Card with a 643 Credit Score?

With a credit score of 643, it's understandable to have questions about your likelihood of approval for a credit card. Scores in this range are often viewed as fair, which means you may still be approved for some types of credit cards, but not always with the most favorable terms. It's crucial to acknowledge this reality, while also remaining optimistic about your potential credit opportunities.

Given your current score, you're likely to be taken into consideration for basic credit cards that may offer a lower credit limit and have higher interest rates due to the perceived risk by lenders. Another sensible option could be secured credit cards. These types of cards require a deposit upfront, which will serve as your credit limit. Over time, responsible use of these cards can help improve your credit score. Also, there are certain credit cards designed for fair credit that might be suitable for you. Remember, the journey towards a high credit score is gradual but it's completely achievable with patience and consistent effort.

A credit score of 643 is somewhat below the average and might make securing a traditional personal loan more challenging. Lenders generally prefer scores above 700, so a score of 643 may be seen as a higher risk. This could potentially result in less favorable loan conditions, higher interest rates, or the need for extra steps such as collateral or a co-signer. We feel for your position, but it's key to face the situation honestly.

You might consider other paths towards lending, such as peer-to-peer platforms or credit unions, which might have more relaxed credit restrictions. Alternatively, seek out lenders that specialize in low-credit loans. Keep in mind, however, that these avenues often come with higher rates to account for the increased risk to the lender. But remember, take this moment as a stepping stone, not a setback. There are always opportunities to improve your financial situation.

Can I Get a Car Loan with a 643 Credit Score?

If you've got a credit score of 643, you may find it somewhat difficult to be approved for a car loan. Generally, lenders prefer credit scores of 660 and above to offer the most favorable terms. A score of 643 doesn't drop into the subprime category (below 600), but it is still on the lower side of what most lenders usually consider. For this reason, they may see you as a higher risk based on your score, which could result in higher interest rates or possible loan denial.

This doesn't mean all hope is lost. While it might be challenging, there are lenders willing to work with those who have lower credit scores. However, be aware that the costs could be higher due to increased interest rates. These rates are their way of mitigating the risk they face lending to individuals with less-than-perfect credit scores. It's not an easy road, but with careful planning and understanding the terms offered, getting a car loan with a credit score of 643 isn't impossible.

What Factors Most Impact a 643 Credit Score?

Decoding a credit score of 643 requires understanding the facets that impact your score. The key is not only to identify these elements but to take strategic steps to address them.

Payment Regularity

Your credit scores depend heavily on your payment regularity. Missed or late payments can lead to a lower score. For a score like 643, it's likely that this may be a factor.

How to Check: Go through your credit report, paying close attention to payment history. Any missed payments or marks of irregularity can be detected here.

Credit Use

Your credit utilization, or how much of the total credit available to you is being used, plays a significant role. A high credit utilization rate could be weighing down your score.

How to Check: Examine your credit card bills and calculate the percentage of your credit limit that you're using. Attempt to keep this percentage around 30% or less.

Credit History Span

An abbreviated credit history can lower your score. If your history of using credit only spans a few years, it could be influencing your score of 643.

How to Check: Your credit report will display the age of your credit accounts. Be mindful if you've recently begun to build credit.

Variety of Credit

Different types of credit like credit cards, mortgages, or installment loans contribute to a healthy credit mix and often indicate creditworthiness.

How to Check: Review your credit report to assess the variety of your credit. Strive for a good mix, but remember to manage each responsibly.

Public Records

Bankruptcies, tax liens, or other judgments in public records could be damaging to your score.

How to Check: Look at your credit report for any public records. Take steps to resolve any disputes or outstanding public records.

How Do I Improve my 643 Credit Score?

With a credit score of 643, you’re on the cusp of the fair credit field. This means potential for upward mobility is definitely within reach. Here’s your tailor-made plan to level up:

1. Normalizing On-Time Payments

Ensure that every bill payment is submitted on time. Setup automated deductions if possible. Creditors will appreciate this regularity, thus boosting your score.

2. Prune Credit Utilization Rate

Keeping the use of your credit cards below 30% of your limit, and ideally below 10%, improves your credit utilization rate. Prioritize paying off the cards with the most relative debt.

3. Consider a Secured Loan

Secured loans or credit-builder loans hold your own money in a savings account as collateral, but should be your last resort. It’s a great way to show lenders you’re responsible while boosting your credit.

4. Authorized User Status

If you know someone with a good credit score, they could add you to their account as an authorized user. Your credit could benefit from their good habits, provided their issuer reports to credit bureaus.

5. Multiple Credit Options

Having a mix of credit types, such as a car loan in addition to credit cards, shows lenders your aptitude at managing diverse credit sources responsibly.

While boosting your credit score takes time, making changes now and planning for the future will pay dividends towards achieving your financial goals.