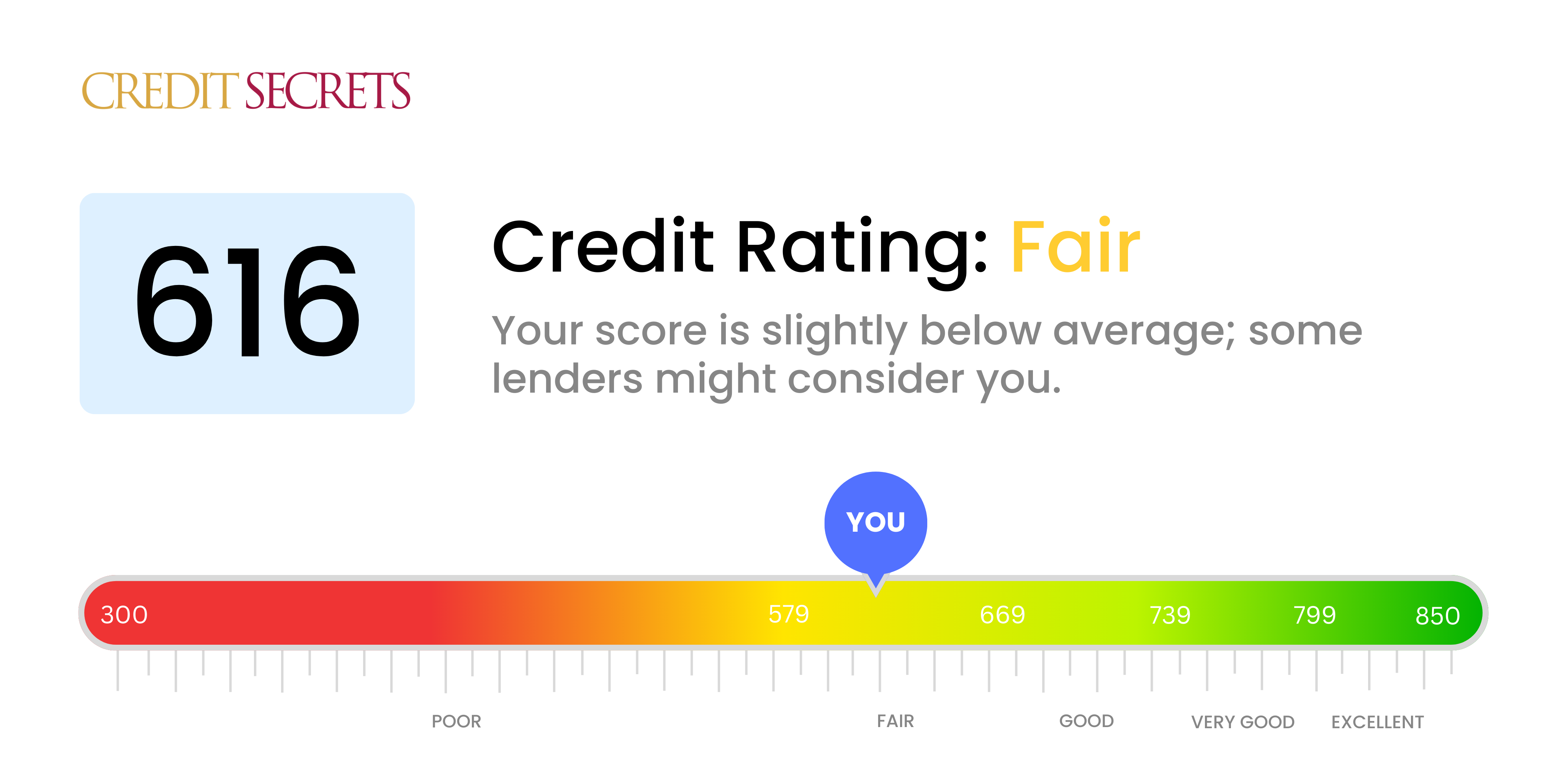

Is 616 a good credit score?

A credit score of 616 falls into the 'Fair' category. While this isn't regarded as a good score, there's no need to lose hope as it's totally possible to improve it over time

With a score of 616, you might face challenges in securing lower interest rates or approvals for loans and credit cards. Nevertheless, by taking positive steps such as repaying debts on time and minimizing credit usage, you have the potential to gradually build up your score for a better financial future.

Can I Get a Mortgage with a 616 Credit Score?

Having a credit score of 616, it's somewhat unlikely that you'll be readily approved for a mortgage. Typically, lenders seek borrowers with credit scores considerably higher, as it provides them with a sense of confidence in your ability to pay back the loan. A score of 616 could imply a record of financial ups and downs, late payments, or even prior default incidents.

While this might feel like a discouraging predicament, you're not without options. You may want to first explore alternatives such as securing a co-signer, who can offer additional assurance to the lender, or considering FHA loans which are more flexible on credit scores. But know this, it's well within your power to improve your credit score. It starts by addressing unpaid debts that may be pulling your score down and then following it up with a sustained effort towards timely bill payments and sensible financial routines. Remember, the journey to a stronger credit score isn't a sprint, but a consistent and steady climb upward.

Can I Get a Credit Card with a 616 Credit Score?

A credit score of 616 might not make it easy for you to be approved for a standard credit card. This number reflects that you've had some financial hiccups in the past, which can make you seem like a risk to lenders. This can feel like a tough pill to swallow, but it's crucial to face this reality head on. Being aware of your existing credit status is an important step towards better financial health.

While a regular credit card may not be an option right now, don't despair. You could consider alternatives like a secured credit card, where you provide a deposit that becomes your credit limit. This type of card is often easier to get accepted for, and can be a useful tool in your journey towards improving your credit. Additionally, exploring the option of a co-signer or perhaps using a prepaid debit card are other possibilities. These options won't solve your credit issues overnight, but they can offer a pathway forward. Please remember, the interest rates on these options may be higher due to the risk involved for the lenders.

A credit score of 616, unfortunately, is likely to limit your prospects of getting a personal loan approval from most traditional lenders. This score is perceived as a higher risk, indicating that there could be some past financial hiccups. It's important, however, not to lose hope and understand that this is just a temporary setback on your financial journey.

While the traditional personal loan might be a challenge, other options may be available to you. Secured loans, where you provide an asset as collateral, could be one route. Another is a co-signed loan, where someone with a better credit score guarantees your loan. Peer-to-peer lending platforms can also be an option as they sometimes have softer credit score requirements. Remember, though, these options may have higher interest rates and less appealing terms due to the increased risk to the lender. Though they represent additional costs, they could also serve as stepping stones towards improving your financial situation in the long run.

Can I Get a Car Loan with a 616 Credit Score?

With a credit score of 616, securing a car loan may prove to be a tough task. This score is typically classified as "fair," and many lenders prefer scores above 660 when considering loan approvals. With a score of 616, you may find that your options are limited, and you might face higher interest rates if approved. The reason for this is that lenders often view lower credit scores as indicative of a higher risk, suggesting difficulties in repaying debts in the past.

Yet, it's important to remember that a credit score of 616 doesn't entirely prevent you from buying a car. There are lenders who cater to people with lower credit scores, but be cautious in approaching these offers. These loans carry higher interest rates to offset the lender's risk. While higher interest rates make the journey somewhat rougher, sufficient planning and understanding of the loan terms can make car ownership a reality.

What Factors Most Impact a 616 Credit Score?

Grasping a score of 616 is critical to improving your financial situation. The factors contributing to this score are what we need to address to enhance your financial future. Keep in mind, everyone's financial journey is singular, laden with times of growth and learning.

Payment Consistency

Keeping up with your payments significantly influences your score. Consistent late payments or defaults could be carrying your score down.

What to do: Look at your credit report for late payments or defaults. Contemplate any instances where payments were late, as these can impact your score.

Credit Capacity

A high utilization of your credit limit can decrease your score. If your credit cards are maxed out, this might be part of your score's issue.

What to do: Go over your credit card statements. If your balances are close to your limits, aim to reduce them.

Duration of Credit History

A shorter credit history can erode your score.

What to do: Look over your credit report to understand the length of your credit history. Pay attention to when you have recently opened new accounts.

Variety of Credit and Recent Credit

Managing a mix of credit types and new credit effectively can improve your score.

What to do: Assess your mix of credit accounts, such as credit cards, installment loans, and mortgage loans. Reflect on whether you have been applying for new credit judiciously.

Public Record

Public records like bankruptcies or tax liens can have a daunting effect on your score.

What to do: Check your credit report for any public records. Resolve any items listed that may need attention.

How Do I Improve my 616 Credit Score?

A credit score of 616 falls into the “fair” category, but don’t be dismayed. By taking some customized steps geared towards your current situation, you can start to see improvement. Here are the most effective strategies that you could consider:

1. Repay Outstanding Debts

Having ongoing late or defaulted payments can severely hurt your score. Start by addressing these and pay off past-due balances as quickly as you can. Getting these balances to zero should be a top priority. You can also consider contacting your creditors to discuss a manageable repayment plan, tailored to your financial capacity.

2. Minimize Credit Utilization

Watch your credit card balances. Maintaining them under 30% of your limit can positively impact your credit score. Even better, aim for under 10% in the longer run. Target cards with the highest balance-to-limit ratio first.

3. Opt for a Secured Credit Card

Given your current credit score, it might be difficult to get approval for an unsecured credit card. A secured credit card, which needs a cash deposit equivalent to its credit line, could be a good option. Use it for modest purchases and always pay off the total balance every month.

4. Seek to be an Authorized User

If you have a close trustable person with a good credit history, ask if you can be an authorized user on one of their cards. This can positively influence your score, providing the account is managed responsibly and the creditor reports the account’s activity to credit bureaus.

5. Add Variety to Your Credit Portfolio

Once you have a strong payment history via your secured card, consider diversifying your credit types. This could mean taking up a credit builder loan or getting store credit cards. Make sure to handle these responsibly to boost your credit score further.