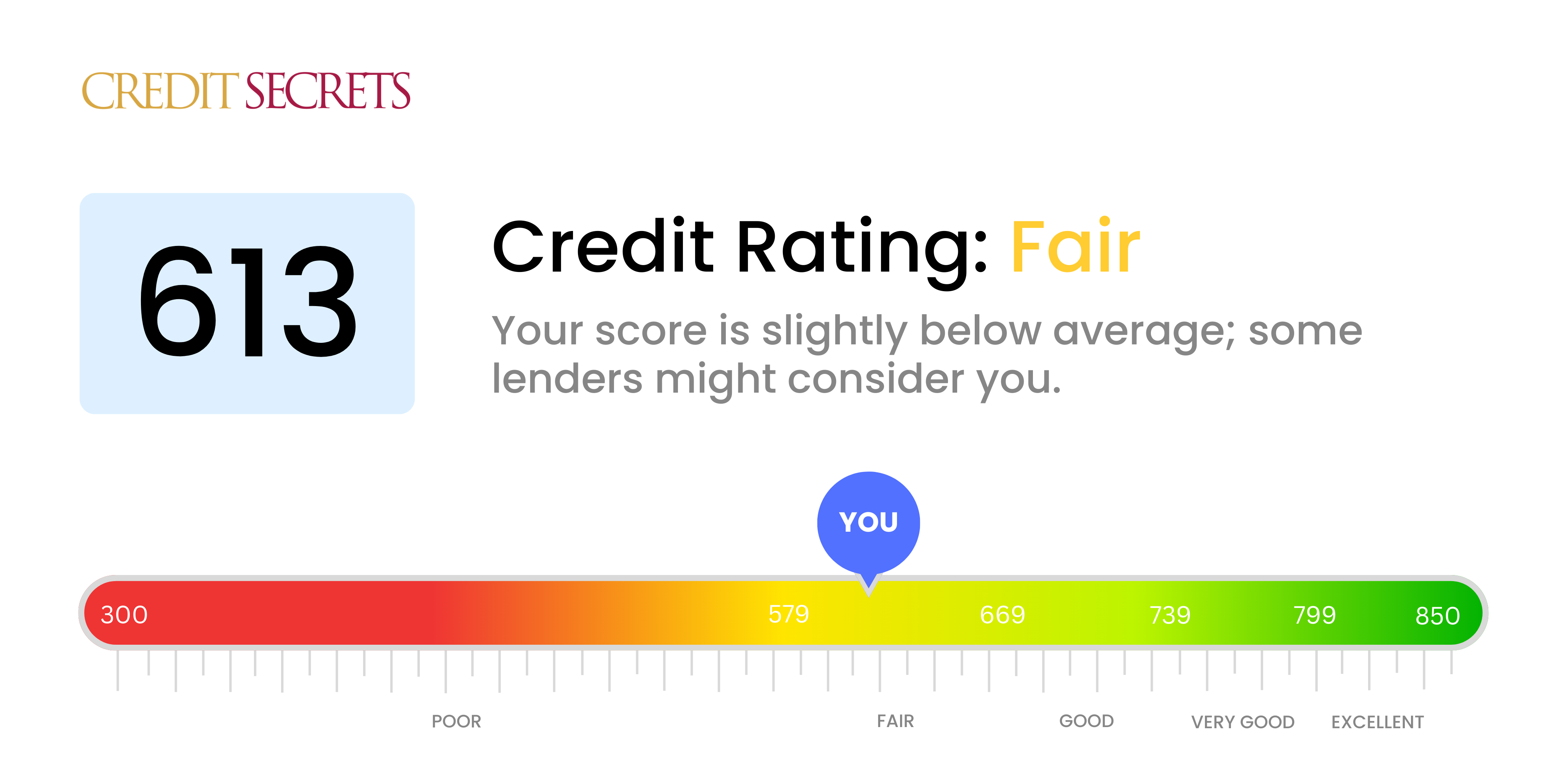

Is 613 a good credit score?

A credit score of 613 falls into the category of 'Fair' according to standard credit score ranges. This score is not deemed bad, however, it could use some improvement for better financial options.

With a score of 613, you're likely to encounter some challenges when applying for loans or credit, and you may be offered higher interest rates than those with higher scores. Nevertheless, it's worth noting that improving your credit score is completely achievable and should be encouraged. By consistently making payments on time, reducing your debt and keeping low balances on your credit cards, you can gradually elevate your credit score to a more favorable range.

Can I Get a Mortgage with a 613 Credit Score?

Having a credit score of 613 may make it challenging to be approved for a mortgage. Lenders typically prefer applicants with a score of 620 or higher. A credit score of 613 indicates that there may be some past financial issues, such as delayed payments or overuse of credit. It's understandable that this may feel frustrating, but remember, it's not a permanent state and there are other options available.

While traditional mortgages might be out of reach, consider looking into FHA loans, which are government-backed mortgages designed to assist individuals with lower credit scores. Also, some smaller, local banks or credit unions may have more flexible lending standards. Although it's essential to note that even if you are approved for a mortgage with a lower credit score, you could face higher interest rates as lending to you is considered a higher risk. Over time, this could equate to paying significantly more in interest over the life of the loan, highlighting the importance of credit health.

Can I Get a Credit Card with a 613 Credit Score?

Maintaining a credit score of 613 in itself is an accomplishment, yet it often presents challenges when trying to obtain a traditional credit card. It's not easy to hear, but lenders may see this score as a sign of potential risk. However, understanding the nature of your credit score is the first step towards a mere financial improvement.

Considering the challenges with a credit score of 613, you might want to consider different strategies. Secured credit cards can be a feasible option. These cards require a deposit which is typically equivalent to your credit limit, and are generally easier to obtain. Alternatively, prepaid debit cards can potentially be an option. An essential point to remember is that interest rates for credit available to you at this score may be higher due to the risk perceived by lenders. However, by diligently managing these alternatives, one can significantly advance towards increased financial stability. Remember, real progress takes time, but it's certainly possible with careful planning and action.

A credit score of 613, unfortunately, falls short of the criteria for approval of a personal loan by most traditional lenders. Such lenders typically interpret this score to indicate a greater risk. Although confronting this reality of your credit standing might seem daunting, it is a critical step towards navigating your available options and achieving your financial goals.

Conventional personal loan paths might be less available, however, you could explore alternatives such as secured loans, which entail offering collateral, or loans backed by a co-signer. Another potential avenue could be peer-to-peer lending platforms that may be more accommodating with credit requirements. It is crucial to note that these alternatives may come with steeper interest rates and less advantageous terms, as a reflection of the increased risk perceived by lenders. Remember, every financial decision you make should be carefully evaluated in light of your individual circumstances and long-term goals.

Can I Get a Car Loan with a 613 Credit Score?

A credit score of 613 is not exactly considered the best, especially when applying for a car loan. Most lenders favor scores over 660 and see anything below 600 as subprime. Unfortunately, your score of 613, falls closer to this unfavorable category. This might result in a higher interest rate or even a denial of the loan as lenders see this as a higher risk, suggesting possible difficulties repaying the loan based on past credit history.

However, don't lose hope. Your dream of owning a car is not impossible. Certain lenders are willing to work with those who have lower credit scores. But bear in mind, because of the perceived risk, they may charge higher interest rates as a precautionary measure for their investment. It's crucial to thoroughly scrutinize the terms before accepting. If you tread carefully and consider your alternatives, getting a car loan is still achievable.

What Factors Most Impact a 613 Credit Score?

Understanding a credit score of 613 is pivotal to devising a roadmap to better financial health. It's important to identify and address the issues behind this score to improve your financial standing. Everyone's financial path is unique, with plenty of chances for progress and education.

Payment History

On-time payment is crucial to your credit score. If your payments have been late or defaulted, this could be a significant factor affecting your score.

How to Check: Scan your credit report for any late or defaulted payments. Think about any instances where you've delayed a payment, these could've affected your score negatively.

Credit Utilization

High credit utilization might be impacting your score. If your credit card balances are nearing their limits, this might be an issue.

How to Check: Look through your credit card statements. Is your balance almost at the limit? Always aim to keep your balance low compared to the maximum credit limit.

Length of Credit History

Short credit history can adversely affect your score.

How to Check: Inspect your credit report to determine the age of your oldest and newest accounts, as well the average age of all accounts. Did you recently open a new account?

Credit Variety and New Credit

Maintaining a mix of credit types and responsibly handling new credit is crucial for a healthy score.

How to Check: Assess your mix of credit accounts, like credit cards, retail accounts, installment loans, and mortgage loans. Have you been sparingly applying for new credit?

Public Records

Public records such as bankruptcies or tax liens could be significantly affecting your score.

How to Check: Review your credit report for any public records. Take action on any items mentioned that may need resolution.

How Do I Improve my 613 Credit Score?

A 613 credit score is within the fair range, but there are proactive ways to enhance this. Focus on these effective strategies based on your current situation:

1. Make Up-to-Date Payments

Ensure you meet all your payment obligations on time. This could be for a credit card bill or an installment on a personal loan. Late or missed payments lower your score; consistent on-time payments can gradually restore it.

2. Attend to your Credit Utilization Rate

This is the ratio of your current total outstanding balances on your credit cards to your total credit limit. Aim to keep this below 30% for all cards as high rates negatively impact your credit score. Prioritize reducing your usage by focusing on cards closest to their limit.

3. Opt for a Secured Loan

Your score may limit access to conventional credit cards. However, a secured loan, backed by collateral like a saving account is a viable option. This demonstrates responsible handling of credit as you make regular payments.

4. Seek Out a Co-signer

Instead of becoming an authorized user, consider getting a trusted individual with a strong credit score to co-sign on a line of credit or loan. This can help transform your credit as the credit bureaus will also track their repayment history.

5. Explore Varied Types of Credit

Showing competence in handling various credit forms, like installment and revolving credit, boosts your credit score. Solid payment records with a secured card or loan open the door to other credit types, such as retail cards or auto loans, which, when managed responsibly, enhance your score.