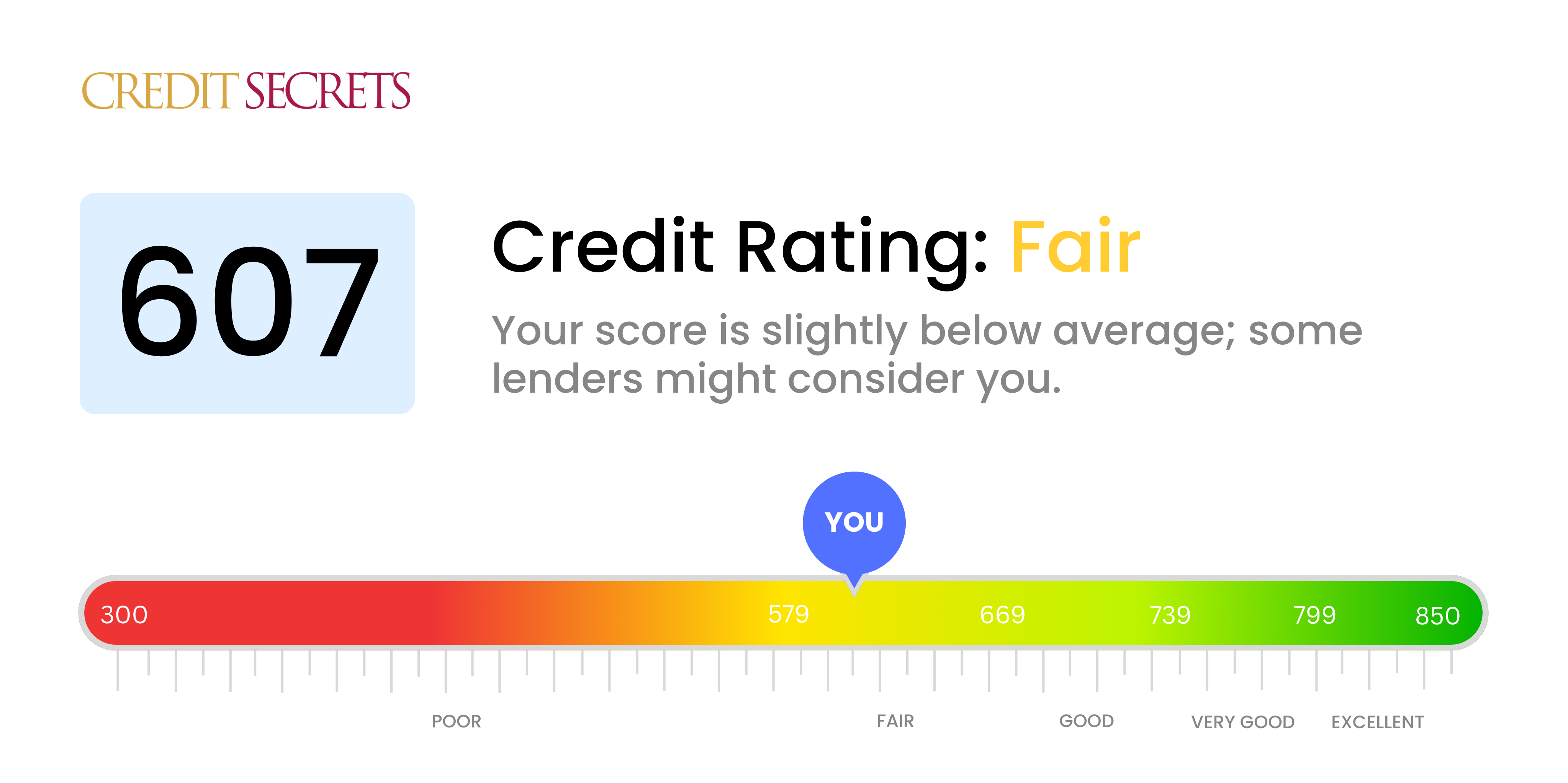

Is 607 a good credit score?

A credit score of 607 falls under the 'Fair' category. This isn't the highest bracket, but there's plenty of optimism here, as with responsible financial behaviors, it can be improved upon significantly.

With this score, you may face slightly higher interest rates or may have to deal with stricter lending terms when compared to those with 'Good' or 'Excellent' credit scores. However, it's important to remember that many have raised their scores from 'Fair' to 'Good' or even 'Excellent'. So, even if you're encountering financial obstacles now, there's plenty of room for betterment in your financial future.

Can I Get a Mortgage with a 607 Credit Score?

A credit score of 607 indicates that you may experience challenges in being approved for a mortgage. This score is below the typical minimum set by most lenders, which usually lies around the 660 mark. With this score, it suggests a history of uneven credit practices, late payments, or possible defaults on previous loans.

While this may present a hurdle in attaining your goal of home ownership, options still exist. Some mortgage programs are designed for those with lower credit scores, providing potential avenues you could explore. For example, FHA loans are designed for those with scores as low as 580. However, it's important to remember these programs often come with higher interest rates. Bettering your credit score will not only make it easier to get a mortgage but also result in more favorable loan terms. Try to focus on paying your bills regularly and on time, reducing your balances and avoiding new debts, to gradually improve your score.

Can I Get a Credit Card with a 607 Credit Score?

With a credit score of 607, you might find it quite challenging to get approval for a standard credit card. This is because lenders often see scores in this range as an indicator of potential financial risk. It may seem distressing, but recognizing and accepting your current credit status is the key stepping-stone towards a better financial future. It doesn't mean you're stuck forever. However, it's crucial to face it head-on with courage and a realistic mindset.

Since it may not be straightforward to secure a traditional credit card with a score of 607, it could be worth considering some alternatives. Secured cards, for instance, demand a deposit that functions as your credit limit – they're typically easier to get and can be instrumental in rebuilding your credit over time. Also, think about options like requesting a trustworthy friend or family member to co-sign a credit application, or using prepaid debit cards. Keep in mind that the interest rates linked with these options might be on the higher side due to increased risk perception by the lenders. The situation may not change overnight, but these options can offer a viable path forward towards financial stability.

With a credit score of 607, securing a personal loan may be a challenge. This score falls below the typical threshold lenders are comfortable with and may denote a high risk for potential loan default. Remember, this is simply an indicator of past financial behavior, and while it might be disheartening, it doesn't diminish your worth or potential.

Since traditional personal loans might prove difficult, consider investigating other lending solutions. This could include a secured loan, where you offer an asset as collateral, or a co-signed loan, which involves another person with better credit standing agreeing to help cover the loan if you're unable to. Alternatively, peer-to-peer lending platforms might be an avenue to explore, as they may have more lenient credit score expectations. Keep in mind, these alternative options may entail higher interest rates and less flexible terms, which is a reflection of the higher risk perceived by the lender due to your lower credit score.

Can I Get a Car Loan with a 607 Credit Score?

With a credit score of 607, you may find it somewhat challenging to get approved for a car loan. Typically, lenders are drawn towards scores over 660. Scores below 600 are often categorized as subprime. Your score of 607 is just above that line, but may still face hurdles when trying to secure a car loan. This is simply because a lower credit score means a higher risk for lenders, as it signifies that there may be difficulty in repaying the loan.

Yet, having a lower credit score doesn't mean a car loan is out of your reach. Some lenders are more willing to work with individuals who have credit scores that aren't ideal. However, be prepared for these loans to likely carry higher interest rates. It's a measure lenders use to balance the risks they are taking. It may not be a straight path, but the possibility of securing a car loan, albeit at potentially higher interest rates, still stands for you as long as you carefully review the loan terms and conditions.

What Factors Most Impact a 607 Credit Score?

With a score of 607, you're at the start of your journey towards a healthier financial standing. Understanding what's impacting your score is the key to a brighter financial future. Let's delve into the factors that could potentially be impacting your score.

On-Time Payments

Your payment history greatly influences your score. If late or missed payments possibly exist within your credit history, these are likely impacting your score.

How to Check: Look at your personal credit report. See if there are any late or missed payments. Reflect on any recent financial struggles that might've resulted in a missed payment.

Credit Utilization Ratio

Holding high credit balances compared to your limits could harm your score. If your credit cards are constantly tapped out, they are very likely hitting your score.

How to Check: Review your credit card statements. If your balances are persistently high, aim to decrease and manage them effectively for a healthier score.

Duration of Credit History

A relatively short credit history could be a contributing factor to your existing score.

How to Check: Evaluate your credit report for the age of your accounts. If most of your accounts are fairly new, it could be impacting your score.

Repeated Credit Applications

Frequent, recent applications for new credit can push down your score.

How to Check: Look at your credit report for any recently rejected applications or credit inquiries, these could be influencing your score.

Public Records

Public records such as collections or foreclosures can significantly impact your score.

How to Check: Check your credit report for any listed collections or foreclosure actions. Any found would be key to understanding the cause of your current score.

How Do I Improve my 607 Credit Score?

At 607, your credit score falls into the ‘fair’ category. With a focused plan, you can elevate this rating. Here are some practical strategies tailored for your current score:

1. Clear Any Collection Accounts

Begin by resolving any accounts that have reached the collections stage. These can heavily impact your score. Make payment arrangements with your creditors – they are often open to negotiation. Clearing these debts not only improves your score but also enhances your credibility with lenders.

2. Pay Down High Credit Card Debt

High credit card debt is a key contributor to lower credit scores. As a rule, aim to keep your balance under 30% of your available credit. Start by focusing on cards nearing their credit limits.

3. Consider a Credit Builder Loan

Given your present score, you may qualify for a credit builder loan. These loans exist primarily to build credit history – you simply borrow, repay, and create a positive transaction record. A successful credit builder loan will reflect favorably on your credit report.

4. Request an Increase in Credit Limits

With lower utilization rates, your credit score can greatly increase. Requesting a higher limit on your credit cards, without increasing your spend, can accomplish this. However, ensure to be disciplined and resist the temptation to overspend.

5. Add Variety to Your Credit Portfolio

A variety of credit types is beneficial for your score. Once you have improved your payment history with the above steps, consider adding other credits like a small installment loan or a retail card. Remember, the key is to manage these accounts responsibly.