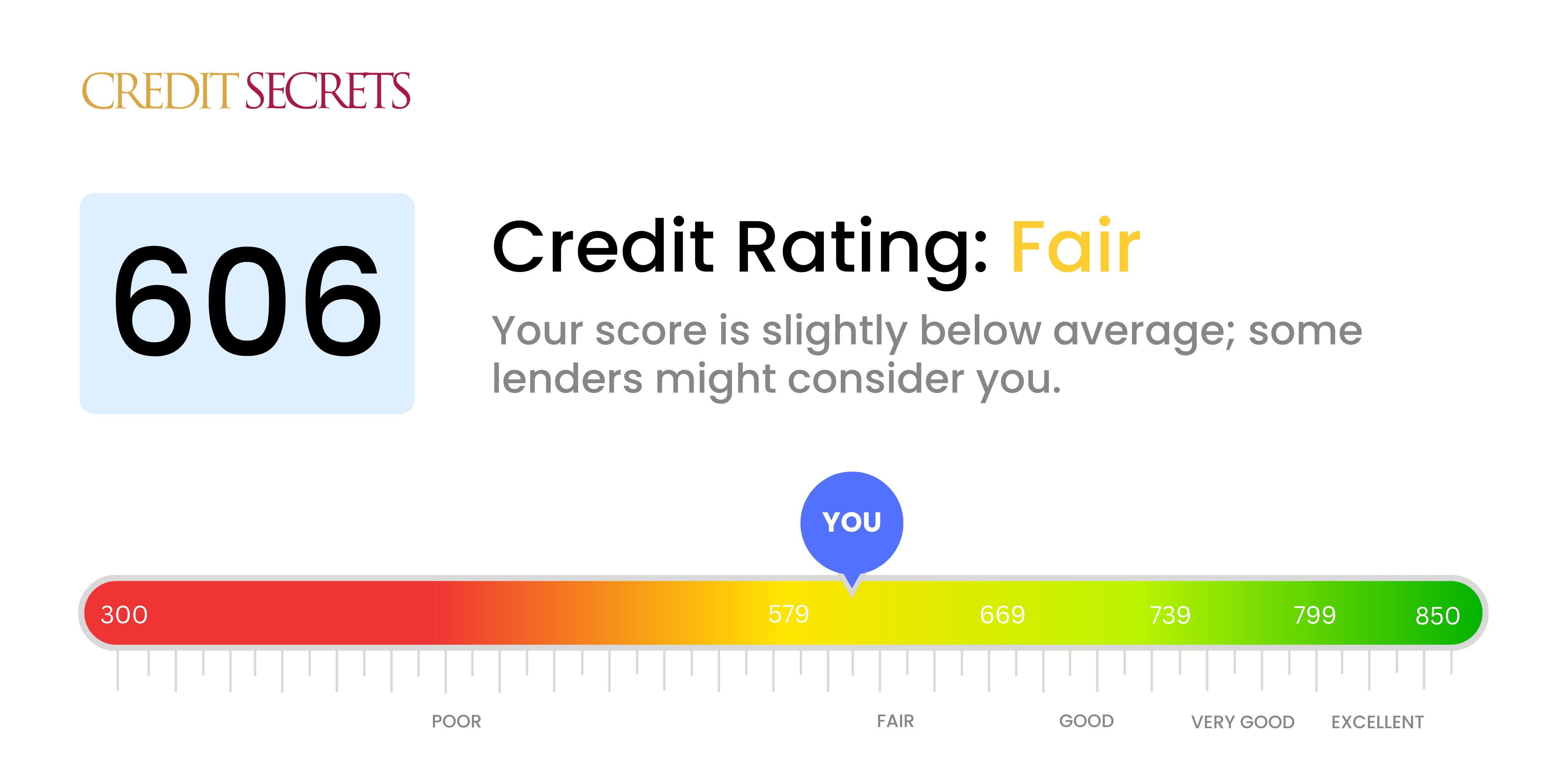

Is 606 a good credit score?

A credit score of 606 falls into the 'Fair' category. With this score, you might face difficulties in securing loans or credit cards, or you might be given higher interest rates than those with better scores. However, with some disciplined financial habits, you can improve your score over time.

Keep in mind, every lender has different standards when it comes to creditworthiness. So, while a 606 credit score is technically 'Fair', certain lenders might see it as an increased risk, while others may deem it a lower risk. Rest assured, though, a 'Fair' score doesn't exclude you from accessing credit entirely. It's a starting point on your journey to better financial health.

Can I Get a Mortgage with a 606 Credit Score?

Having a credit score of 606 can pose some challenges when seeking mortgage approval. Typically, most lenders require a credit score higher than 620 for approving mortgage applications. A score of 606 suggests a somewhat unstable financial past, perhaps characterized by irregular payments or even defaults. Despite this, it's essential to understand that your financial journey is not defined by your past, and there is potential for change.

Your credit score being just on the edge of this 'fair' boundary should motivate you to take action. In the interim, you can consider alternatives such as Federal Housing Administration (FHA) loans, which are designed for those with lower credit scores. However, bear in mind these alternatives often come with higher interest rates. It's crucial, therefore, to start working consistently towards elevating your credit score, to open more opportunities and gain better terms for future mortgage applications. Remember, while the journey to financial stability may seem challenging, every step you take brings you closer to your goal.

Can I Get a Credit Card with a 606 Credit Score?

A credit score of 606 falls into the category of fair credit. It's understandable to feel concerned about this, but being realistic about your situation is a good starting point. While it's possible to get approved for a credit card with a 606 credit score, your options may be somewhat limited and there's a chance you'll encounter higher interest rates due to perceived financial risks.

The best cards for you to consider at this point are likely to be secured credit cards or those specifically designed for individuals looking to improve their credit. Secured cards generally require a cash deposit, which then becomes your credit limit. Over time, responsible use of such a card can contribute positively to your credit score and create possibilities for more favorable credit in the future. Meanwhile, it's important to be prepared for higher than average interest rates on any credit cards you do obtain, as lenders may view you as a somewhat risky borrower.

With a credit score of 606, it may be challenging to secure a traditional personal loan. Lenders often perceive such scores as moderately risky and may hesitate to extend credit. This reality might feel disappointing, but understanding where you stand can empower you to find alternate solutions.

One option might be a secured loan where you commit collateral, such as a car or property, as a guarantee. Alternatively, a co-signed loan allows an individual with a stronger credit profile to support your application. There are also peer-to-peer lending platforms that might consider your request. Remember, these alternatives generally introduce higher interest rates and potentially more unfavorable terms due to the increased risk perceived by lenders. Nevertheless, they can provide possible routes to accessing financing under challenging circumstances.

Can I Get a Car Loan with a 606 Credit Score?

Having a credit score of 606 might create some hurdles when trying to secure a car loan. Typically, scores above 660 are favored by lenders, whereas scores that fall below 600 get categorized as subprime. Your score, being closer to the subprime range, may lead to less favorable loan conditions, higher interest rates, or perhaps a denial of the loan application. This is simply due to the fact that lower credit scores can be viewed as risky by lenders, as they suggest a possibility of difficulties in repaying the loan.

Despite the challenges, getting a car isn't out of reach. There are lenders out there who work with individuals with credit scores similar to yours, but approach with caution. The interest rates on these loans can be noticeably higher, as lenders use them as a buffer for the perceived risk. Yet, if you're diligent about understanding the terms of the loan, and make payments on time, owning a car is still possible. Remember, it's not an easy road, but it's definitely not a dead-end.

What Factors Most Impact a 606 Credit Score?

Understanding a Score of 606

Gaining insight into a score of 606 is the first step for enhancing your credit health. Acknowledging and rectifying the most impactful factors shaping this score can guide you towards favorable financial health. Every financial journey is distinct and filled with chances for development and knowledge.

Payment History

Payment regularity can significantly impact your credit score. Regular late or defaulted payments might be a major factor behind your score.

Method to Investigate: Check your credit report for any outstanding payments or defaults. Recollect if there were any instances where payments were delayed. These could have lowered your score.

Credit Utilization

Maxing out your credit cards can pull down your score. If your card balances are nearly filled up, this could be influencing your score.

Method to Investigate: Study your credit card reports. Are the outstanding amounts nearing the limits? It's recommended to keep balances low relative to the limit.

Duration of Credit History

A relatively short credit history can have a negative effect on your score.

Method to Investigate: Examine your credit report to find out the age of your oldest, newest, and average age of all your accounts. Consider if you have opened new accounts recently.

Diversity of Credit and New Credit

Maintaining a healthy variety of credit types and careful handling of new credit can work wonders for your score.

Method to Investigate: Evaluate your assortment of credit accounts like credit cards, retail accounts, installment loans, and mortgage loans. Monitor if you have been applying for new credit sparingly.

Public Records

Public records such as bankruptcies or tax liens can carry a substantial effect on your score.

Method to Investigate: Scrutinize your credit report for any public records. Address those items that might need attention.

How Do I Improve my 606 Credit Score?

A credit score of 606 puts you in the “fair” category. Uplifting your score from here will unlock greater financial opportunities for you. Let’s take a look at step-by-step recommendations customized for your current situation:

1. Do a Credit Report Review

Start by thoroughly reviewing your credit report for potential errors. Misreporting can hurt your credit score, and disputing such errors can result in a quick improvement.

2. Regularly Pay Your Bills On Time

Paying bills on time is crucial’, as payment history is a significant factor that affects your credit score. Prioritize timely payments to start improving your score.

3. Keep Credit Utilization Low

It’s critical to use your credit wisely. Try to keep your credit card balances well below your credit limits. Ideally, aim to utilize less than 30% of your total available credit.

4. Explore Credit-Builder Loans

You may consider getting a credit-builder loan, which can be a powerful tool to boost your credit if managed responsibly. Regular, timely payments on such loans can improve your credit score.

5. Steer Clear of New Debt

Avoid incurring new debt. Reducing the amount you owe can have a positive impact on your credit score, allowing you not only to control your financial situation better but also to show lenders you’re responsible.

6. Maintain Older Credit Accounts

Long-standing credit accounts contribute to your credit history length, which can help your credit score. Unless there’s a compelling reason, try to keep your old credit accounts open and in good standing.